As the ASX 200 gears up for a potential rise, buoyed by the onset of Black Friday sales and a robust performance from U.S. markets, investors are keenly observing opportunities across various sectors. While penny stocks might seem like an outdated concept, they continue to represent intriguing prospects within the investment landscape. By focusing on companies with strong financials and growth potential, investors can uncover valuable opportunities in these smaller or newer enterprises.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$330.52M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.76 | A$97.36M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.41 | A$111.24M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.65 | A$808.63M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.03 | A$114.16M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Indiana Resources (ASX:IDA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Indiana Resources Limited explores rare earth elements, gold, and base metals in Australia and has a market cap of A$69.95 million.

Operations: The company generates revenue from its exploration activities, amounting to A$0.21 million.

Market Cap: A$69.95M

Indiana Resources Limited, with a market cap of A$69.95 million, is pre-revenue and has been experiencing shareholder dilution with shares outstanding growing by 3.4% over the past year. The company is debt-free and its short-term assets of A$1.8 million cover both short-term liabilities of A$900K and long-term liabilities of A$22K. Despite being unprofitable, Indiana has reduced losses at 26.2% per year over five years but faces less than a year of cash runway if current free cash flow trends continue. Recently, it announced a special dividend payment scheduled for December 20, 2024.

- Get an in-depth perspective on Indiana Resources' performance by reading our balance sheet health report here.

- Assess Indiana Resources' previous results with our detailed historical performance reports.

Southern Cross Media Group (ASX:SXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Southern Cross Media Group Limited, with a market cap of A$134.34 million, produces audio content for broadcast and digital networks in Australia.

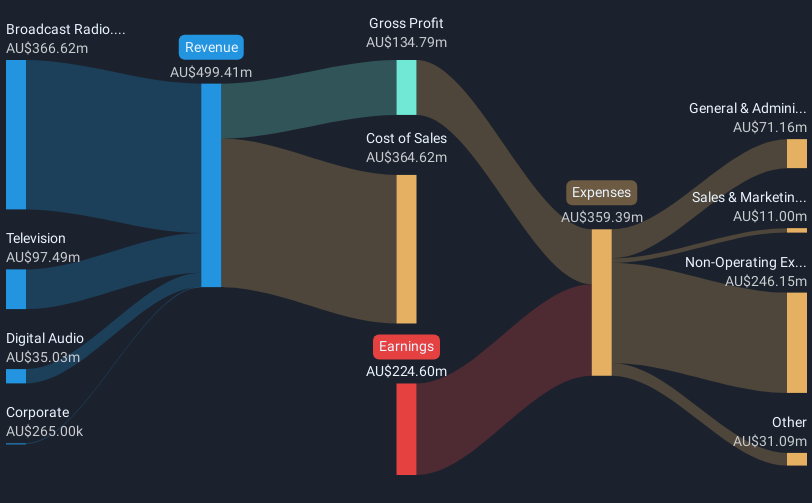

Operations: The company's revenue is primarily derived from Broadcast Radio (A$366.62 million), followed by Television (A$97.49 million) and Digital Audio (A$35.03 million).

Market Cap: A$134.34M

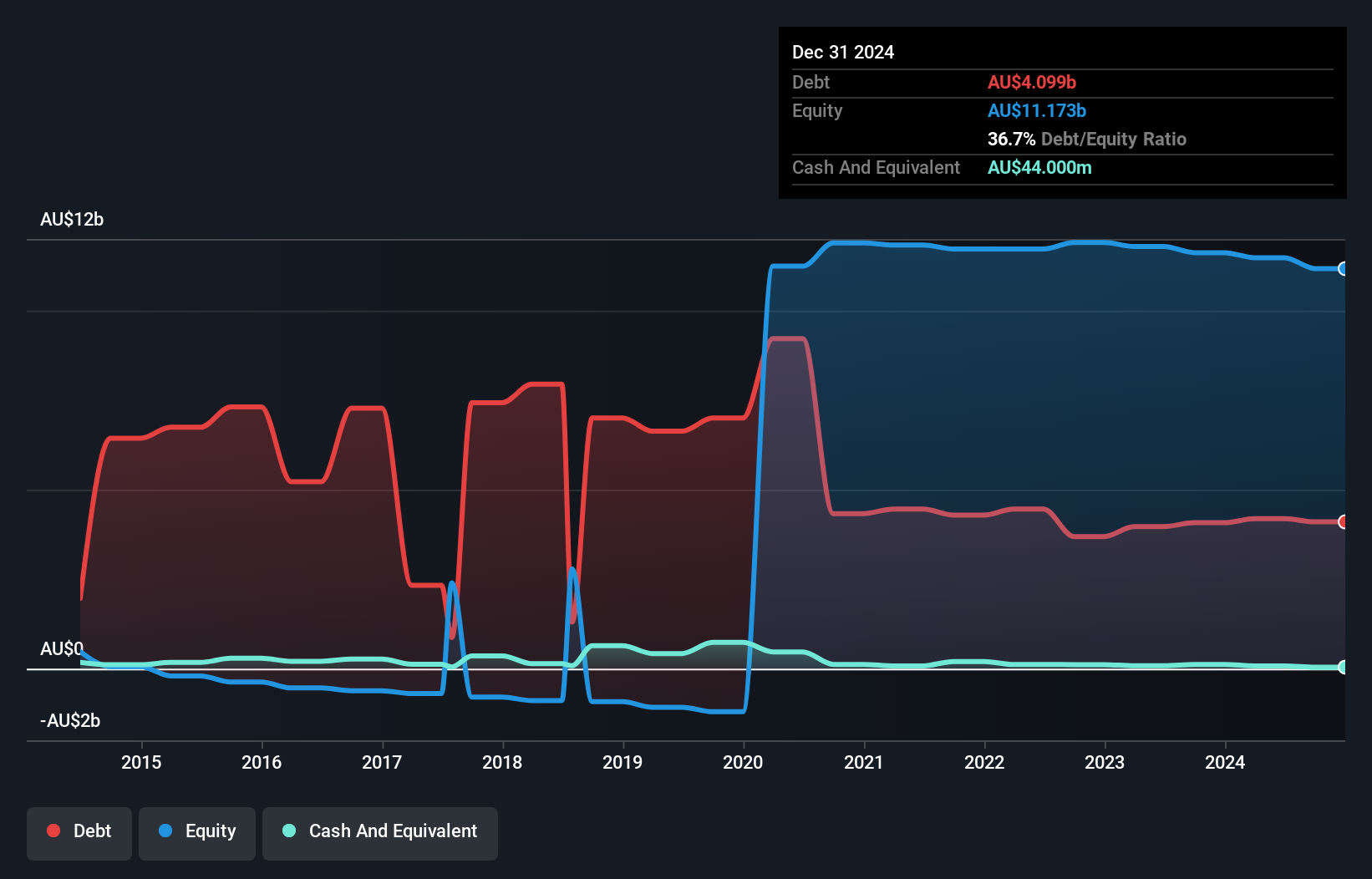

Southern Cross Media Group Limited, with a market cap of A$134.34 million, derives its revenue primarily from Broadcast Radio (A$366.62 million). Despite being unprofitable, the company has a stable weekly volatility of 7% and trades at good value compared to peers. Its short-term assets (A$116.9M) exceed short-term liabilities but fall short against long-term liabilities (A$414.6M). The debt-to-equity ratio has improved over five years, yet remains high at 52.8%. While losses have increased by 38.4% annually over five years, it maintains a cash runway exceeding three years if free cash flow remains positive.

- Click here and access our complete financial health analysis report to understand the dynamics of Southern Cross Media Group.

- Evaluate Southern Cross Media Group's prospects by accessing our earnings growth report.

TPG Telecom (ASX:TPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TPG Telecom Limited offers telecommunications services to various customer segments in Australia, with a market cap of A$8.42 billion.

Operations: The company generates revenue from two main segments: Consumer, contributing A$4.53 billion, and Enterprise, Government and Wholesale, accounting for A$1.09 billion.

Market Cap: A$8.42B

TPG Telecom, with a market cap of A$8.42 billion, shows mixed financial health as it navigates the penny stock landscape. While its debt is well covered by operating cash flow and interest payments are sufficiently managed by EBIT, short-term assets fall short of covering both short- and long-term liabilities. The company has experienced negative earnings growth recently due to a significant one-off loss impacting results. Despite these challenges, TPG's management and board have seasoned tenures, bolstered by recent strategic appointments including Paula Jane Dwyer as an independent non-executive director. Additionally, regulatory approval for network sharing with Optus could enhance regional 5G services.

- Navigate through the intricacies of TPG Telecom with our comprehensive balance sheet health report here.

- Assess TPG Telecom's future earnings estimates with our detailed growth reports.

Summing It All Up

- Discover the full array of 1,044 ASX Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXL

Southern Cross Media Group

Southern Cross Media Group Limited, together with its subsidiaries, creates audio content for distribution on broadcast and digital networks in Australia.

Undervalued with adequate balance sheet.