- Australia

- /

- Consumer Finance

- /

- ASX:CCP

3 ASX Stocks Estimated To Be Below Market Value In June 2024

Reviewed by Simply Wall St

In the past year, the Australian stock market has shown modest growth with a 6.7% increase, while maintaining stability over the last week. Given these conditions and expected future earnings growth, stocks that are currently undervalued may present particularly appealing opportunities for investors looking for potential gains in a growing market.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.70 | A$1.21 | 42.1% |

| Smart Parking (ASX:SPZ) | A$0.48 | A$0.95 | 49.7% |

| MaxiPARTS (ASX:MXI) | A$1.885 | A$3.13 | 39.9% |

| Charter Hall Group (ASX:CHC) | A$12.39 | A$22.39 | 44.7% |

| ReadyTech Holdings (ASX:RDY) | A$3.18 | A$5.95 | 46.6% |

| hipages Group Holdings (ASX:HPG) | A$1.035 | A$1.94 | 46.7% |

| IPH (ASX:IPH) | A$6.16 | A$11.35 | 45.7% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Regal Partners (ASX:RPL) | A$3.52 | A$6.17 | 43% |

| SiteMinder (ASX:SDR) | A$5.02 | A$8.34 | 39.8% |

We're going to check out a few of the best picks from our screener tool

Credit Corp Group (ASX:CCP)

Overview: Credit Corp Group Limited, operating in Australia and the United States, specializes in debt ledger purchase and collection as well as consumer lending services, with a market capitalization of approximately A$1.02 billion.

Operations: Credit Corp Group's revenue is derived from debt ledger purchasing in the United States (A$40.32 million), Australia and New Zealand (A$235.28 million), and consumer lending across these regions plus the United States (A$164.48 million).

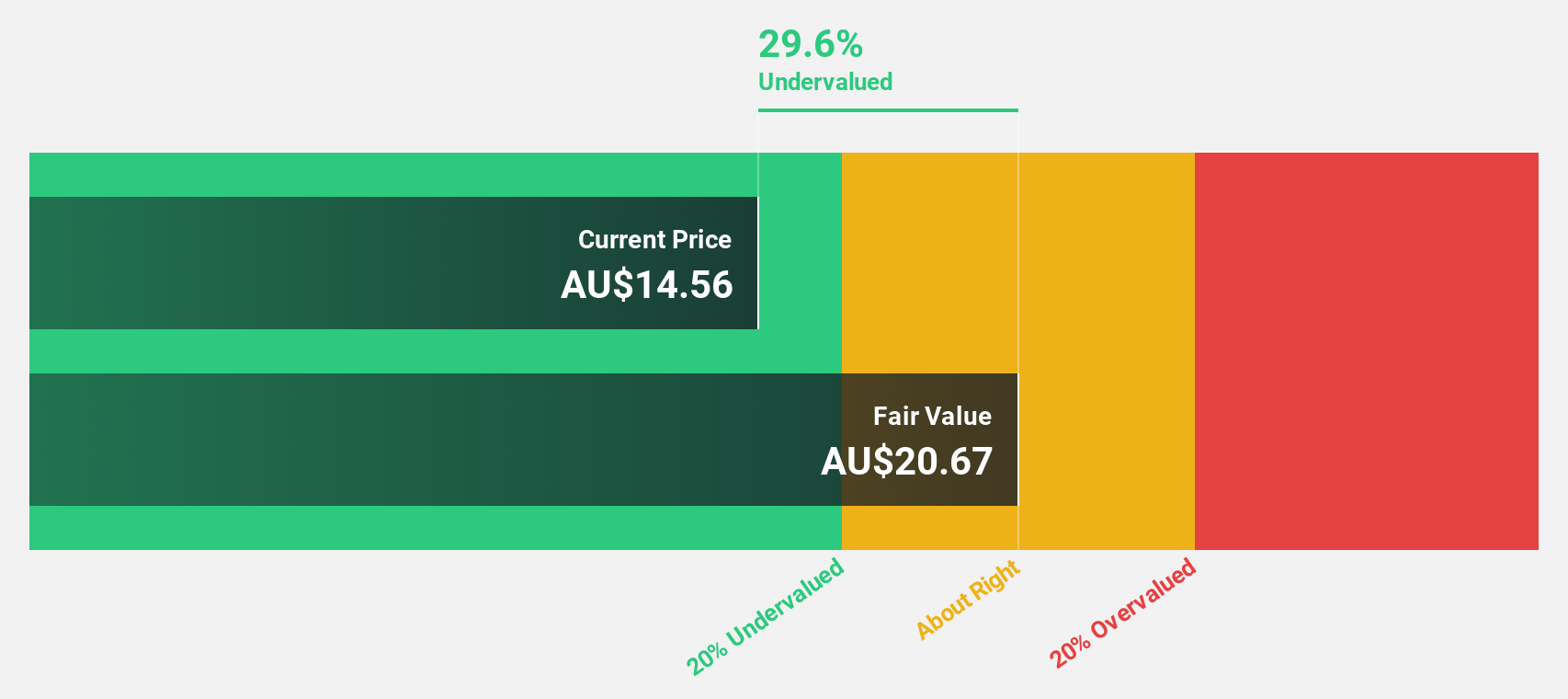

Estimated Discount To Fair Value: 37.3%

Credit Corp Group is currently trading at A$14.95, significantly below the estimated fair value of A$23.8, indicating a potential undervaluation based on discounted cash flows. While the company's earnings are expected to grow by 24.9% annually, outpacing the Australian market's average, its revenue growth forecast of 10.6% also exceeds the market expectation of 5.5%. However, challenges include a profit margin decrease from last year and dividends that are not well-covered by cash flows, reflecting some financial strain.

- Our earnings growth report unveils the potential for significant increases in Credit Corp Group's future results.

- Take a closer look at Credit Corp Group's balance sheet health here in our report.

Nickel Industries (ASX:NIC)

Overview: Nickel Industries Limited is involved in the mining of nickel ore and the production of nickel pig iron and nickel matte, with a market capitalization of approximately A$3.66 billion.

Operations: The company generates revenue through three primary segments: nickel ore mining in Indonesia contributing A$36.81 million, HPAL projects in Indonesia and Hong Kong totaling A$32.58 million, and RKEF projects across Indonesia and Singapore amounting to A$1.81 billion.

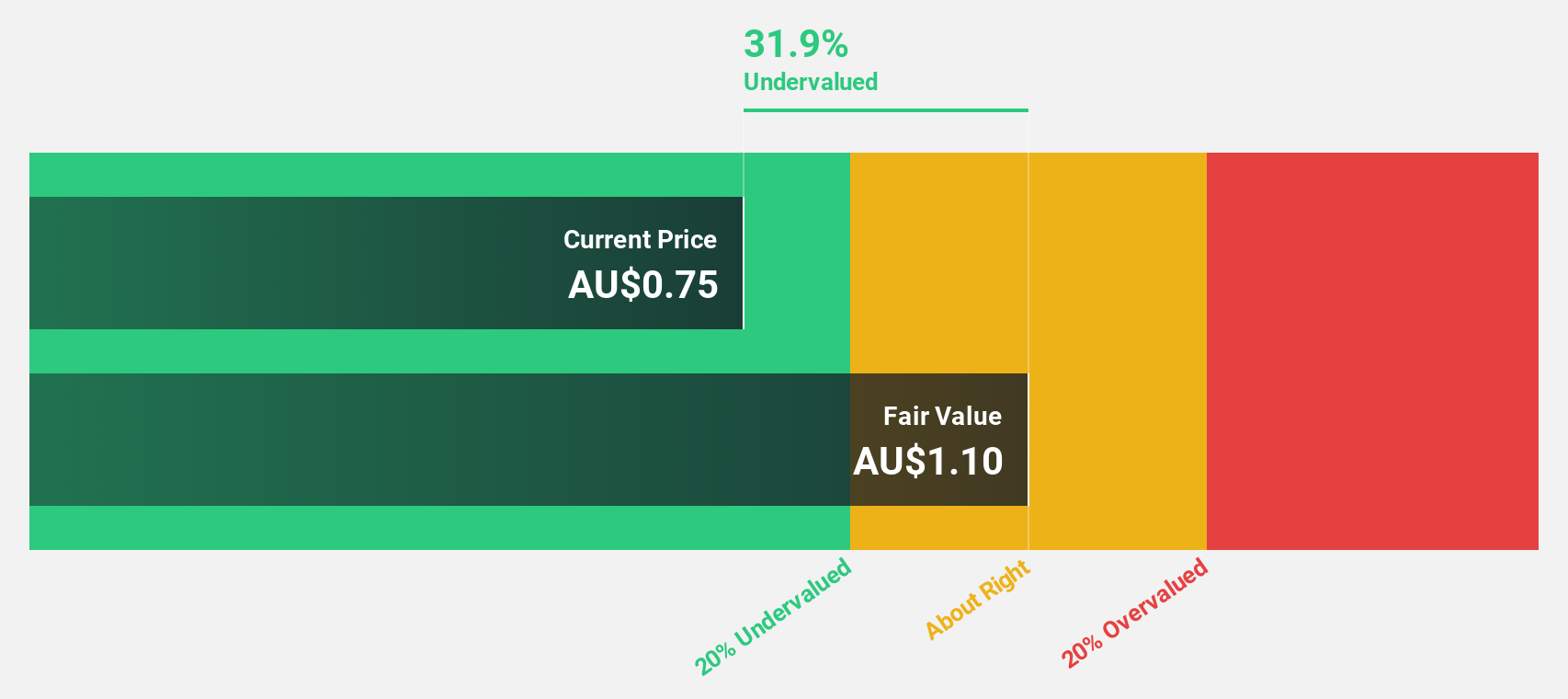

Estimated Discount To Fair Value: 13.6%

Nickel Industries is priced at A$0.86, below the estimated fair value of A$0.99, suggesting a modest undervaluation. The company's earnings are projected to grow significantly at 36.7% annually, outstripping the broader Australian market's growth rate. However, its dividend sustainability is questionable due to inadequate cash flow coverage and a recent increase in shareholder dilution, alongside lower profit margins compared to the previous year.

- Our growth report here indicates Nickel Industries may be poised for an improving outlook.

- Click here to discover the nuances of Nickel Industries with our detailed financial health report.

Sandfire Resources (ASX:SFR)

Overview: Sandfire Resources Limited is a mining company focused on the exploration, evaluation, and development of mineral tenements and projects, with a market capitalization of approximately A$4.02 billion.

Operations: The company generates revenue primarily from its MATSA Copper Operations and Degrussa Copper Operations, which collectively brought in approximately $676.24 million.

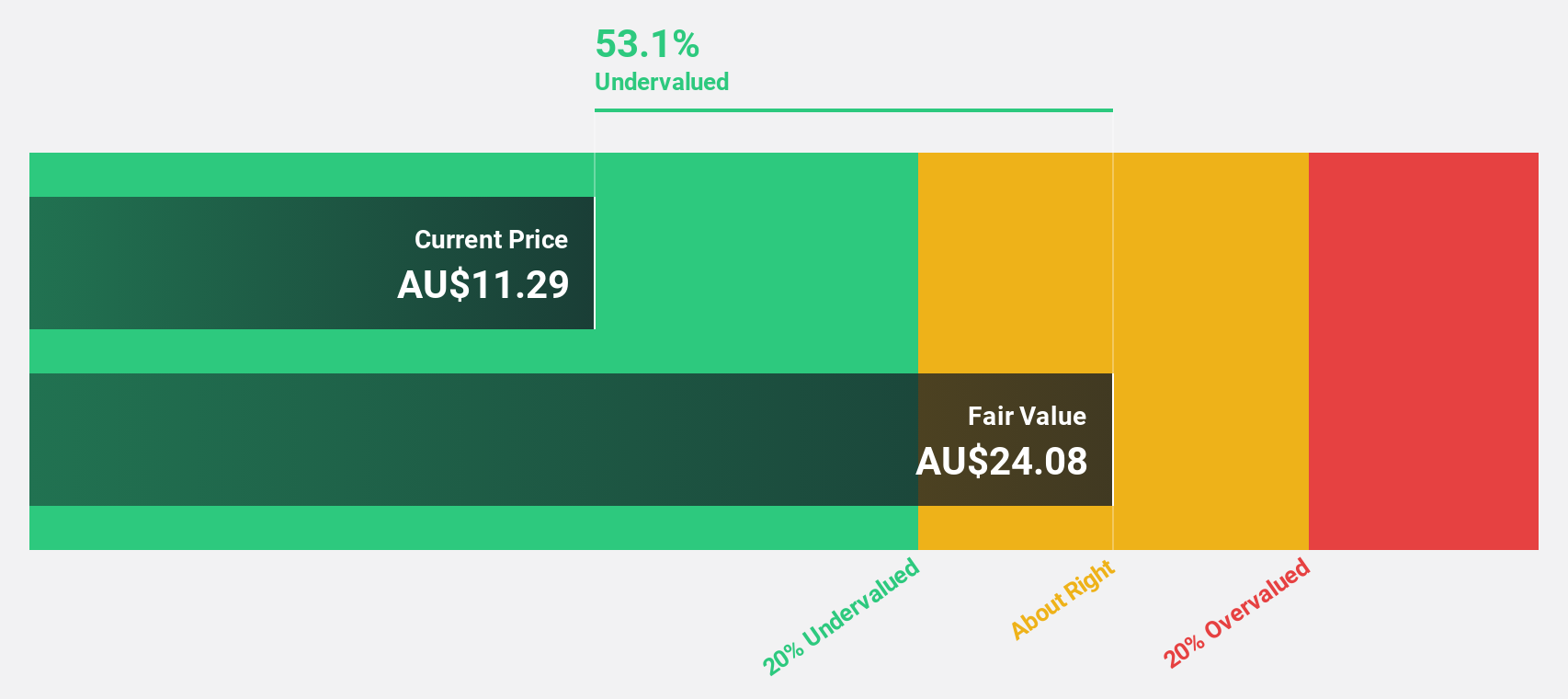

Estimated Discount To Fair Value: 37.2%

Sandfire Resources, priced at A$8.78, is considered undervalued against a fair value of A$13.96, reflecting a 37.1% discount. The company's revenue growth is expected to outpace the Australian market average at 15.3% annually versus 5.5%. While its return on equity might remain low at 9.8%, Sandfire's earnings are forecast to surge by nearly 60% per year over the next three years as it moves towards profitability, aligning with above-average market growth expectations.

- In light of our recent growth report, it seems possible that Sandfire Resources' financial performance will exceed current levels.

- Get an in-depth perspective on Sandfire Resources' balance sheet by reading our health report here.

Seize The Opportunity

- Unlock more gems! Our Undervalued ASX Stocks Based On Cash Flows screener has unearthed 45 more companies for you to explore.Click here to unveil our expertly curated list of 48 Undervalued ASX Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Credit Corp Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCP

Credit Corp Group

Engages in the provision of debt ledger purchase and collection, and consumer lending services in Australia, New Zealand, and the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives