- Australia

- /

- Metals and Mining

- /

- ASX:FMG

We Think The Compensation For Fortescue Ltd's (ASX:FMG) CEO Looks About Right

Key Insights

- Fortescue's Annual General Meeting to take place on 6th of November

- CEO Dino Otranto's total compensation includes salary of US$1.03m

- The total compensation is 38% less than the average for the industry

- Fortescue's total shareholder return over the past three years was 88% while its EPS was down 18% over the past three years

Performance at Fortescue Ltd (ASX:FMG) has been rather uninspiring recently and shareholders may be wondering how CEO Dino Otranto plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 6th of November. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for Fortescue

How Does Total Compensation For Dino Otranto Compare With Other Companies In The Industry?

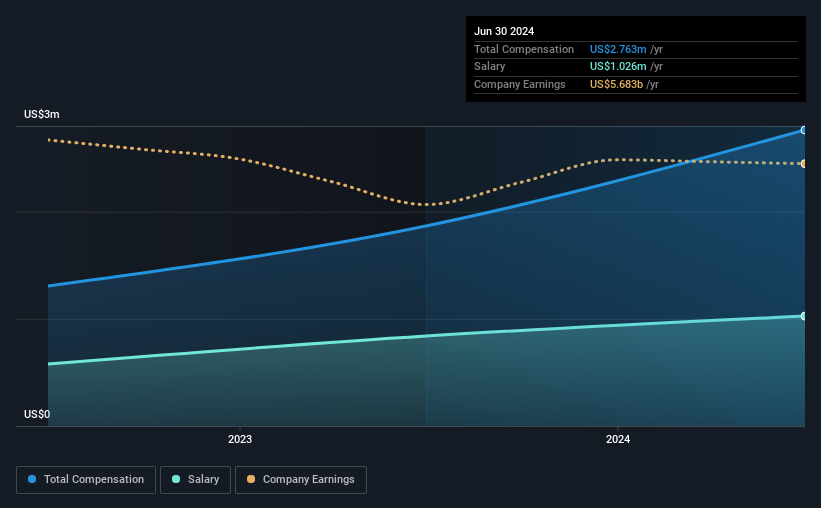

Our data indicates that Fortescue Ltd has a market capitalization of AU$60b, and total annual CEO compensation was reported as US$2.8m for the year to June 2024. That's a notable increase of 48% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.0m.

On comparing similar companies in the Australian Metals and Mining industry with market capitalizations above AU$12b, we found that the median total CEO compensation was US$4.4m. Accordingly, Fortescue pays its CEO under the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$1.0m | US$839k | 37% |

| Other | US$1.7m | US$1.0m | 63% |

| Total Compensation | US$2.8m | US$1.9m | 100% |

Speaking on an industry level, nearly 65% of total compensation represents salary, while the remainder of 35% is other remuneration. Fortescue sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Fortescue Ltd's Growth

Over the last three years, Fortescue Ltd has shrunk its earnings per share by 18% per year. In the last year, its revenue is up 8.0%.

Overall this is not a very positive result for shareholders. The fairly low revenue growth fails to impress given that the EPS is down. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Fortescue Ltd Been A Good Investment?

Most shareholders would probably be pleased with Fortescue Ltd for providing a total return of 88% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us wonder if these strong returns can continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for Fortescue (1 is potentially serious!) that you should be aware of before investing here.

Switching gears from Fortescue, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FMG

Fortescue

Engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives