Xref's(ASX:XF1) Share Price Is Down 49% Over The Past Three Years.

Xref Limited (ASX:XF1) shareholders will doubtless be very grateful to see the share price up 143% in the last quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 49% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Xref

Xref isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Xref grew revenue at 36% per year. That's well above most other pre-profit companies. While its revenue increased, the share price dropped at a rate of 14% per year. That seems like an unlucky result for holders. It's possible that the prior share price assumed unrealistically high future growth. Before considering a purchase, investors should consider how quickly expenses are growing, relative to revenue.

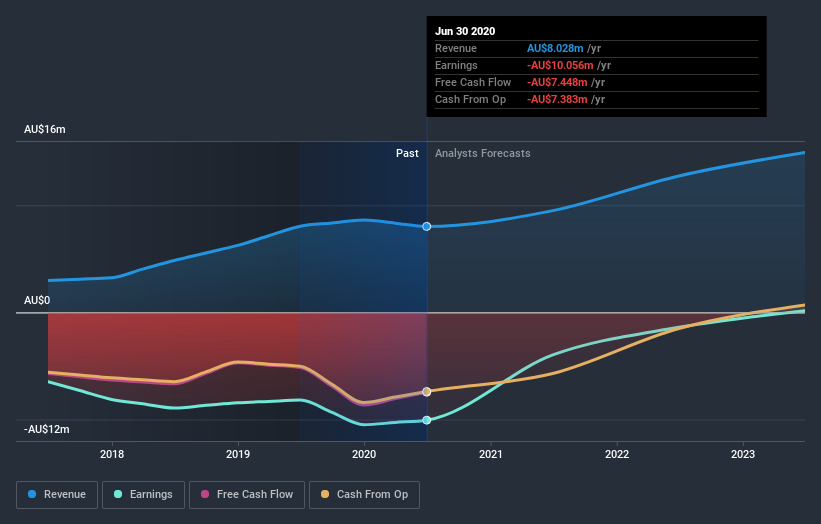

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Xref shareholders are up 1.4% for the year. While you don't go broke making a profit, this return was actually lower than the average market return of about 5.7%. On the bright side, that's certainly better than the yearly loss of about 14% endured over the last three years, implying that the company is doing better recently. We hope the turnaround in fortunes continues. It's always interesting to track share price performance over the longer term. But to understand Xref better, we need to consider many other factors. Even so, be aware that Xref is showing 4 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Xref, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:XF1

Xref

Engages in the development of human resources technology that automates pre-employment recruitment checks, employee engagement surveys, and exit interviews in Australia, Canada, the United Kingdom, New Zealand, and the United States.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion