- Australia

- /

- Renewable Energy

- /

- ASX:LGI

3 Promising ASX Penny Stocks With Market Caps Under A$700M

Reviewed by Simply Wall St

The Australian market has shown resilience despite global uncertainties, with investors cautiously optimistic following recent geopolitical developments and trade discussions. In such a climate, penny stocks—though an outdated term—remain relevant as they highlight smaller or less-established companies that can offer significant value. By focusing on those with strong financials and clear growth potential, investors may uncover promising opportunities among these under-the-radar stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.48 | A$137.56M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.945 | A$58.84M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$410.95M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.10 | A$228.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.043 | A$50.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.069 | A$36.34M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.82 | A$391.73M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.855 | A$149.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 425 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix technology in the United States and internationally, with a market cap of A$244.97 million.

Operations: The company's revenue is primarily generated from its operations in developing, manufacturing, and selling soft tissue repair products, amounting to NZ$84.70 million.

Market Cap: A$244.97M

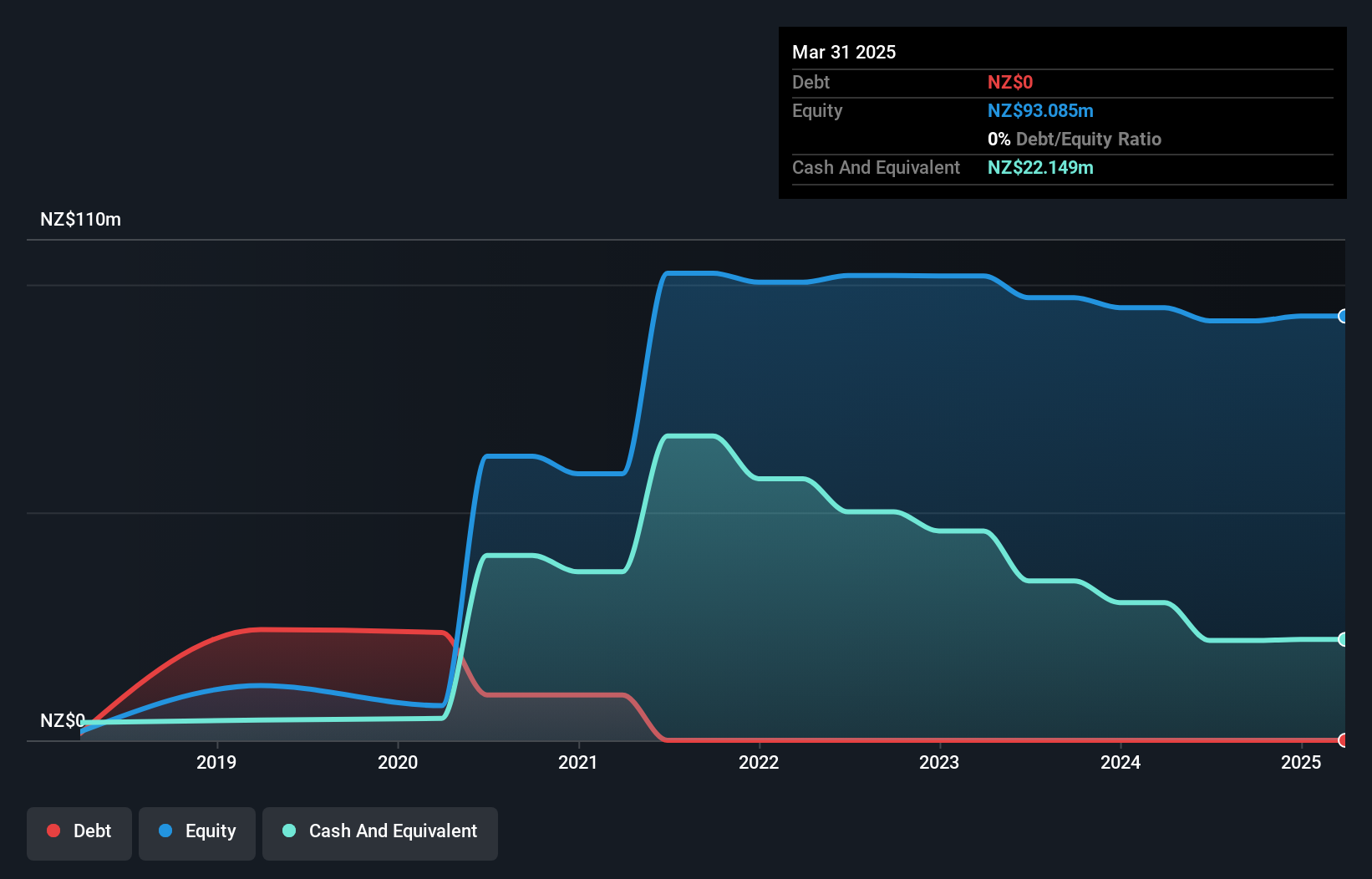

Aroa Biosurgery, with a market cap of A$244.97 million, is gaining attention due to its innovative ENIVO platform for surgical applications, which shows promise in addressing complications like seromas post-mastectomy. Despite being unprofitable and having a negative return on equity of -4.1%, the company has no debt and strong short-term asset coverage over liabilities. Its earnings have grown by 21.2% annually over five years, reducing losses significantly. Trading well below estimated fair value and with an experienced management team, Aroa presents an intriguing opportunity in the penny stock segment as it pursues commercialization efforts for ENIVO technology.

- Unlock comprehensive insights into our analysis of Aroa Biosurgery stock in this financial health report.

- Learn about Aroa Biosurgery's future growth trajectory here.

LGI (ASX:LGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LGI Limited operates in Australia, offering carbon abatement and renewable energy solutions through the utilization of biogas from landfills, with a market cap of A$362.38 million.

Operations: The company's revenue is derived from Carbon Abatement (A$17.29 million), Renewable Energy (A$17.08 million), and Infrastructure Construction and Management (A$2.37 million).

Market Cap: A$362.38M

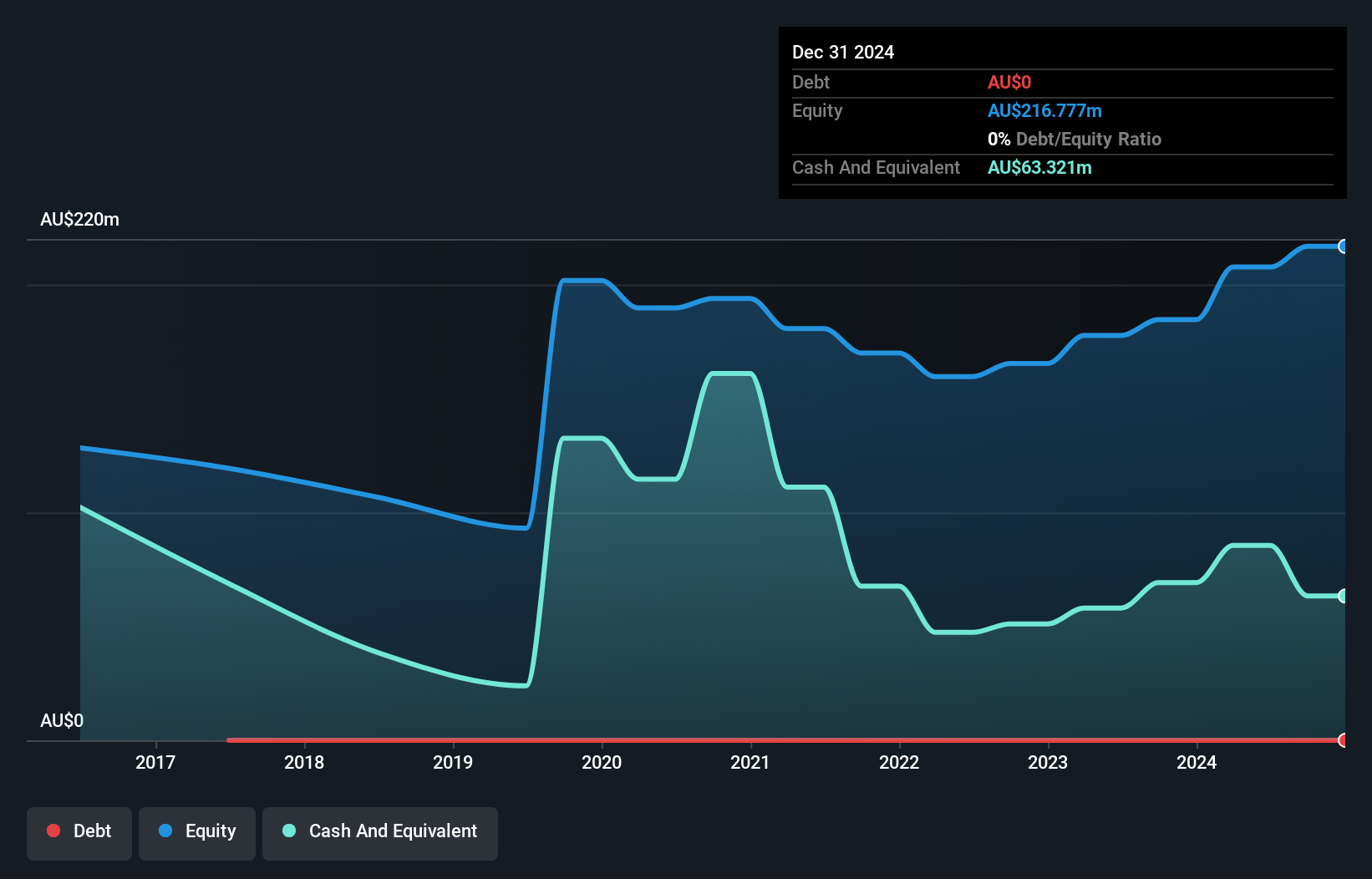

LGI Limited, with a market cap of A$362.38 million, has recently been added to the S&P/ASX Emerging Companies Index. The company reported A$36.78 million in sales for the year ending June 2025, driven by its carbon abatement and renewable energy segments. Despite a decline in net profit margins from 20.1% to 17.6%, LGI's debt management is robust, with a net debt to equity ratio of 20.2% and operating cash flow covering debt well at 43.2%. Although earnings growth was negative over the past year, forecasts suggest potential annual growth of around 25%.

- Navigate through the intricacies of LGI with our comprehensive balance sheet health report here.

- Gain insights into LGI's future direction by reviewing our growth report.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited offers integrated payment solutions and value-added services in Australia, with a market cap of A$602.76 million.

Operations: The company generates revenue from its Payments segment, which accounts for A$460.86 million, and its Banking segment, contributing A$14.78 million.

Market Cap: A$602.76M

