- Australia

- /

- Specialty Stores

- /

- ASX:APE

Insider Action Drives These 3 Top Undervalued Small Caps In None Region

Reviewed by Simply Wall St

In recent weeks, global markets have shown varied performance, with small-cap indices like the Russell 2000 outperforming larger counterparts amid shifting economic conditions. As consumer spending strengthens and industrial output faces challenges, investors are increasingly considering small-cap stocks that may offer unique opportunities in a dynamic economic landscape. Identifying promising stocks often involves looking at factors such as growth potential and insider activity, which can signal confidence from those closest to the company's operations.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.0x | 0.9x | 21.01% | ★★★★★★ |

| Bytes Technology Group | 22.0x | 5.6x | 12.14% | ★★★★★☆ |

| East West Banking | 3.6x | 0.8x | 36.28% | ★★★★★☆ |

| Sagicor Financial | 1.4x | 0.3x | -46.47% | ★★★★☆☆ |

| Robert Walters | 41.5x | 0.2x | 42.00% | ★★★☆☆☆ |

| Security Bank | 7.6x | 1.8x | 2.84% | ★★★☆☆☆ |

| Megaworld | 4.2x | 1.0x | -134.72% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -111.59% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -46.30% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

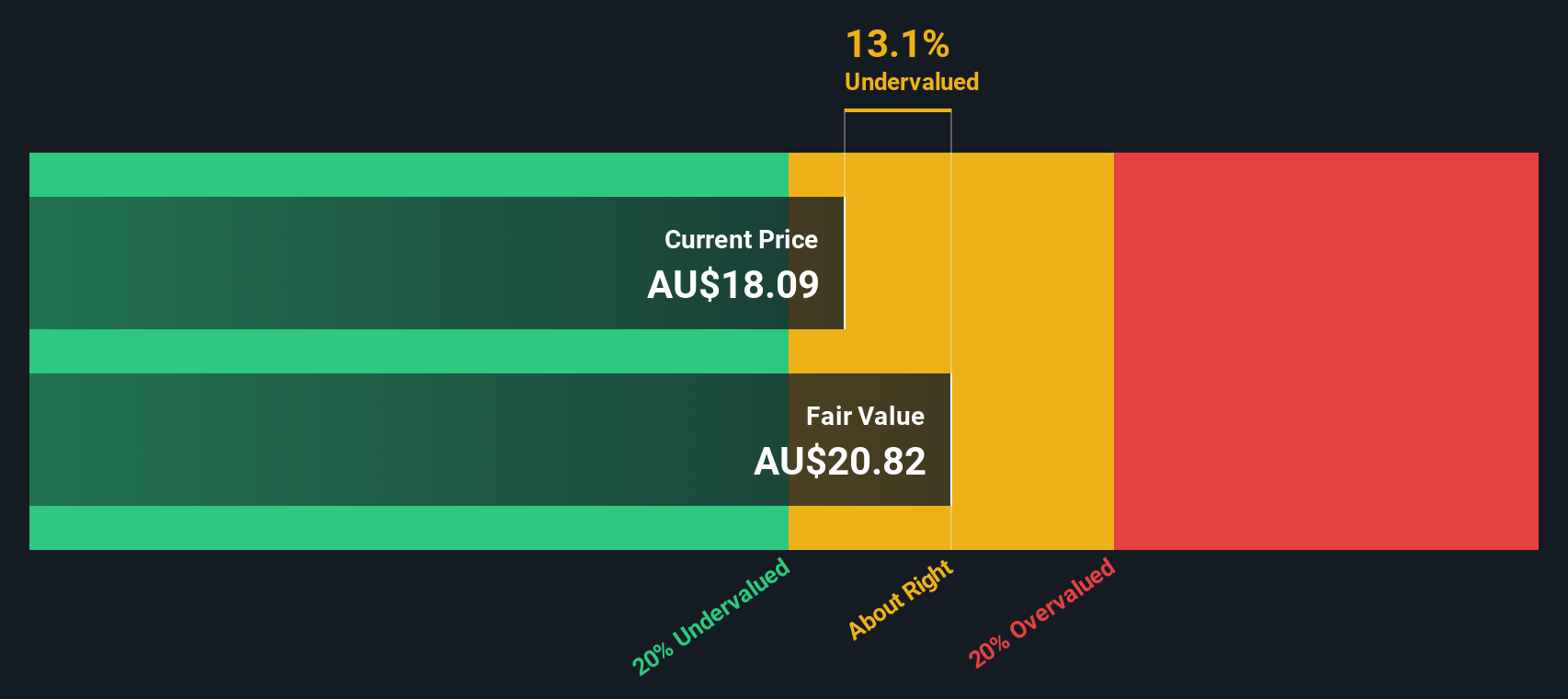

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a leading automotive retail group in Australia, primarily engaged in car retailing, with a market capitalization of A$3.92 billion.

Operations: The primary revenue stream for the company is car retailing, generating A$10.50 billion. The gross profit margin has fluctuated over time, reaching 18.17% in the latest period reported. Operating expenses and cost of goods sold significantly impact overall profitability, with operating expenses recorded at A$1.36 billion and COGS at A$8.59 billion in the most recent data available.

PE: 11.9x

Eagers Automotive, a smaller player in the automotive sector, recently showcased insider confidence with Nicholas Politis acquiring 200,000 shares for A$2.09 million between August and October 2024. Despite facing challenges like higher-risk external borrowing and a dip in net income to A$116.02 million for H1 2024 from A$137.76 million the previous year, sales grew to A$5.46 billion from A$4.82 billion. The company continues paying dividends at A$0.24 per share, reflecting ongoing shareholder value commitment amidst industry volatility.

- Unlock comprehensive insights into our analysis of Eagers Automotive stock in this valuation report.

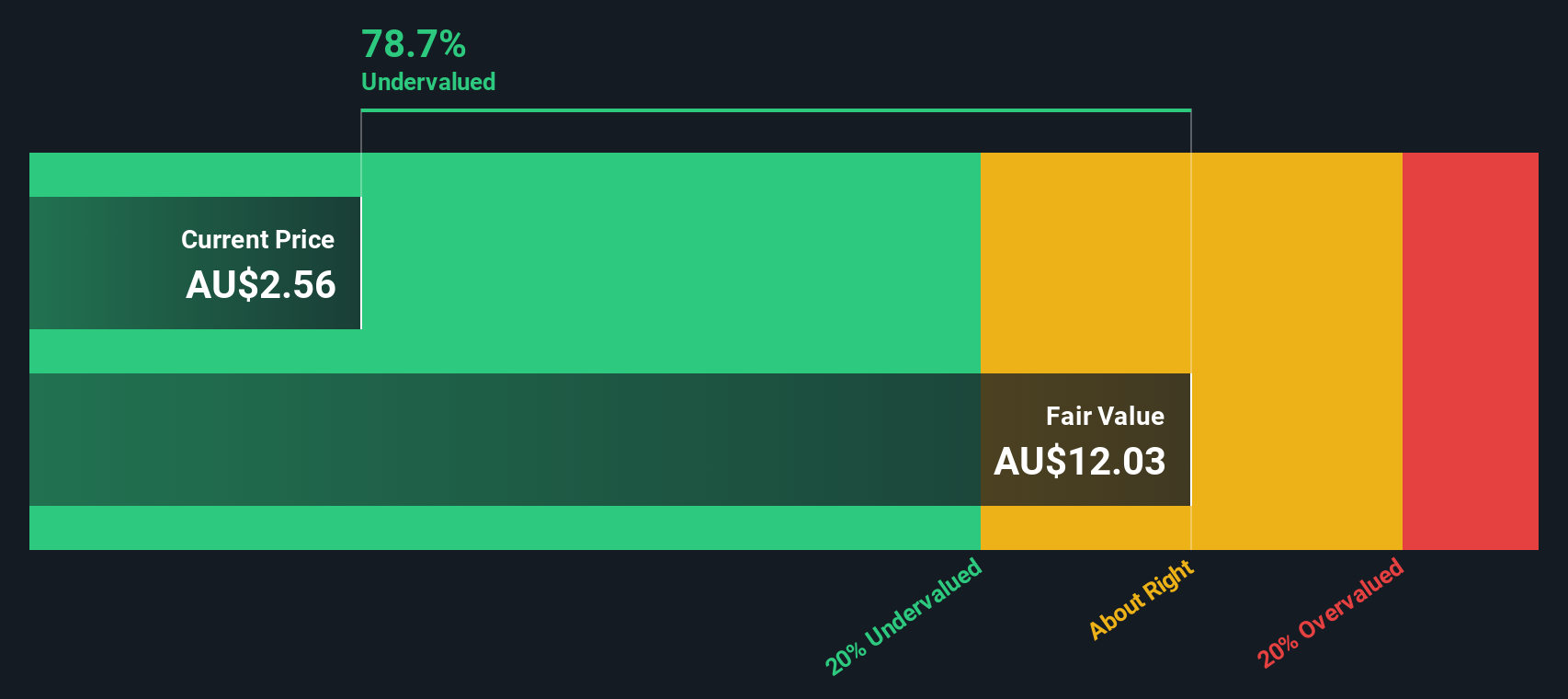

Westgold Resources (ASX:WGX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Westgold Resources is a mining company focused on gold production, primarily operating in the Bryah and Murchison regions, with a market capitalization of A$1.08 billion.

Operations: Westgold Resources generates revenue primarily from its Bryah and Murchison segments, with recent figures showing A$183.25 million and A$533.23 million, respectively. The company has experienced fluctuations in its gross profit margin, reaching 21.91% as of June 2024, indicating variability in cost management or pricing strategies over time.

PE: 32.3x

Westgold Resources, a company with promising growth potential, forecasts earnings to grow by 30.6% annually. Recently added to the S&P/ASX 200 Index, it produced a record 77,369 ounces of gold in Q1 FY25 at A$3,723/oz. The merger with Karora Resources boosts its portfolio and production capabilities. With insider confidence shown through recent share purchases and strategic leadership changes, Westgold aims for increased production efficiency and expanded resource exploration efforts in coming years.

- Navigate through the intricacies of Westgold Resources with our comprehensive valuation report here.

Understand Westgold Resources' track record by examining our Past report.

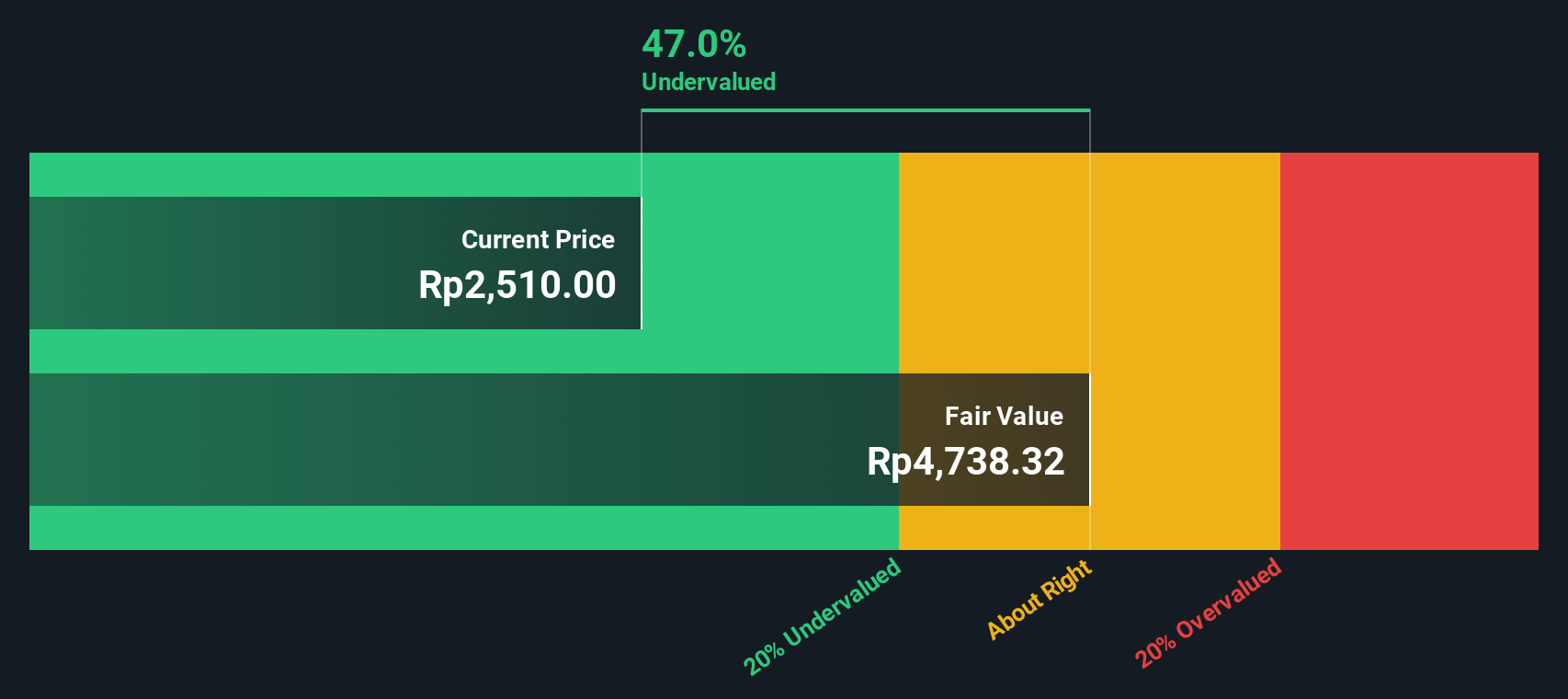

Semen Indonesia (Persero) (IDX:SMGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Semen Indonesia (Persero) is a leading cement producer in Indonesia, engaged in both cement and non-cement production activities, with a market capitalization of approximately IDR 49.20 trillion.

Operations: The company's primary revenue streams are derived from Cement Production, generating IDR 33.81 trillion, and Non-Cement Production, contributing IDR 13.35 trillion. Over recent periods, the gross profit margin has shown a decreasing trend from 31.92% in Q1 2020 to 24.89% by mid-2024. Operating expenses have consistently impacted profitability, with notable allocations towards sales and marketing as well as general and administrative functions across the reviewed periods.

PE: 16.9x

Semen Indonesia's recent insider confidence is evident as their Director of Human Capital & General Affair, Agung Wiharto, purchased 521,139 shares valued at approximately IDR 2.01 billion. Despite a dip in sales and net income for the half-year ending June 2024 compared to the previous year, with sales at IDR 16.41 trillion and net income at IDR 501 billion, earnings are projected to grow by over 16% annually. However, reliance on external borrowing poses higher risk for funding stability.

Make It Happen

- Embark on your investment journey to our 200 Undervalued Small Caps With Insider Buying selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagers Automotive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APE

Eagers Automotive

Owns and operates motor vehicle dealerships in Australia and New Zealand.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives