As the Australian market rebounds, with the ASX200 rising by 0.5% and IT leading sector gains, investors are keenly observing opportunities in various segments. Penny stocks, a term that may seem outdated yet remains significant, represent smaller or newer companies that can offer unique investment potential when backed by solid financials. This article will explore several penny stocks that stand out for their financial strength and potential to deliver long-term value amidst current market dynamics.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.49 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.935 | A$315.87M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$248.73M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$105.1M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.19 | A$340.76M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$239.83M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.31 | A$61.65M | ★★★★★☆ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market capitalization of A$468.78 million.

Operations: No revenue segments are reported for this mineral exploration and evaluation company.

Market Cap: A$468.78M

Chalice Mining, with a market cap of A$468.78 million, operates as a pre-revenue entity in the mineral exploration sector. Recent executive changes include the appointment of Dan Brearley as COO to advance its Gonneville Project, highlighting strategic leadership focus. Financially, Chalice is debt-free with sufficient cash runway for over three years if current cash flow trends continue. However, it remains unprofitable with increasing losses over the past five years and no profitability forecast in the near term. Despite this, revenue is expected to grow significantly at 41.35% annually according to analyst estimates.

- Jump into the full analysis health report here for a deeper understanding of Chalice Mining.

- Evaluate Chalice Mining's prospects by accessing our earnings growth report.

Nuix (ASX:NXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across multiple regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of A$1.46 billion.

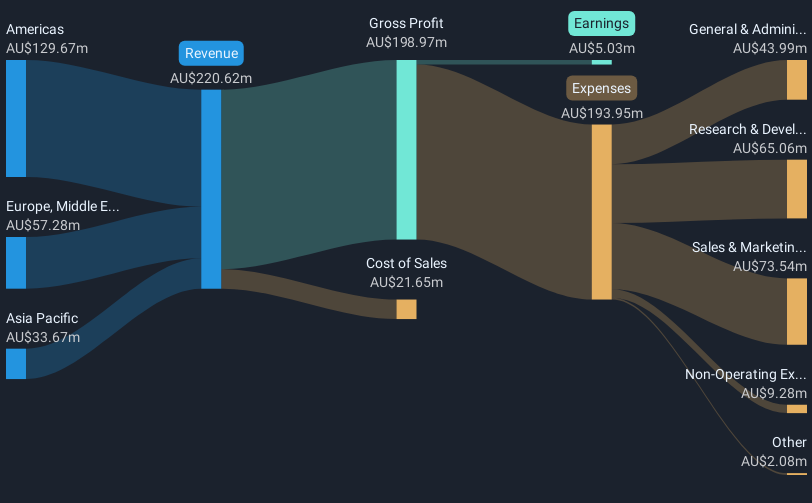

Operations: The company's revenue is primarily derived from its Software & Programming segment, totaling A$220.62 million.

Market Cap: A$1.46B

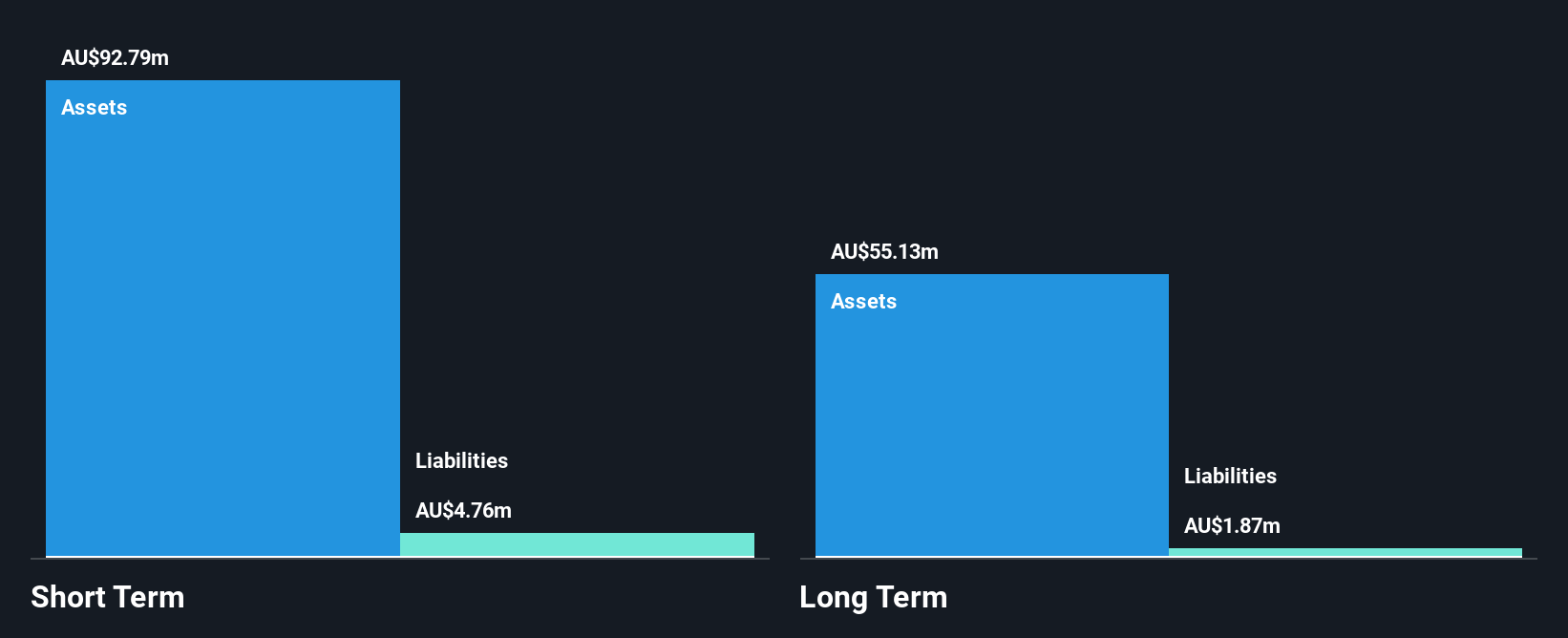

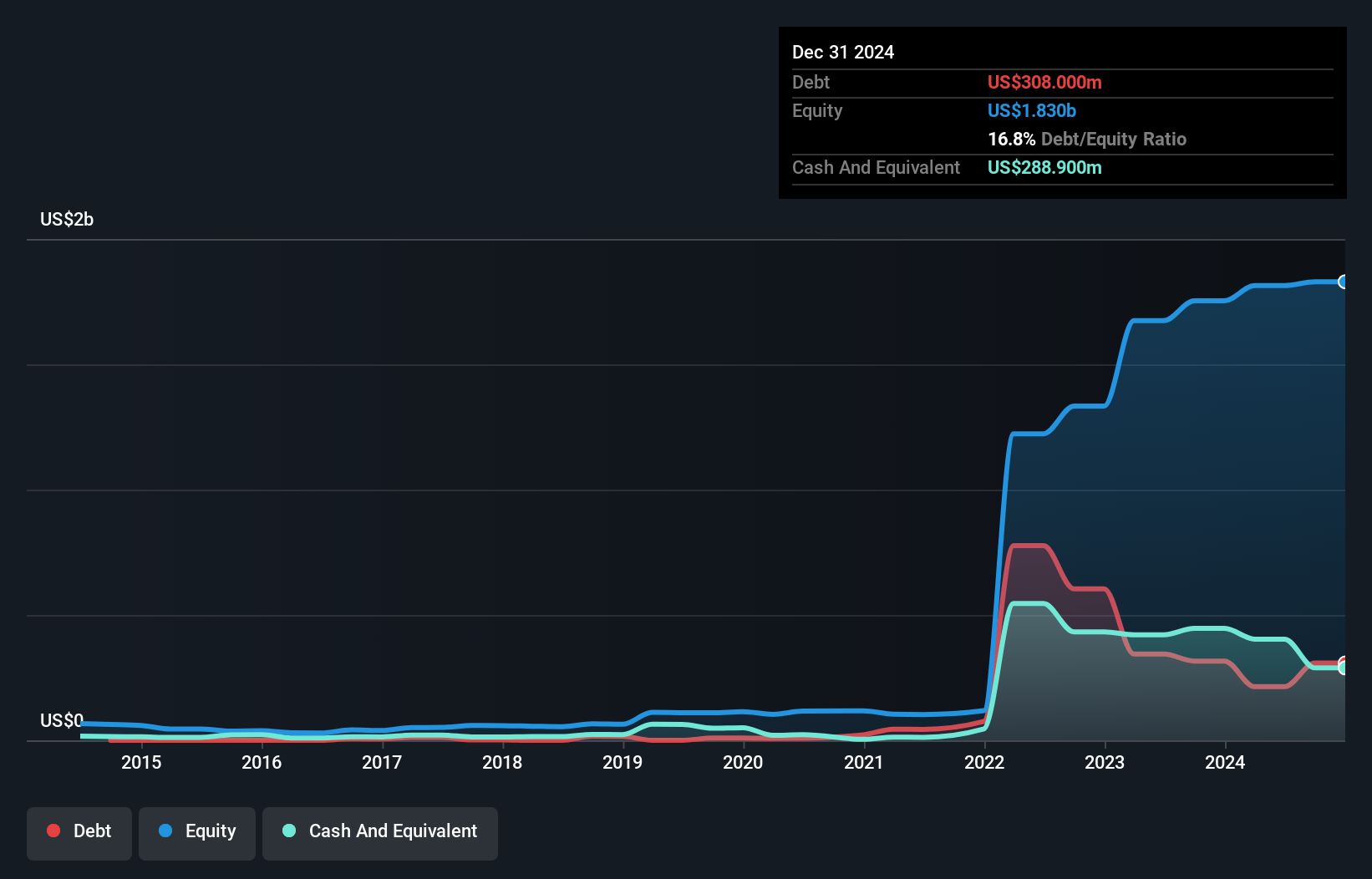

Nuix Limited, with a market cap of A$1.46 billion, has recently provided earnings guidance for the first half of 2024, expecting statutory revenue between A$104 million and A$106 million. The company has transitioned to profitability over the past year despite a significant one-off loss of A$6.4 million impacting recent financial results. Nuix is debt-free and its short-term assets (A$115.4 million) comfortably cover both short-term (A$83.6 million) and long-term liabilities (A$26.8 million). While earnings growth forecasts are robust at 40.28% annually, Return on Equity remains low at 1.8%.

- Unlock comprehensive insights into our analysis of Nuix stock in this financial health report.

- Review our growth performance report to gain insights into Nuix's future.

Stanmore Resources (ASX:SMR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stanmore Resources Limited is an Australian company involved in the exploration, development, production, and sale of metallurgical coal, with a market cap of A$2.42 billion.

Operations: The company generates revenue from its Metals & Mining segment, specifically in coal, amounting to $2.54 billion.

Market Cap: A$2.42B

Stanmore Resources Limited, with a market cap of A$2.42 billion, has shown significant earnings growth over the past five years but faced negative earnings growth last year. The company's Price-To-Earnings ratio of 5.6x suggests it is undervalued compared to the broader Australian market. Despite having more cash than total debt and short-term assets exceeding short-term liabilities, long-term liabilities remain uncovered by current assets. Profit margins have decreased from 25.5% to 10.6%, and future earnings are expected to decline significantly over the next three years, highlighting potential challenges ahead for investors in this sector.

- Click here to discover the nuances of Stanmore Resources with our detailed analytical financial health report.

- Gain insights into Stanmore Resources' outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Explore the 1,031 names from our ASX Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives