- Australia

- /

- Metals and Mining

- /

- ASX:MAG

3 Promising ASX Penny Stocks With Market Caps Over A$20M

Reviewed by Simply Wall St

As Australian shares brace for a potential downturn, with the ASX 200 futures indicating a significant drop, investors are keenly observing market movements and their implications. In such volatile times, penny stocks—though an older term—remain relevant as they often represent smaller or emerging companies that could offer value. By focusing on those with strong financials and growth potential, investors might uncover opportunities in these lesser-known stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.59 | A$75.01M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.24 | A$153.74M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.56 | A$109.97M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$2.83 | A$949.17M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.22 | A$343.85M | ★★★★★☆ |

| CTI Logistics (ASX:CLX) | A$1.68 | A$131.06M | ★★★★☆☆ |

| West African Resources (ASX:WAF) | A$2.10 | A$2.39B | ★★★★★★ |

| GR Engineering Services (ASX:GNG) | A$2.72 | A$454.75M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$241.6M | ★★★★★★ |

| Accent Group (ASX:AX1) | A$1.82 | A$1.03B | ★★★★☆☆ |

Click here to see the full list of 1,007 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alterity Therapeutics (ASX:ATH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alterity Therapeutics Limited is an Australian company focused on researching and developing therapeutic drugs for neurological disorders such as Alzheimer’s, Huntington’s, and Parkinson’s diseases, with a market cap of A$54.91 million.

Operations: The company's revenue is primarily generated from its biotechnology segment, amounting to A$3.72 million.

Market Cap: A$54.91M

Alterity Therapeutics, with a market cap of A$54.91 million, is focused on developing treatments for neurological disorders but remains pre-revenue. Recent positive Phase 2 trial results for ATH434 in treating Multiple System Atrophy highlight its potential, supported by Orphan Drug Designation from the U.S. FDA and European Commission. However, the company faces challenges with a forecasted decline in earnings and has been unprofitable over the past five years. Despite a volatile share price and limited cash runway, recent equity offerings have bolstered its financial position temporarily while it continues to navigate clinical trials and regulatory pathways.

- Click to explore a detailed breakdown of our findings in Alterity Therapeutics' financial health report.

- Examine Alterity Therapeutics' earnings growth report to understand how analysts expect it to perform.

Magmatic Resources (ASX:MAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Magmatic Resources Limited is involved in the development and exploration of mineral properties in Australia, with a market cap of A$21.27 million.

Operations: Magmatic Resources Limited has not reported any specific revenue segments.

Market Cap: A$21.27M

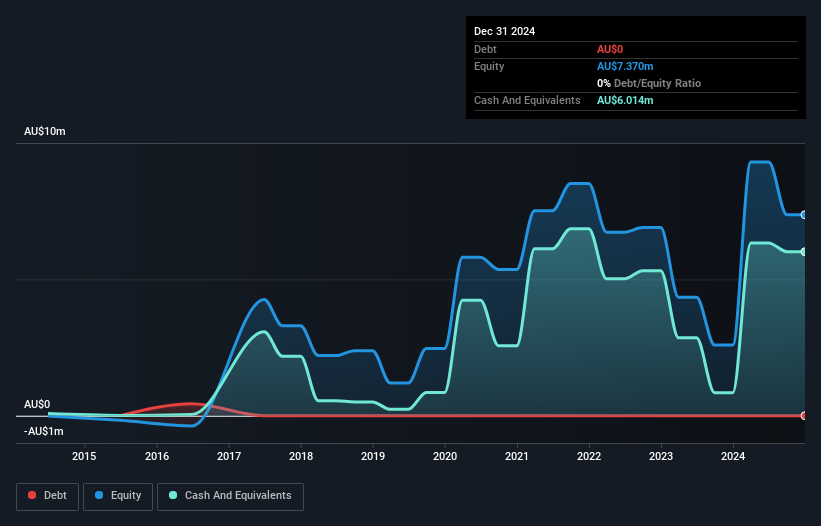

Magmatic Resources, with a market cap of A$21.27 million, is pre-revenue and focuses on mineral exploration in Australia. It benefits from an experienced management team and board, with tenures averaging 2.4 and 4.4 years respectively. The company is debt-free and has a robust cash runway exceeding three years based on current free cash flow levels, though it remains unprofitable with losses decreasing to A$0.83 million for the half-year ended December 2024 from A$2.1 million the previous year. Despite high share price volatility, shareholders have not experienced significant dilution recently.

- Unlock comprehensive insights into our analysis of Magmatic Resources stock in this financial health report.

- Gain insights into Magmatic Resources' historical outcomes by reviewing our past performance report.

Vmoto (ASX:VMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vmoto Limited develops, manufactures, markets, and distributes electric two-wheel vehicles globally with a market cap of A$38.56 million.

Operations: The company generates revenue of A$58.71 million from the manufacture and distribution of electric two-wheel vehicles.

Market Cap: A$38.56M

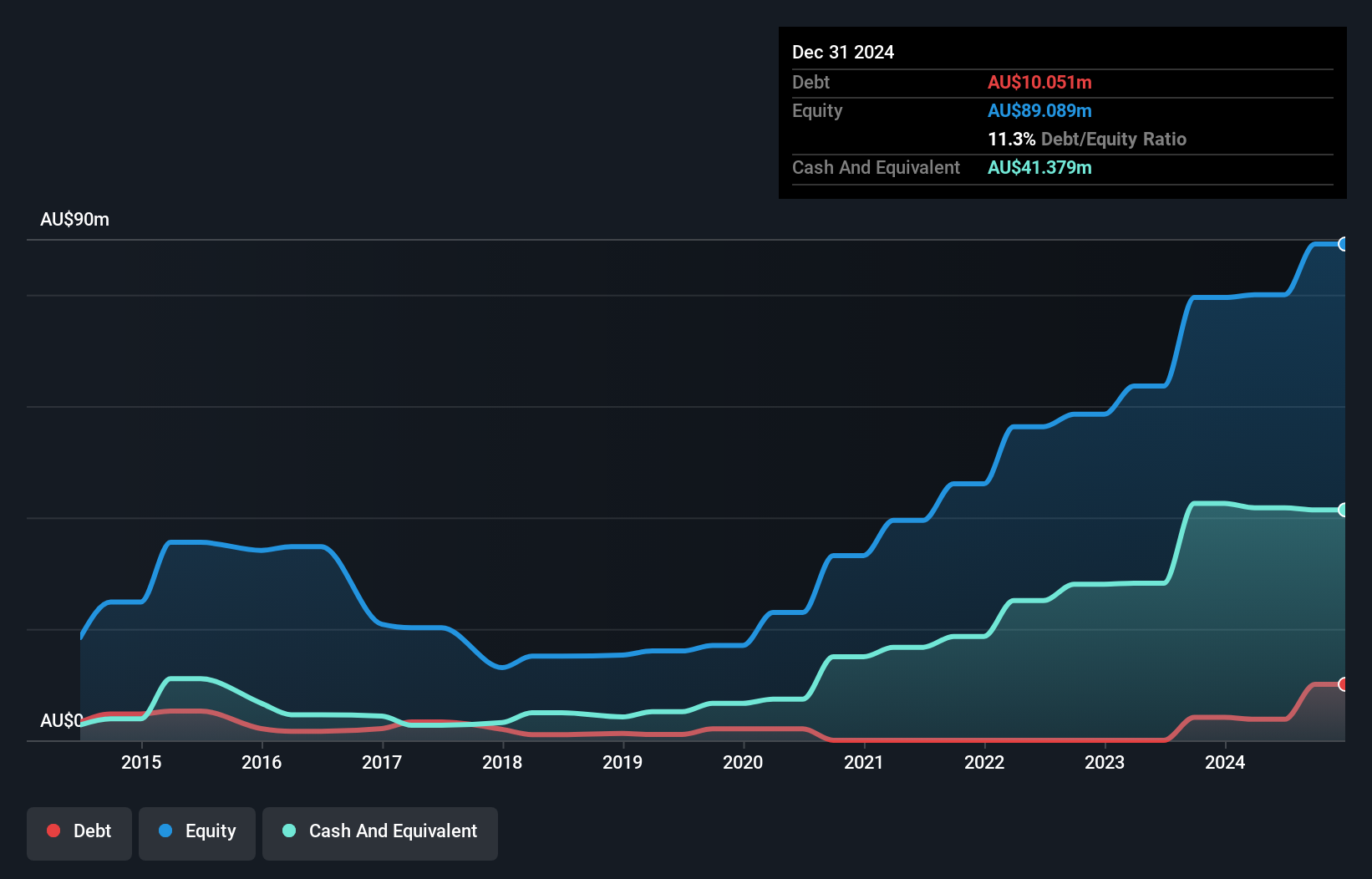

Vmoto Limited, with a market cap of A$38.56 million, generates A$58.71 million in revenue from its electric two-wheel vehicles but has seen earnings decline significantly over the past year. The company recently faced shareholder activism aimed at board changes, which were not approved by shareholders during the March 2025 meeting. Vmoto's decision to delist from the ASX follows a share buyback program that repurchased 9.46% of its shares for A$4.75 million, reflecting concerns about low trading liquidity and share price valuation. Despite a seasoned management team and reduced debt levels, Vmoto's net profit margins have decreased substantially from last year’s figures.

- Take a closer look at Vmoto's potential here in our financial health report.

- Explore historical data to track Vmoto's performance over time in our past results report.

Summing It All Up

- Embark on your investment journey to our 1,007 ASX Penny Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Magmatic Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAG

Magmatic Resources

Engages in the development and exploration of mineral properties in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives