ASX Growth Companies With High Insider Ownership In January 2025

Reviewed by Simply Wall St

As the Australian market continues to navigate the economic landscape shaped by the new Trump administration, the ASX200 has shown resilience, closing up 0.36% at 8,408 points amid positive tariff developments. In this environment of cautious optimism, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business and may offer potential stability in a fluctuating market.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medallion Metals (ASX:MM8) | 13.8% | 67.5% |

| Acrux (ASX:ACR) | 20.2% | 91.8% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.8% | 77.3% |

| Pointerra (ASX:3DP) | 23.8% | 126.4% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★★

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and other international markets with a market cap of A$591.37 million.

Operations: The company's revenue is primarily generated from its Biopharmaceutical Sector, amounting to A$88.18 million.

Insider Ownership: 10.4%

Clinuvel Pharmaceuticals demonstrates strong growth potential with earnings projected to grow 26.17% annually, outpacing the Australian market's 12.6%. Revenue is similarly forecasted to increase by 21.4% per year, surpassing the market's 6.1%. The company trades at a significant discount compared to its estimated fair value and peers, with no substantial insider trading activity reported recently. Recent events include addressing shareholder queries on vitiligo treatments and participating in a healthcare conference.

- Click to explore a detailed breakdown of our findings in Clinuvel Pharmaceuticals' earnings growth report.

- Our expertly prepared valuation report Clinuvel Pharmaceuticals implies its share price may be lower than expected.

Develop Global (ASX:DVP)

Simply Wall St Growth Rating: ★★★★★★

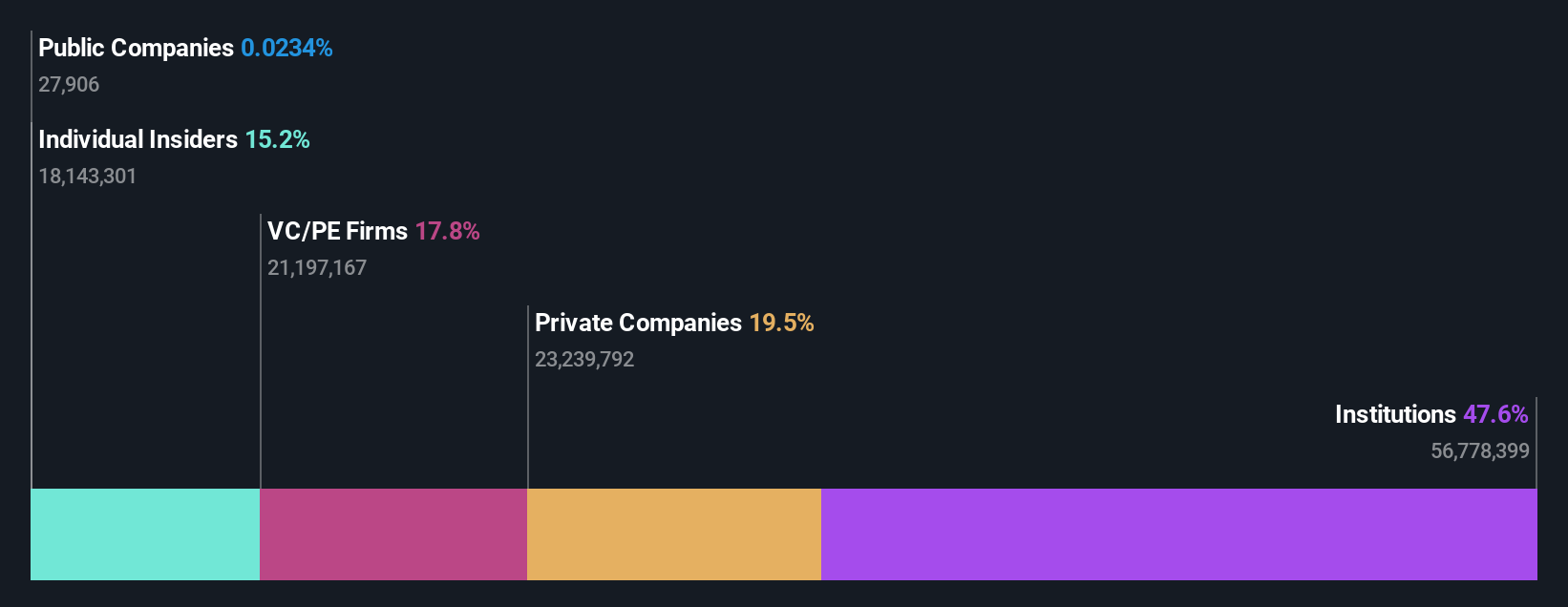

Overview: Develop Global Limited, along with its subsidiaries, focuses on the exploration and development of mineral resource properties in Australia and has a market cap of A$660 million.

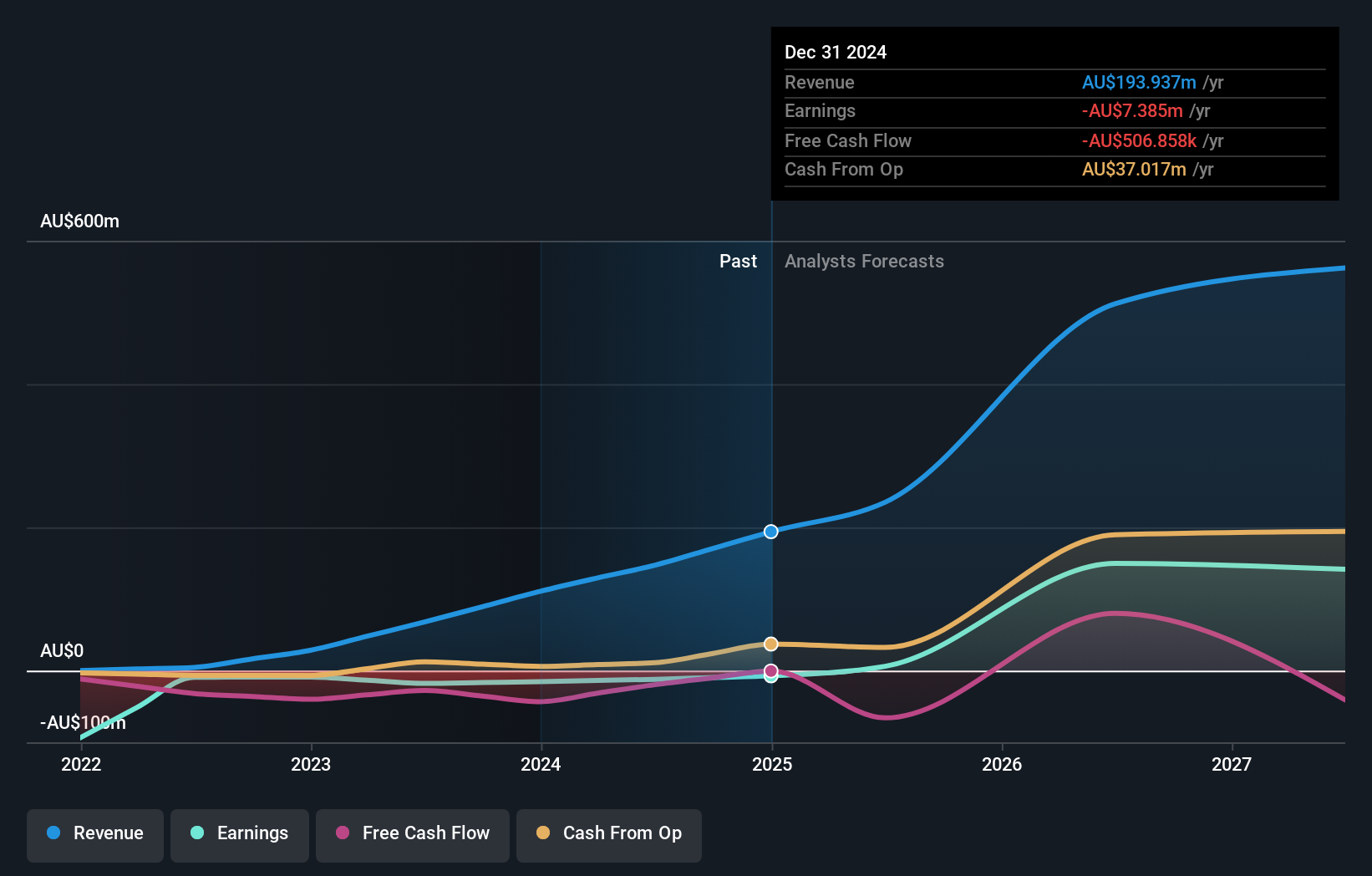

Operations: The company generates revenue primarily from its mining services segment, which amounted to A$147.23 million.

Insider Ownership: 20.4%

Develop Global is positioned for substantial growth, with revenue projected to increase by 56.2% annually, significantly outpacing the Australian market's average. The company is expected to achieve profitability within three years, marking an above-average profit growth rate. Despite no recent insider trading activity, Develop Global trades at a favorable value compared to industry peers. Recent presentations at key conferences highlight ongoing engagement and strategic direction under Managing Director Bill Beament's leadership.

- Take a closer look at Develop Global's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Develop Global shares in the market.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited owns, operates, and franchises quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$4.04 billion.

Operations: The company generates revenue primarily from its quick service restaurant operations, amounting to A$364.99 million.

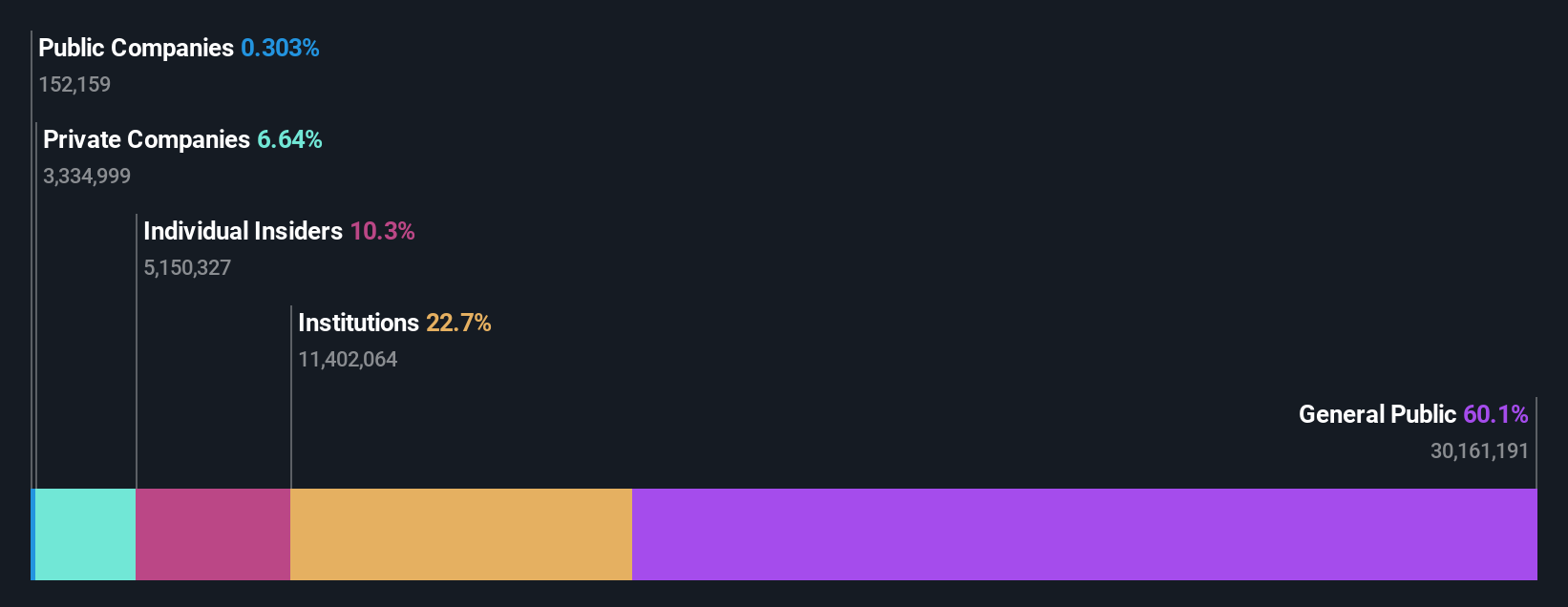

Insider Ownership: 12.8%

Guzman y Gomez is experiencing rapid growth, with revenue increasing by 31.9% last year and forecasted to grow 18% annually, outpacing the Australian market. Insiders have shown confidence through recent substantial share purchases. Despite expected profitability within three years, its projected return on equity remains low at 11.7%. Recent inclusion in the S&P Global BMI Index and board changes mark significant developments for the company as it navigates its growth trajectory.

- Unlock comprehensive insights into our analysis of Guzman y Gomez stock in this growth report.

- Our comprehensive valuation report raises the possibility that Guzman y Gomez is priced higher than what may be justified by its financials.

Key Takeaways

- Explore the 89 names from our Fast Growing ASX Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CUV

Clinuvel Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for patients with genetic, metabolic, systemic, and life-threatening disorders in Australia, Europe, the United States, Switzerland, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives