The Australian stock market is showing signs of recovery, with the ASX200 poised to potentially reach 9,000 points following positive movements in global indices and a boost from China's recent policy changes affecting rare earth exports. In this context, penny stocks—though an older term—remain relevant for investors seeking opportunities in smaller or newer companies that might offer unique value propositions. By focusing on those with robust financials and potential for growth, investors can uncover promising opportunities among these lesser-known stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.455 | A$130.4M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.61 | A$123.12M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.92 | A$57.29M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.65 | A$407.87M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.24 | A$239.13M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.043 | A$50.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.072 | A$37.92M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.84 | A$401.28M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.27 | A$1.39B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 422 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Articore Group (ASX:ATG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Articore Group Limited operates online platforms for designing and selling artwork-printed products across Australia, the United States, the United Kingdom, and internationally, with a market cap of A$91.99 million.

Operations: The company generates revenue primarily through its Redbubble segment, contributing A$236.18 million, and its Teepublic segment, adding A$201.83 million.

Market Cap: A$91.99M

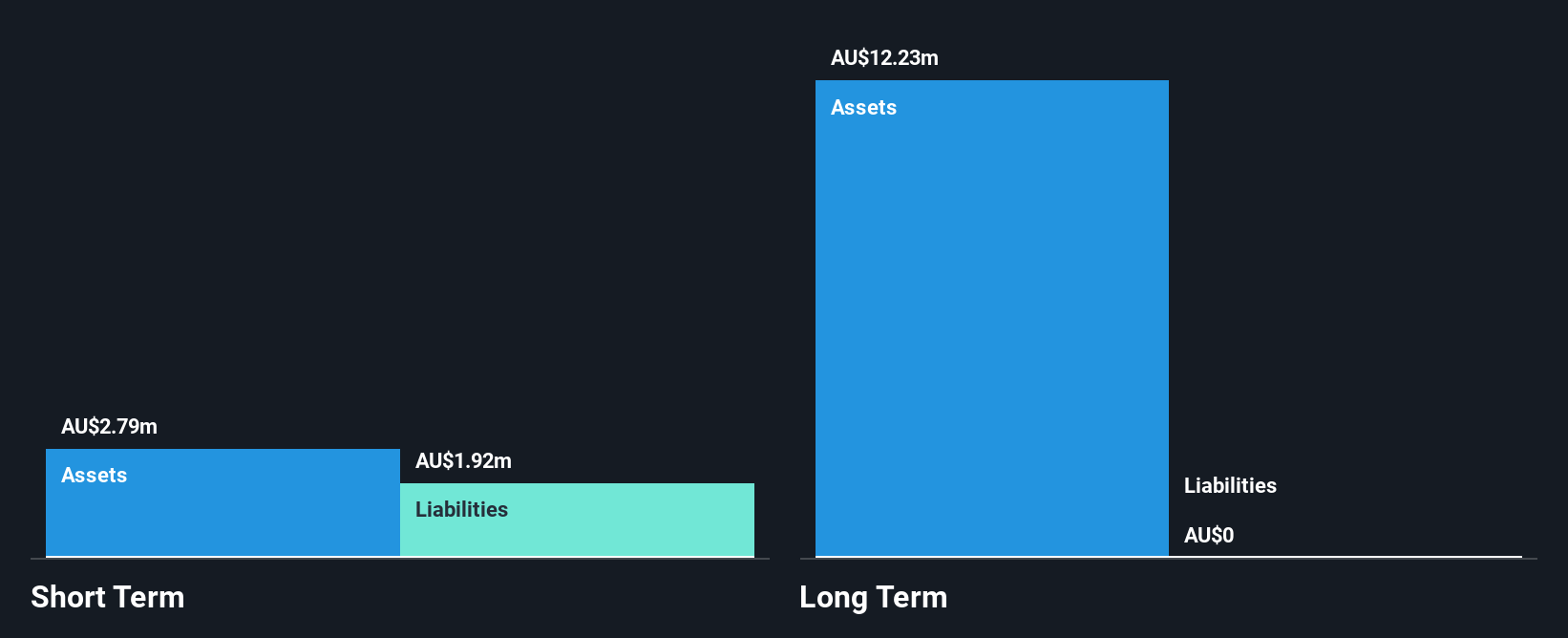

Articore Group, with a market cap of A$91.99 million, operates online platforms for artwork-printed products and has faced recent challenges but is making strategic moves to stabilize its business. Despite being unprofitable with a negative return on equity of -24.63% and short-term liabilities exceeding short-term assets, the company remains debt-free and has sufficient cash runway for over three years. Recent investor activism led to board stability as shareholders rejected resolutions to replace directors. The company reported a net loss of A$11.3 million for FY25 but anticipates an EBIT turnaround in FY26, targeting between A$2 million and A$8 million.

- Click here to discover the nuances of Articore Group with our detailed analytical financial health report.

- Gain insights into Articore Group's outlook and expected performance with our report on the company's earnings estimates.

CuFe (ASX:CUF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CuFe Ltd is an Australian mineral exploration and production company with a market capitalization of A$36.36 million.

Operations: CuFe Ltd has not reported any revenue segments.

Market Cap: A$36.36M

CuFe Ltd, with a market cap of A$36.36 million, is pre-revenue and has recently turned profitable, reporting net income of A$7.01 million for the year ended June 30, 2025. Despite achieving profitability, its financial stability is questioned by auditors citing going concern doubts. The company remains debt-free with short-term assets exceeding liabilities but faces high share price volatility and low return on equity at 5.7%. Recent strategic actions include a follow-on equity offering worth A$5.40 million, potentially enhancing liquidity but also indicating reliance on external funding to support operations.

- Jump into the full analysis health report here for a deeper understanding of CuFe.

- Evaluate CuFe's historical performance by accessing our past performance report.

Omni Bridgeway (ASX:OBL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Omni Bridgeway Limited, with a market cap of A$477.36 million, offers dispute and litigation finance services across regions including Australia, the United States, Canada, Latin America, Asia, New Zealand, Europe, the Middle East, and Africa.

Operations: The company's revenue is primarily generated from funding and providing services related to legal dispute resolution, amounting to A$87.77 million.

Market Cap: A$477.36M

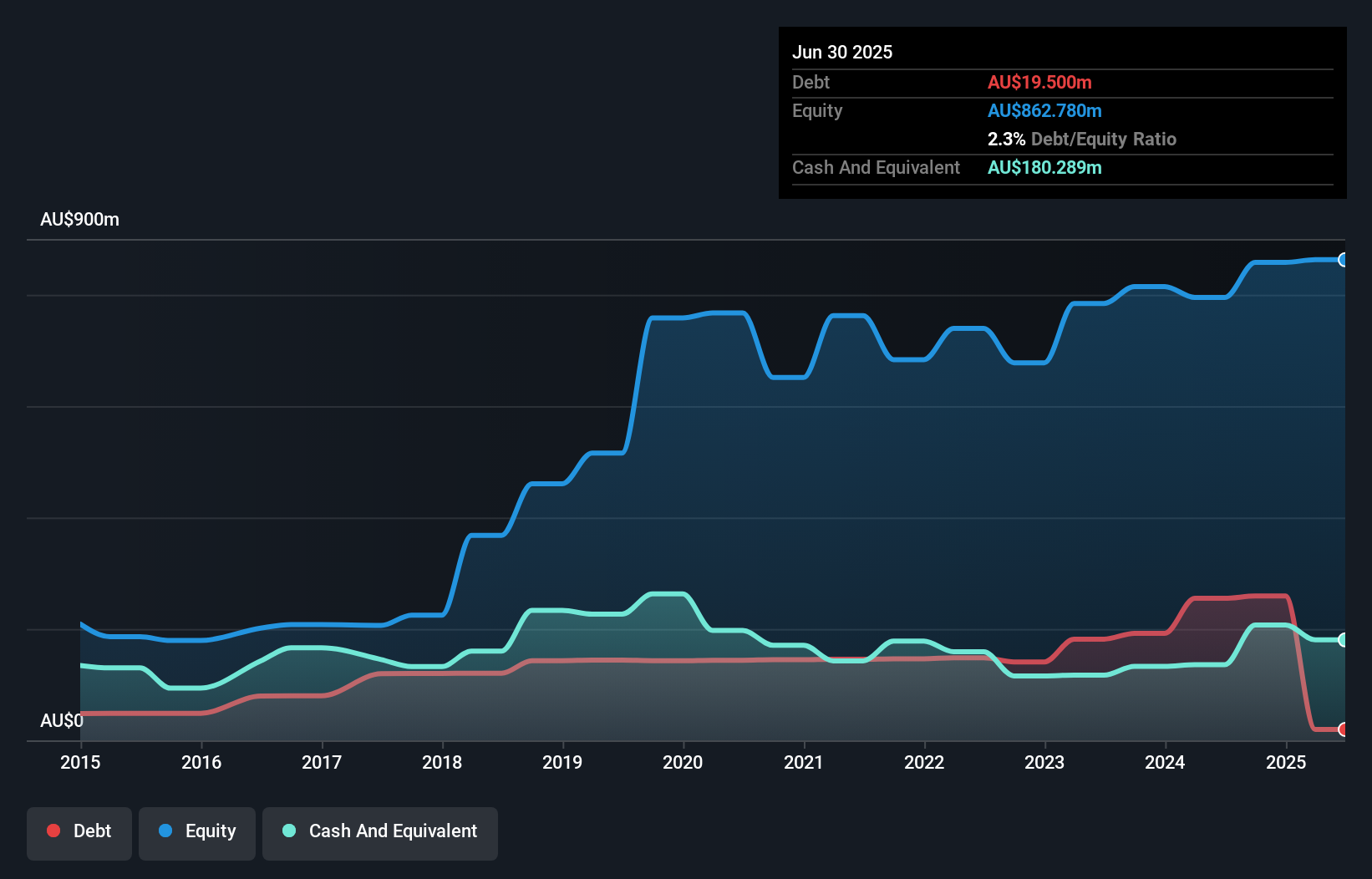

Omni Bridgeway Limited, with a market cap of A$477.36 million, has shown significant financial improvement, becoming profitable over the past year with net income reaching A$349.8 million for the fiscal year ending June 30, 2025. The company benefits from a strong balance sheet where short-term assets of A$269.0 million exceed both short and long-term liabilities. Its price-to-earnings ratio of 1.4x suggests it is trading at good value compared to the broader Australian market average of 21.3x. Despite declining sales figures, Omni Bridgeway's revenue surged to A$651.22 million, reflecting robust operational performance in its sector.

- Take a closer look at Omni Bridgeway's potential here in our financial health report.

- Assess Omni Bridgeway's future earnings estimates with our detailed growth reports.

Key Takeaways

- Click here to access our complete index of 422 ASX Penny Stocks.

- Want To Explore Some Alternatives? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ATG

Articore Group

Owns and operates online platforms that facilitates design and sale of products printed with the artwork in Australia, the United States, the United Kingdom, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)