In a week marked by significant volatility on the Australian market, with the ASX 200 futures pointing to a downbeat close amid escalating China-U.S. trade tensions, investors are keenly observing how these developments might impact their portfolios. Amidst such turbulence, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate uncertain economic conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| IPH (ASX:IPH) | 7.78% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.30% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.12% | ★★★★★☆ |

| GR Engineering Services (ASX:GNG) | 6.91% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 9.14% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.60% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.80% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.63% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.51% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 5.16% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

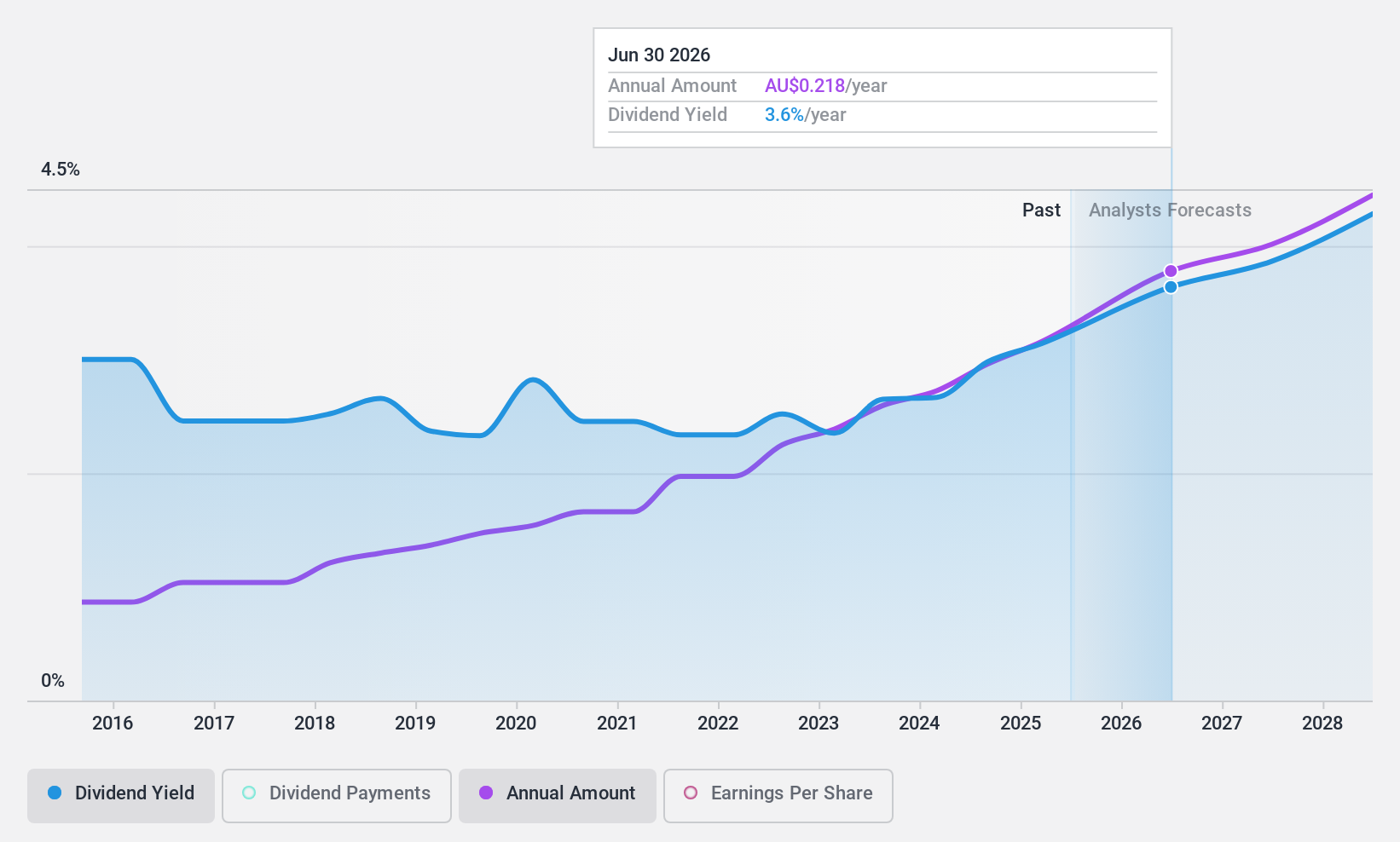

Amotiv (ASX:AOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amotiv Limited, with a market cap of A$1.01 billion, operates through its subsidiaries to manufacture, import, distribute, and sell automotive products across Australia, New Zealand, Thailand, South Korea, France, and the United States.

Operations: Amotiv Limited's revenue segments include Powertrain & Undercar at A$322.90 million, Lighting Power & Electrical at A$329.97 million, and 4WD Accessories & Trailering at A$345.41 million.

Dividend Yield: 5.5%

Amotiv Limited's dividend, recently set at A$0.185 per share, is well-covered by both earnings and cash flows with payout ratios of 70.1% and 45.1%, respectively. Despite a lower yield of 5.46% compared to top Australian dividend payers, its dividends are sustainable though historically volatile. Recent leadership changes aim to enhance governance and risk management, potentially stabilizing future payouts amidst current trading below fair value estimates by 45%.

- Click here to discover the nuances of Amotiv with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Amotiv shares in the market.

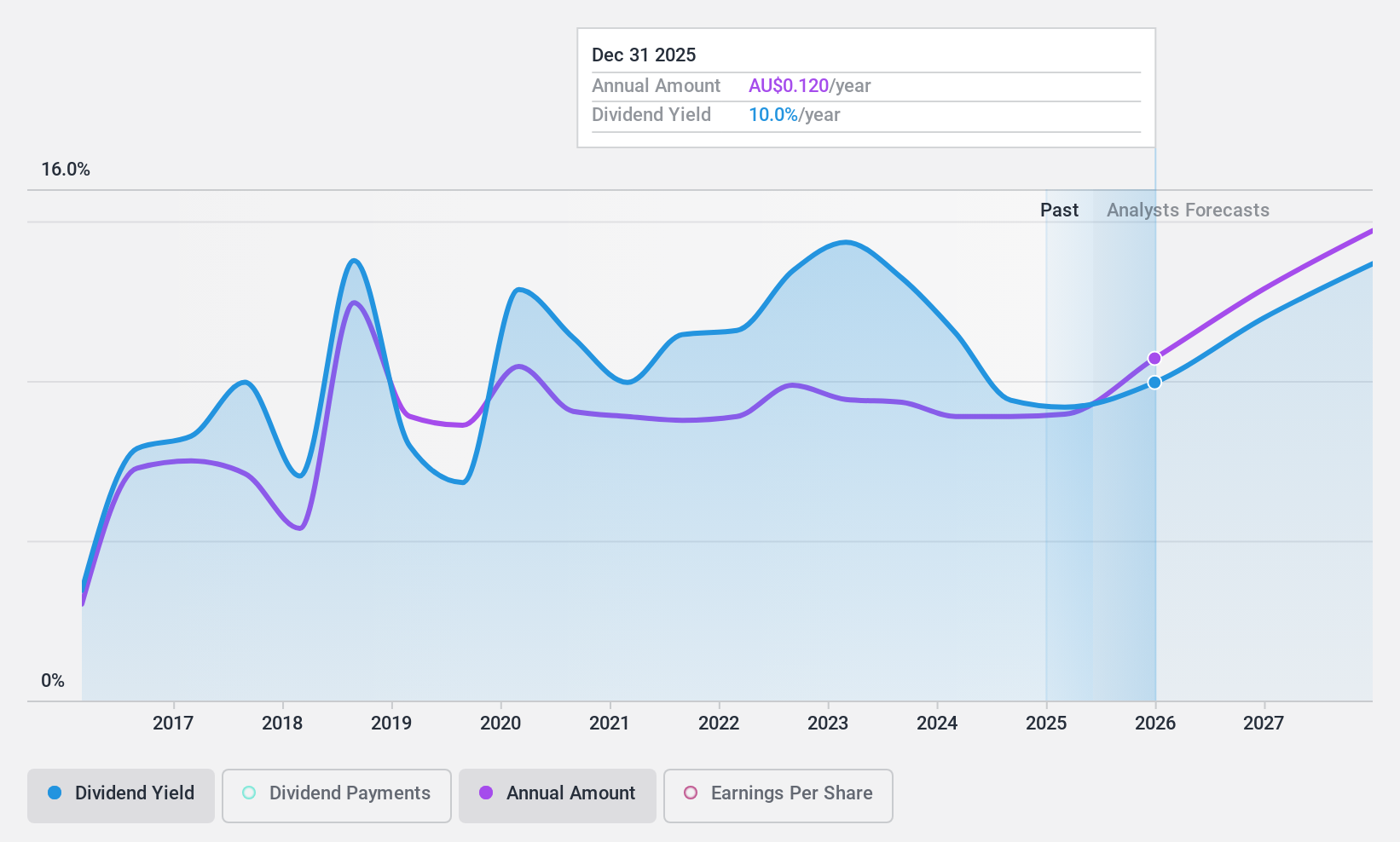

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kina Securities Limited operates in Papua New Guinea offering commercial banking, financial services, fund administration, investment management, and share brokerage with a market cap of A$306.67 million.

Operations: Kina Securities Limited generates revenue primarily from its Banking & Finance segment, which accounts for PGK 421.46 million, and its Wealth Management segment, contributing PGK 47.36 million.

Dividend Yield: 9.5%

Kina Securities offers a dividend yield in the top 25% of Australian payers at 9.47%, supported by a payout ratio of 74.8%. However, its dividend history is volatile over nine years, with payments sometimes unstable. Recent leadership stabilization could positively impact future performance. The company trades below estimated fair value and maintains a high level of bad loans at 11.1%, which may affect financial health despite earnings coverage for dividends now and in three years (68.4% forecast).

- Get an in-depth perspective on Kina Securities' performance by reading our dividend report here.

- Our valuation report here indicates Kina Securities may be undervalued.

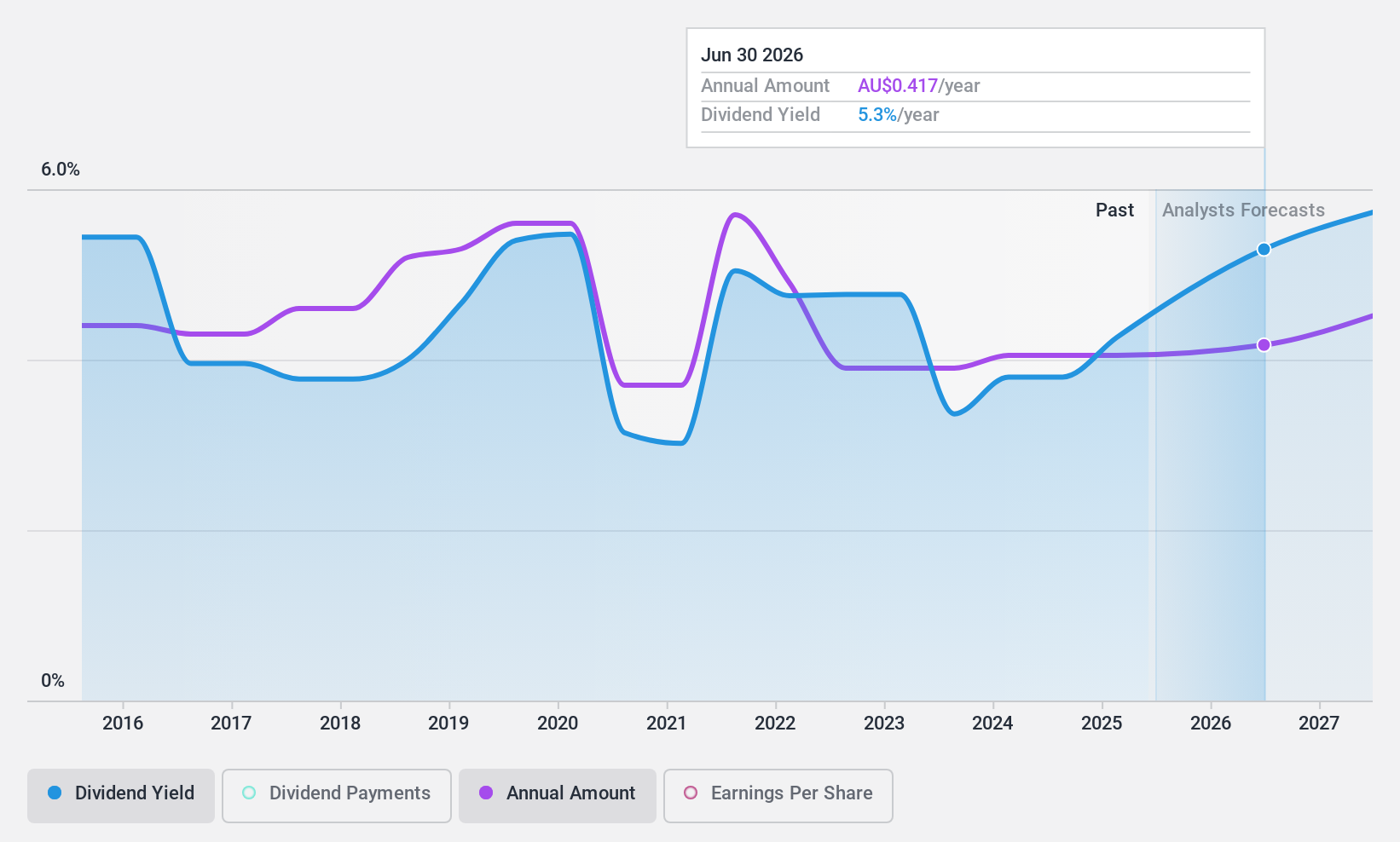

Steadfast Group (ASX:SDF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Steadfast Group Limited operates as a general insurance brokerage service provider across Australasia, Asia, and Europe with a market cap of A$6.28 billion.

Operations: Steadfast Group Limited generates revenue primarily through its Insurance Intermediary segment, which accounts for A$1.63 billion, and its Premium Funding segment, contributing A$120.20 million.

Dividend Yield: 3%

Steadfast Group declared a fully franked interim dividend of A$0.078 per share for the half year ended December 2024, with dividends well-covered by cash flows (40.6% payout ratio) but less so by earnings (85.8% payout ratio). Despite a history of volatile and unreliable dividend payments, recent increases suggest improvement. The company has experienced leadership changes with Noelene Palmer as COO from July 2025, potentially influencing future stability amidst high debt levels and trading below fair value estimates.

- Dive into the specifics of Steadfast Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Steadfast Group is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Unlock our comprehensive list of 31 Top ASX Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDF

Steadfast Group

Provides general insurance brokerage services Australasia, Asia, and Europe.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives