- Australia

- /

- Metals and Mining

- /

- ASX:BHP

It's Unlikely That BHP Group Limited's (ASX:BHP) CEO Will See A Huge Pay Rise This Year

Key Insights

- BHP Group will host its Annual General Meeting on 23rd of October

- CEO Mike Henry's total compensation includes salary of US$1.88m

- Total compensation is 146% above industry average

- BHP Group's EPS declined by 24% over the past three years while total shareholder return over the past three years was 29%

The share price of BHP Group Limited (ASX:BHP) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 23rd of October. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

Check out our latest analysis for BHP Group

Comparing BHP Group Limited's CEO Compensation With The Industry

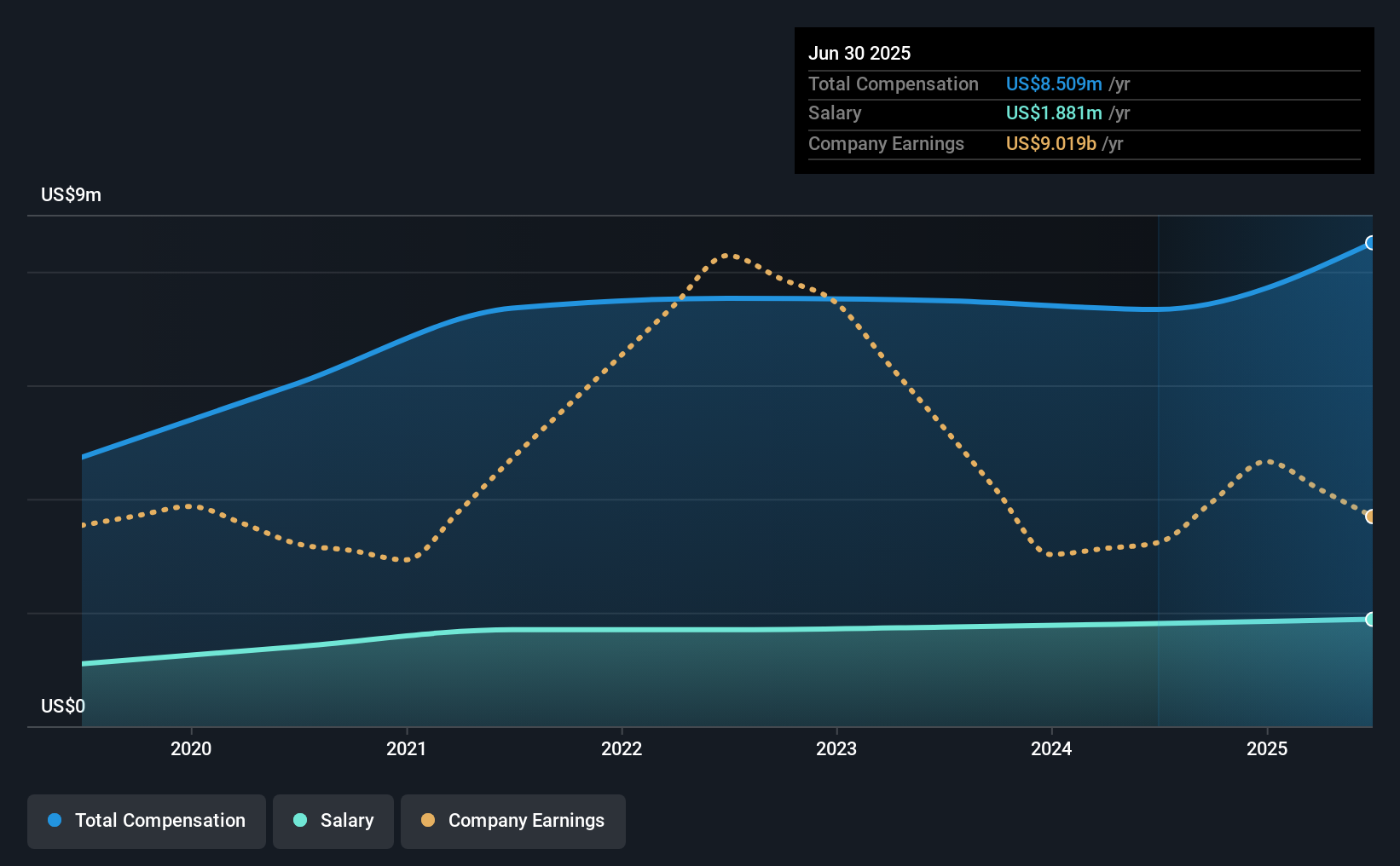

At the time of writing, our data shows that BHP Group Limited has a market capitalization of AU$221b, and reported total annual CEO compensation of US$8.5m for the year to June 2025. Notably, that's an increase of 16% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.9m.

For comparison, other companies in the Australian Metals and Mining industry with market capitalizations above AU$12b, reported a median total CEO compensation of US$3.5m. Accordingly, our analysis reveals that BHP Group Limited pays Mike Henry north of the industry median. Moreover, Mike Henry also holds AU$24m worth of BHP Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | US$1.9m | US$1.8m | 22% |

| Other | US$6.6m | US$5.5m | 78% |

| Total Compensation | US$8.5m | US$7.3m | 100% |

On an industry level, around 67% of total compensation represents salary and 33% is other remuneration. It's interesting to note that BHP Group allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at BHP Group Limited's Growth Numbers

Over the last three years, BHP Group Limited has shrunk its earnings per share by 24% per year. It saw its revenue drop 7.9% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has BHP Group Limited Been A Good Investment?

BHP Group Limited has served shareholders reasonably well, with a total return of 29% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for BHP Group that investors should look into moving forward.

Switching gears from BHP Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if BHP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BHP

BHP Group

Operates as a resources company in Australia, Europe, China, Japan, India, South Korea, rest of Asia, North America, South America, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026