- Belgium

- /

- Communications

- /

- ENXTBR:EVS

EVS Broadcast Equipment's (EBR:EVS) Sluggish Earnings Might Be Just The Beginning Of Its Problems

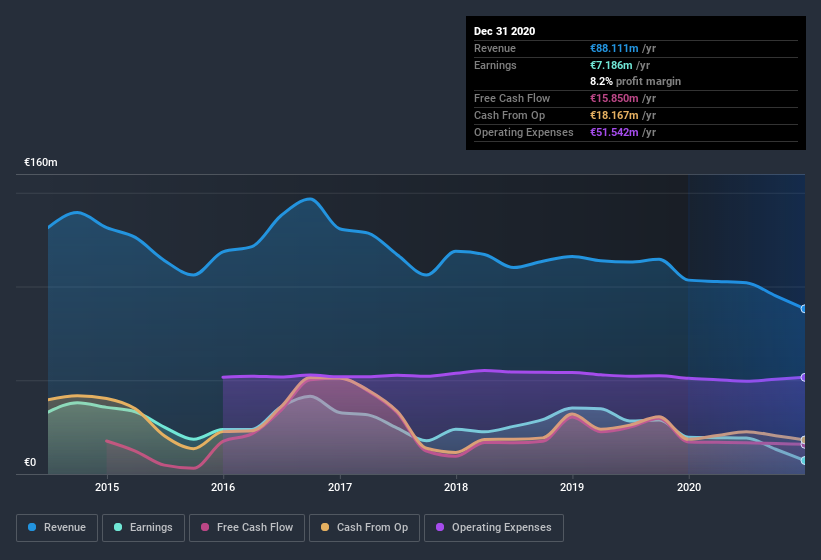

A lackluster earnings announcement from EVS Broadcast Equipment SA (EBR:EVS) last week didn't sink the stock price. We think that investors are worried about some weaknesses underlying the earnings.

View our latest analysis for EVS Broadcast Equipment

How Do Unusual Items Influence Profit?

To properly understand EVS Broadcast Equipment's profit results, we need to consider the €1.4m expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect EVS Broadcast Equipment to produce a higher profit next year, all else being equal.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that EVS Broadcast Equipment received a tax benefit which contributed €2.8m to the bottom line. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On EVS Broadcast Equipment's Profit Performance

In its last report EVS Broadcast Equipment received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. Given the contrasting considerations, we don't have a strong view as to whether EVS Broadcast Equipment's profits are an apt reflection of its underlying potential for profit. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. While conducting our analysis, we found that EVS Broadcast Equipment has 3 warning signs and it would be unwise to ignore these bad boys.

Our examination of EVS Broadcast Equipment has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading EVS Broadcast Equipment or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EVS Broadcast Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTBR:EVS

EVS Broadcast Equipment

Provides live video technology for broadcast and media productions in the United States, Europe, Africa, Middle East, and Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)