Here's Why Incitec Pivot (ASX:IPL) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Incitec Pivot (ASX:IPL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Incitec Pivot

How Fast Is Incitec Pivot Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Incitec Pivot grew its EPS from AU$0.077 to AU$0.52, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

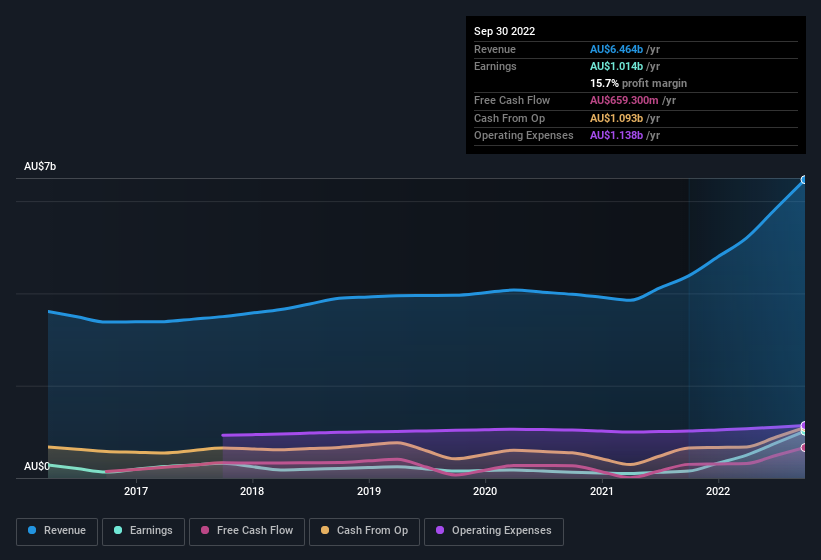

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Incitec Pivot shareholders is that EBIT margins have grown from 11% to 22% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Incitec Pivot's forecast profits?

Are Incitec Pivot Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Incitec Pivot insiders refrain from selling stock during the year, but they also spent AU$169k buying it. This is a good look for the company as it paints an optimistic picture for the future. We also note that it was the Independent Non-Executive Chairman, Brian Kruger, who made the biggest single acquisition, paying AU$143k for shares at about AU$3.58 each.

Should You Add Incitec Pivot To Your Watchlist?

Incitec Pivot's earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Incitec Pivot on your watchlist. Even so, be aware that Incitec Pivot is showing 2 warning signs in our investment analysis , and 1 of those is concerning...

Keen growth investors love to see insider buying. Thankfully, Incitec Pivot isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DNL

Dyno Nobel

Manufactures and distributes commercial explosives in in the United States, Australia, and Mexico.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives