- Australia

- /

- Metals and Mining

- /

- ASX:LTR

ASX Growth Companies With Insider Ownership October 2025

Reviewed by Simply Wall St

As the Australian market ended slightly in the red midweek, with gold prices reaching record highs and sectors experiencing mixed performances, investors are keenly observing trends that could influence future growth opportunities. In this context, companies with high insider ownership often attract attention as they can signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.1% | 91.2% |

| Titomic (ASX:TTT) | 11.3% | 74.9% |

| Pointerra (ASX:3DP) | 21.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.1% | 144.4% |

| IperionX (ASX:IPX) | 18.2% | 96.3% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Echo IQ (ASX:EIQ) | 18.9% | 49.9% |

| Adveritas (ASX:AV1) | 18.8% | 96.8% |

| Acrux (ASX:ACR) | 15.9% | 121.1% |

Let's review some notable picks from our screened stocks.

Alpha HPA (ASX:A4N)

Simply Wall St Growth Rating: ★★★★★★

Overview: Alpha HPA Limited is a specialty materials and technology company engaged in the HPA First and Alpha Sapphire projects in Queensland, with a market cap of A$909.82 million.

Operations: The company's revenue is derived from the HPA First Project, contributing A$0.26 million, and the Alpha Sapphire Project, contributing A$0.06 million.

Insider Ownership: 10.5%

Revenue Growth Forecast: 84% p.a.

Alpha HPA demonstrates significant growth potential, with expected revenue growth of 84% annually, outpacing the Australian market. Although it reported a net loss of A$32.56 million for the year ended June 2025, profitability is anticipated within three years. Insider ownership remains high, though recent trading activity is not substantial. Despite limited cash runway and modest current revenue (A$318K), its forecasted return on equity at 35.6% suggests strong future performance prospects.

- Unlock comprehensive insights into our analysis of Alpha HPA stock in this growth report.

- Our valuation report unveils the possibility Alpha HPA's shares may be trading at a premium.

Artrya (ASX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artrya Limited is a medical technology company focused on developing and commercializing an artificial intelligence platform for detecting, diagnosing, and addressing coronary artery disease in Australia, with a market cap of A$395.22 million.

Operations: The company's revenue segment is derived from the development of AI-driven CCTA image analysis technology, amounting to A$0.03 million.

