- Australia

- /

- Specialized REITs

- /

- ASX:NSR

3 ASX Dividend Stocks Yielding Up To 6.1%

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.3%, but it is up 10% over the past year with earnings forecast to grow by 12% annually. In this context, identifying dividend stocks that offer reliable yields can be a prudent strategy for investors looking to benefit from both income and potential growth.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 7.92% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.41% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.48% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.93% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.75% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.69% | ★★★★★☆ |

| GrainCorp (ASX:GNC) | 6.09% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.49% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.07% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 6.47% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

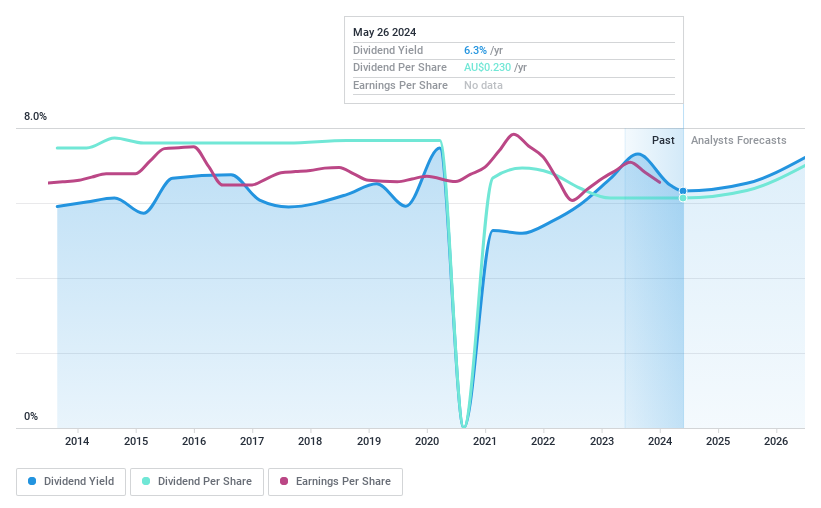

MyState (ASX:MYS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MyState Limited (ASX:MYS) operates in Australia offering banking, trustee, and managed fund services through its subsidiaries, with a market cap of A$412.72 million.

Operations: MyState Limited generates revenue from its banking segment (A$135.47 million), wealth management services (A$15.68 million), and corporate and consolidation activities (A$0.08 million).

Dividend Yield: 6.2%

MyState Limited recently declared a fully franked dividend of A$0.115 per share, payable on September 16, 2024. Despite a payout ratio of 71.8%, which suggests dividends are covered by earnings, the company's dividend history has been volatile over the past decade with significant drops and unreliability. Earnings have declined slightly year-over-year but remain substantial at A$35.29 million for FY2024. The stock's price-to-earnings ratio is an attractive 11.7x compared to the broader Australian market's 19.3x.

- Navigate through the intricacies of MyState with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, MyState's share price might be too optimistic.

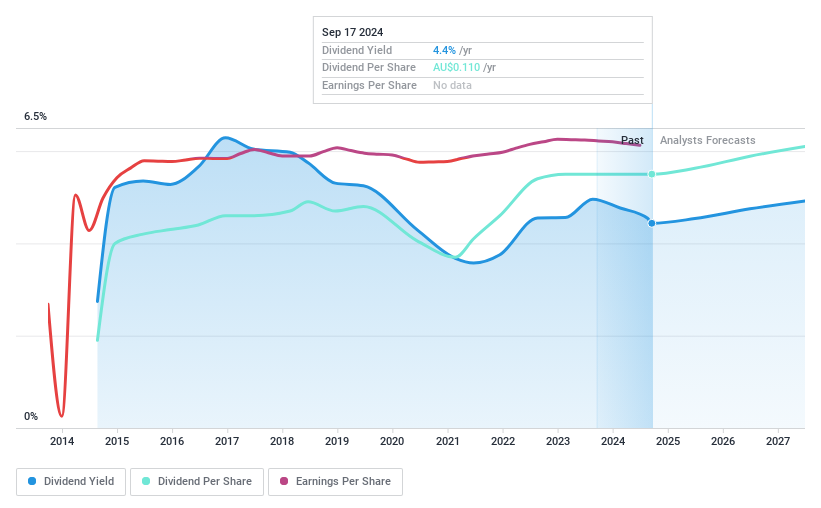

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited (ASX:NCK) is involved in sourcing and retailing household furniture and related accessories across Australia, the United Kingdom, and New Zealand, with a market cap of A$1.28 billion.

Operations: Nick Scali Limited generates revenue primarily through the retailing of furniture, amounting to A$468.19 million.

Dividend Yield: 4.4%

Nick Scali Limited declared a fully franked final dividend of A$0.33 per share for the six months ended June 30, 2024, with a record date of September 26 and payable on October 17. Despite a decrease in sales to A$468.19 million and net income to A$80.61 million, the company maintains stable dividends covered by earnings (68.9% payout ratio) and cash flows (54.8% cash payout ratio). The dividend yield stands at 4.41%, lower than top-tier Australian dividend payers but reliable over the past decade with consistent growth and stability.

- Unlock comprehensive insights into our analysis of Nick Scali stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Nick Scali is priced lower than what may be justified by its financials.

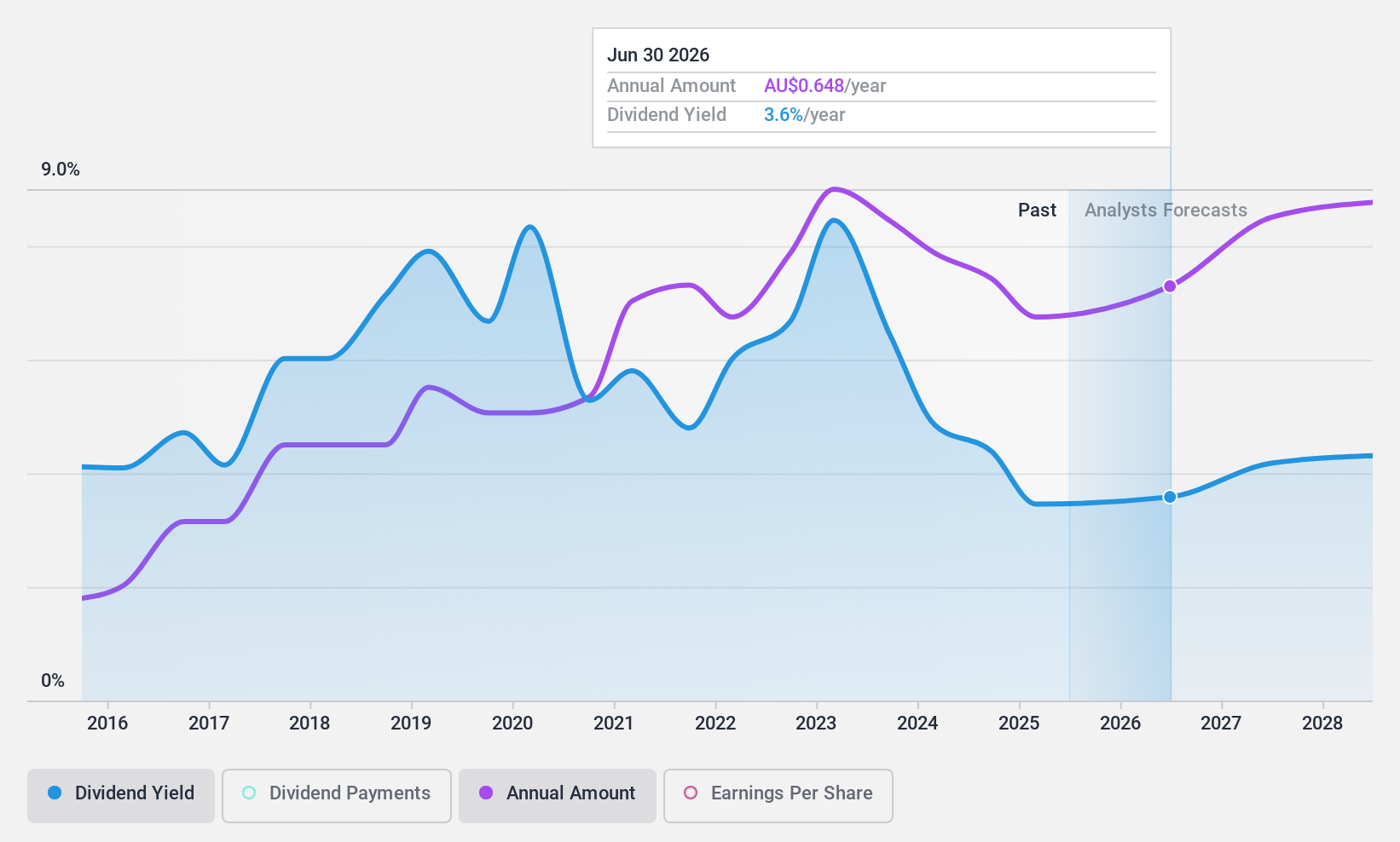

National Storage REIT (ASX:NSR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Storage REIT (ASX:NSR) is the largest self-storage provider in Australia and New Zealand, operating over 225 centres and serving more than 90,000 residential and commercial customers, with a market cap of A$3.41 billion.

Operations: National Storage REIT generates revenue primarily from the operation and management of storage centres, amounting to A$354.69 million.

Dividend Yield: 4.5%

National Storage REIT reported A$355.37 million in revenue for the fiscal year ending June 30, 2024, with net income of A$28.93 million. The company announced a final distribution of 5.5 cents per stapled security, maintaining a reliable dividend history over the past decade despite a lower yield compared to top-tier Australian dividend payers. Dividends are covered by earnings (55.5% payout ratio) and cash flows (83% cash payout ratio), indicating sustainability amidst stable financials and growing revenue streams.

- Click here to discover the nuances of National Storage REIT with our detailed analytical dividend report.

- Our valuation report unveils the possibility National Storage REIT's shares may be trading at a premium.

Make It Happen

- Investigate our full lineup of 35 Top ASX Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 225 centres providing tailored storage solutions to over 90,000 residential and commercial customers.

Established dividend payer with adequate balance sheet.