- Australia

- /

- Hospitality

- /

- ASX:FLT

Three ASX Growth Companies With High Insider Ownership And A 32% Return On Equity

Reviewed by Simply Wall St

Amidst the mixed sector performance and significant events such as the debut of Bitcoin on the ASX and notable IPOs, the Australian market continues to present varied opportunities for investors. In this context, companies with high insider ownership can be particularly appealing, as they often indicate a strong alignment between company management and shareholder interests, potentially fostering robust growth in challenging market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 30.1% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Change Financial (ASX:CCA) | 26.6% | 85.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

| SiteMinder (ASX:SDR) | 11.3% | 72.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Capricorn Metals (ASX:CMM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricorn Metals Ltd is an Australian company focused on the evaluation, exploration, development, and production of gold properties, with a market capitalization of approximately A$1.82 billion.

Operations: The company generates revenue primarily from its Karlawinda project, totaling A$356.94 million.

Insider Ownership: 12.3%

Return On Equity Forecast: 31% (2026 estimate)

Capricorn Metals, an Australian growth company with high insider ownership, demonstrates a robust forecast with earnings expected to grow by 26.5% per year, outpacing the market's 13.7%. Despite some insider selling over the past three months, revenue is also set to increase by 14.1% annually. However, profit margins have declined from last year's 25.4% to just 5.2%, signaling potential challenges in maintaining profitability amidst growth.

- Get an in-depth perspective on Capricorn Metals' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Capricorn Metals' shares may be trading at a premium.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer servicing both leisure and corporate sectors across various regions globally, with a market capitalization of approximately A$4.37 billion.

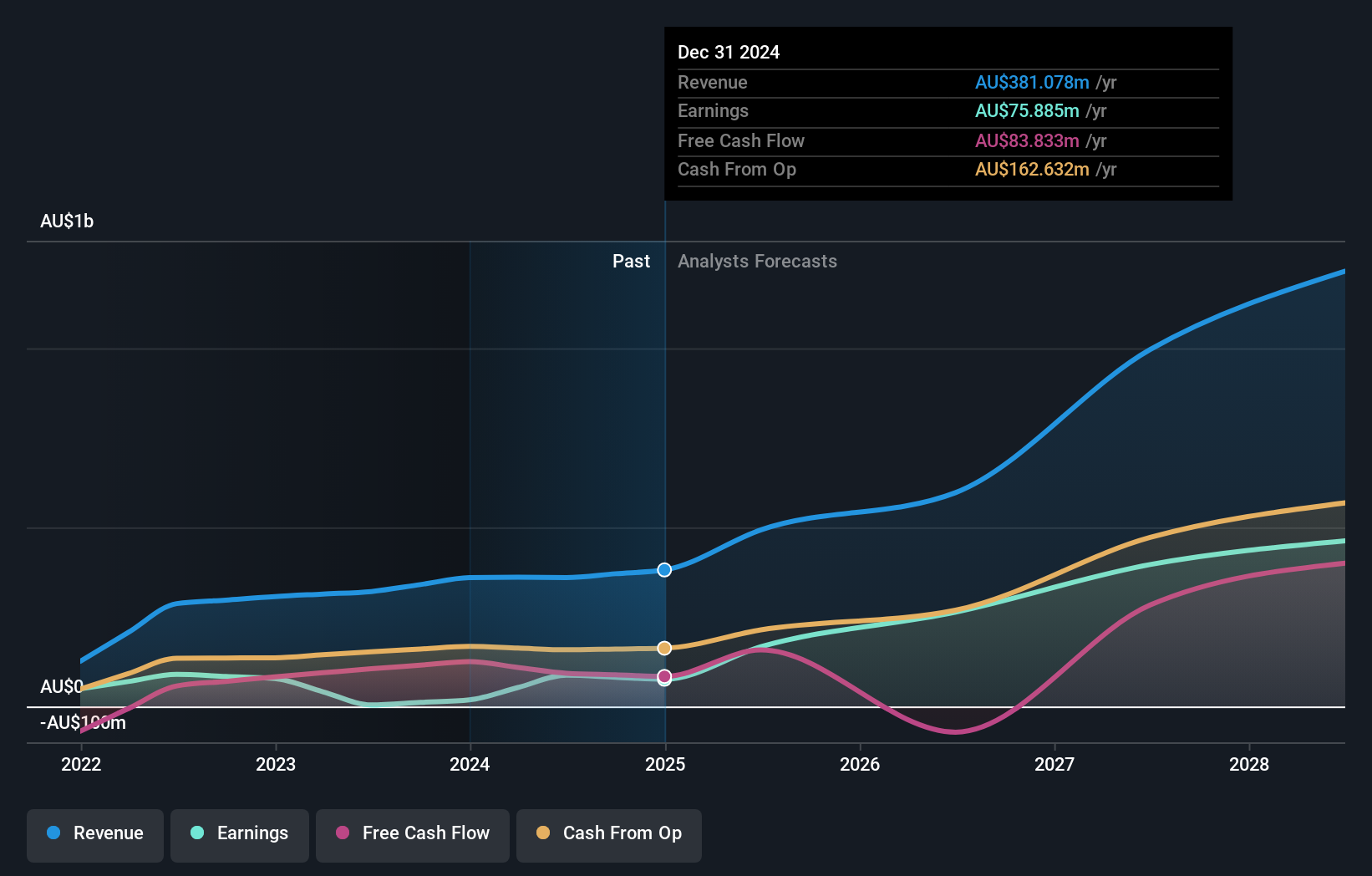

Operations: The company generates revenue primarily through its leisure and corporate travel services, with A$1.28 billion from leisure and A$1.06 billion from corporate segments.

