- Australia

- /

- Metals and Mining

- /

- ASX:MIN

3 ASX Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

The Australian market has shown mixed performance recently, with the ASX 200 closing slightly up by 0.1% at 8,361 points. While sectors like IT and Materials have led gains, Utilities have notably lagged behind, reflecting varied investor sentiment across different areas of the economy. In such a diverse landscape, growth stocks with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the company in its potential for future success.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Brightstar Resources (ASX:BTR) | 11.6% | 98.8% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.4% | 108.2% |

| Echo IQ (ASX:EIQ) | 19.8% | 65.9% |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Image Resources (ASX:IMA) | 20.6% | 79.9% |

| BETR Entertainment (ASX:BBT) | 32% | 121.8% |

Here we highlight a subset of our preferred stocks from the screener.

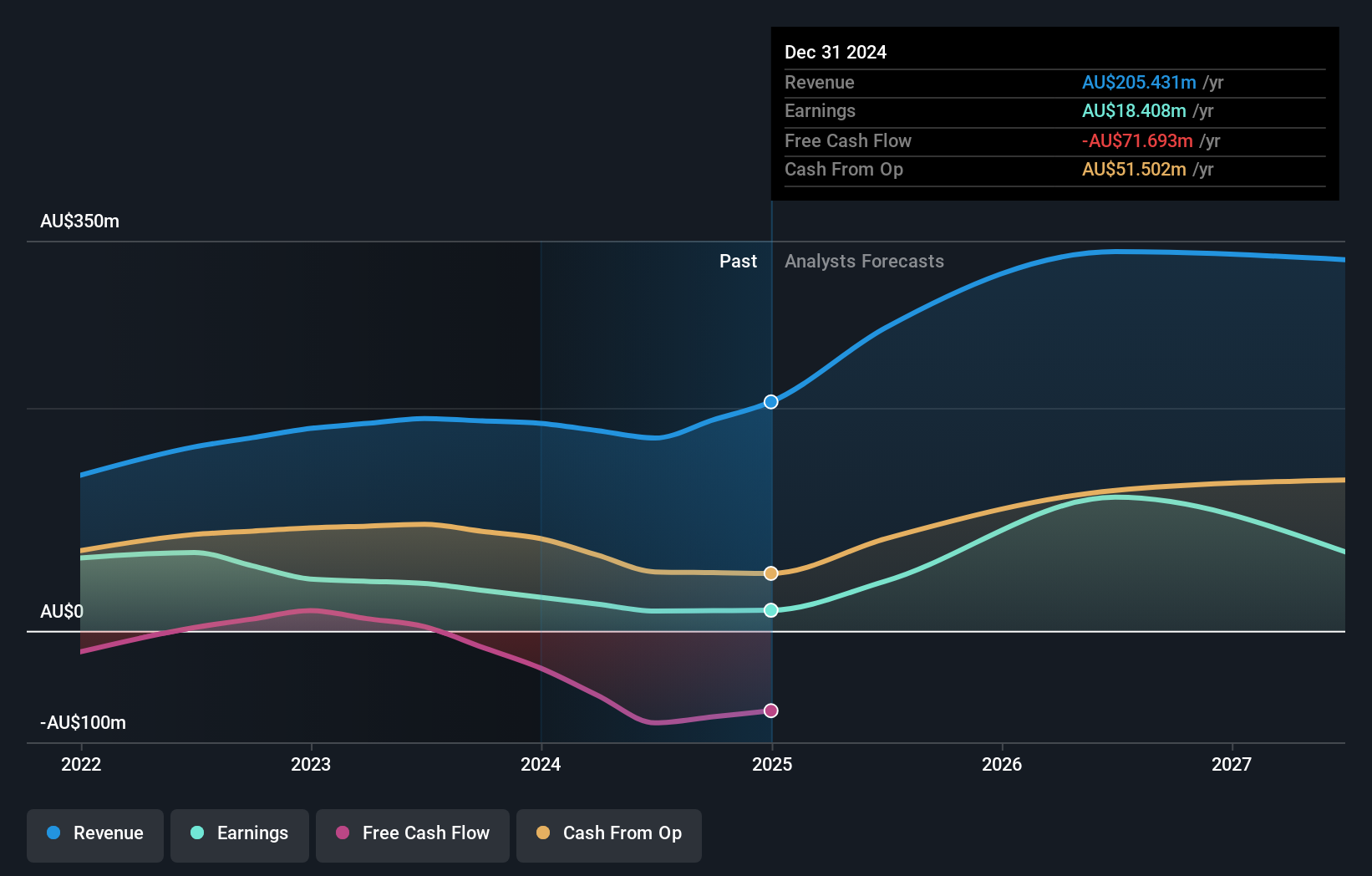

Alkane Resources (ASX:ALK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alkane Resources Ltd is an Australian company focused on gold exploration and production, with a market capitalization of A$457.18 million.

Operations: The company's revenue primarily comes from its gold operations, generating A$206.19 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 48.9% p.a.

Alkane Resources is experiencing strong growth prospects, with revenue expected to increase by 20.3% annually, outpacing the Australian market's 5.6%. Earnings are also forecast to grow significantly at 48.9% per year. Despite a decrease in profit margins from last year, Alkane maintains high-quality earnings and substantial insider ownership. Recent exploration results at Tomingley Gold Operations demonstrate comprehensive reporting and potential resource expansion, underscoring Alkane's commitment to long-term growth in the mining sector.

- Click to explore a detailed breakdown of our findings in Alkane Resources' earnings growth report.

- Our comprehensive valuation report raises the possibility that Alkane Resources is priced higher than what may be justified by its financials.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Flight Centre Travel Group Limited offers travel retailing services for both leisure and corporate clients across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally with a market cap of A$2.90 billion.

Operations: The company's revenue segments consist of A$1.38 billion from leisure travel services and A$1.13 billion from corporate travel services.

Insider Ownership: 13.7%

Earnings Growth Forecast: 23.6% p.a.

Flight Centre Travel Group shows promising growth potential, with earnings expected to rise significantly at 23.6% annually, surpassing the Australian market's average. While revenue growth is moderate at 6.3%, it still exceeds market expectations. Insider confidence is evident through substantial recent share purchases, and a new A$200 million buyback program further supports shareholder value. However, profit margins have declined from last year, and dividends remain inadequately covered by free cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Flight Centre Travel Group.

- Upon reviewing our latest valuation report, Flight Centre Travel Group's share price might be too pessimistic.

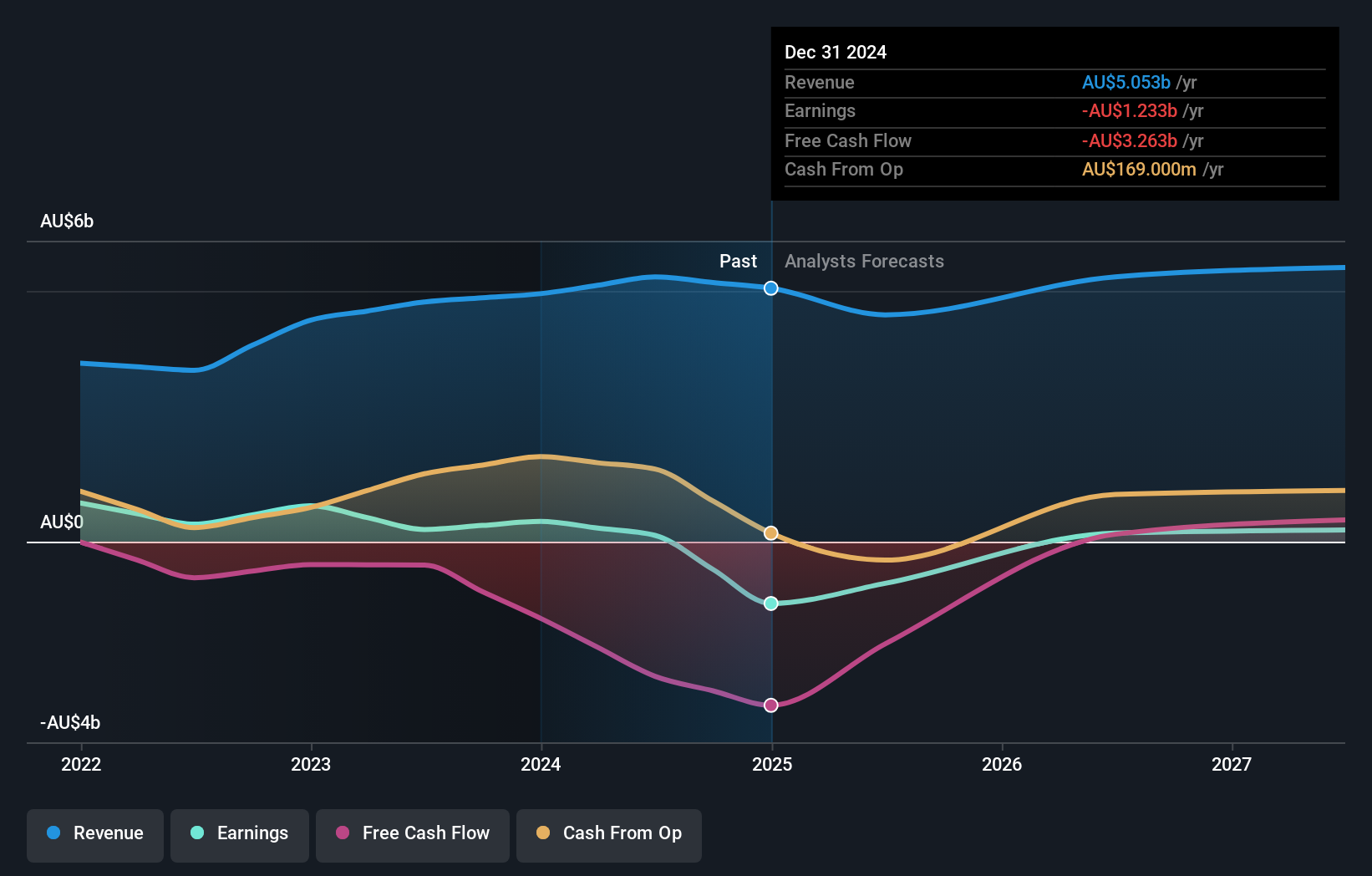

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited operates as a mining services company across Australia, Asia, and internationally with a market cap of A$4.71 billion.

Operations: The company's revenue segments include A$16 million from Energy, A$1.05 billion from Lithium, A$2.36 billion from Iron Ore, and A$3.64 billion from Mining Services, with an additional contribution of A$28 million from Other Commodities.

Insider Ownership: 11.7%

Earnings Growth Forecast: 71.9% p.a.

Mineral Resources is positioned for growth, with earnings projected to increase significantly at 71.92% annually, although revenue growth of 6.8% lags behind high-growth benchmarks but outpaces the Australian market average. Insider activity shows more buying than selling recently, albeit not in substantial volumes. The company trades below its estimated fair value and relative to peers, despite recent challenges such as index removals and strategic asset sales discussions involving its A$1 billion Bald Hill lithium mine.

- Click here to discover the nuances of Mineral Resources with our detailed analytical future growth report.

- Our expertly prepared valuation report Mineral Resources implies its share price may be lower than expected.

Taking Advantage

- Reveal the 98 hidden gems among our Fast Growing ASX Companies With High Insider Ownership screener with a single click here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, operates as a mining services company in Australia, Asia, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives