- Australia

- /

- Metals and Mining

- /

- ASX:VSR

3 Promising ASX Penny Stocks With A$30M Market Cap

Reviewed by Simply Wall St

The Australian market has been experiencing mixed performance, with the ASX200 down 0.4% as investors react to disappointing Chinese stimulus measures and fluctuating commodity prices. Amidst these broader market conditions, penny stocks—though an older term—remain a relevant area for those seeking growth opportunities in smaller or newer companies. With strong financial foundations, these stocks can offer potential upside while mitigating some of the risks typically associated with this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$71.5M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.885 | A$306.91M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.565 | A$350.38M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.86 | A$127.05M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.17 | A$1.08B | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.34 | A$114.39M | ★★★★★☆ |

Click here to see the full list of 1,037 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Metal Bank (ASX:MBK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metal Bank Limited is involved in the exploration of mineral properties in Australia, with a market capitalization of A$8.39 million.

Operations: Metal Bank Limited has not reported any revenue segments.

Market Cap: A$8.39M

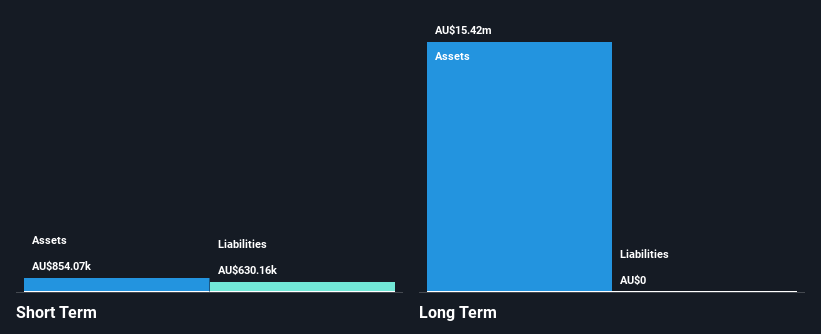

Metal Bank Limited, with a market capitalization of A$8.39 million, is currently pre-revenue and unprofitable, having reported a net loss of A$2.22 million for the year ending June 30, 2024. The company recently announced a follow-on equity offering to raise approximately A$1.56 million through rights issuance, which may help extend its cash runway beyond the current forecasted three months based on historical free cash flow trends. Despite high share price volatility and past shareholder dilution, Metal Bank remains debt-free with no long-term liabilities and has an experienced board averaging over 11 years in tenure.

- Dive into the specifics of Metal Bank here with our thorough balance sheet health report.

- Gain insights into Metal Bank's historical outcomes by reviewing our past performance report.

PharmX Technologies (ASX:PHX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PharmX Technologies Limited operates as a technology and software development company in Australia, with a market capitalization of A$28.13 million.

Operations: PharmX Technologies generates revenue from its Health Services segment, amounting to A$6.42 million.

Market Cap: A$28.13M

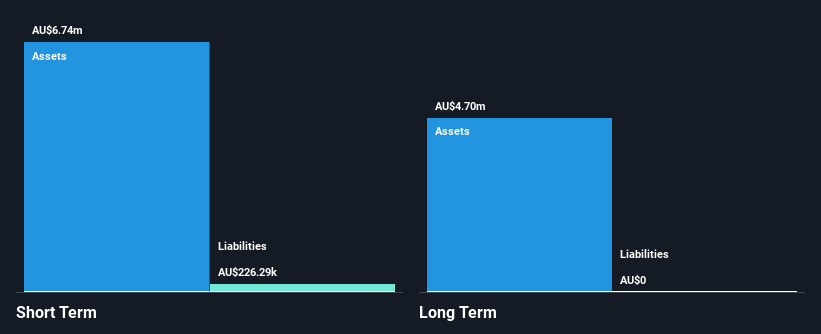

PharmX Technologies, with a market cap of A$28.13 million, has transitioned to profitability this year, marking significant progress in its financial performance. The company reported revenues of A$8.09 million for the year ending June 30, 2024, although it still recorded a net loss of A$1.77 million. Despite high share price volatility and low return on equity at 0.6%, PharmX remains debt-free and has not diluted shareholders recently. Its board is seasoned with an average tenure of 4.4 years, bolstered by recent strategic appointments like Sandy Mellis as an independent director to enhance governance expertise.

- Jump into the full analysis health report here for a deeper understanding of PharmX Technologies.

- Review our historical performance report to gain insights into PharmX Technologies' track record.

Voltaic Strategic Resources (ASX:VSR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Voltaic Strategic Resources Limited is an Australian company engaged in mineral exploration, with a market capitalization of A$9.08 million.

Operations: Currently, there are no reported revenue segments for this Australian mineral exploration company.

Market Cap: A$9.08M

Voltaic Strategic Resources, with a market capitalization of A$9.08 million, remains pre-revenue and unprofitable but has shown improvement by reducing losses at a significant rate over the past five years. The company maintains a strong financial position with no debt and sufficient cash runway for over three years. Recent earnings for the half-year ended June 2024 showed a net income turnaround compared to last year's loss, indicating potential progress in financial management. However, its share price remains highly volatile. The recent appointment of Daniel Raihani as non-executive director may bring valuable expertise to the boardroom dynamics.

- Unlock comprehensive insights into our analysis of Voltaic Strategic Resources stock in this financial health report.

- Learn about Voltaic Strategic Resources' historical performance here.

Seize The Opportunity

- Dive into all 1,037 of the ASX Penny Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VSR

Flawless balance sheet low.

Market Insights

Community Narratives