3 ASX Penny Stocks With Market Caps Under A$300M To Consider

Reviewed by Simply Wall St

The Australian market has shown resilience, with the XJO climbing past 9,000 points on strong performance from the real estate sector and investor speculation on potential RBA rate cuts. For those looking to invest in smaller or newer companies, penny stocks — despite the name's vintage feel — can still offer surprising value. In this article, we highlight three ASX penny stocks that stand out for their financial strength and potential long-term success amidst current market dynamics.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.45 | A$128.96M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.71 | A$127.84M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.91 | A$56.66M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.63 | A$404.79M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.18 | A$234.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.041 | A$47.96M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.505 | A$59.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.855 | A$408.45M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.26 | A$1.38B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Ardiden (ASX:ADV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ardiden Limited is a gold exploration company operating in Canada with a market capitalization of A$26.57 million.

Operations: Ardiden Limited currently does not report any revenue segments.

Market Cap: A$26.57M

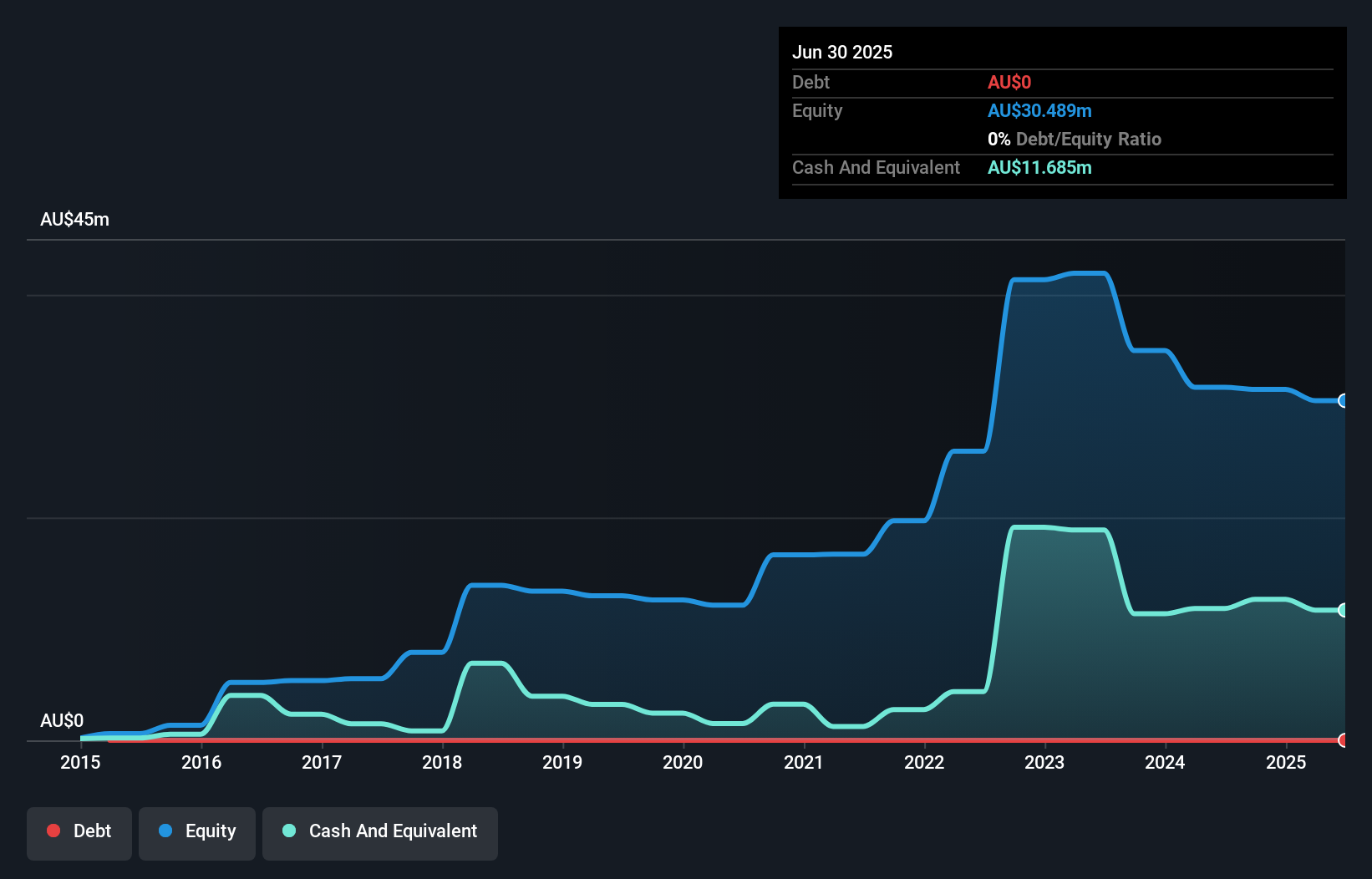

Ardiden Limited, a pre-revenue gold exploration company with a market capitalization of A$26.57 million, has recently announced significant corporate actions. The company is involved in a reverse merger with Lac Gold Pty Ltd valued at A$19.3 million, which will result in Lac Gold shareholders holding 61.9% of the merged entity. Ardiden also plans to raise A$10 million through share issuance to support its operations. Despite its unprofitability and volatile share price, Ardiden maintains a strong cash position with no debt and sufficient runway for over three years due to positive free cash flow growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Ardiden.

- Explore historical data to track Ardiden's performance over time in our past results report.

Ai-Media Technologies (ASX:AIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ai-Media Technologies Limited offers captioning, transcription, and translation services across several regions including Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom with a market cap of A$198.37 million.

Operations: The company generates A$64.86 million in revenue from its Internet Software & Services segment.

Market Cap: A$198.37M

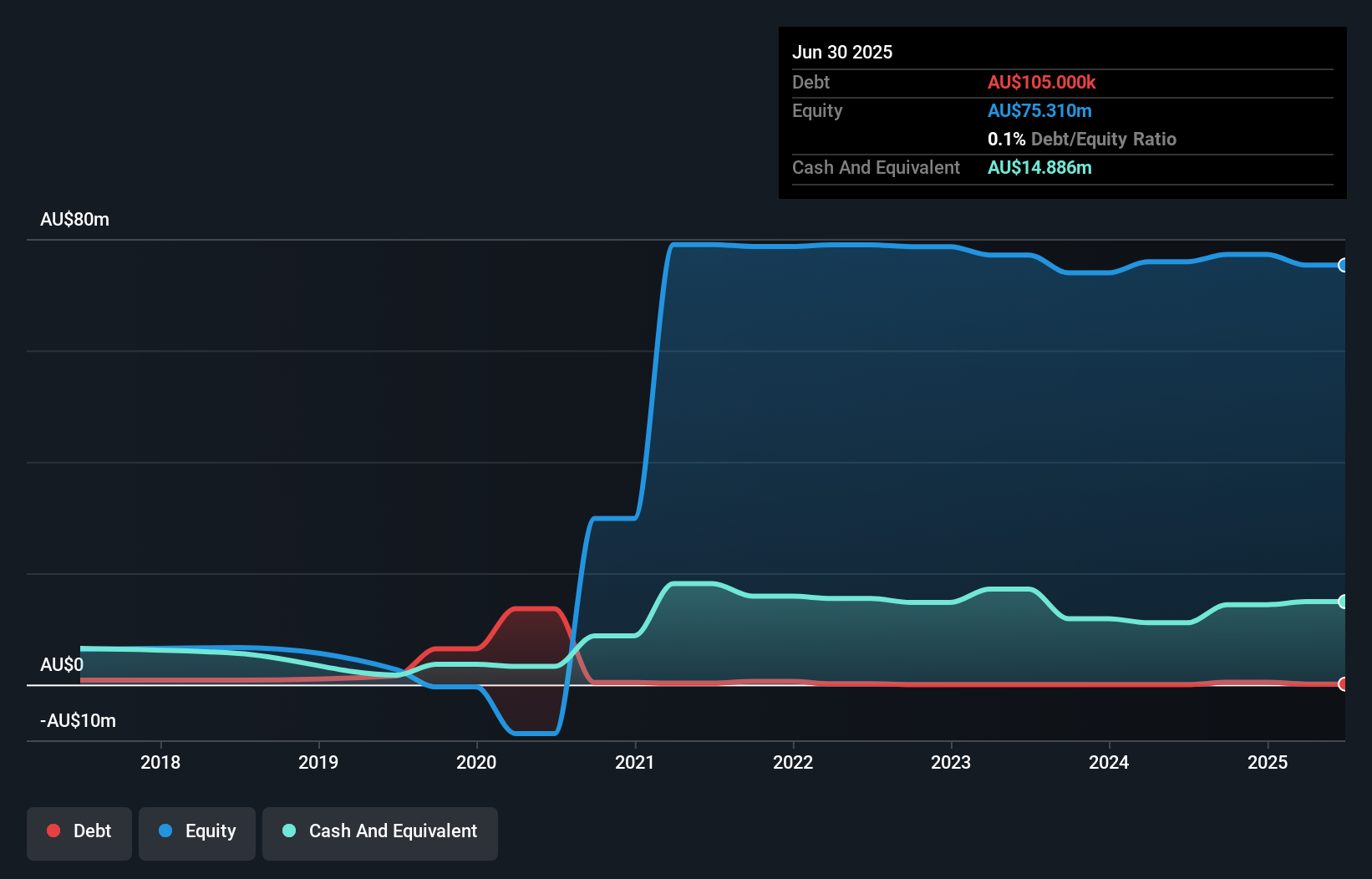

Ai-Media Technologies Limited, with a market cap of A$198.37 million, operates in the Internet Software & Services sector and reported A$64.86 million in revenue for the fiscal year ending June 2025. Despite being unprofitable, Ai-Media has reduced losses over five years and maintains a positive cash flow, ensuring a cash runway exceeding three years. The company recently appointed Grant Thornton as its auditor and saw changes in its board composition with Alison Loat retiring after nine years of service. While insider selling has occurred recently, Ai-Media's short-term assets comfortably cover both short- and long-term liabilities.

- Get an in-depth perspective on Ai-Media Technologies' performance by reading our balance sheet health report here.

- Evaluate Ai-Media Technologies' prospects by accessing our earnings growth report.

Core Lithium (ASX:CXO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Core Lithium Ltd focuses on developing lithium and various metal deposits in Northern Territory and South Australia, with a market cap of A$289.31 million.

Operations: The company's revenue segment includes the Finniss Lithium Project, which reported a revenue of -A$2.42 million.

Market Cap: A$289.31M

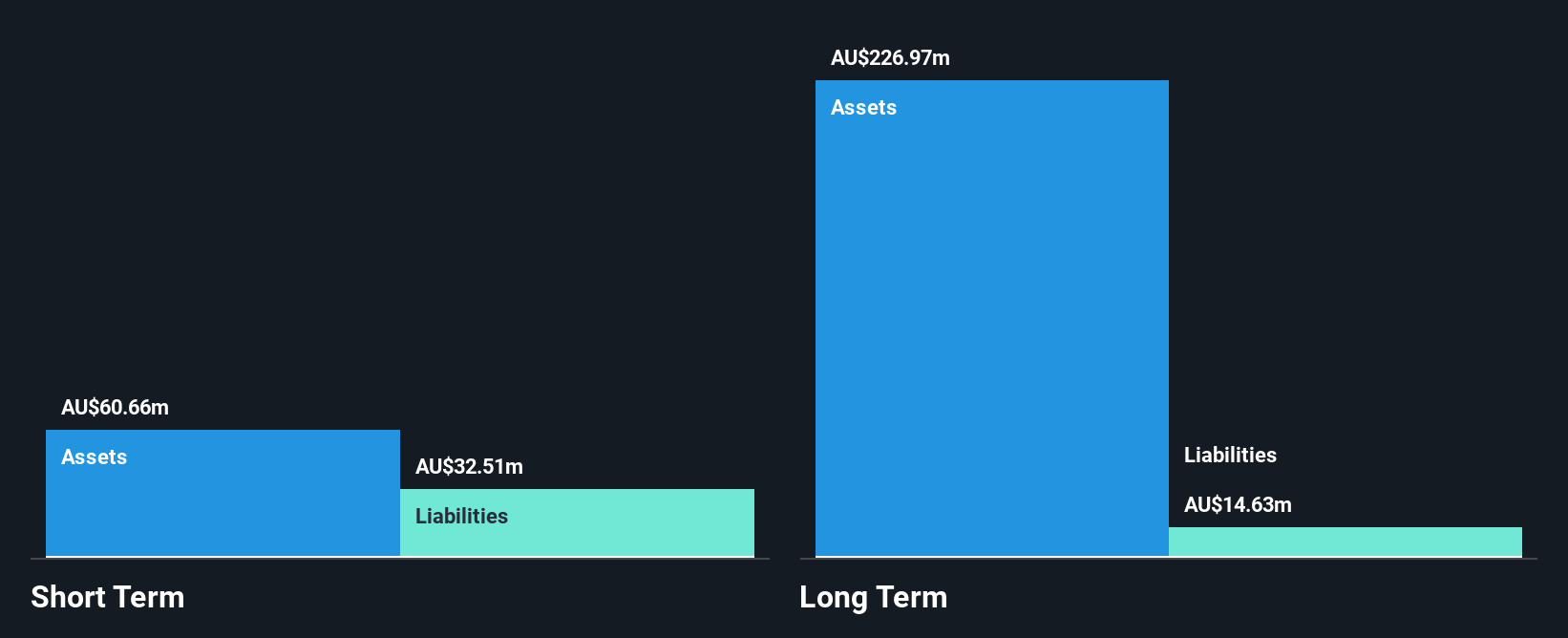

Core Lithium Ltd, with a market cap of A$289.31 million, is pre-revenue and has been actively raising capital through follow-on equity offerings, totaling over A$64 million recently. The company reported a net loss of A$23.37 million for the fiscal year ending June 2025, showing improvement from the previous year's loss. Despite being debt-free and having short-term assets exceeding liabilities, Core Lithium's cash runway is limited to five months based on past free cash flow but extended by recent capital raises. The management team's inexperience contrasts with an experienced board guiding strategic decisions amidst ongoing financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Core Lithium.

- Examine Core Lithium's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Explore the 423 names from our ASX Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AIM

Ai-Media Technologies

Provides captioning, transcription, and translation products and services in Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion