The Australian market has experienced mixed performance, with the ASX200 down 0.3% at 7,988 points in early afternoon trade while sectors such as Materials and Real Estate show positive movement. In this fluctuating environment, identifying growth companies with high insider ownership can be crucial for investors seeking stability and potential upside, as these stocks often reflect strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 61.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Acrux (ASX:ACR) | 14.6% | 91.6% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.5% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Underneath we present a selection of stocks filtered out by our screen.

Alpha HPA (ASX:A4N)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alpha HPA Limited is a specialty metals and technology company with a market cap of A$1.02 billion.

Operations: Alpha HPA's revenue primarily comes from its HPA First Project, generating A$0.04 million.

Insider Ownership: 17.3%

Earnings Growth Forecast: 44.7% p.a.

Alpha HPA, with significant insider ownership, is forecast to achieve high revenue growth at 96.8% per year and become profitable within three years. Despite recent shareholder dilution and a net loss of A$24.98 million for the fiscal year ending June 2024, the company’s earnings are expected to grow by 44.72% annually. Recent activities include presenting at the AusIMM Critical Minerals Conference and completing a follow-on equity offering of A$5.32 million in June 2024.

- Dive into the specifics of Alpha HPA here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Alpha HPA is trading beyond its estimated value.

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

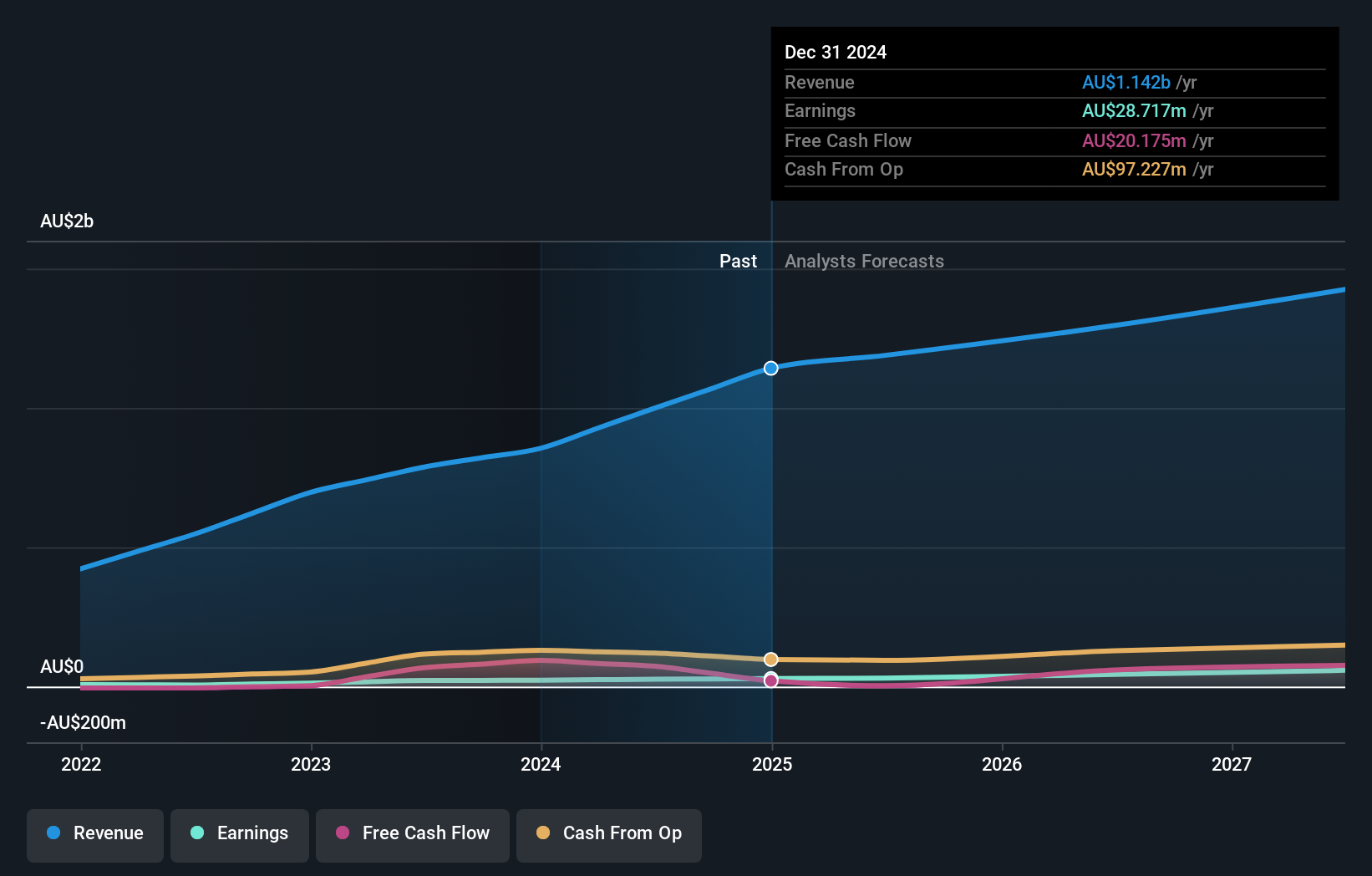

Overview: Aussie Broadband Limited, with a market cap of A$1.14 billion, provides telecommunications and technology services in Australia.

Operations: Aussie Broadband Limited generates revenue through its Business (A$96.97 million), Wholesale (A$159.73 million), Residential (A$585.07 million), Symbio Group (A$69.93 million), and Enterprise and Government (A$88.04 million) segments in Australia.

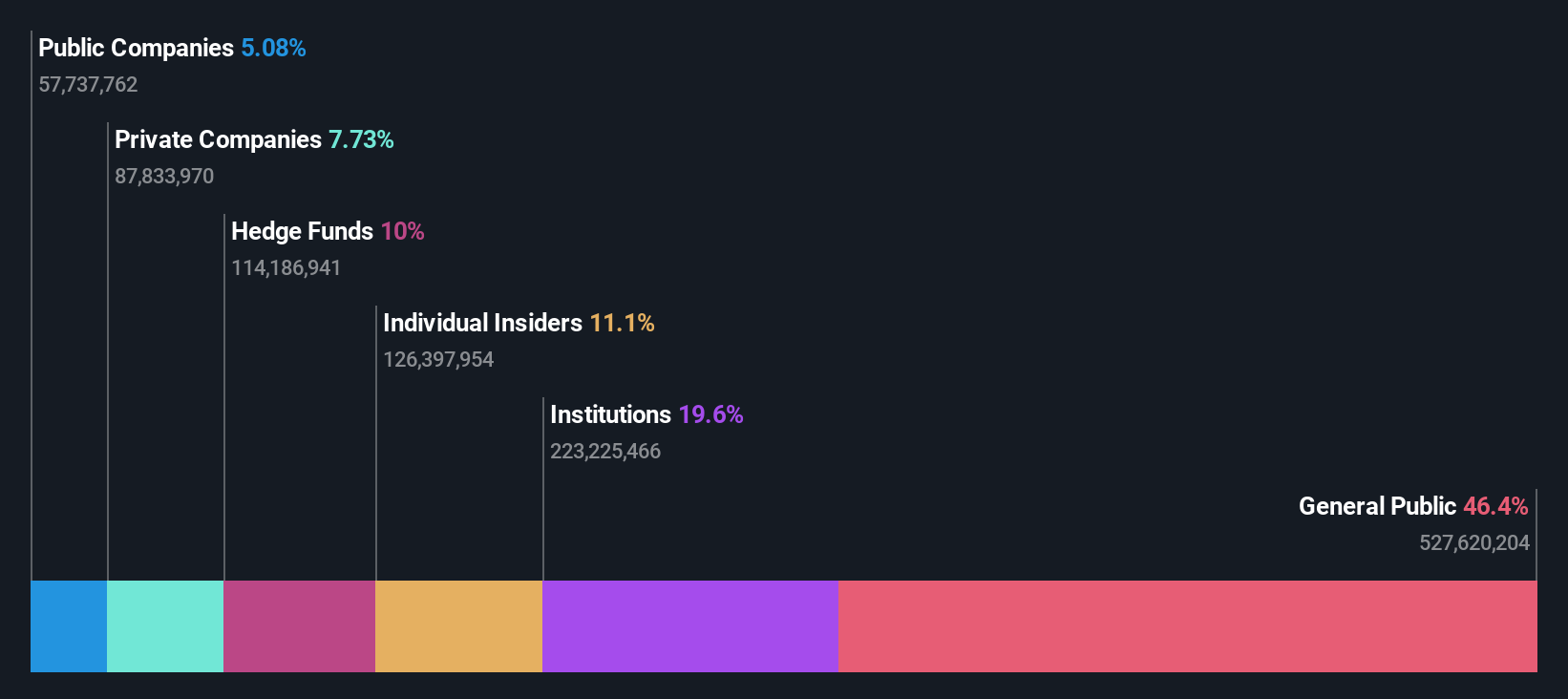

Insider Ownership: 10.8%

Earnings Growth Forecast: 27.3% p.a.

Aussie Broadband, with substantial insider ownership, is forecast to grow its revenue by 9.6% annually and earnings by 27.3% per year, outpacing the Australian market. Despite past shareholder dilution and low future return on equity (10.8%), it trades at a significant discount to estimated fair value. Recent developments include appointing Andy Giles Knopp as Group CFO and announcing a fully franked dividend of A$0.04 per share for fiscal year 2024, with net income rising to A$26.38 million from A$21.72 million last year.

- Unlock comprehensive insights into our analysis of Aussie Broadband stock in this growth report.

- Our comprehensive valuation report raises the possibility that Aussie Broadband is priced higher than what may be justified by its financials.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is a global infection prevention company with a market cap of A$1.11 billion.

Operations: The company's revenue primarily comes from its Healthcare Equipment segment, generating A$170.01 million.

Insider Ownership: 15.1%

Earnings Growth Forecast: 23.2% p.a.

Nanosonics, a growth company with high insider ownership, reported A$170.01 million in sales for the fiscal year ending June 30, 2024, up from A$165.99 million last year. Despite a decline in net income to A$12.97 million from A$19.88 million, earnings are forecast to grow significantly at 23.2% annually over the next three years. Trading at 28.3% below estimated fair value and with revenue growth expected to outpace the Australian market, Nanosonics remains promising despite lower profit margins and return on equity forecasts (11.2%).

- Delve into the full analysis future growth report here for a deeper understanding of Nanosonics.

- Our valuation report unveils the possibility Nanosonics' shares may be trading at a premium.

Taking Advantage

- Gain an insight into the universe of 97 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ABB

Aussie Broadband

Provides telecommunications and technology services in Australia.

Excellent balance sheet with reasonable growth potential.