- Australia

- /

- Specialized REITs

- /

- ASX:NSR

3 ASX Stocks Estimated To Be Trading Below Their Fair Value

Reviewed by Simply Wall St

The Australian stock market has recently experienced a decline, with the ASX200 closing down 0.4% at 8,131 points as all sectors lost ground amid the Reserve Bank's decision to keep interest rates steady at 4.35%. In this environment of cautious economic outlook and sector-wide losses, identifying stocks that may be trading below their fair value can present potential opportunities for investors looking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Telix Pharmaceuticals (ASX:TLX) | A$22.41 | A$44.49 | 49.6% |

| DUG Technology (ASX:DUG) | A$1.81 | A$3.48 | 48% |

| MLG Oz (ASX:MLG) | A$0.62 | A$1.15 | 46.2% |

| Ansell (ASX:ANN) | A$31.20 | A$57.80 | 46% |

| Ingenia Communities Group (ASX:INA) | A$4.70 | A$9.43 | 50.2% |

| Megaport (ASX:MP1) | A$6.78 | A$13.42 | 49.5% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| IDP Education (ASX:IEL) | A$14.04 | A$27.38 | 48.7% |

| Audinate Group (ASX:AD8) | A$9.25 | A$17.81 | 48.1% |

| Energy One (ASX:EOL) | A$5.56 | A$11.06 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

Data#3 (ASX:DTL)

Overview: Data#3 Limited provides information technology solutions and services across Australia, Fiji, and the Pacific Islands with a market capitalization of A$1.17 billion.

Operations: The company's revenue primarily derives from its role as a value-added IT reseller and IT solutions provider, generating A$805.75 million.

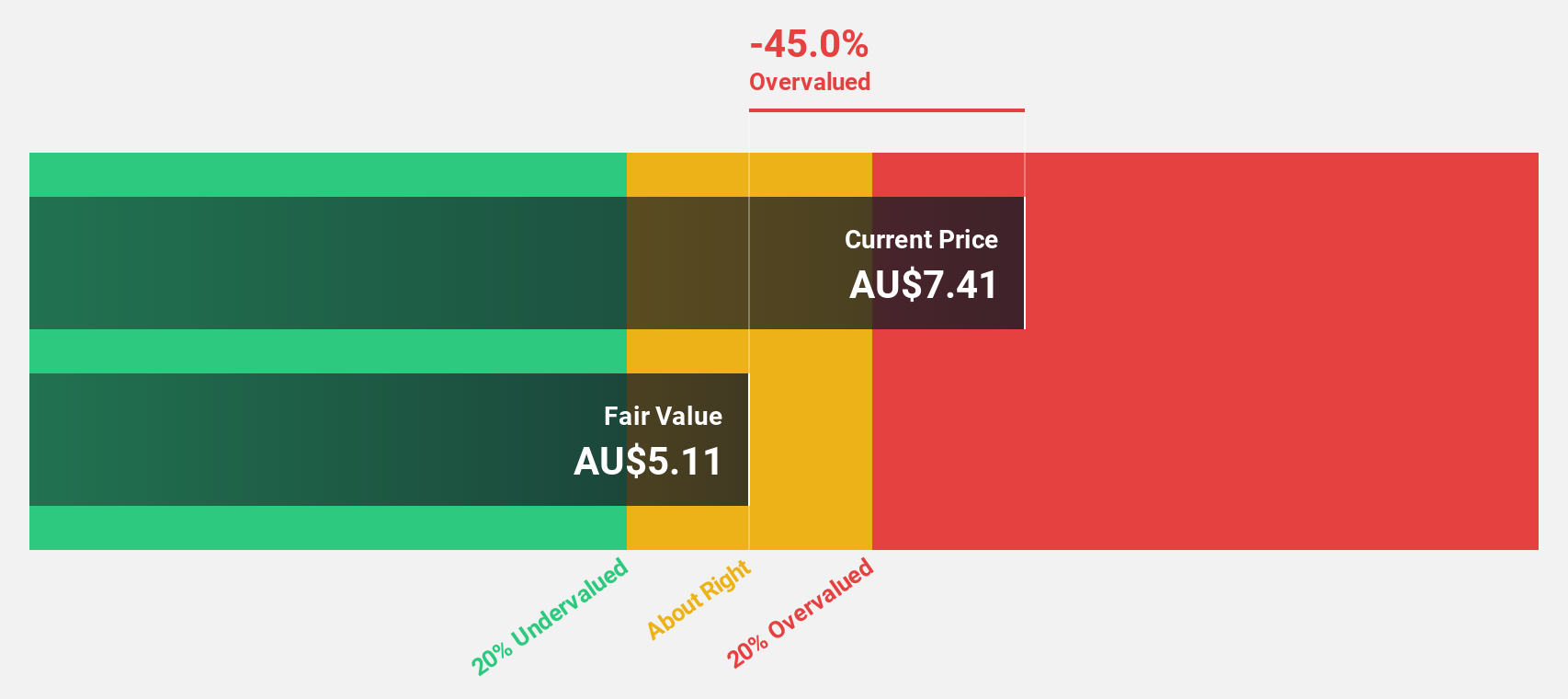

Estimated Discount To Fair Value: 45.5%

Data#3 is trading at A$7.32, significantly below its estimated fair value of A$13.44, indicating potential undervaluation based on cash flows. Analysts expect a 21% price increase, aligning with strong revenue growth forecasts of 33.3% annually, surpassing market expectations. However, the dividend yield of 3.52% isn't well covered by earnings or cash flows, and earnings growth at 10.9% per year lags behind the broader Australian market's forecasted growth rate of 12.3%.