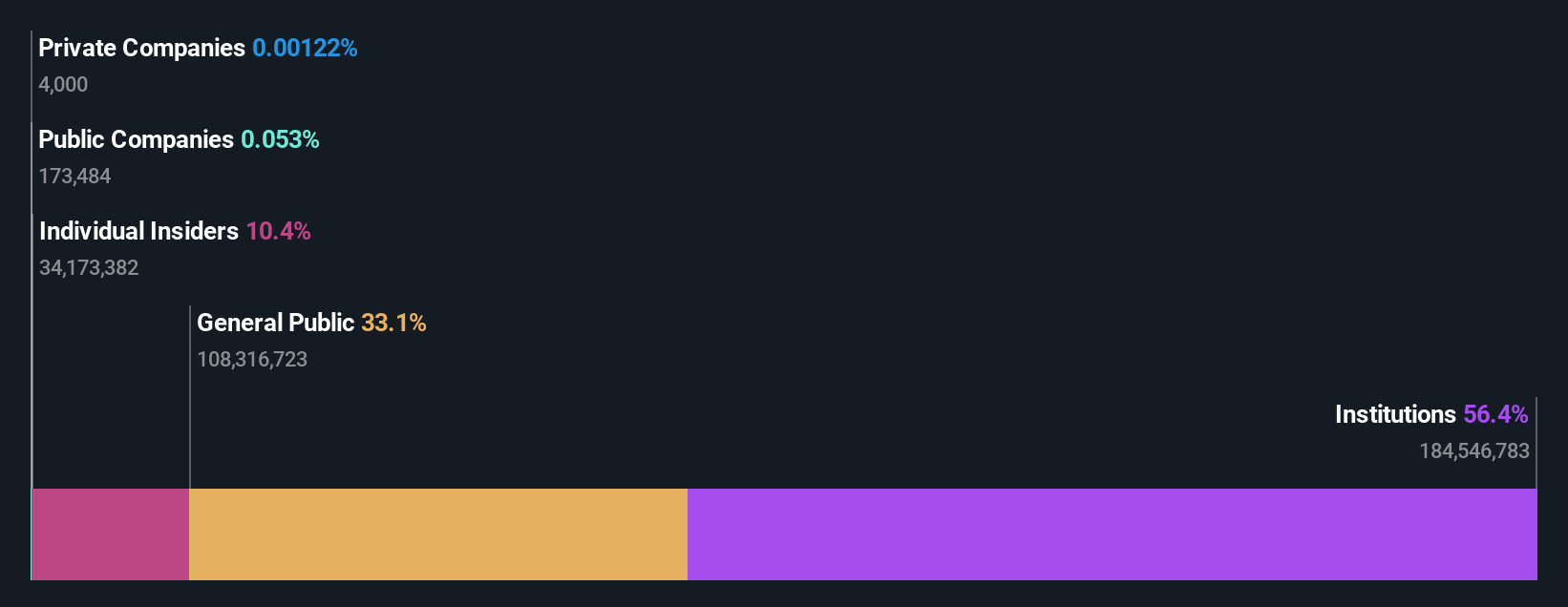

Insider Ownership: 13.3%

Return On Equity Forecast: 22% (2026 estimate)

Flight Centre Travel Group, trading at a significant discount of 20.8% below its estimated fair value, recently turned profitable. The company's revenue growth is forecasted at 9.7% annually, surpassing the Australian market's average of 5.4%. Additionally, FLT's earnings are expected to increase by 18.8% each year, also outperforming the market prediction of 13.7%. However, its annual profit growth isn't projected to exceed the high threshold of 20%, and there has been no substantial insider buying or selling reported in the past three months.

- Navigate through the intricacies of Flight Centre Travel Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Flight Centre Travel Group shares in the market.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally, with a market capitalization of A$5.96 billion.

Operations: The company generates revenue through three primary segments: Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Return On Equity Forecast: 33% (2027 estimate)

Technology One Limited, with a price-to-earnings ratio of 54.4x, sits below the software industry average of 60.6x, indicating potential value. The company's earnings are expected to grow by 14.3% annually, outpacing the Australian market forecast of 13.7%. While its revenue growth at 11.1% yearly exceeds the national market rate of 5.4%, it does not reach the high growth benchmark of over 20%. Additionally, recent financial results show a solid increase in both revenue and net income year-over-year as of March 2024.

- Take a closer look at Technology One's potential here in our earnings growth report.

- According our valuation report, there's an indication that Technology One's share price might be on the expensive side.

Next Steps

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 89 more companies for you to explore.Click here to unveil our expertly curated list of 92 Fast Growing ASX Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives