- Australia

- /

- Metals and Mining

- /

- ASX:CXO

3 Promising ASX Penny Stocks With At Least A$100M Market Cap

Reviewed by Simply Wall St

The Australian market showed resilience today, managing to edge upward despite challenges from notable companies like Aristocrat Leisure and Macquarie Group. In such a fluctuating market, finding stocks with potential can be key for investors. Penny stocks, though often seen as relics of past speculative times, still hold promise when backed by solid financials and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.695 | A$220.43M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.79 | A$144.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.96 | A$1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.545 | A$72.88M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.70 | A$416.29M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.55M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.29 | A$2.61B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.31 | A$157.06M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.26 | A$759.73M | ✅ 4 ⚠️ 4 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.90 | A$1.33B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 995 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Australian Vanadium (ASX:AVL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Australian Vanadium Limited, with a market cap of A$103.62 million, engages in mineral exploration activities in Australia through its subsidiary.

Operations: Australian Vanadium Limited does not report any revenue segments.

Market Cap: A$103.62M

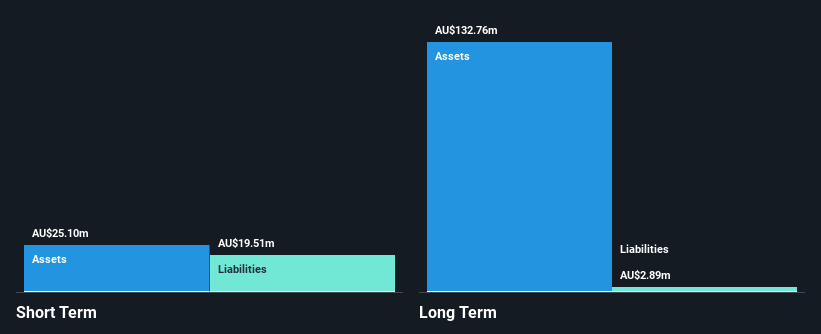

Australian Vanadium, with a market cap of A$103.62 million, is currently pre-revenue and unprofitable, reporting minimal sales of A$11K for the half year ending December 31, 2024. The company has experienced increased losses over the past five years and was recently removed from key indices such as the S&P/ASX Emerging Companies Index. Despite having no debt and short-term assets exceeding liabilities, its cash runway is less than a year if current free cash flow trends persist. Recent strategic shifts include Bryah Resources withdrawing from a collaboration agreement related to a significant government grant.

- Get an in-depth perspective on Australian Vanadium's performance by reading our balance sheet health report here.

- Evaluate Australian Vanadium's prospects by accessing our earnings growth report.

BrainChip Holdings (ASX:BRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BrainChip Holdings Ltd develops software and hardware solutions for artificial intelligence and machine learning across various regions, with a market cap of A$476.05 million.

Operations: The company generates revenue from its segment focused on the technological development of designs, amounting to $0.40 million.

Market Cap: A$476.05M

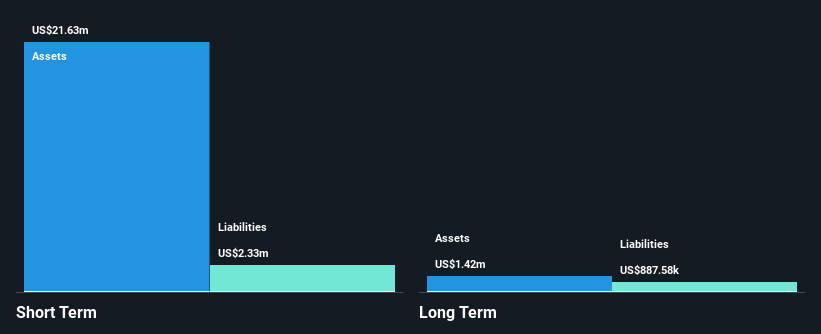

BrainChip Holdings, with a market cap of A$476.05 million, is pre-revenue, generating US$398K annually. Despite its unprofitability and negative return on equity (-123.22%), the company remains debt-free with short-term assets surpassing liabilities. BrainChip's recent collaborations highlight its Akida technology's potential in AI applications; partnerships include projects for post-quantum cryptographic security and AI-powered water safety solutions. The company's cash runway extends over a year under current conditions, but volatility remains high compared to most Australian stocks. Management tenure averages 1.4 years, indicating relatively new leadership guiding these strategic initiatives forward.

- Click here to discover the nuances of BrainChip Holdings with our detailed analytical financial health report.

- Assess BrainChip Holdings' previous results with our detailed historical performance reports.

Core Lithium (ASX:CXO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Core Lithium Ltd focuses on developing lithium and various metal deposits in Northern Territory and South Australia, with a market cap of A$212.16 million.

Operations: The company generates revenue primarily from the Finniss Lithium Project, amounting to A$57.12 million.

Market Cap: A$212.16M

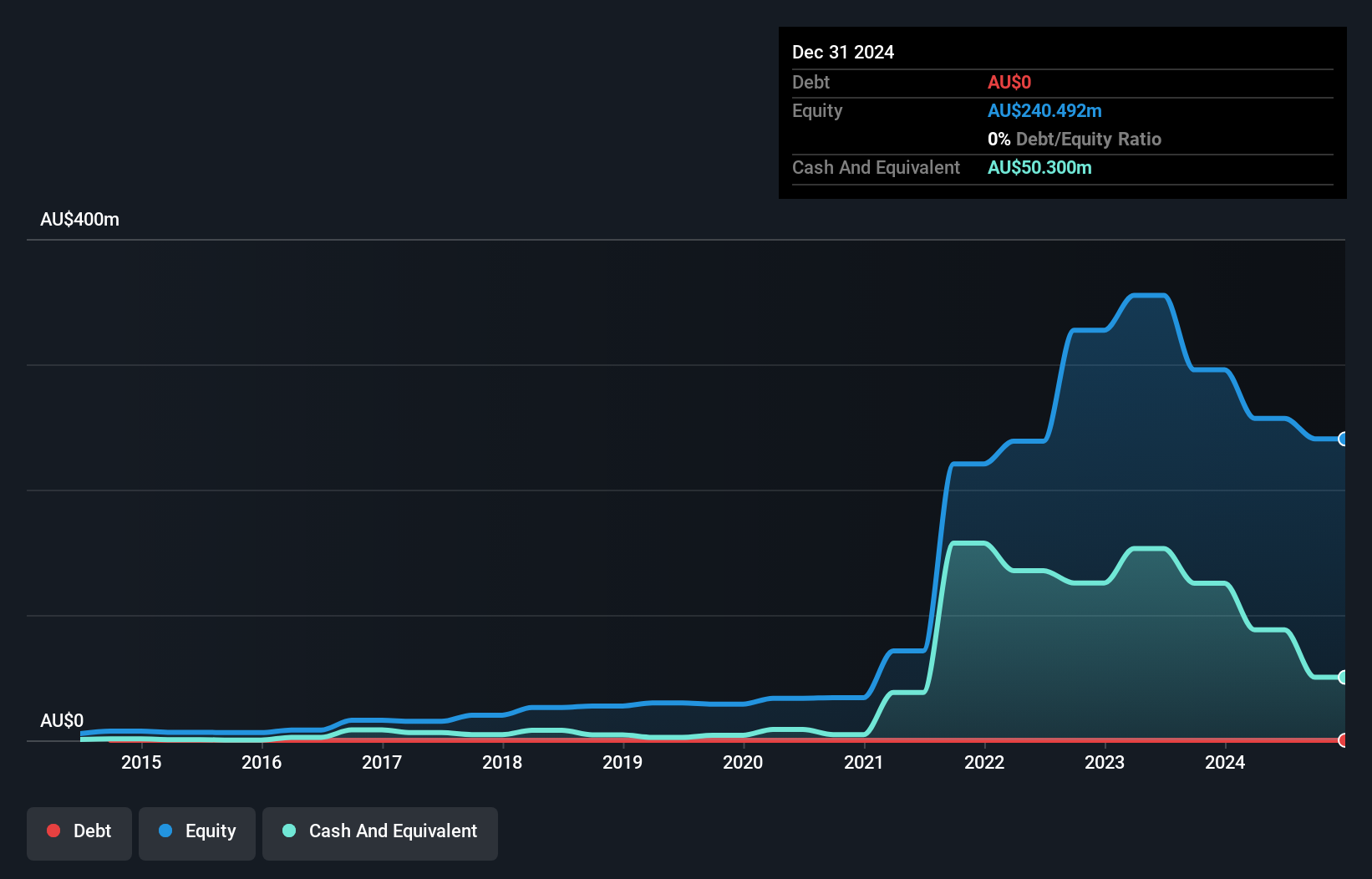

Core Lithium Ltd, with a market cap of A$212.16 million, primarily focuses on the Finniss Lithium Project, generating A$57.12 million in revenue. Despite being unprofitable and having a negative return on equity (-23.5%), the company is debt-free and has short-term assets exceeding liabilities. The ongoing Finniss Restart Study aims to optimize infrastructure and enhance productivity without adding flotation circuits, potentially reducing operating costs. This study is crucial for future decisions regarding mine operations at BP33, a high-grade lithium deposit. However, Core's cash runway remains under one year amid its volatile share price and new management team tenure averaging 1 year.

- Click to explore a detailed breakdown of our findings in Core Lithium's financial health report.

- Understand Core Lithium's earnings outlook by examining our growth report.

Make It Happen

- Get an in-depth perspective on all 995 ASX Penny Stocks by using our screener here.

- Ready For A Different Approach? Outshine the giants: these 30 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CXO

Core Lithium

Engages in the development of lithium and various metal deposits in Northern Territory and South Australia.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives