- Australia

- /

- Trade Distributors

- /

- ASX:IPG

3 ASX Penny Stocks With Market Caps Over A$40M

Reviewed by Simply Wall St

The Australian share market is poised for a positive start today, with the ASX 200 expected to rise by up to 0.7%, buoyed by easing concerns over trade tariffs and geopolitical tensions. In this context, investors often seek out opportunities that offer both growth potential and affordability, making penny stocks an intriguing option despite their somewhat outdated label. These stocks typically belong to smaller or newer companies, and when they come with strong financial health, they can present valuable opportunities for those willing to explore them further.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.505 | A$313.17M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.5425 | A$106.53M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.02 | A$328.89M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$248.73M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.18 | A$337.66M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$243.19M | ★★★★★★ |

| Nickel Industries (ASX:NIC) | A$0.745 | A$3.2B | ★★★★★☆ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Core Lithium (ASX:CXO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Core Lithium Ltd focuses on developing lithium and various metal deposits in Northern Territory and South Australia, with a market cap of A$197.16 million.

Operations: The company's revenue is derived entirely from the Finniss Lithium Project, generating A$189.49 million.

Market Cap: A$197.16M

Core Lithium Ltd, with a market cap of A$197.16 million, focuses on the Finniss Lithium Project as its primary revenue source, generating A$189.49 million. Despite being debt-free and having stable weekly volatility over the past year, Core Lithium remains unprofitable with losses increasing by 82.2% annually over five years and a negative return on equity of -80.59%. The company has sufficient short-term assets to cover liabilities but faces less than a year of cash runway based on current free cash flow trends. The management team is relatively new, with an average tenure of 0.8 years.

- Take a closer look at Core Lithium's potential here in our financial health report.

- Review our growth performance report to gain insights into Core Lithium's future.

IPD Group (ASX:IPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IPD Group Limited is an Australian company that distributes electrical infrastructure, with a market cap of A$432.40 million.

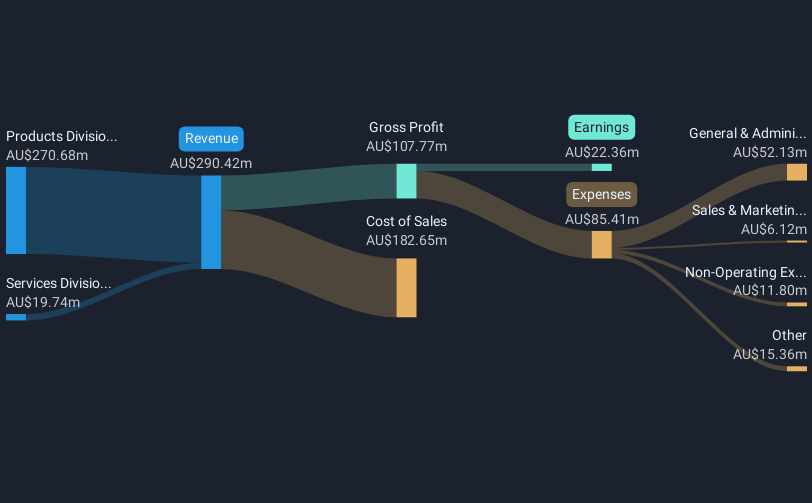

Operations: The company generates revenue from its Products Division, which accounts for A$270.68 million, and its Services Division, contributing A$19.74 million.

Market Cap: A$432.4M

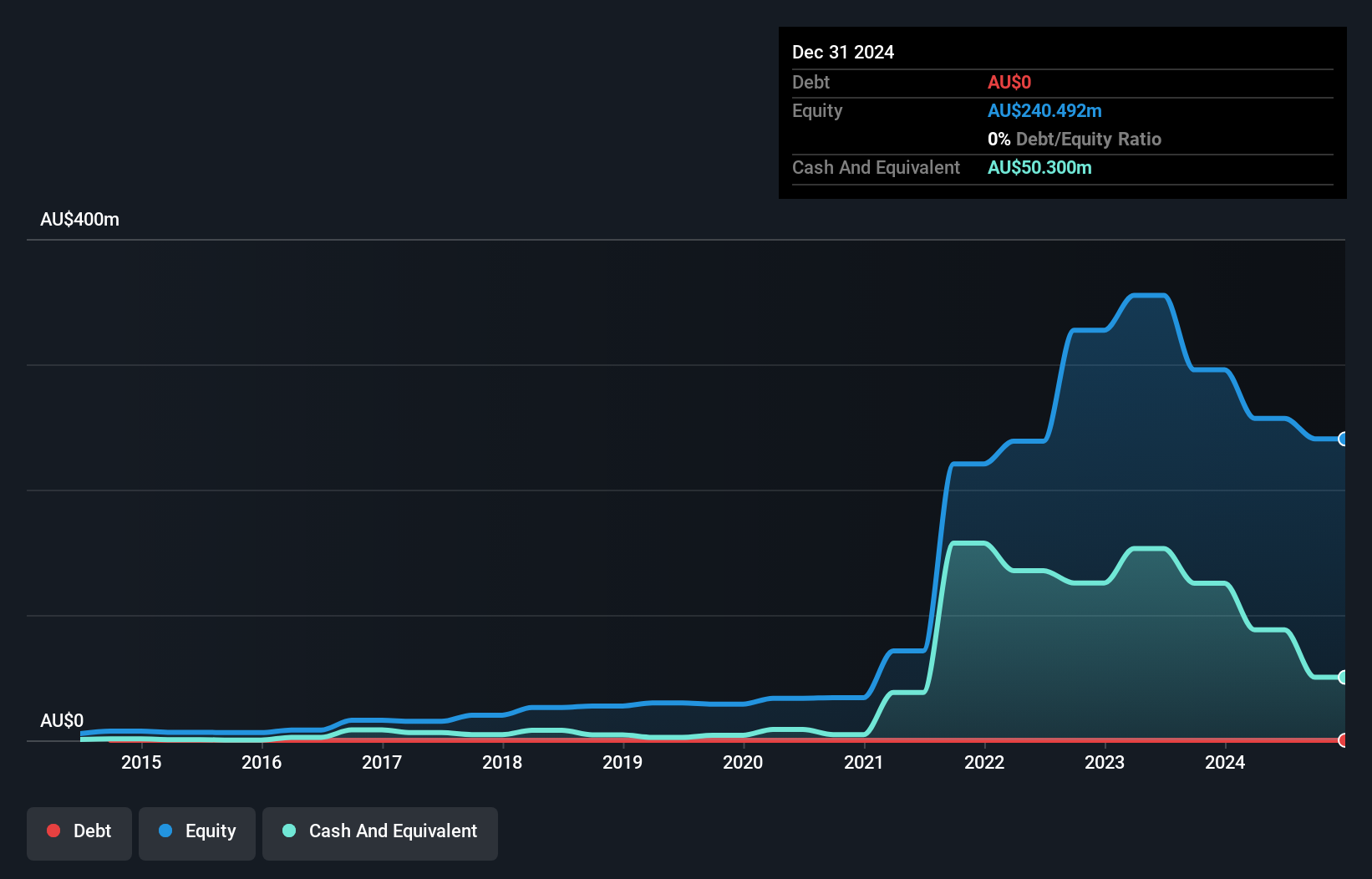

IPD Group Limited, with a market cap of A$432.40 million, demonstrates financial stability and growth potential in the electrical infrastructure sector. The company forecasts revenue growth for 1H25, with EBIT expected between A$19.2 million and A$19.8 million, indicating positive momentum. IPD's earnings have grown significantly over the past year by 39.1%, outpacing industry averages, while maintaining a satisfactory net debt to equity ratio of 5.8%. Short-term assets exceed both short- and long-term liabilities, highlighting strong liquidity management. Although its Return on Equity is relatively low at 14.8%, the company's price-to-earnings ratio suggests good value compared to industry peers.

- Jump into the full analysis health report here for a deeper understanding of IPD Group.

- Gain insights into IPD Group's future direction by reviewing our growth report.

Investigator Resources (ASX:IVR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Investigator Resources Limited, along with its subsidiaries, is involved in the exploration of mineral properties in Australia and has a market capitalization of A$41.31 million.

Operations: The company's revenue segment is focused on Mineral Exploration, generating A$0.01 million.

Market Cap: A$41.31M

Investigator Resources, with a market cap of A$41.31 million, remains pre-revenue with only A$14K generated from mineral exploration. Despite being unprofitable, the company has reduced its losses by 21.1% annually over the past five years and benefits from an experienced management team averaging 6.2 years in tenure. Investigator is debt-free and has short-term assets of A$4.6 million exceeding both short- and long-term liabilities, providing some financial stability despite high share price volatility and limited cash runway under one year based on current free cash flow trends.

- Click here to discover the nuances of Investigator Resources with our detailed analytical financial health report.

- Assess Investigator Resources' previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Click here to access our complete index of 1,031 ASX Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPG

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives