ASX Stocks Estimated To Be Trading Below Value In March 2025

Reviewed by Simply Wall St

The Australian stock market has been navigating a turbulent period, marked by volatility on the ASX and significant external pressures like Trump tariffs, fluctuating iron ore prices, and changes in OPEC's production cuts. In such uncertain times, identifying undervalued stocks can be a strategic approach for investors seeking opportunities amidst broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Regal Partners (ASX:RPL) | A$3.16 | A$5.95 | 46.9% |

| Acrow (ASX:ACF) | A$1.045 | A$2.00 | 47.6% |

| Domino's Pizza Enterprises (ASX:DMP) | A$27.21 | A$51.30 | 47% |

| Audinate Group (ASX:AD8) | A$8.47 | A$16.45 | 48.5% |

| PointsBet Holdings (ASX:PBH) | A$1.10 | A$2.13 | 48.5% |

| SciDev (ASX:SDV) | A$0.43 | A$0.81 | 47% |

| Charter Hall Group (ASX:CHC) | A$17.10 | A$31.99 | 46.5% |

| Electro Optic Systems Holdings (ASX:EOS) | A$1.125 | A$2.25 | 50% |

| Pantoro (ASX:PNR) | A$0.135 | A$0.26 | 48% |

| ReadyTech Holdings (ASX:RDY) | A$2.75 | A$5.15 | 46.6% |

Let's explore several standout options from the results in the screener.

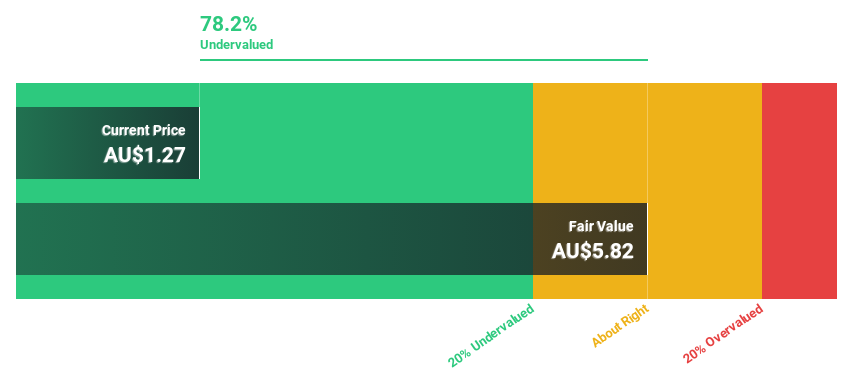

Bellevue Gold (ASX:BGL)

Overview: Bellevue Gold Limited is an Australian company involved in the exploration, development, mining, and processing of gold properties with a market capitalization of A$1.50 billion.

Operations: The company's revenue segment focuses on the exploration and evaluation of minerals and mine development, generating A$471.68 million.

Estimated Discount To Fair Value: 37.7%

Bellevue Gold appears undervalued based on cash flows, trading at A$1.17, which is 37.7% below its fair value estimate of A$1.87. The company reported substantial sales growth to A$222.34 million for the half year ended December 31, 2024, with net income rising to A$12.06 million from last year's A$2.19 million. Despite a forecasted revenue growth rate of 14.7% per year being slower than desired, earnings are expected to grow significantly at over 20% annually.

- In light of our recent growth report, it seems possible that Bellevue Gold's financial performance will exceed current levels.

- Navigate through the intricacies of Bellevue Gold with our comprehensive financial health report here.

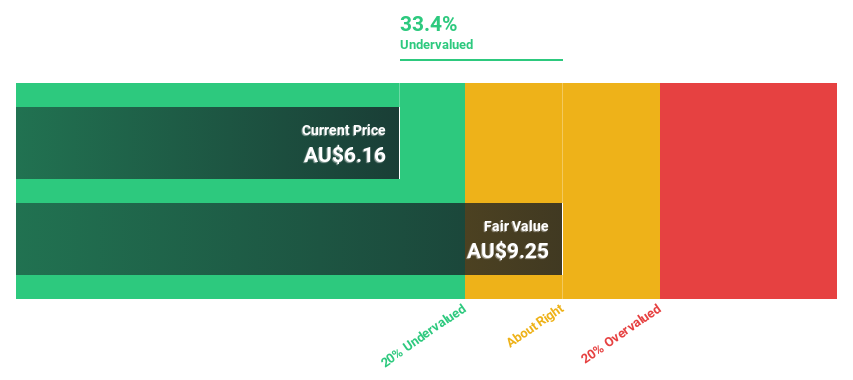

Champion Iron (ASX:CIA)

Overview: Champion Iron Limited is involved in the acquisition, exploration, development, and production of iron ore deposits in Canada with a market cap of A$2.71 billion.

Operations: The company's revenue is primarily generated from its iron ore concentrate segment, which amounts to CA$1.51 billion.

Estimated Discount To Fair Value: 43.7%

Champion Iron is trading at A$5.23, significantly undervalued compared to its fair value estimate of A$9.29. Despite a challenging third quarter with sales dropping to CAD 363.17 million and net income declining sharply, the company benefits from strategic partnerships like the Kamistiatusset Project, potentially enhancing long-term cash flows. Though burdened by high debt and lower profit margins, Champion's earnings are forecast to grow significantly at over 20% annually, supporting its undervaluation thesis based on discounted cash flow analysis.

- Our expertly prepared growth report on Champion Iron implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Champion Iron stock in this financial health report.

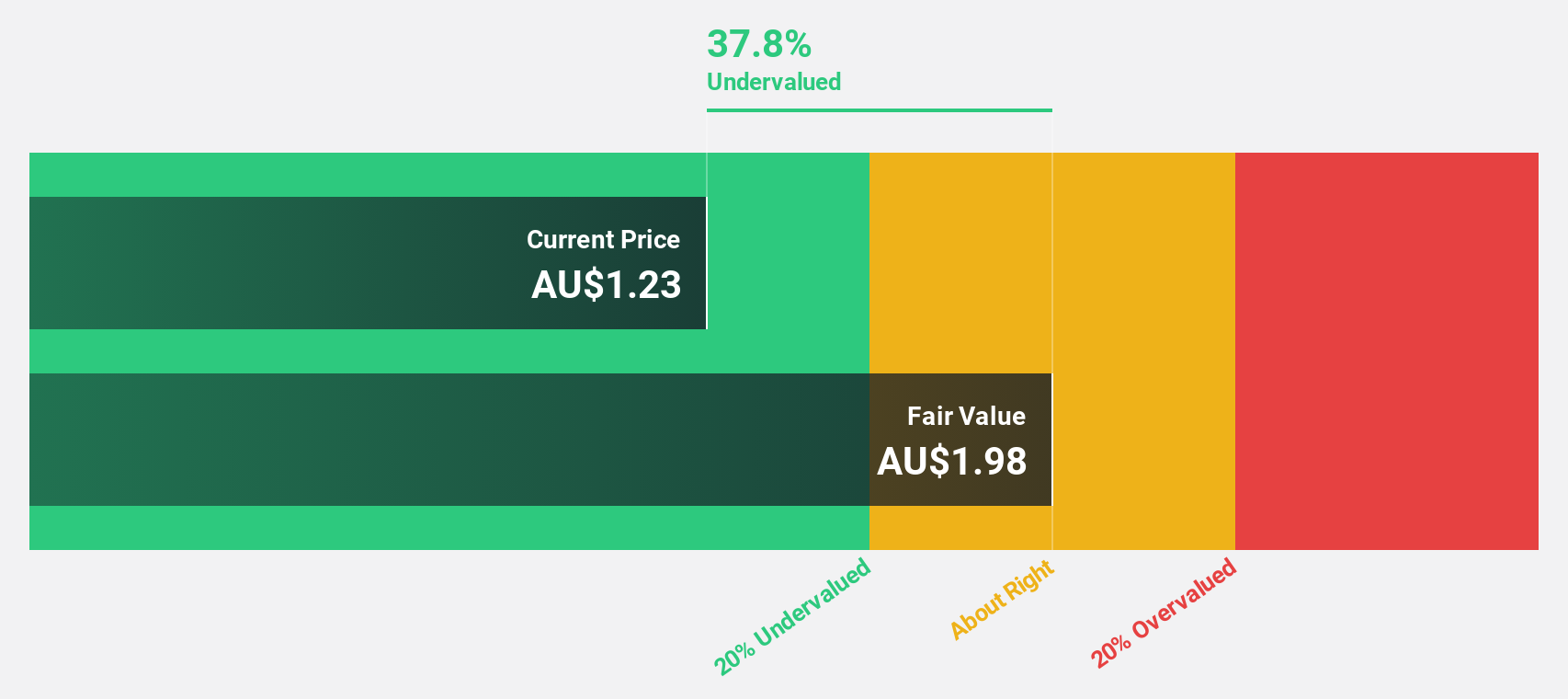

Infomedia (ASX:IFM)

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$500.30 million.

Operations: The company generates revenue from its Publishing - Periodicals segment, amounting to A$142.41 million.

Estimated Discount To Fair Value: 35%

Infomedia is trading at A$1.34, below its estimated fair value of A$2.05, suggesting undervaluation based on discounted cash flow analysis. Recent earnings show strong growth with net income rising to A$8.33 million from A$5.12 million year-on-year, despite large one-off items impacting results. The company forecasts significant annual earnings growth over 20%, supported by a share buyback program that could enhance shareholder value by reducing outstanding shares and potentially increasing future cash flows per share.

- According our earnings growth report, there's an indication that Infomedia might be ready to expand.

- Click to explore a detailed breakdown of our findings in Infomedia's balance sheet health report.

Taking Advantage

- Delve into our full catalog of 44 Undervalued ASX Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Infomedia, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFM

Infomedia

A technology company, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives