- Australia

- /

- Metals and Mining

- /

- ASX:CMM

ASX Stocks That Could Be Undervalued In April 2025

Reviewed by Simply Wall St

In the wake of recent market volatility driven by global tariff tensions, Australian shares are poised for a significant downturn, with ASX 200 futures indicating a sharp decline. Amidst this challenging environment, identifying undervalued stocks requires careful analysis of fundamentals and resilience to external economic pressures.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Acrow (ASX:ACF) | A$1.035 | A$2.04 | 49.3% |

| Nick Scali (ASX:NCK) | A$15.01 | A$28.70 | 47.7% |

| GenusPlus Group (ASX:GNP) | A$2.65 | A$5.20 | 49% |

| Environmental Group (ASX:EGL) | A$0.24 | A$0.47 | 49.4% |

| PolyNovo (ASX:PNV) | A$1.05 | A$2.06 | 49.1% |

| Amaero International (ASX:3DA) | A$0.26 | A$0.46 | 43.6% |

| James Hardie Industries (ASX:JHX) | A$34.84 | A$60.84 | 42.7% |

| SciDev (ASX:SDV) | A$0.43 | A$0.84 | 48.5% |

| Integral Diagnostics (ASX:IDX) | A$2.28 | A$4.07 | 44% |

| Pantoro (ASX:PNR) | A$2.55 | A$4.92 | 48.2% |

Here's a peek at a few of the choices from the screener.

Capricorn Metals (ASX:CMM)

Overview: Capricorn Metals Ltd is involved in the evaluation, exploration, development, and production of gold properties in Australia with a market cap of A$3.50 billion.

Operations: The company's revenue primarily comes from its Karlawinda gold operations, generating A$379.47 million.

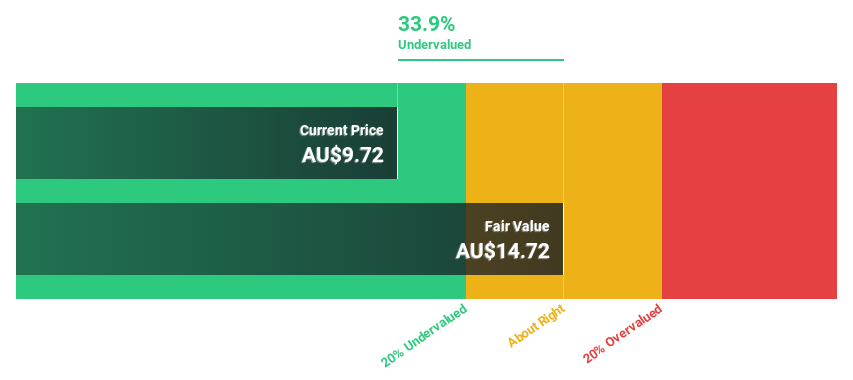

Estimated Discount To Fair Value: 26.6%

Capricorn Metals is trading at A$8.47, below its estimated fair value of A$11.54, suggesting it may be undervalued based on cash flows. Recent earnings results show sales increased to A$201.37 million for the half year ending December 2024, although net income decreased to A$43.11 million compared to the previous year. Despite this, revenue and earnings are forecasted to grow significantly faster than the market, with a high return on equity expected in three years.

- Our expertly prepared growth report on Capricorn Metals implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Capricorn Metals.

Nanosonics (ASX:NAN)

Overview: Nanosonics Limited is a global infection prevention company with a market capitalization of A$1.42 billion.

Operations: The company generates revenue primarily from its Healthcare Equipment segment, which accounts for A$183.97 million.

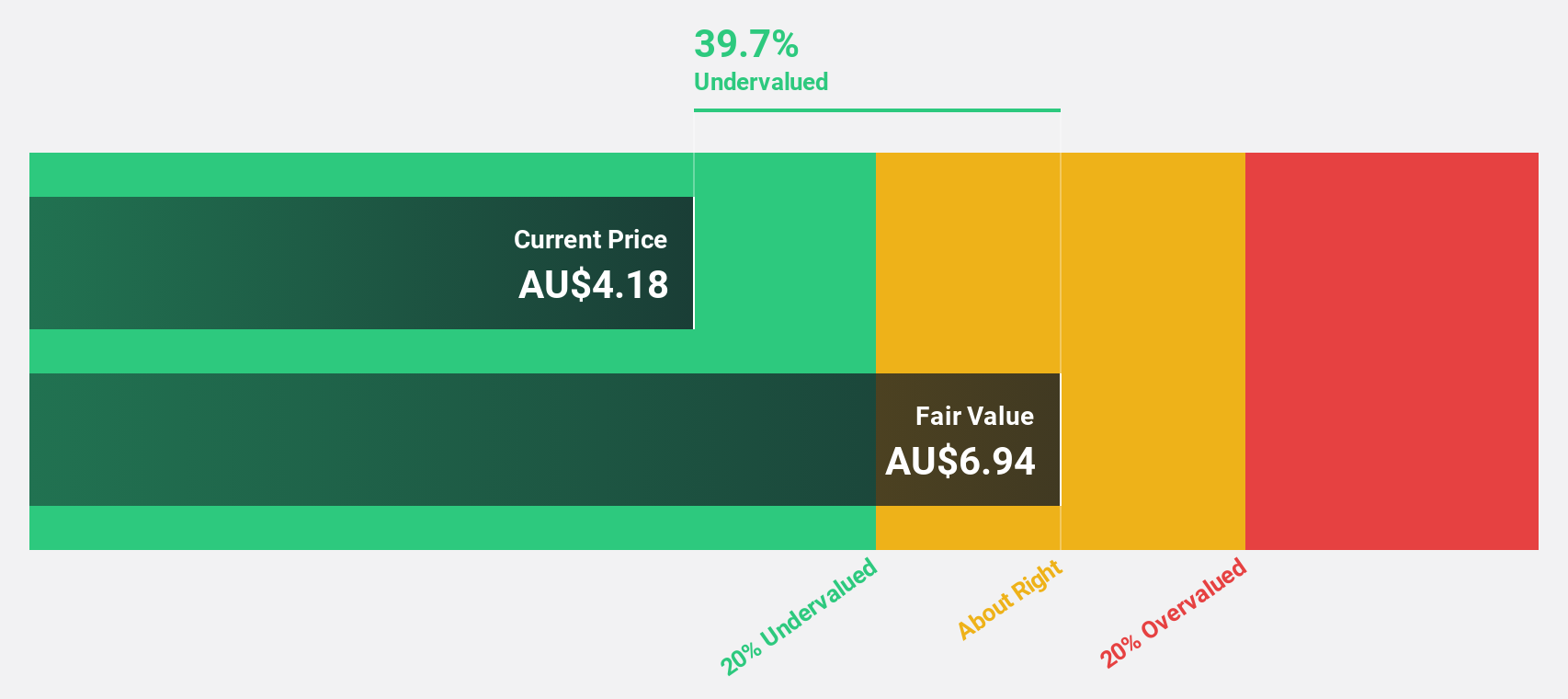

Estimated Discount To Fair Value: 34.3%

Nanosonics is trading at A$4.64, below its estimated fair value of A$7.06, indicating potential undervaluation based on cash flows. Recent earnings show sales increased to A$93.6 million for H1 2025, with net income rising to A$9.76 million year-over-year. Revenue and earnings are forecasted to grow significantly faster than the market, though return on equity remains low in future projections. The company has also revised its revenue growth guidance upwards for early 2025.

- According our earnings growth report, there's an indication that Nanosonics might be ready to expand.

- Click to explore a detailed breakdown of our findings in Nanosonics' balance sheet health report.

Sigma Healthcare (ASX:SIG)

Overview: Sigma Healthcare Limited is a pharmaceutical wholesaler, distributor, and pharmacy franchisor operating in Australia and internationally with a market cap of A$33.36 billion.

Operations: The company generates revenue primarily through its Wholesale and Retail Services Segment, which accounts for A$3.29 billion.

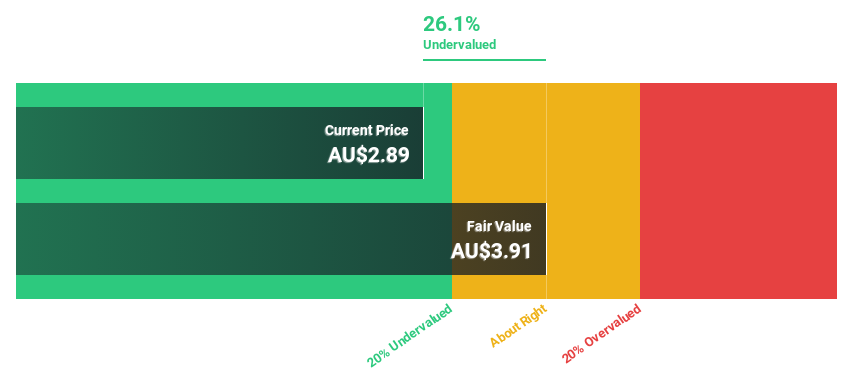

Estimated Discount To Fair Value: 15.1%

Sigma Healthcare, trading at A$2.89, is below its estimated fair value of A$3.4, suggesting it may be undervalued based on cash flows. Revenue is projected to grow 39.2% annually, outpacing the Australian market's 5.8%. Earnings are expected to increase by 15.3% per year but remain below significant growth levels and face substantial insider selling recently. Sigma's inclusion in major indices like S&P/ASX 100 highlights its market relevance despite these challenges.

- Our growth report here indicates Sigma Healthcare may be poised for an improving outlook.

- Navigate through the intricacies of Sigma Healthcare with our comprehensive financial health report here.

Key Takeaways

- Unlock more gems! Our Undervalued ASX Stocks Based On Cash Flows screener has unearthed 38 more companies for you to explore.Click here to unveil our expertly curated list of 41 Undervalued ASX Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Capricorn Metals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMM

Capricorn Metals

Engages in the evaluation, exploration, development, and production of gold properties in Australia.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives