As the ASX200 inches up by 0.05% to 8,180 points amidst a mixed performance across sectors, with telecommunications and IT leading gains while energy and materials lag due to falling iron ore prices, investors are keenly observing the broader market dynamics influenced by global trends such as Wall Street's tech-driven rally. In this environment, growth companies with substantial insider ownership can be particularly appealing as they often signal confidence from those closest to the business, potentially offering resilience and alignment of interests in fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 49.1% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 71.5% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Liontown Resources (ASX:LTR) | 14.7% | 61.8% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Here we highlight a subset of our preferred stocks from the screener.

Humm Group (ASX:HUM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Humm Group Limited offers a range of financial products and services across Australia, New Zealand, Ireland, the United Kingdom, and Canada with a market capitalization of A$405.59 million.

Operations: The company's revenue segments include PosPP with A$49.70 million, Australia Cards at A$42 million, New Zealand Cards totaling A$65.90 million, and Commercial and Leasing contributing A$86.10 million.

Insider Ownership: 36.5%

Humm Group is positioned for growth with expected annual earnings growth of 23.9%, outpacing the Australian market's 12.2%. While revenue is set to increase at 13.1% annually, it remains below the high-growth threshold of 20%. The company recently became profitable and offers good relative value compared to peers. However, its financial position shows debt not well covered by operating cash flow, and future return on equity is forecasted low at 6.8%.

- Take a closer look at Humm Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Humm Group shares in the market.

Kogan.com (ASX:KGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kogan.com Ltd is an online retailer operating in Australia with a market capitalization of A$515.58 million.

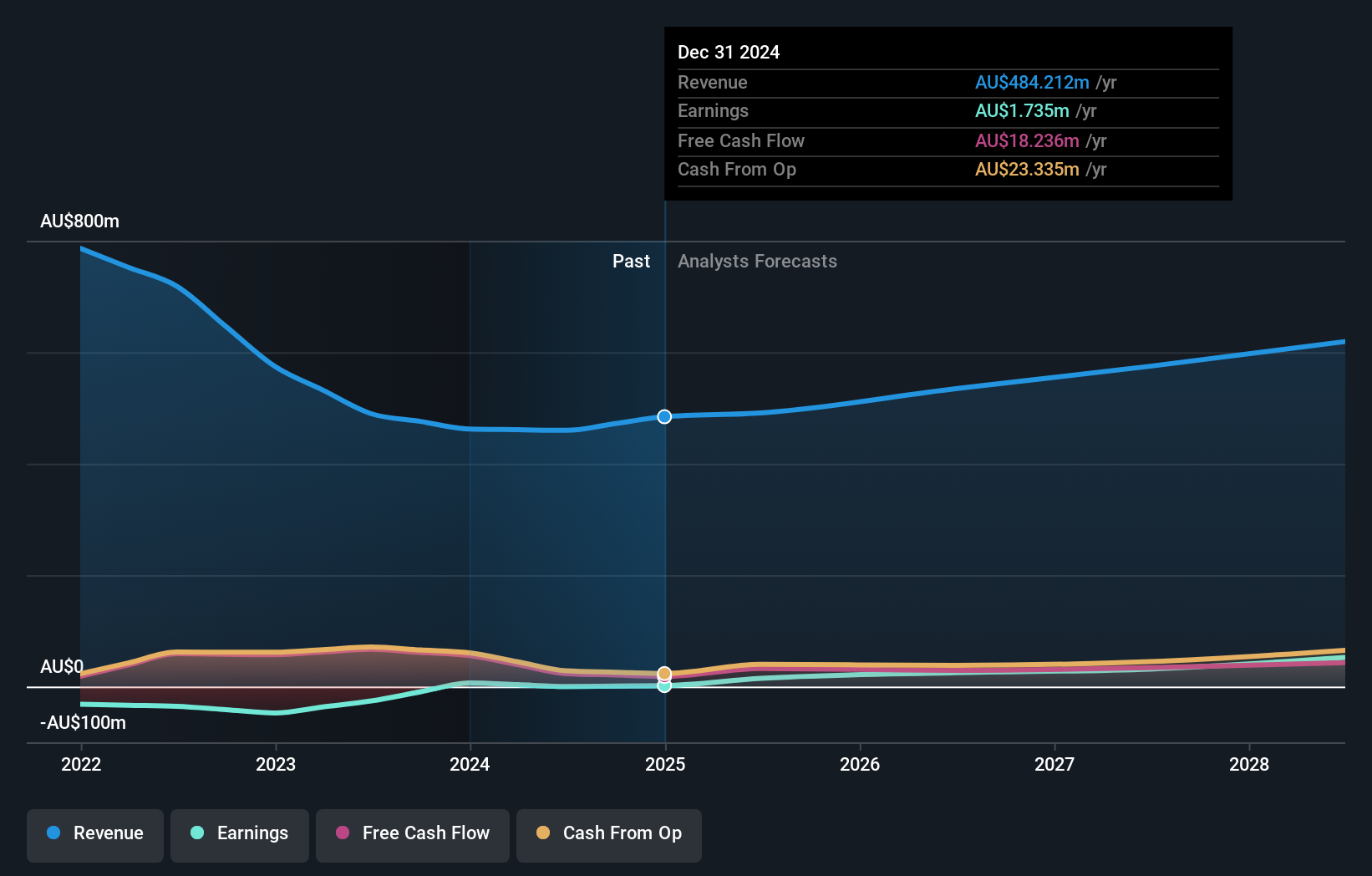

Operations: The company generates revenue through its operations in Australia and New Zealand, with A$277.82 million from Kogan Parent-Australia, A$11.20 million from Mighty Ape-Australia, A$135.34 million from Mighty Ape-New Zealand, and A$35.35 million from Kogan Parent-New Zealand.

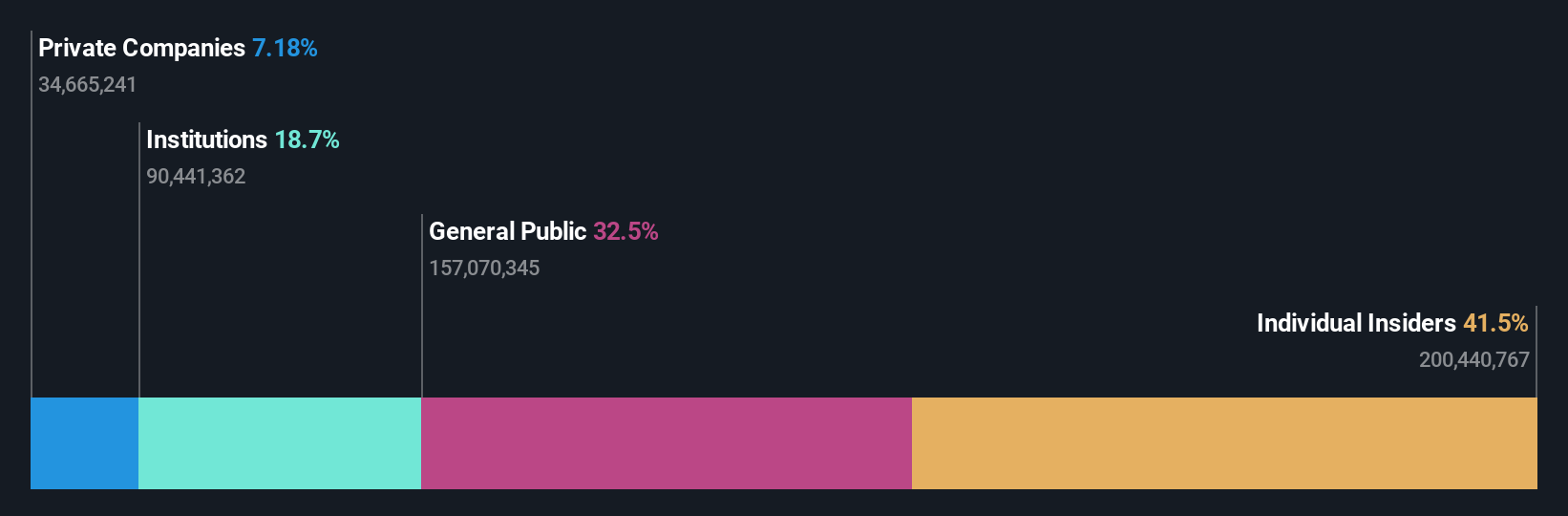

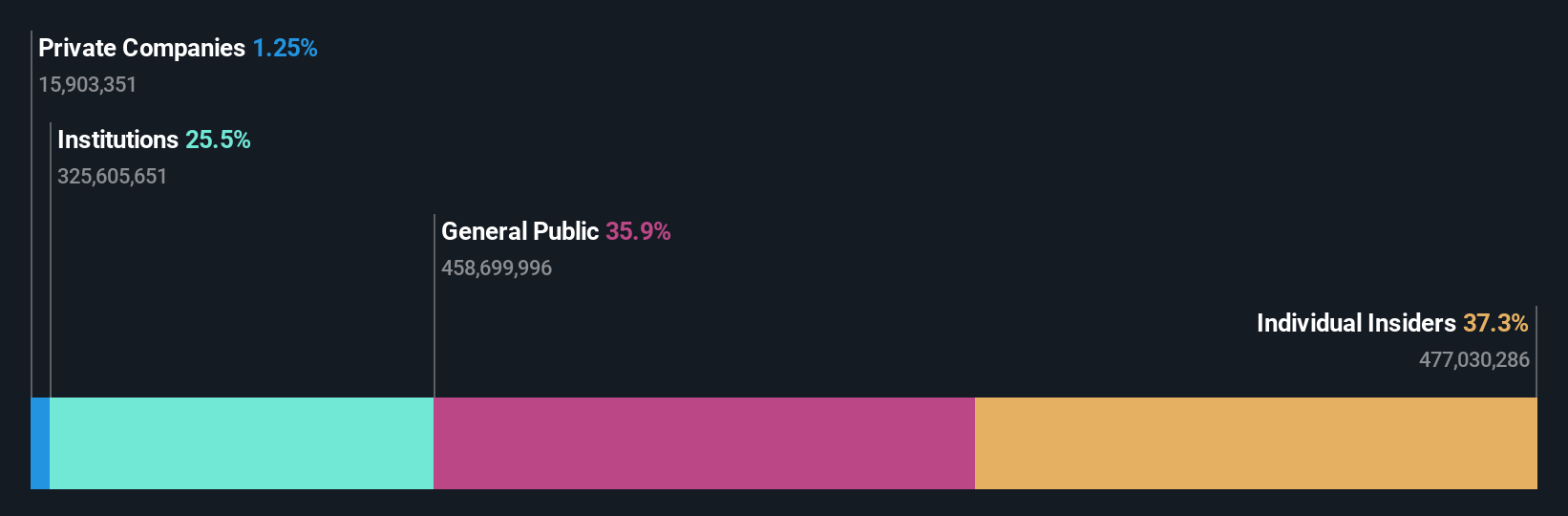

Insider Ownership: 19.6%

Kogan.com demonstrates potential for growth with forecasted annual earnings growth of 31.1%, surpassing the Australian market's 12.2%. The company recently achieved profitability, reporting a net income of A$0.083 million for the year ending June 2024, compared to a loss previously. Trading significantly below its estimated fair value, Kogan.com completed a substantial share buyback program worth A$51.8 million, indicating strong insider confidence despite dividends not being well covered by earnings.

- Click here and access our complete growth analysis report to understand the dynamics of Kogan.com.

- The valuation report we've compiled suggests that Kogan.com's current price could be inflated.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited is a company focused on developing regenerative medicine products across Australia, the United States, Singapore, and Switzerland, with a market cap of A$1.67 billion.

Operations: The company's revenue is primarily derived from the development of its cell technology platform for commercialization, amounting to $5.90 million.

Insider Ownership: 22.2%

Mesoblast is poised for growth with forecasted revenue expansion of 45.8% annually, outpacing the Australian market's 5.5%. Insider confidence is evident as more shares were bought than sold in recent months. Despite a net loss of US$87.96 million in fiscal 2024, the company anticipates profitability within three years and trades significantly below its fair value estimate. Recent developments include a US$50 million convertible note issuance and FDA acceptance of Ryoncil’s BLA resubmission for SR-aGVHD treatment approval.

- Unlock comprehensive insights into our analysis of Mesoblast stock in this growth report.

- In light of our recent valuation report, it seems possible that Mesoblast is trading behind its estimated value.

Seize The Opportunity

- Discover the full array of 99 Fast Growing ASX Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kogan.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KGN

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives