- Australia

- /

- Oil and Gas

- /

- ASX:IVZ

ASX Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the Australian market braces for a challenging week due to renewed global tariff threats, investors are keenly watching how this could impact various sectors. In such uncertain times, penny stocks—often smaller or newer companies—can present intriguing opportunities for those willing to explore beyond the larger names. Despite their vintage label, these stocks can still offer surprising value and potential growth when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.60 | A$122.65M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.91 | A$56.66M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.68 | A$412.63M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.17 | A$233.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.044 | A$51.47M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.071 | A$37.4M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.795 | A$379.78M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.31 | A$1.42B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Focus Minerals (ASX:FML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Focus Minerals Limited is involved in the exploration and development of gold properties in Western Australia, with a market cap of A$682.01 million.

Operations: The company's revenue is primarily derived from its Coolgardie operations, amounting to A$151.74 million.

Market Cap: A$682.01M

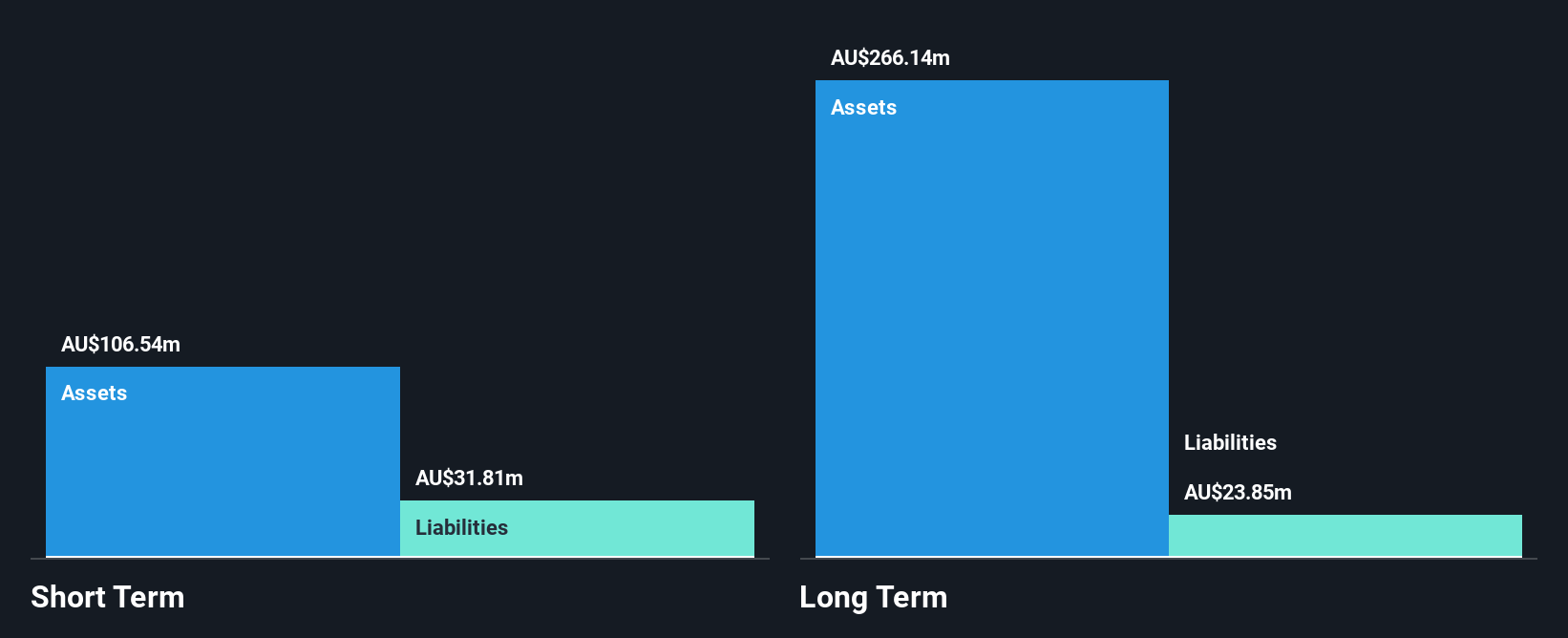

Focus Minerals Limited has demonstrated significant financial growth, with earnings increasing by a very large margin over the past year, surpassing both its historical averages and industry benchmarks. The company is debt-free, with short-term assets significantly exceeding both short-term and long-term liabilities. Recent earnings results show a substantial turnaround from a net loss to A$221.4 million in net income for the half-year ended June 30, 2025. Despite stable weekly volatility over the past year, its share price remains highly volatile in the short term. Focus Minerals' experienced management and board are instrumental in navigating this growth phase effectively.

- Navigate through the intricacies of Focus Minerals with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Focus Minerals' track record.

Global Lithium Resources (ASX:GL1)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Global Lithium Resources Limited focuses on the evaluation, exploration, and development of lithium resources in Australia with a market cap of A$103.38 million.

Operations: Currently, there are no reported revenue segments for Global Lithium Resources Limited.

Market Cap: A$103.38M

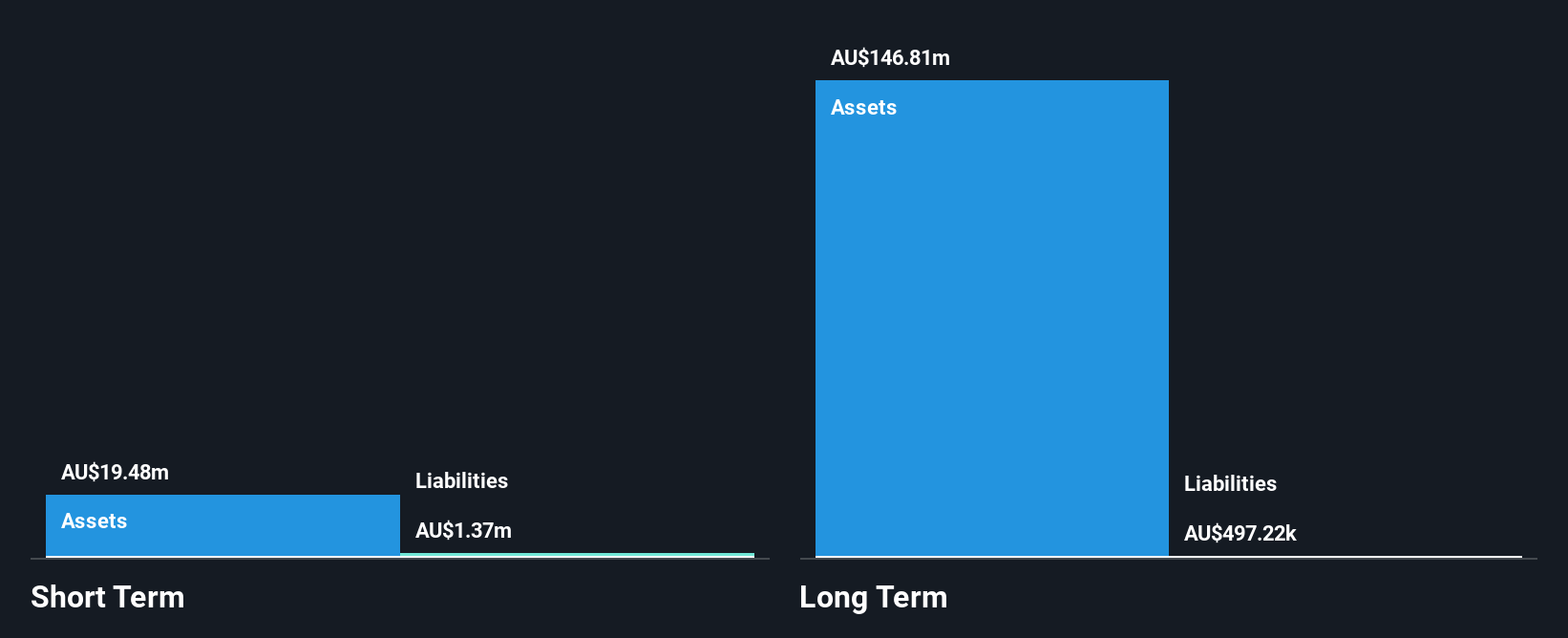

Global Lithium Resources Limited, with a market cap of A$103.38 million, is navigating its pre-revenue phase with recent earnings reporting A$1.77 million in revenue and a net loss of A$3.85 million for the year ending June 30, 2025. Despite being debt-free and having short-term assets exceeding liabilities, the company faces challenges including limited cash runway under current free cash flow conditions and an inexperienced board with an average tenure of less than one year. The company's share price has been highly volatile recently, reflecting investor uncertainty amidst unprofitability and forecasted earnings decline over the next three years.

- Jump into the full analysis health report here for a deeper understanding of Global Lithium Resources.

- Learn about Global Lithium Resources' future growth trajectory here.

Invictus Energy (ASX:IVZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Invictus Energy Limited is an independent upstream oil and gas company focused on the exploration and appraisal of oil and gas properties in northern Zimbabwe, Africa, with a market cap of A$272.59 million.

Operations: The company's revenue is derived entirely from its Oil and Gas segment, amounting to A$0.09 million.

Market Cap: A$272.59M

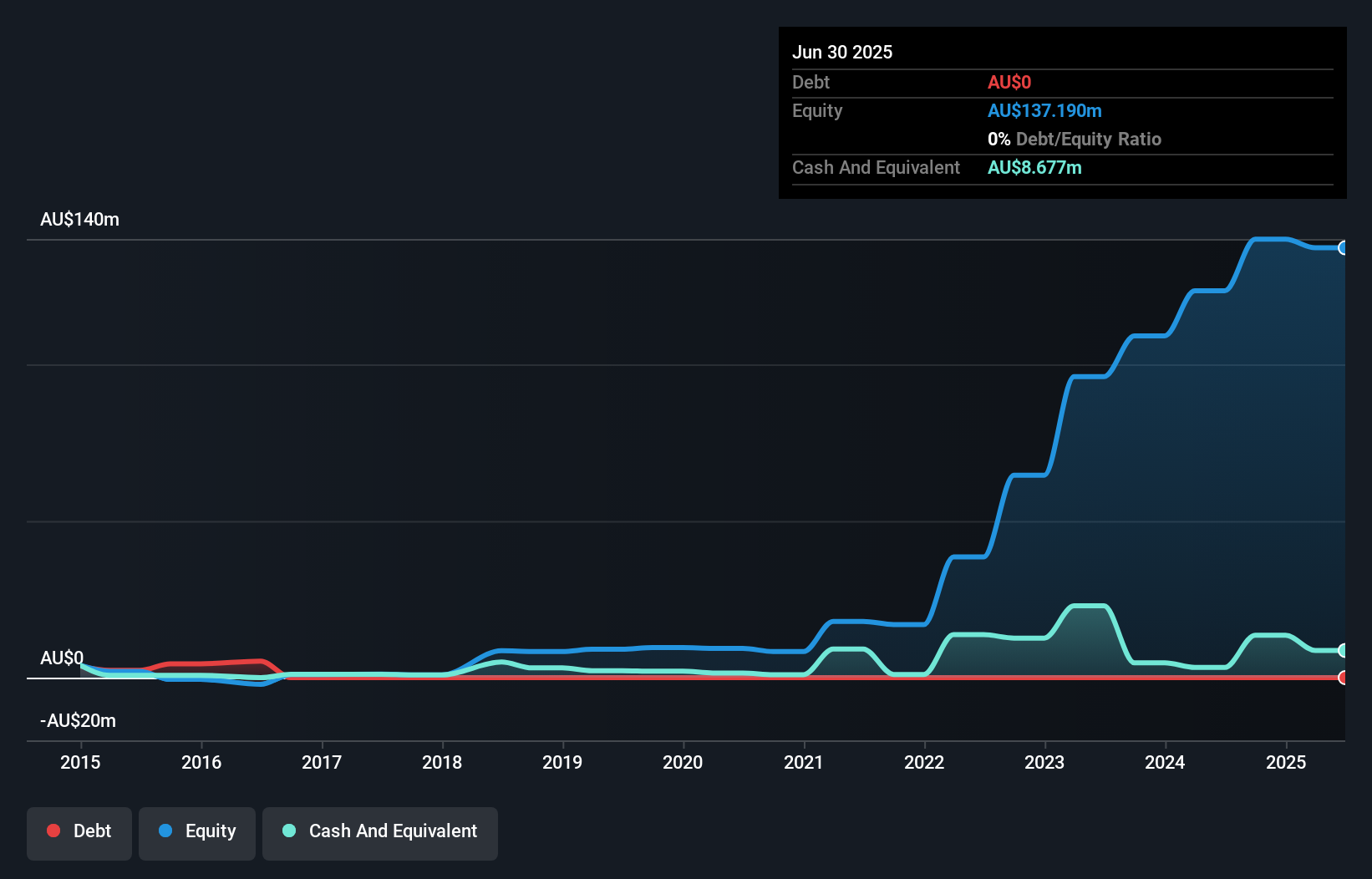

Invictus Energy Limited, with a market cap of A$272.59 million, remains in its pre-revenue phase with earnings of just A$0.09 million and a net loss of A$4.65 million for the year ending June 30, 2025. Despite being debt-free and having short-term assets exceeding liabilities, the company faces significant challenges including high share price volatility and auditor concerns about its ability to continue as a going concern. Recent capital raising efforts through a follow-on equity offering aim to bolster its limited cash runway, but it was recently dropped from the S&P/ASX Emerging Companies Index, reflecting ongoing investor caution.

- Unlock comprehensive insights into our analysis of Invictus Energy stock in this financial health report.

- Assess Invictus Energy's previous results with our detailed historical performance reports.

Taking Advantage

- Navigate through the entire inventory of 423 ASX Penny Stocks here.

- Interested In Other Possibilities? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IVZ

Invictus Energy

An independent upstream oil and gas company, engages in the exploration and appraisal of oil and gas properties in northern Zimbabwe, Africa.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)