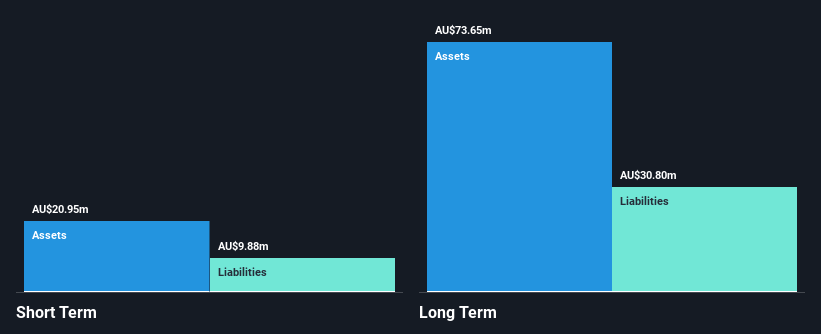

Tyro Payments Limited, with a market cap of A$602.76 million, has demonstrated resilience in the penny stock segment despite challenges. The company's revenue from its Payments and Banking segments totaled A$475.64 million for the year ending June 2025, though net income declined to A$17.82 million from A$25.71 million previously. Tyro's short-term assets exceed both its short-term and long-term liabilities, indicating solid financial footing without debt concerns. However, recent earnings growth has been negative at -30.7%, contrasting with a forecasted annual growth rate of 7.96%. Experienced management and board teams bolster operational stability amidst fluctuating profit margins.

- Click here to discover the nuances of Tyro Payments with our detailed analytical financial health report.

- Gain insights into Tyro Payments' outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Get an in-depth perspective on all 425 ASX Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LGI

LGI

Provides carbon abatement and renewable energy solutions with biogas from landfill in Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)