The Australian market recently experienced a dip, with the ASX down 0.3% as investors awaited key CPI data and closely monitored geopolitical developments, such as the US-China diplomatic talks. In this environment of cautious optimism and sector fluctuations, identifying high-growth tech stocks requires careful consideration of companies that demonstrate resilience and potential for innovation amidst broader economic challenges.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 11.53% | 37.56% | ★★★★★☆ |

| Infomedia | 7.00% | 20.05% | ★★★★☆☆ |

| Clinuvel Pharmaceuticals | 22.04% | 26.15% | ★★★★★☆ |

| Pro Medicus | 19.44% | 20.97% | ★★★★★☆ |

| Kinatico | 13.27% | 42.29% | ★★★★☆☆ |

| Immutep | 104.12% | 46.46% | ★★★★★☆ |

| BlinkLab | 104.90% | 101.40% | ★★★★★★ |

| Artrya | 49.60% | 61.45% | ★★★★★☆ |

| PYC Therapeutics | 10.34% | 24.40% | ★★★★★☆ |

| FINEOS Corporation Holdings | 9.22% | 57.85% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Immutep (ASX:IMM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Immutep Limited is a biotechnology company focused on developing innovative Lymphocyte Activation Gene-3 related immunotherapies for cancer and autoimmune diseases in Australia, with a market cap of A$419.50 million.

Operations: Immutep generates revenue primarily from its immunotherapy segment, amounting to A$5.03 million. The company is engaged in the development of Lymphocyte Activation Gene-3 related therapies aimed at treating cancer and autoimmune diseases.

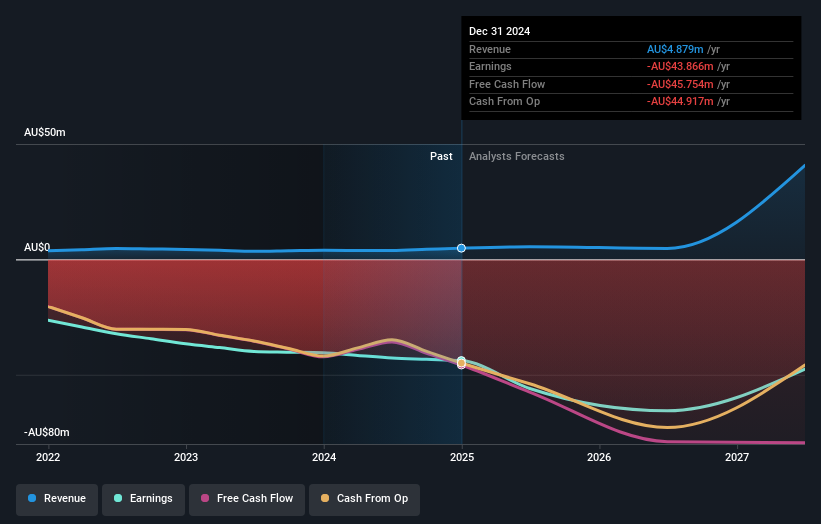

Immutep, an Australian biotechnology firm, has demonstrated significant strides in the high-growth tech sector, particularly through its innovative immunotherapy developments. With a remarkable annual revenue growth forecast at 104.1%, the company is set to outpace the industry average significantly. Recent clinical trials, such as the INSIGHT-003 and EFTISARC-NEO studies, have shown promising results in treating non-small cell lung cancer and soft tissue sarcoma, potentially revolutionizing treatment paradigms with eftilagimod alfa (efti). These advancements underscore Immutep's potential to impact future medical treatments profoundly despite its current lack of profitability and meaningful revenue (A$5M). As it moves towards profitability forecasted within three years and continues to engage in groundbreaking research—evidenced by R&D expenses aligning with industry innovation standards—Immutep remains a notable entity within tech-driven biotech development.

Nuix (ASX:NXL)

Simply Wall St Growth Rating: ★★★★☆☆

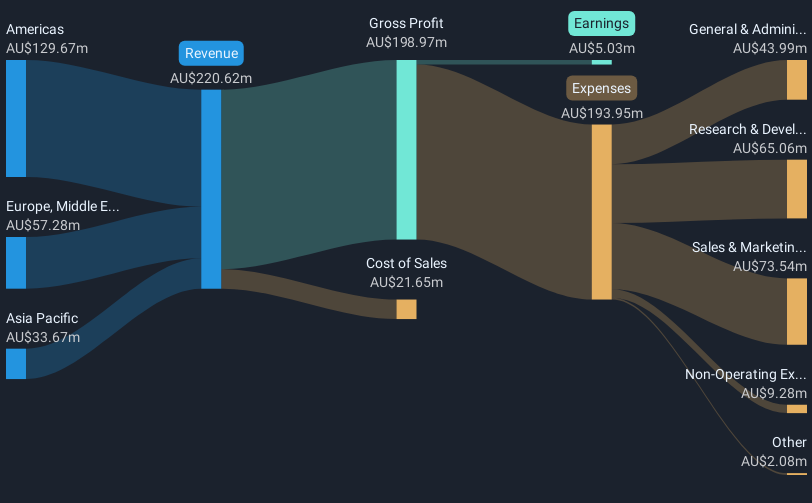

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of A$816.56 million.

Operations: Nuix generates revenue primarily from its Software & Programming segment, amounting to A$221.50 million.

Nuix, a tech entity navigating the competitive landscape of Australia's software industry, recently projected an 8.9% annual revenue growth, outpacing the national average of 7.8%. Despite its recent removal from the S&P/ASX 200 Index and a shift in registered office location to Sydney's Market Street, Nuix maintains focus on innovation with R&D investments aligning closely with these strategic changes. The company anticipates profitability within three years, supported by an impressive expected earnings growth rate of 44.1% annually. This trajectory is set against a backdrop where software firms are increasingly adopting SaaS models to secure stable subscription revenues, positioning Nuix to leverage these industry shifts effectively despite current unprofitability and a challenging past fiscal year marked by a net loss of AUD 9.21 million from sales totaling AUD 221.5 million.

- Click to explore a detailed breakdown of our findings in Nuix's health report.

Gain insights into Nuix's historical performance by reviewing our past performance report.

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PYC Therapeutics Limited is a drug-development company focused on discovering and developing novel RNA therapeutics for treating genetic diseases in Australia, with a market cap of A$699.91 million.

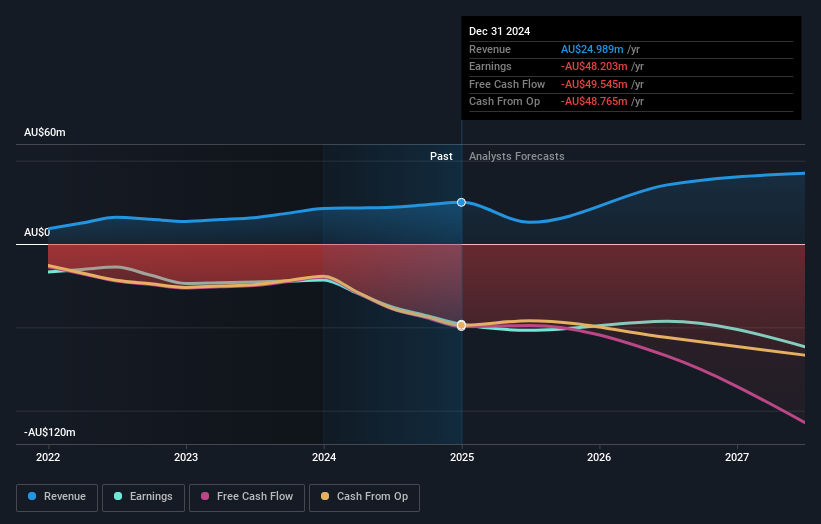

Operations: The company generates revenue of A$23.49 million from its focus on the discovery and development of novel RNA therapeutics aimed at treating genetic diseases.

Amidst a challenging landscape, PYC Therapeutics has demonstrated resilience with a 10.3% annual revenue growth, outstripping the Australian market average of 7.8%. Recent board and executive team enhancements aim to bolster the company's strategic direction, particularly in advancing its innovative therapeutic pipeline. Despite a notable net loss increase to AUD 50.3 million from AUD 37.73 million year-over-year, PYC is poised for recovery with anticipated profitability and an impressive forecasted earnings growth of 24.4% annually over the next three years. These developments suggest a strategic pivot towards stabilizing and eventually growing its financial health, leveraging both leadership expertise and R&D initiatives to navigate forthcoming market challenges effectively.

- Delve into the full analysis health report here for a deeper understanding of PYC Therapeutics.

Examine PYC Therapeutics' past performance report to understand how it has performed in the past.

Taking Advantage

- Take a closer look at our ASX High Growth Tech and AI Stocks list of 20 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)