For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Central Petroleum (ASX:CTP). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Central Petroleum

How Fast Is Central Petroleum Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that Central Petroleum grew its EPS from AU$0.0065 to AU$0.039, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

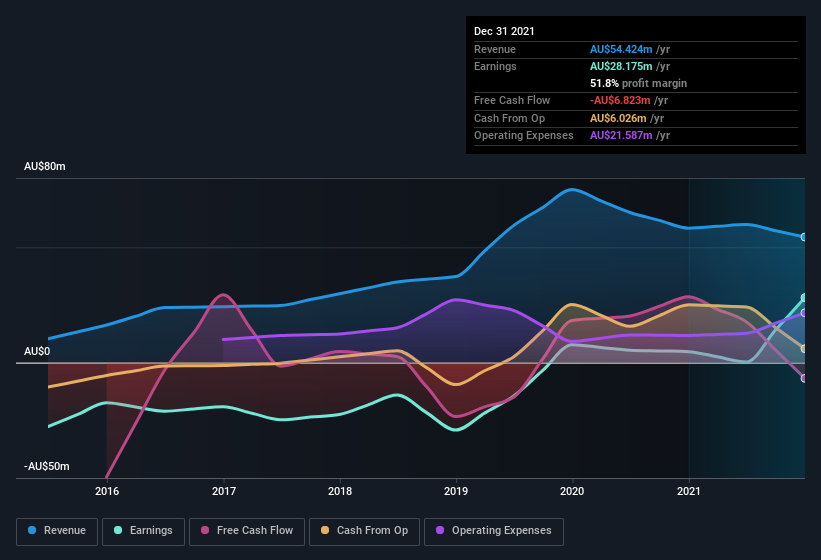

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, revenue is down and so are margins. That will not make it easy to grow profits, to say the least.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Central Petroleum's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Central Petroleum Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first; I didn't see insiders sell Central Petroleum shares in the last year. Even better, though, is that the , Troy Harry, bought a whopping AU$326k worth of shares, paying about AU$0.04 per share, on average. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

On top of the insider buying, it's good to see that Central Petroleum insiders have a valuable investment in the business. Indeed, they hold AU$20m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 23% of the company; visible skin in the game.

Is Central Petroleum Worth Keeping An Eye On?

Central Petroleum's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Central Petroleum deserves timely attention. Before you take the next step you should know about the 3 warning signs for Central Petroleum (2 don't sit too well with us!) that we have uncovered.

As a growth investor I do like to see insider buying. But Central Petroleum isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CTP

Central Petroleum

Engages in the development, production, processing, and marketing of hydrocarbons, including natural gas, and crude oil and condensate in Australia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026