Here's Why We Think Insurance Australia Group (ASX:IAG) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Insurance Australia Group (ASX:IAG), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Insurance Australia Group Growing Its Earnings Per Share?

Over the last three years, Insurance Australia Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Insurance Australia Group's EPS grew from AU$0.30 to AU$0.54, over the previous 12 months. Year on year growth of 76% is certainly a sight to behold.

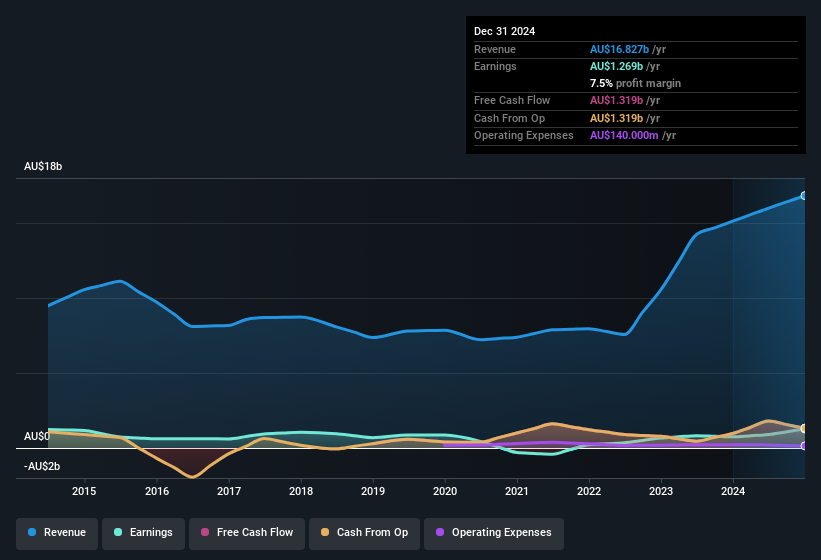

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Insurance Australia Group shareholders can take confidence from the fact that EBIT margins are up from 9.6% to 14%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

View our latest analysis for Insurance Australia Group

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Insurance Australia Group?

Are Insurance Australia Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Insurance Australia Group shares, in the last year. Add in the fact that George Sartorel, the Independent Non-Executive Director of the company, paid AU$38k for shares at around AU$7.69 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Recent insider purchases of Insurance Australia Group stock is not the only way management has kept the interests of the general public shareholders in mind. Specifically, the CEO is paid quite reasonably for a company of this size. The median total compensation for CEOs of companies similar in size to Insurance Australia Group, with market caps over AU$12b, is around AU$6.5m.

The Insurance Australia Group CEO received AU$5.2m in compensation for the year ending June 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Insurance Australia Group Worth Keeping An Eye On?

Insurance Australia Group's earnings per share have been soaring, with growth rates sky high. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Insurance Australia Group may be at an inflection point. If so, then its potential for further gains probably merit a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Insurance Australia Group (1 is potentially serious!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Insurance Australia Group, you'll probably love this curated collection of companies in AU that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IAG

Insurance Australia Group

Insurance Australia Group Limited underwrites general insurance products and provides investment management services in Australia and New Zealand.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives