- Australia

- /

- Metals and Mining

- /

- ASX:IGO

3 ASX Dividend Stocks Yielding Up To 7.7%

Reviewed by Simply Wall St

As the Australian market navigates its way through recent technical challenges and prepares for a series of holiday disruptions, investors are keenly observing how these developments might impact trading dynamics on the ASX. With positive sentiment spurred by global market trends and upcoming economic data releases, dividend stocks remain an attractive option for those seeking steady income amidst uncertainty. In this context, selecting stocks that offer robust dividends can be particularly appealing as they provide potential returns even when broader market conditions fluctuate.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.47% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.43% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.89% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.06% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.03% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.68% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.35% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.80% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 9.09% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.63% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

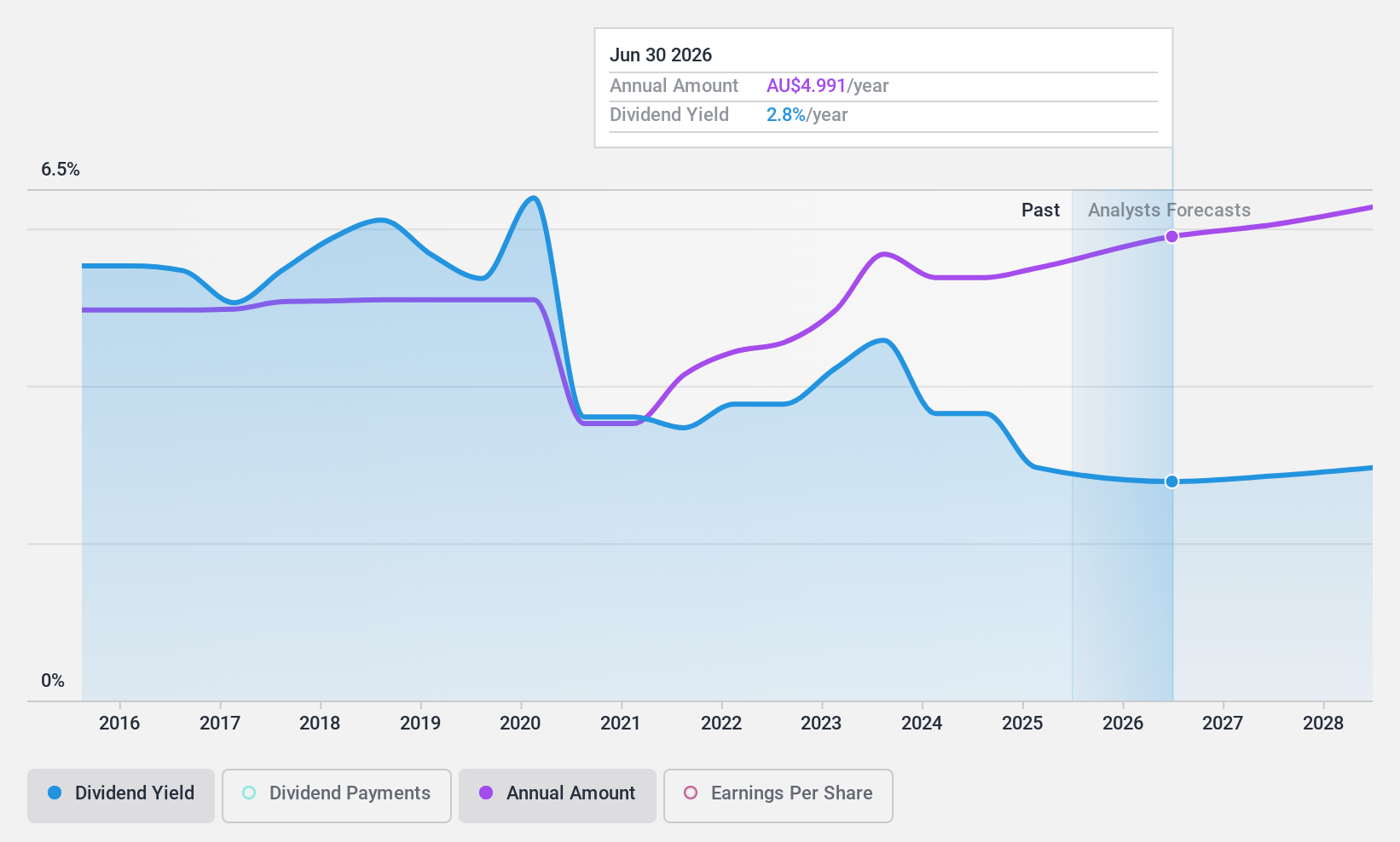

Commonwealth Bank of Australia (ASX:CBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Commonwealth Bank of Australia offers financial services across Australia, New Zealand, and internationally with a market cap of A$251.23 billion.

Operations: Commonwealth Bank of Australia's revenue segments include Retail Banking Services (A$12.47 billion), Business Banking (A$8.14 billion), New Zealand operations (A$2.86 billion), and Institutional Banking and Markets (A$2.51 billion).

Dividend Yield: 3.1%

Commonwealth Bank of Australia (CBA) offers dividends currently covered by earnings with a payout ratio of 82.1%, projected to remain sustainable at 77.8% in three years. Despite its low dividend yield compared to top Australian payers, CBA has seen growth in dividend payments over the past decade, though these have been volatile and unreliable at times. Recent fixed-income offerings totaling billions indicate strategic financial maneuvers amidst executive leadership changes, potentially impacting future performance and stability.

- Get an in-depth perspective on Commonwealth Bank of Australia's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Commonwealth Bank of Australia's share price might be too optimistic.

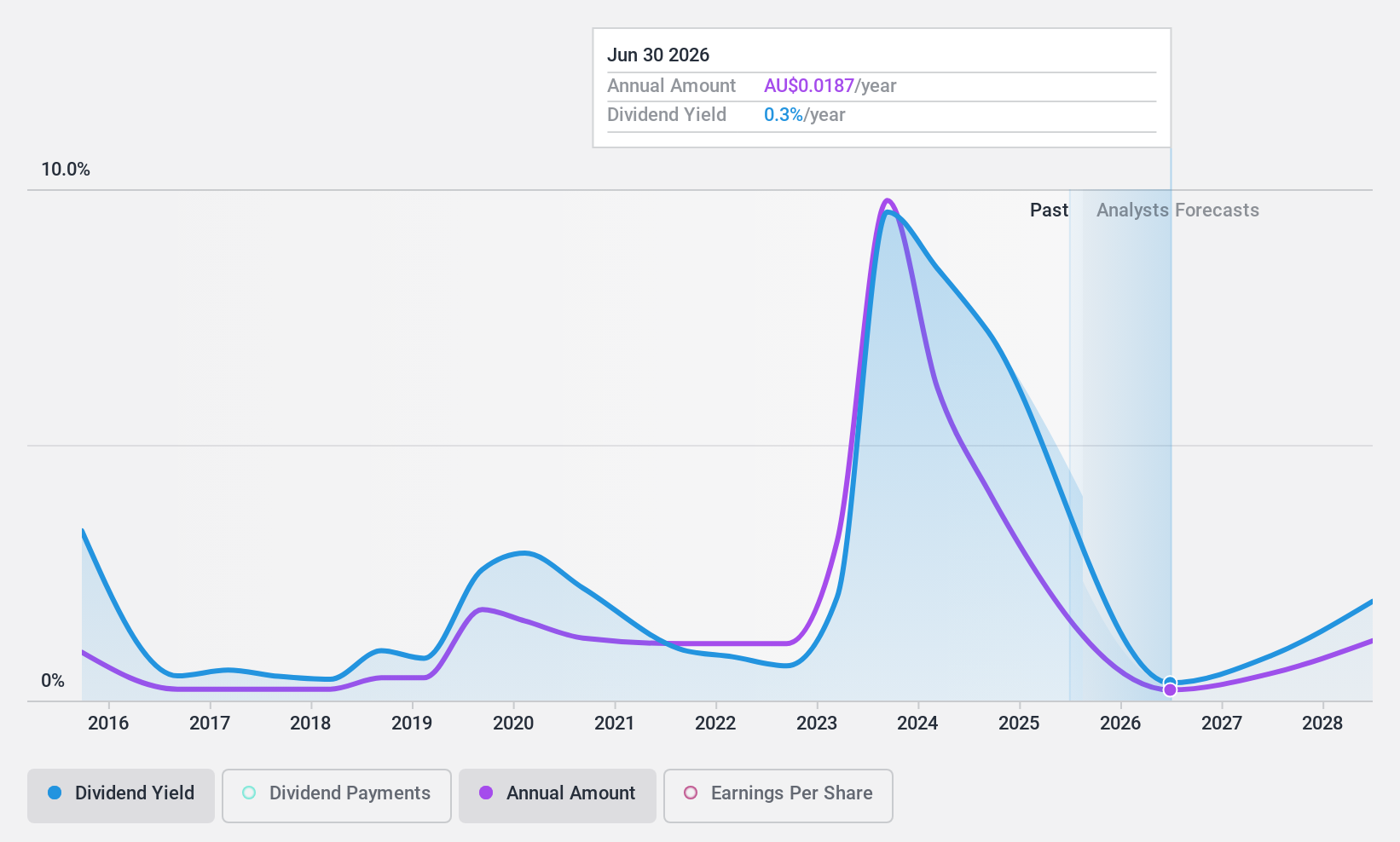

IGO (ASX:IGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an Australian exploration and mining company that focuses on discovering, developing, and operating assets for metals essential to clean energy, with a market cap of A$3.63 billion.

Operations: IGO Limited generates revenue primarily from its Nova Operation at A$539.10 million, followed by the Forrestania Operation at A$234.80 million and the Cosmos Project at A$48.80 million, with additional income from interest revenue amounting to A$18.10 million.

Dividend Yield: 7.7%

IGO's dividend yield of 7.71% ranks it among the top payers in Australia, yet its sustainability is questionable due to a high payout ratio of 10008.1%, indicating dividends are not covered by earnings. Despite a low cash payout ratio of 41.6%, suggesting coverage by cash flows, past dividend payments have been volatile and unreliable. Recent M&A interest, notably in Rio Tinto's Winu Project, highlights strategic growth efforts following prior significant write-downs in acquisitions.

- Click here and access our complete dividend analysis report to understand the dynamics of IGO.

- Our valuation report here indicates IGO may be undervalued.

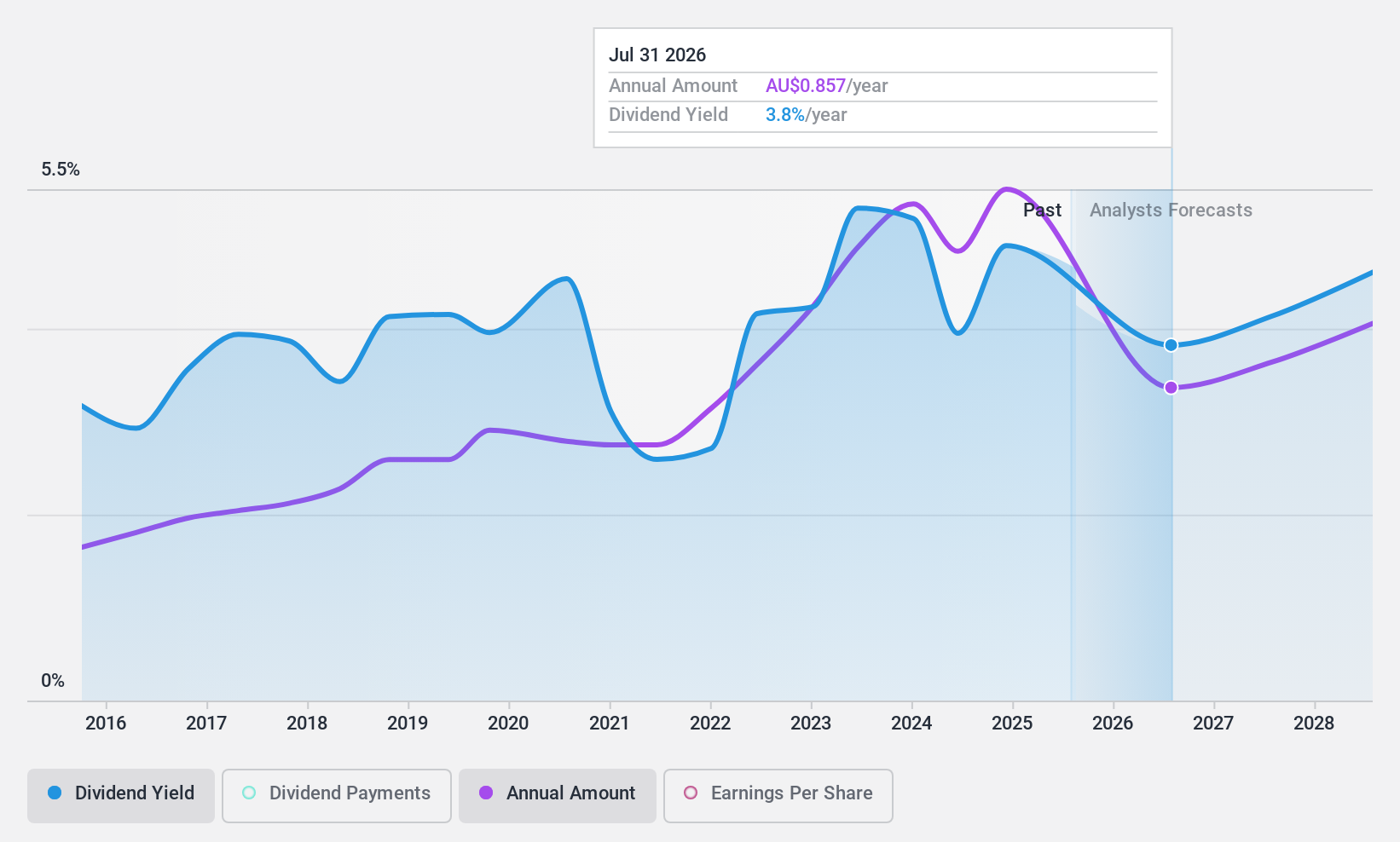

Premier Investments (ASX:PMV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Premier Investments Limited operates specialty retail fashion chains across Australia, New Zealand, Asia, and Europe with a market capitalization of A$5.14 billion.

Operations: Premier Investments Limited generates revenue through its Retail segment, which accounts for A$1.61 billion, and its Investment segment, contributing A$208.53 million.

Dividend Yield: 4.4%

Premier Investments' dividends have been stable and growing over the past decade, with a current yield of 4.35%, which is less competitive compared to top Australian dividend payers. The payout ratio of 82.2% indicates dividends are covered by earnings, while a cash payout ratio of 59.1% suggests strong cash flow support. Recent developments include a proposed merger with Myer Holdings Limited and an announced dividend increase to A$0.70 for the six months ending July 2024.

- Navigate through the intricacies of Premier Investments with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Premier Investments shares in the market.

Next Steps

- Explore the 32 names from our Top ASX Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGO

IGO

Operates as an exploration and mining company that engages in discovering, developing, and operating assets focused on metals to enable clean energy in Australia.

Flawless balance sheet average dividend payer.