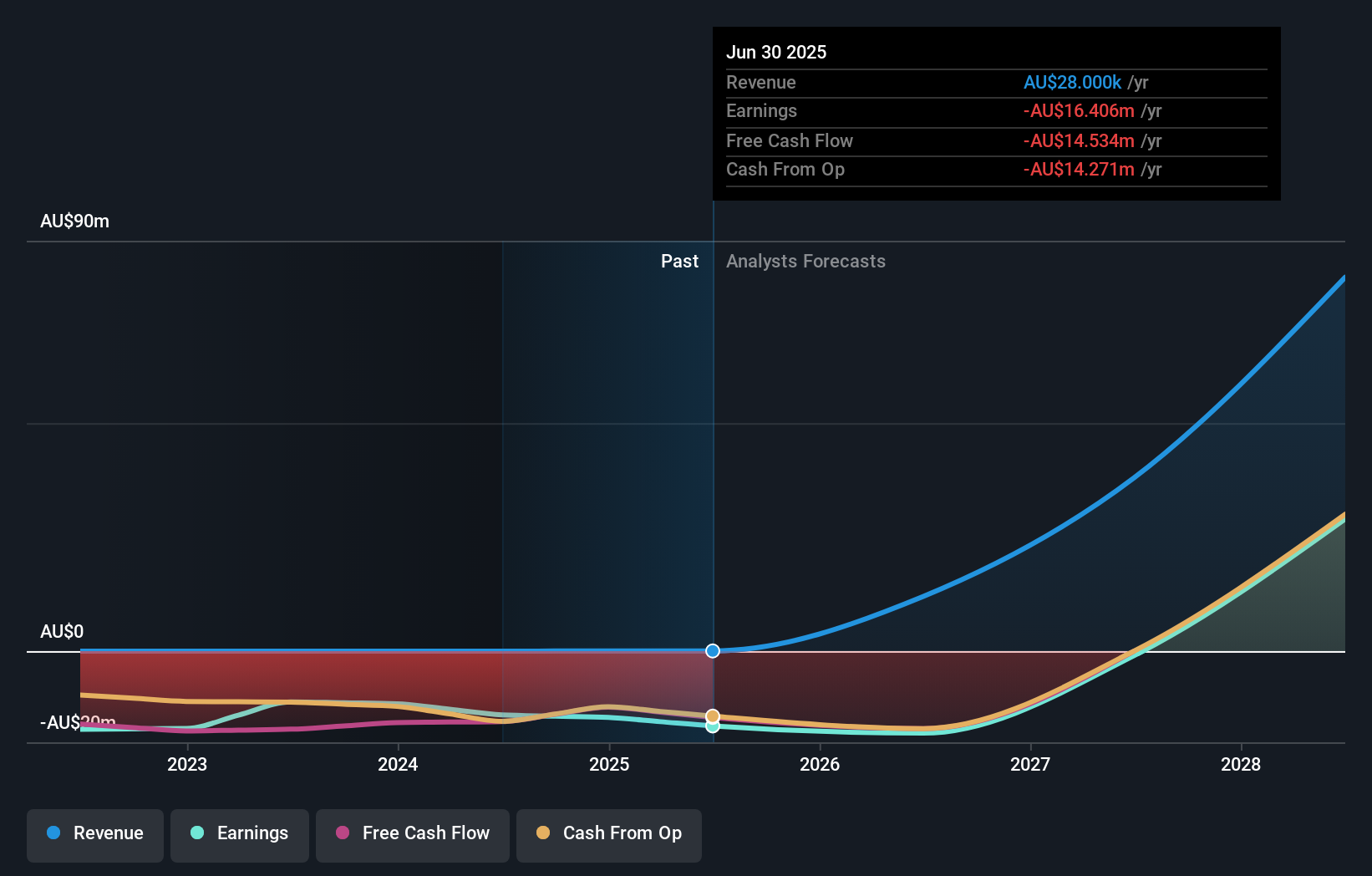

Insider Ownership: 19.4%

Revenue Growth Forecast: 49.6% p.a.

Artrya is poised for significant growth, with revenue anticipated to increase by 49.6% annually, surpassing the Australian market's average growth rate. Despite a net loss of A$16.41 million for the year ending June 2025 and high share price volatility, recent FDA clearance for its Salix® Coronary Plaque module enhances U.S. market prospects and potential revenue streams. Insider ownership is substantial, although recent insider trading activity has been minimal. Recent equity offerings raised nearly A$80 million to support expansion efforts.

- Take a closer look at Artrya's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Artrya's share price might be too optimistic.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★☆

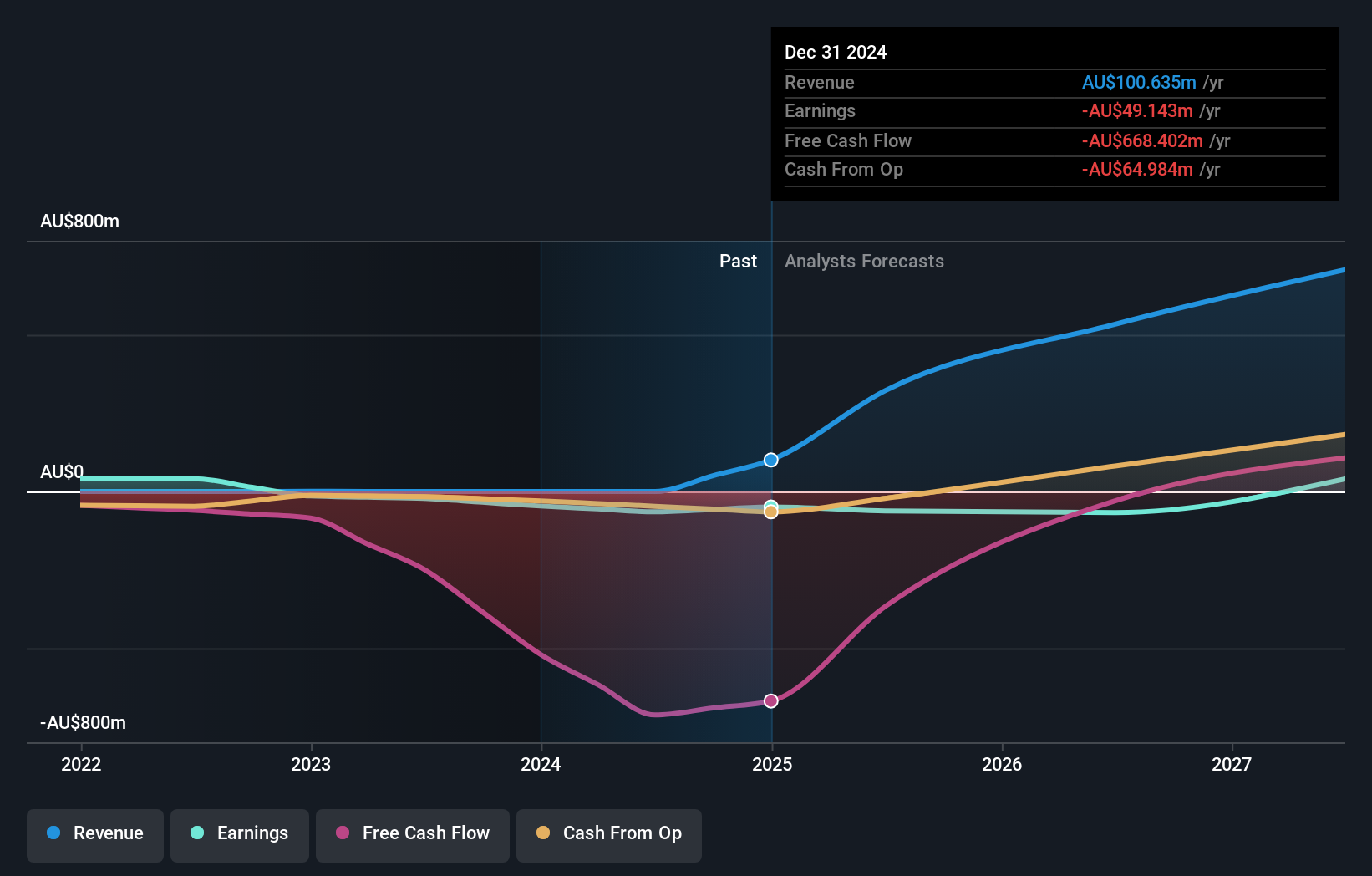

Overview: Liontown Resources Limited is involved in the exploration, evaluation, and development of mineral properties in Australia, with a market cap of A$2.96 billion.

Operations: The company generates revenue primarily from its exploration and development of minerals segment, amounting to A$297.57 million.

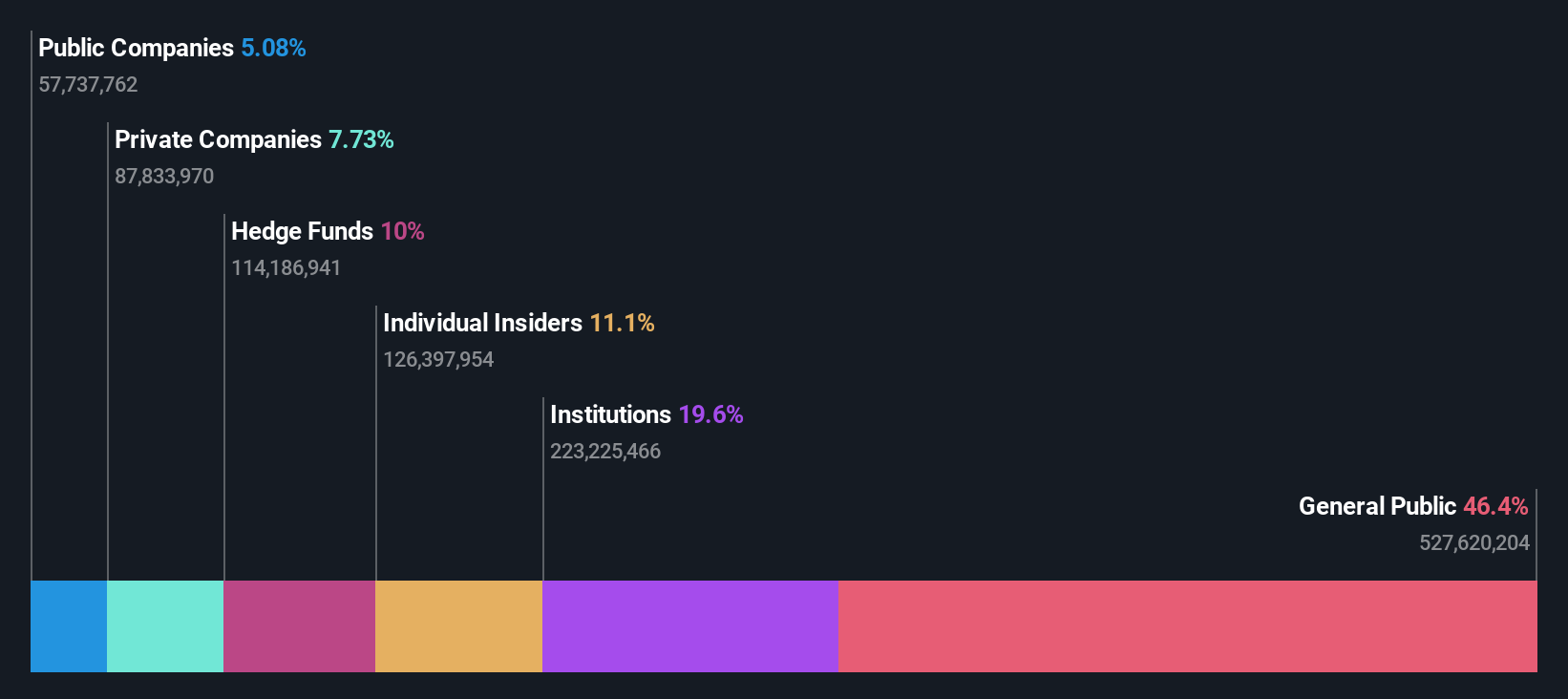

Insider Ownership: 12.4%

Revenue Growth Forecast: 23.5% p.a.

Liontown Resources is experiencing rapid growth, with revenue expected to rise 23.5% annually, outpacing the Australian market's average. Despite a net loss of A$193.28 million for the year ending June 2025, it remains on track to become profitable within three years. Recent equity offerings raised over A$300 million, bolstering its financial position. Insider ownership is significant; however, there has been no substantial insider trading activity in recent months.

- Click here to discover the nuances of Liontown Resources with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Liontown Resources shares in the market.

Taking Advantage

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 104 more companies for you to explore.Click here to unveil our expertly curated list of 107 Fast Growing ASX Companies With High Insider Ownership.

- Interested In Other Possibilities? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives