- Australia

- /

- Metals and Mining

- /

- ASX:EMR

Emerald Resources (ASX:EMR) Valuation Review Following Okvau Mine Production Shortfall and Expansion Update

Reviewed by Kshitija Bhandaru

Emerald Resources (ASX:EMR) has updated investors on the Okvau Gold Mine, reporting that third-quarter production fell short of prior guidance after heavy rainfall limited access to high grade ore during September.

See our latest analysis for Emerald Resources.

Despite a weather-disrupted quarter, Emerald Resources’ 1-day share price return jumped 4.12%, capping off a formidable 29.6% gain for the past month and a year-to-date share price surge of 69.5%. With a 1-year total shareholder return of 32.4% and a staggering 400.9% over three years, momentum has picked up again after a powerful multi-year run. This hints at renewed optimism even as production challenges emerge.

If Emerald’s resilience in the face of setbacks sparks your curiosity, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Emerald's strong rebound in recent months, investors may be wondering if the stock is undervalued after its short-term setbacks, or if the market is already pricing in all the future growth on offer.

Price-to-Earnings of 41.9x: Is it justified?

Emerald Resources is trading at a price-to-earnings (P/E) ratio of 41.9x, which puts it well above the typical valuations seen across the local market and its industry peers.

The price-to-earnings ratio compares a company's current share price to its earnings per share, serving as a quick way to assess how much investors are paying for current and expected profits. For mining companies like Emerald Resources, a high P/E can indicate expectations for outsized growth ahead, or it may suggest that the stock price already reflects optimistic future assumptions.

Despite strong growth prospects, Emerald’s P/E ratio sits nearly double the Australian Metals and Mining industry average of 22.6x. In fact, it is even higher than the estimated fair P/E ratio of 31.8x based on regression models. This suggests the market is expecting remarkable future earnings growth and is pricing in a premium for those expectations, but it is well ahead of both sector norms and the company’s own calculated fair value multiple.

Explore the SWS fair ratio for Emerald Resources

Result: Price-to-Earnings of 41.9x (OVERVALUED)

However, macroeconomic volatility or ongoing operational disruptions at Okvau could quickly cool recent optimism and challenge Emerald’s premium valuation.

Find out about the key risks to this Emerald Resources narrative.

Another View: SWS DCF Model Points to Undervaluation

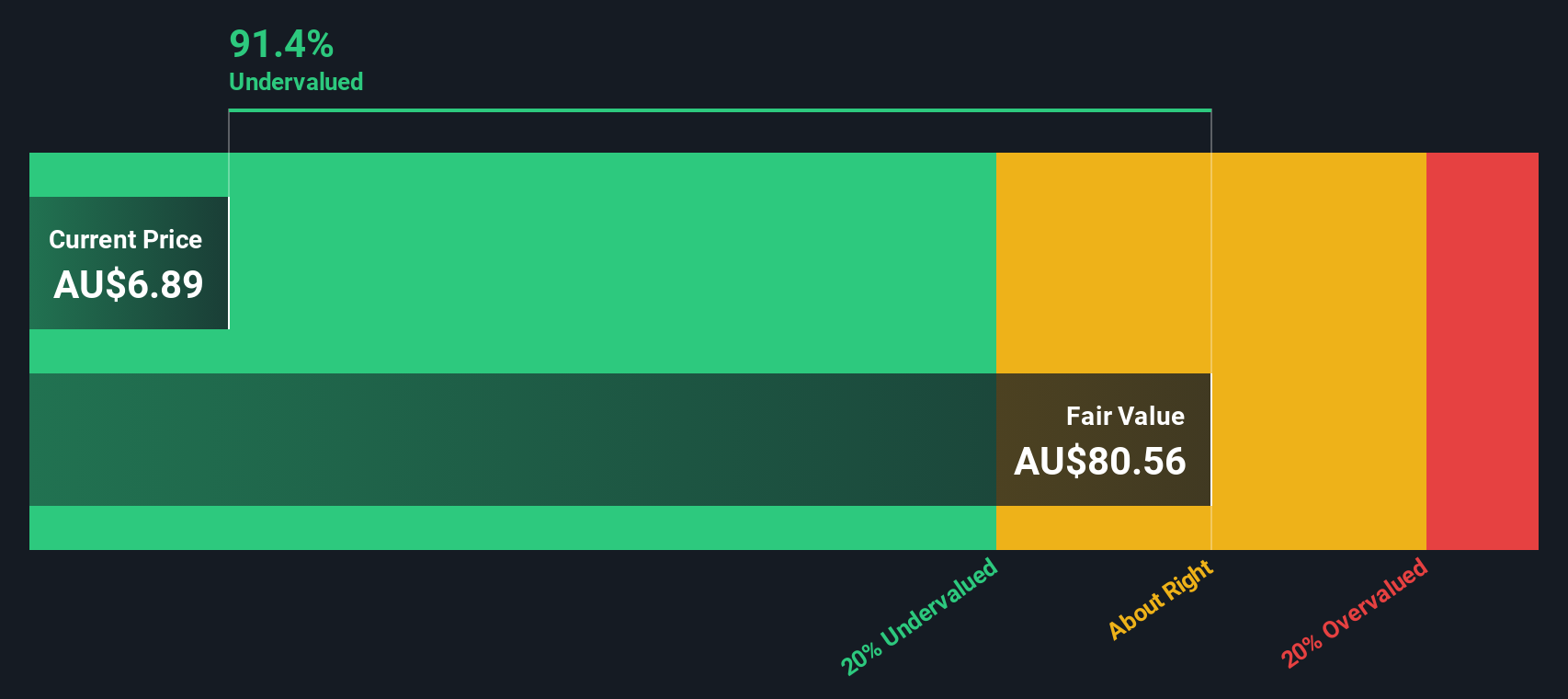

While Emerald Resources appears expensive by traditional earnings multiples, our DCF model suggests the stock is trading at a remarkable 91.5% discount to its estimated fair value. This sharp contrast with the high price-to-earnings ratio raises the question: has the market overlooked Emerald’s long-term earnings potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Emerald Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Emerald Resources Narrative

If you want to dive deeper or reach your own conclusions, it’s easy to shape your perspective and build a personal view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Emerald Resources.

Looking for more investment ideas?

Smart investors always stay ahead by acting on top trends early. Don’t limit your portfolio. These three opportunities may be what your portfolio is missing.

- Boost your income stream and tap into reliable yield by checking out these 18 dividend stocks with yields > 3% that consistently deliver over 3% in annual payouts.

- Seize the rise of artificial intelligence and find potential market winners among these 24 AI penny stocks reshaping industries with breakthrough applications.

- Get ahead of the mainstream by uncovering undervalued prospects with these 878 undervalued stocks based on cash flows based on their cash flow fundamentals before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)