ASX May 2025 Stocks Perceived To Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

The Australian market has seen a mix of optimism and caution recently, influenced by ongoing trade talks between the US and China, as well as geopolitical developments in Asia. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities, especially when these companies are perceived to be trading below their estimated fair value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$0.945 | A$1.78 | 47.1% |

| Elders (ASX:ELD) | A$6.52 | A$11.59 | 43.7% |

| Austal (ASX:ASB) | A$5.16 | A$9.39 | 45% |

| Charter Hall Group (ASX:CHC) | A$18.03 | A$34.25 | 47.4% |

| Nuix (ASX:NXL) | A$2.25 | A$4.11 | 45.2% |

| SciDev (ASX:SDV) | A$0.38 | A$0.68 | 44.4% |

| Regis Healthcare (ASX:REG) | A$7.44 | A$14.13 | 47.4% |

| Polymetals Resources (ASX:POL) | A$0.85 | A$1.53 | 44.5% |

| PointsBet Holdings (ASX:PBH) | A$1.09 | A$2.10 | 48.2% |

| Superloop (ASX:SLC) | A$2.52 | A$4.47 | 43.7% |

Let's explore several standout options from the results in the screener.

Life360 (ASX:360)

Overview: Life360, Inc. operates a technology platform for locating people, pets, and things across North America, Europe, the Middle East, Africa, and internationally with a market cap of A$5.47 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating $371.48 million.

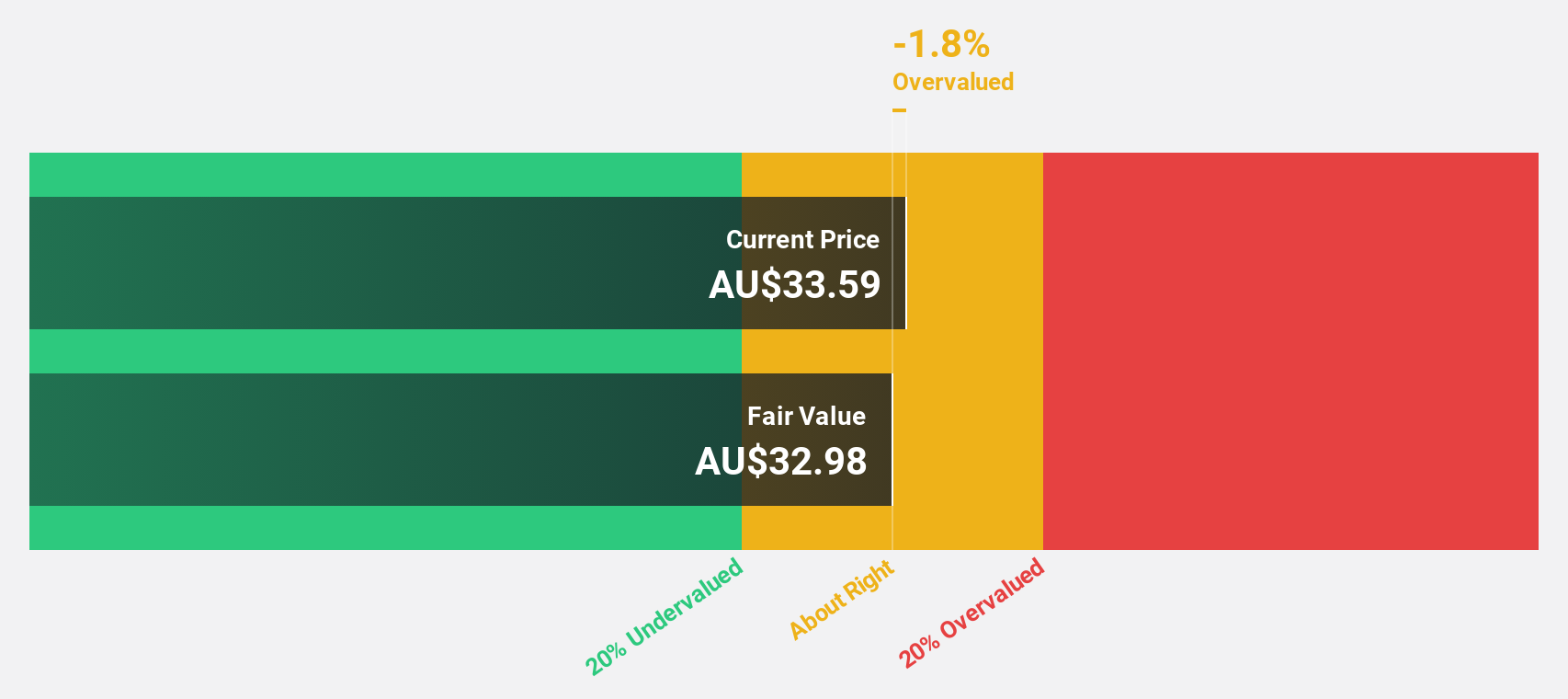

Estimated Discount To Fair Value: 38.8%

Life360, trading at A$23.85, is considered undervalued based on its discounted cash flow analysis with a fair value estimate of A$38.99. The company is expected to achieve profitability within three years, with forecasted earnings growth of 43.72% annually and revenue growth outpacing the Australian market at 15.9% per year. Despite recent insider selling and being dropped from an index, Life360's addition to the S&P/ASX 100 Index underscores its growing prominence in the market landscape.

- Our comprehensive growth report raises the possibility that Life360 is poised for substantial financial growth.

- Navigate through the intricacies of Life360 with our comprehensive financial health report here.

Elders (ASX:ELD)

Overview: Elders Limited is an Australian company that supplies agricultural products and services to rural and regional customers, with a market cap of A$1.24 billion.

Operations: The company's revenue segments include A$2.63 billion from the Branch Network, A$360.81 million from Wholesale Products, and A$138.22 million from Feed and Processing Services.

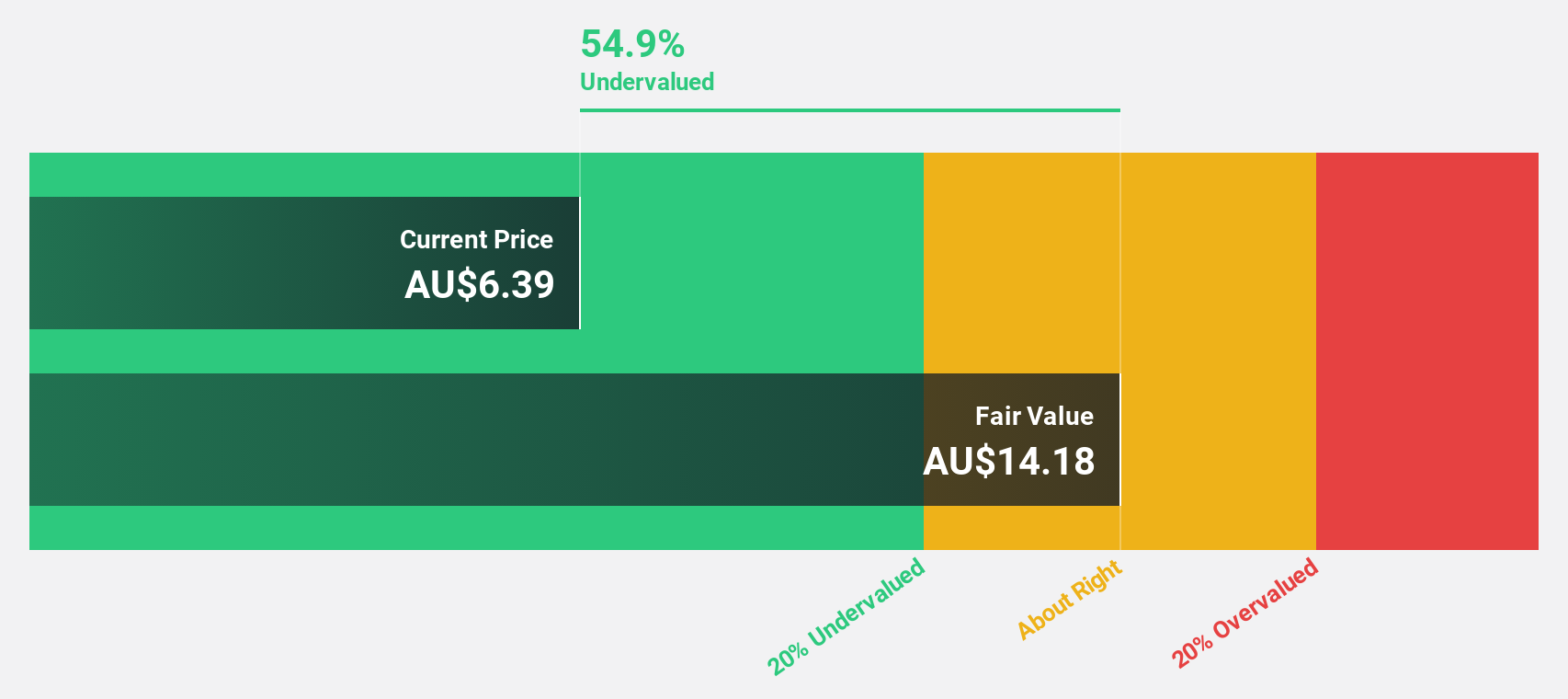

Estimated Discount To Fair Value: 43.7%

Elders, trading at A$6.52, is significantly undervalued with a fair value estimate of A$11.59 based on discounted cash flow analysis. Despite recent shareholder dilution and unsustainable dividends, the stock's earnings are forecast to grow at 26.1% annually, surpassing the Australian market's growth rate of 11.7%. However, profit margins have decreased from last year and debt coverage by operating cash flow remains inadequate, posing potential risks to financial stability.

- The growth report we've compiled suggests that Elders' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Elders' balance sheet health report.

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited, with a market cap of A$7.16 billion, operates in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

Operations: The company's revenue is primarily derived from its Rare Earth Operations, amounting to A$482.82 million.

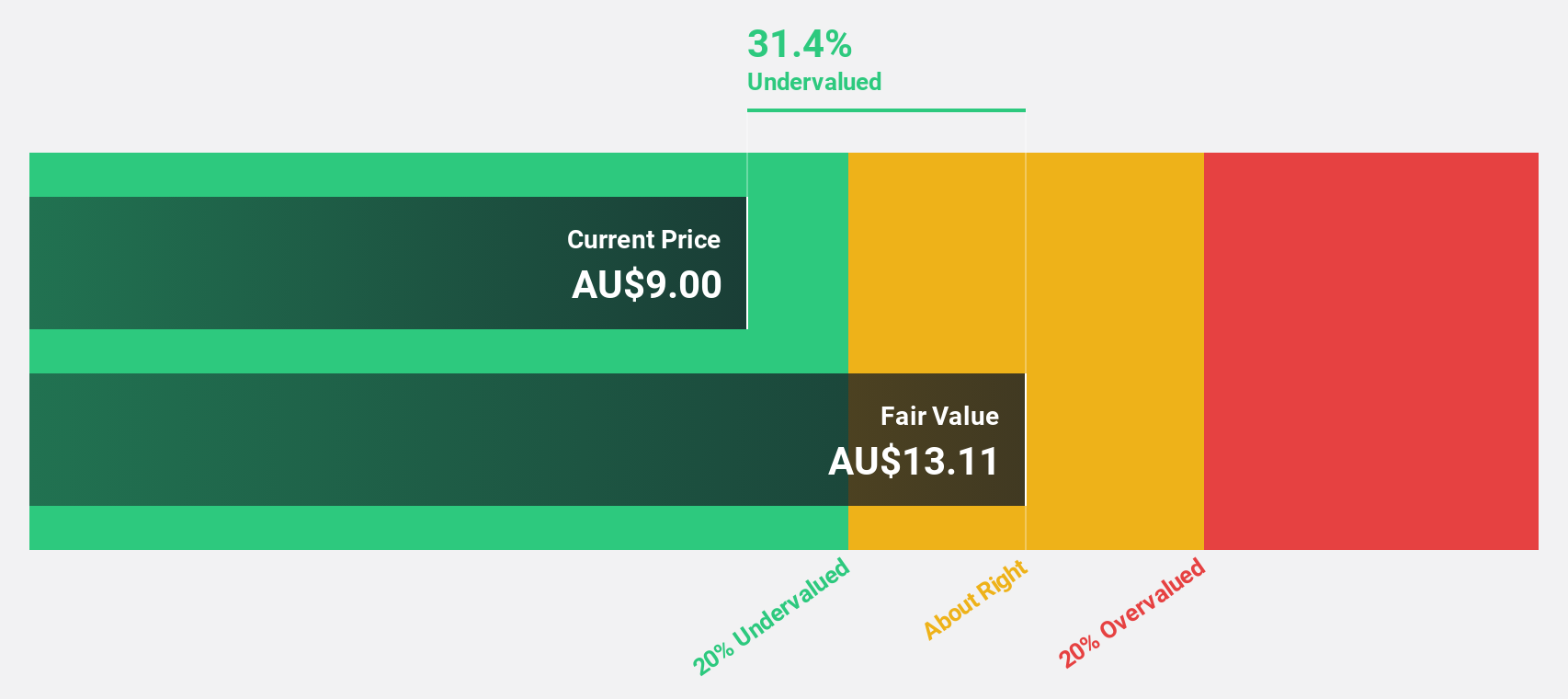

Estimated Discount To Fair Value: 43.5%

Lynas Rare Earths, trading at A$7.65, is considerably undervalued with a fair value estimate of A$13.55 through discounted cash flow analysis. Despite significant insider selling recently and reduced profit margins from 33.2% to 10.5%, earnings are projected to grow substantially at 61.95% annually, outpacing the Australian market's growth rate of 11.7%. However, its return on equity is forecasted to remain low at 15.9% in three years.

- Our expertly prepared growth report on Lynas Rare Earths implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Lynas Rare Earths' balance sheet by reading our health report here.

Seize The Opportunity

- Click this link to deep-dive into the 40 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Life360, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:360

Life360

Operates a technology platform to locate people, pets, and things in North America, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives