- Australia

- /

- Renewable Energy

- /

- ASX:LGI

ASX Growth Stocks With High Insider Stakes Include Energy One And Two Others

Reviewed by Simply Wall St

As the Australian market experiences a steady climb, with the ASX200 surpassing 9,000 points and sectors like Energy and IT leading gains, investors are keenly observing growth companies that demonstrate strong insider ownership. In such an environment, stocks with high insider stakes often signal confidence from those closest to the business, making them attractive options for those looking for potential growth opportunities amidst ongoing global trade discussions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 89.9% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| IperionX (ASX:IPX) | 16.9% | 96.3% |

| Emerald Resources (ASX:EMR) | 18.4% | 39% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| Adveritas (ASX:AV1) | 17.3% | 96.8% |

Let's uncover some gems from our specialized screener.

Energy One (ASX:EOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energy One Limited provides software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in Australasia and Europe, with a market cap of A$623.40 million.

Operations: The company generates revenue of A$61.12 million from its energy software industry segment, serving the wholesale energy, environmental, and carbon trading markets across Australasia and Europe.

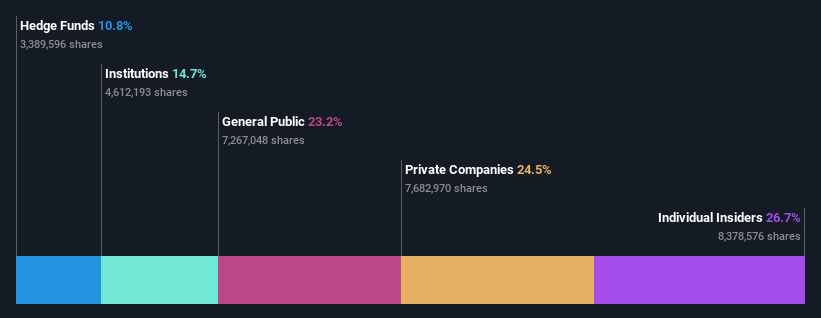

Insider Ownership: 22.7%

Revenue Growth Forecast: 12.2% p.a.

Energy One, recently added to the S&P/ASX Emerging Companies Index, demonstrates robust growth potential with forecasted earnings growth of 24.9% annually, outpacing the Australian market's 14.3%. Despite a significant past year earnings increase of over 300%, insider activity shows notable selling in recent months. The company's revenue is expected to grow at 12.2% annually, surpassing market averages but remaining below high-growth thresholds. Recent financials reveal a net income rise to A$5.89 million from A$1.44 million last year.

- Get an in-depth perspective on Energy One's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Energy One's current price could be inflated.

LGI (ASX:LGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LGI Limited operates in Australia, offering carbon abatement and renewable energy solutions through biogas from landfill, with a market cap of A$399.68 million.

Operations: The company's revenue is primarily derived from carbon abatement (A$17.29 million), renewable energy (A$17.08 million), and infrastructure construction and management (A$2.37 million).

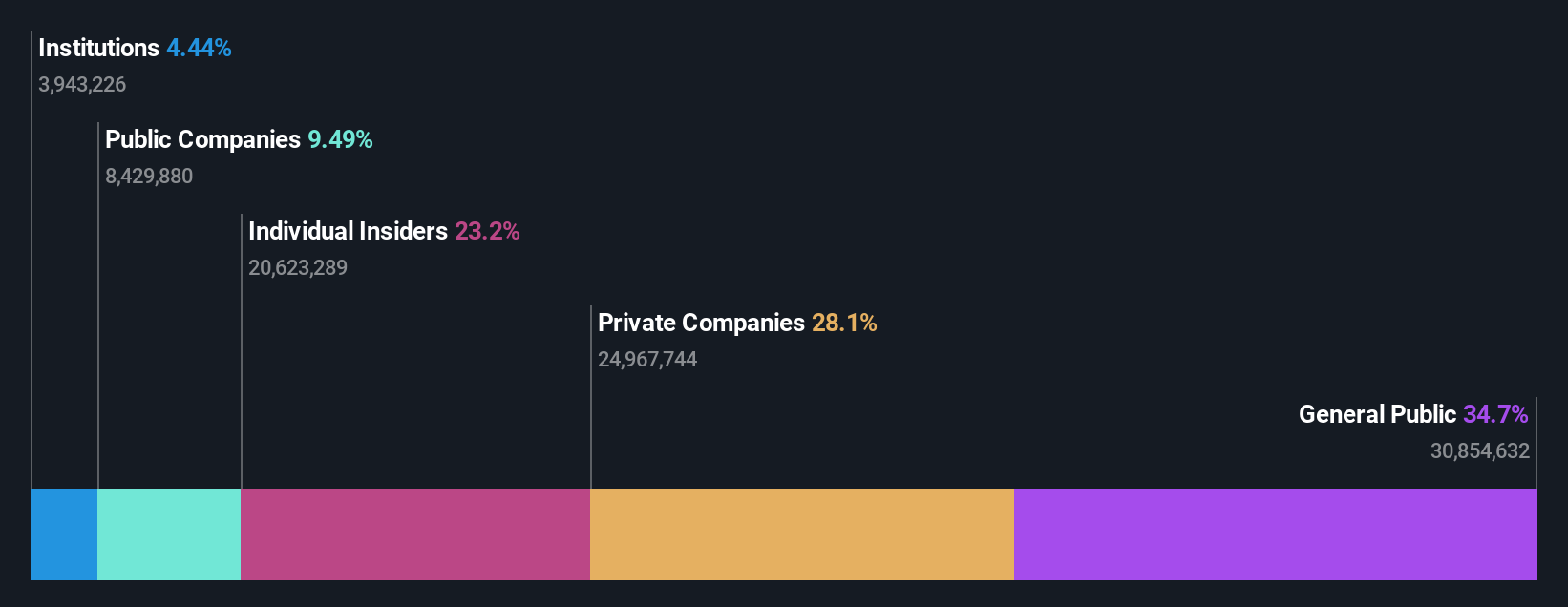

Insider Ownership: 23.2%

Revenue Growth Forecast: 16.4% p.a.

LGI Limited, recently added to the S&P/ASX Emerging Companies Index, shows promising growth with forecasted earnings and revenue increases of 25.6% and 16.4% annually, respectively. Despite trading below fair value estimates, insider activity reveals more buying than selling in recent months. Recent developments include a follow-on equity offering raising A$51.29 million and a contract for a grid-scale battery project in Sydney, aligning with its strategy to enhance energy assets amidst Australia's energy transition efforts.

- Delve into the full analysis future growth report here for a deeper understanding of LGI.

- Our comprehensive valuation report raises the possibility that LGI is priced higher than what may be justified by its financials.

Magnetic Resources (ASX:MAU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Magnetic Resources NL is involved in the exploration of mineral tenements in Western Australia and has a market cap of A$407.47 million.

Operations: The company generates revenue primarily from mineral exploration activities, amounting to A$0.01 million.

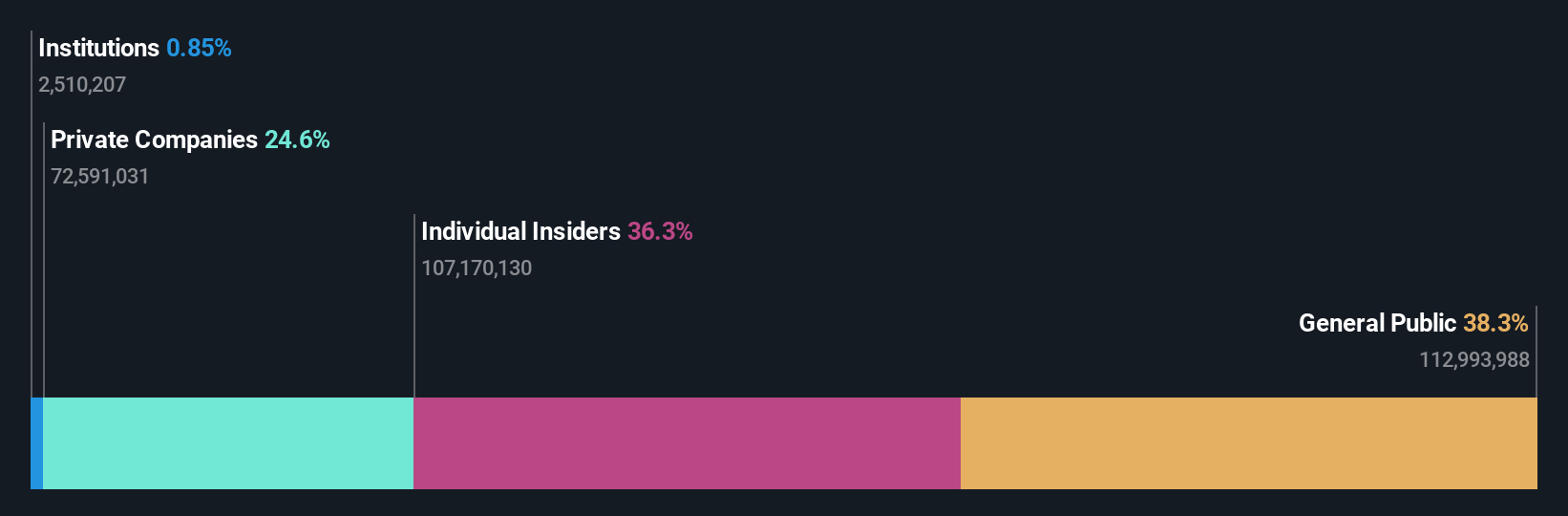

Insider Ownership: 36.3%

Revenue Growth Forecast: 98.8% p.a.

Magnetic Resources, recently added to the S&P/ASX Emerging Companies Index, highlights its growth potential with a forecasted 97.08% annual earnings increase and expected profitability within three years. Despite generating less than A$1 million in revenue and reporting a net loss of A$14.22 million for FY2025, the company raised A$35 million through a follow-on equity offering. No significant insider trading activity was noted recently, underscoring stable internal confidence amidst financial challenges.

- Dive into the specifics of Magnetic Resources here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Magnetic Resources shares in the market.

Next Steps

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 94 more companies for you to explore.Click here to unveil our expertly curated list of 97 Fast Growing ASX Companies With High Insider Ownership.

- Contemplating Other Strategies? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LGI

LGI

Provides carbon abatement and renewable energy solutions with biogas from landfill in Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)