- The analysis detailed in our Data#3 growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Data#3.

National Storage REIT (ASX:NSR)

Overview: National Storage REIT is the largest self-storage provider in Australia and New Zealand, operating over 225 centers that offer tailored storage solutions to more than 90,000 residential and commercial customers, with a market cap of A$3.45 billion.

Operations: The company generates revenue of A$354.69 million from the operation and management of its storage centers.

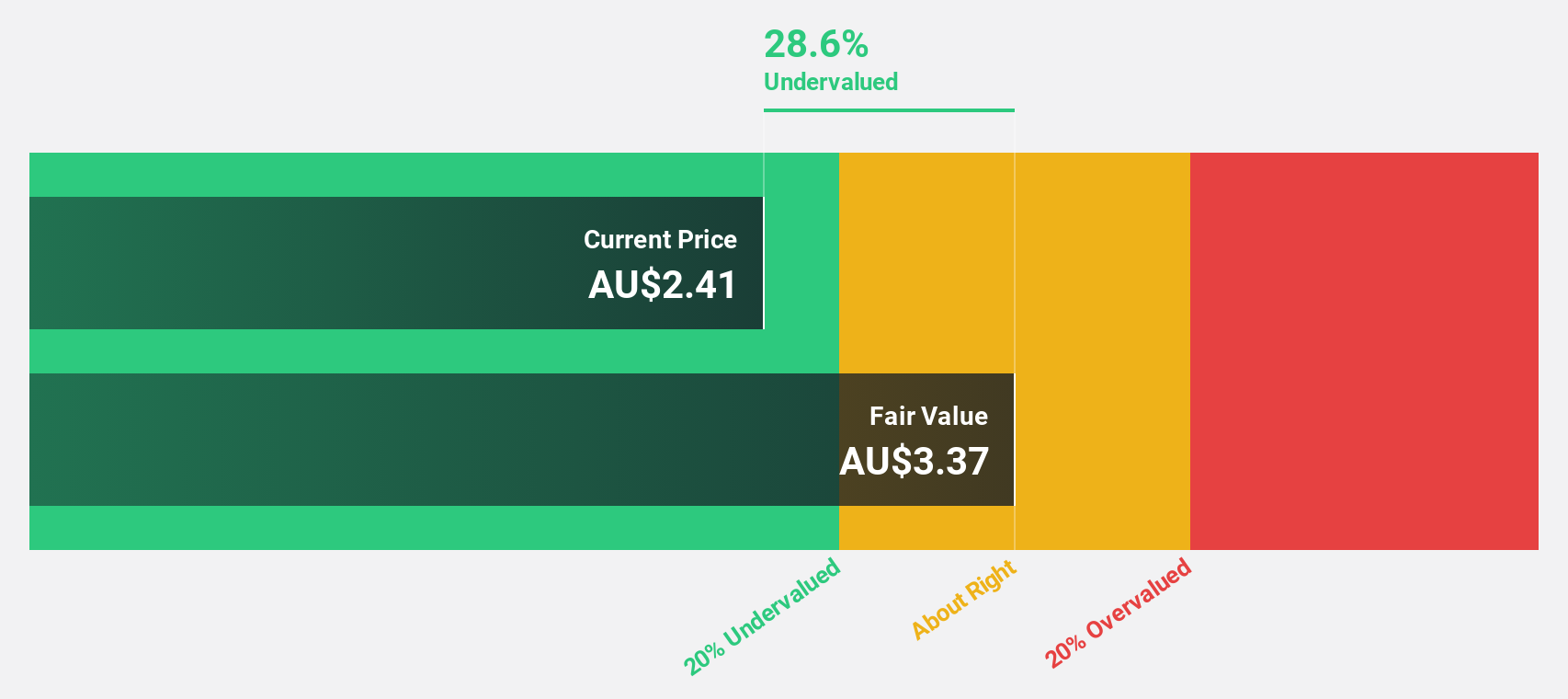

Estimated Discount To Fair Value: 36.8%

National Storage REIT is trading at A$2.50, well below its fair value estimate of A$3.96, highlighting potential undervaluation based on cash flows. Despite recent one-off items impacting results, earnings are expected to grow significantly by 20% annually over the next three years, outpacing the broader Australian market's 12.3% growth forecast. However, a low return on equity of 4.6% in three years could be a concern despite revenue growth projections exceeding market averages at 8.6%.

- In light of our recent growth report, it seems possible that National Storage REIT's financial performance will exceed current levels.

- Dive into the specifics of National Storage REIT here with our thorough financial health report.

Sandfire Resources (ASX:SFR)

Overview: Sandfire Resources Limited is a mining company focused on the exploration, evaluation, and development of mineral tenements and projects, with a market cap of A$4.74 billion.

Operations: The company generates revenue through its Motheo Copper Project ($346.47 million), MATSA Copper Operations ($565.68 million), and Degrussa Copper Operations ($29.40 million).

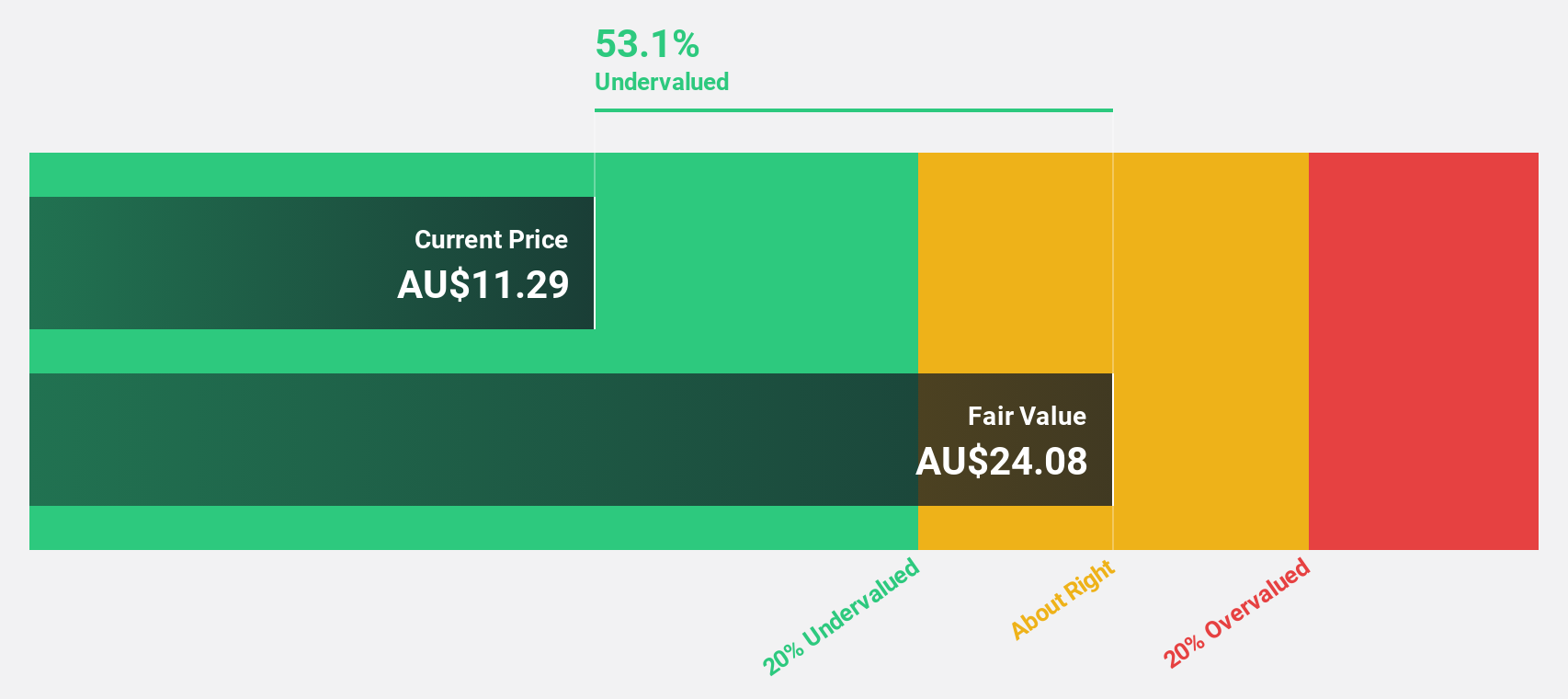

Estimated Discount To Fair Value: 31.8%

Sandfire Resources is trading at A$10.43, significantly below its fair value estimate of A$15.29, suggesting it may be undervalued based on cash flows. The company is projected to achieve profitability within three years with earnings growth forecasted at 38.4% annually, surpassing the Australian market's average growth rate. Despite these positives, its return on equity is expected to remain relatively low at 11.3%, which could temper investor enthusiasm for long-term returns.

- According our earnings growth report, there's an indication that Sandfire Resources might be ready to expand.

- Take a closer look at Sandfire Resources' balance sheet health here in our report.

Turning Ideas Into Actions

- Dive into all 41 of the Undervalued ASX Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 275 locations providing tailored storage solutions to more than 94,500 residential and commercial customers.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives