- Australia

- /

- Construction

- /

- ASX:SXE

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the ASX200 experiences a slight decline of 0.65% amidst regulatory scrutiny and sectoral shifts, investors are keenly observing market dynamics. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever, particularly when these smaller or newer companies exhibit strong financials. This article explores several penny stocks that stand out for their financial strength and growth potential in today's evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.94 | A$243.76M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$325.58M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$322.38M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.94 | A$107.31M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.15 | A$333.01M | ★★★★☆☆ |

| Servcorp (ASX:SRV) | A$4.95 | A$488.43M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$247.67M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Central Petroleum (ASX:CTP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Central Petroleum Limited is involved in the development, production, processing, and marketing of hydrocarbons in Australia with a market cap of A$48.44 million.

Operations: Central Petroleum generates revenue of A$37.15 million from its producing assets segment.

Market Cap: A$48.44M

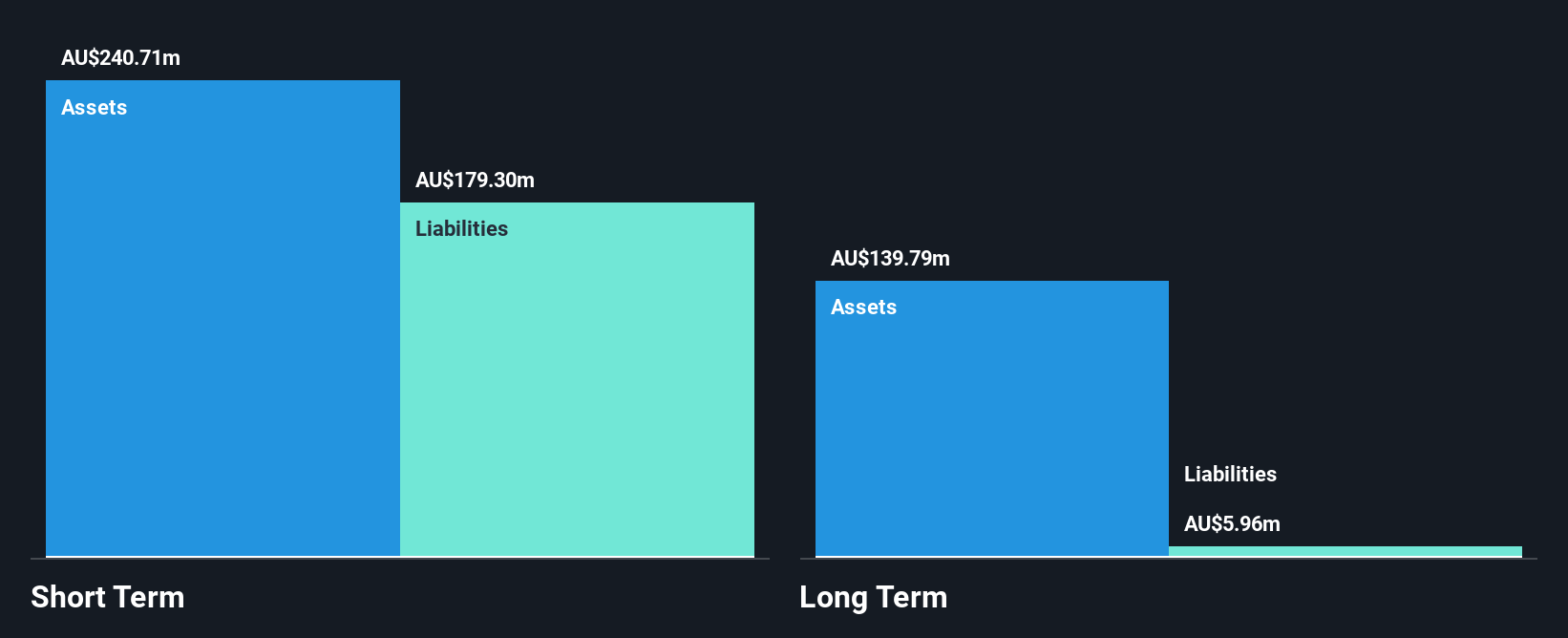

Central Petroleum Limited, with a market cap of A$48.44 million, has recently become profitable and is trading at a significant discount to its estimated fair value. The company benefits from a seasoned management team with an average tenure of 6.5 years and boasts high return on equity at 38.2%. Despite these positives, Central Petroleum faces challenges as its short-term assets do not cover long-term liabilities of A$52.9 million, and interest payments are not well covered by EBIT. Earnings are forecasted to grow annually by 25%, suggesting potential future growth opportunities in the oil and gas sector.

- Navigate through the intricacies of Central Petroleum with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Central Petroleum's future.

Dreadnought Resources (ASX:DRE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dreadnought Resources Limited is a mineral exploration company in Australia with a market cap of A$41.45 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration company.

Market Cap: A$41.45M

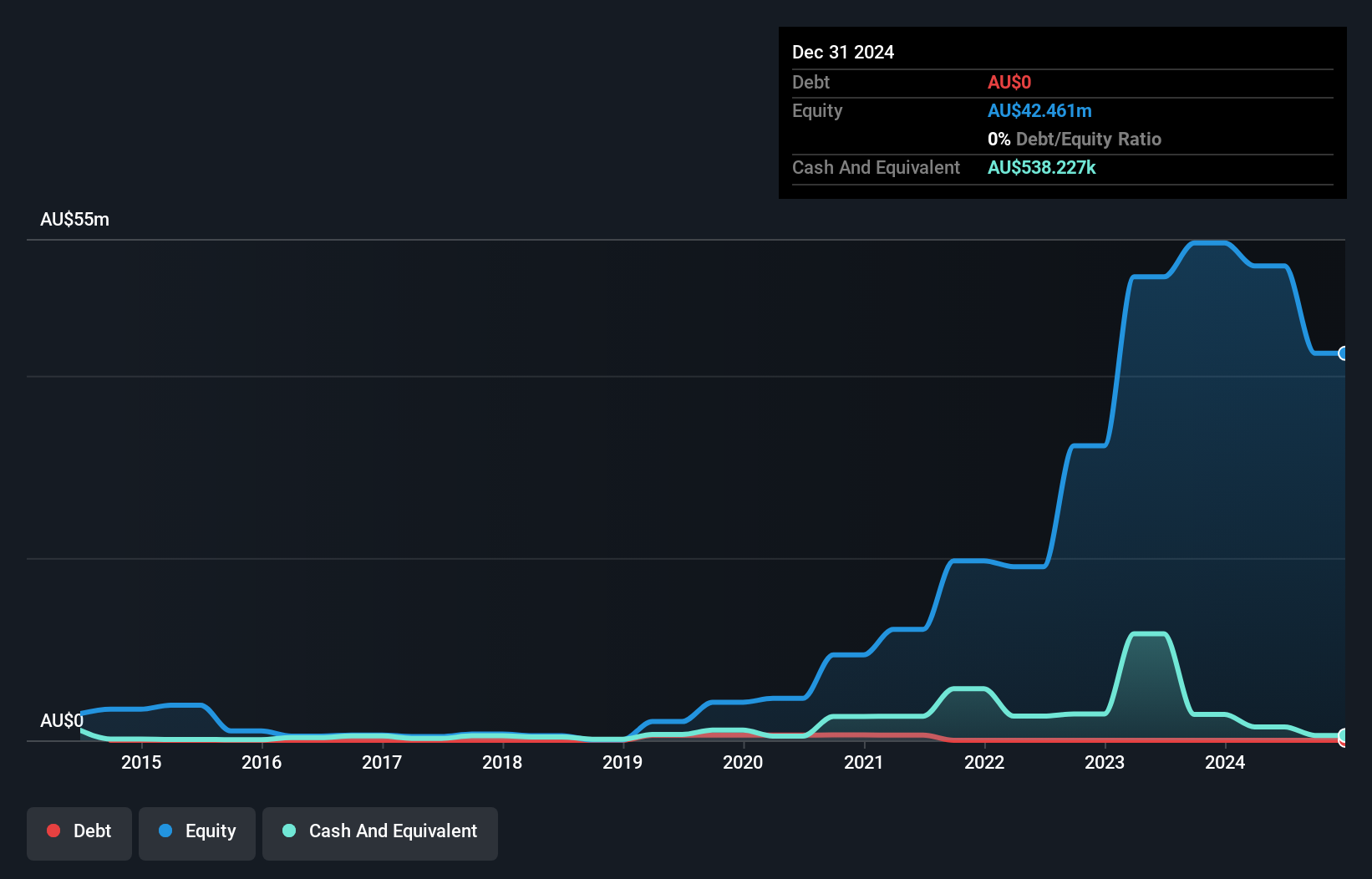

Dreadnought Resources Limited, with a market cap of A$41.45 million, remains pre-revenue and unprofitable, reflecting its early-stage exploration status. The company has no debt and recently raised A$3.71 million through a follow-on equity offering to bolster its cash runway beyond the current 6-month estimate based on free cash flow forecasts. Dreadnought's short-term assets of A$2 million exceed both short- and long-term liabilities, indicating sound liquidity management despite high weekly volatility compared to most Australian stocks. Recent EIS co-funded grant awards for drilling at Mangaroon highlight potential for future critical metals discoveries in Western Australia.

- Click to explore a detailed breakdown of our findings in Dreadnought Resources' financial health report.

- Gain insights into Dreadnought Resources' outlook and expected performance with our report on the company's earnings estimates.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$376.58 million.

Operations: The company's revenue segment includes the provision of electrical services, generating A$551.87 million.

Market Cap: A$376.58M

Southern Cross Electrical Engineering, with a market cap of A$376.58 million, offers stable financial footing and moderate growth prospects in the Australian penny stock landscape. The company generates significant revenue of A$551.87 million from its electrical services, demonstrating substantial operational scale compared to typical penny stocks. Despite earnings growth slowing to 9.1% last year from a 13.9% five-year average, it remains debt-free and has robust liquidity with short-term assets exceeding liabilities by A$62.9 million. Trading at 38.5% below estimated fair value and supported by an experienced management team, Southern Cross presents potential for value-seeking investors amidst some volatility concerns.

- Get an in-depth perspective on Southern Cross Electrical Engineering's performance by reading our balance sheet health report here.

- Evaluate Southern Cross Electrical Engineering's prospects by accessing our earnings growth report.

Where To Now?

- Unlock our comprehensive list of 1,026 ASX Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, and maintenance services and products to resources, commercial, and infrastructure sectors in Australia.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives