- Australia

- /

- Metals and Mining

- /

- ASX:CMM

Capricorn Metals (ASX:CMM) Is Up 12.0% After Posting Record Net Income and Revenue Growth

Reviewed by Simply Wall St

- Capricorn Metals Ltd has announced its full-year earnings for the period ended June 30, 2025, reporting A$505.89 million in sales and A$150.28 million in net income, both higher than the previous year.

- In addition to strong revenue growth, the company’s basic earnings per share from continuing operations rose year over year to A$0.3708.

- We’ll explore how this significant increase in annual net income shapes Capricorn Metals’ overall investment narrative going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Capricorn Metals' Investment Narrative?

Capricorn Metals’ sharp upswing in annual revenue and net income reshapes some of the company’s key discussion points for investors. A big-picture belief for any shareholder hinges on Capricorn continuing its blend of disciplined financial management and robust project development, as seen in its early debt repayment, cash reserves, and recent expansion at Karlawinda. The latest earnings release, showing a clear acceleration in profitability, could strengthen near-term catalysts around project expansion and confidence in operational execution, especially given the market’s rapid share price appreciation this year. However, board and executive turnover remain significant watchpoints, particularly with the CEO situation unresolved and a relatively inexperienced management team. While the positive earnings momentum might offset some previous risks, leadership stability and navigating higher valuation multiples are now more prominent in the investment story. But rapid share price gains bring new risks to the forefront that shouldn’t be overlooked.

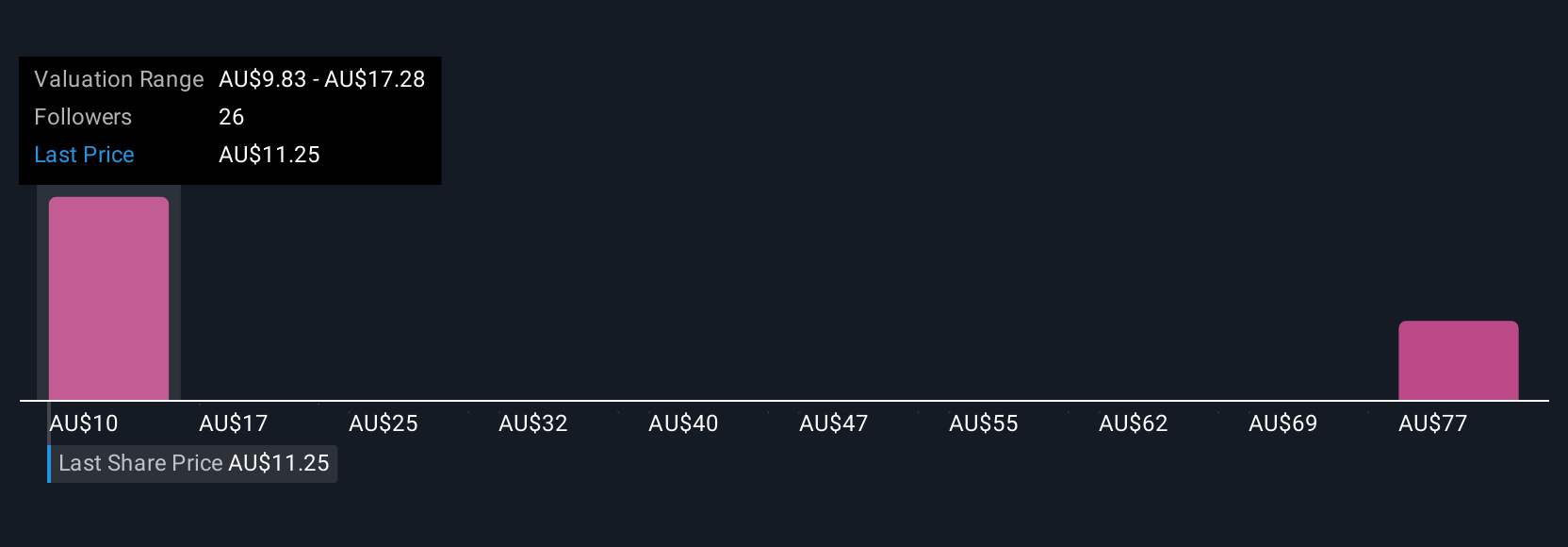

Capricorn Metals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 6 other fair value estimates on Capricorn Metals - why the stock might be worth over 7x more than the current price!

Build Your Own Capricorn Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capricorn Metals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Capricorn Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capricorn Metals' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMM

Capricorn Metals

Explores, develops, evaluates, and produces gold in Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives