As the ASX200 closed up 0.85% at 8,393 points, the Australian market is navigating a landscape of cautious optimism amid expectations that interest rate cuts might be delayed until May. With sectors like Energy and Utilities showing strong performance and Information Technology lagging behind, investors are keenly assessing opportunities for stocks that may be trading below their estimated value. Identifying undervalued stocks requires a careful analysis of market conditions and company fundamentals to uncover potential investments that could offer value in the current economic climate.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Telix Pharmaceuticals (ASX:TLX) | A$22.58 | A$44.20 | 48.9% |

| MLG Oz (ASX:MLG) | A$0.60 | A$1.14 | 47.2% |

| Ingenia Communities Group (ASX:INA) | A$5.00 | A$9.33 | 46.4% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Genesis Minerals (ASX:GMD) | A$2.50 | A$4.74 | 47.2% |

| Vault Minerals (ASX:VAU) | A$0.345 | A$0.64 | 46.3% |

| Ai-Media Technologies (ASX:AIM) | A$0.705 | A$1.40 | 49.7% |

| Energy One (ASX:EOL) | A$5.51 | A$10.72 | 48.6% |

| Credit Clear (ASX:CCR) | A$0.365 | A$0.71 | 48.6% |

| FINEOS Corporation Holdings (ASX:FCL) | A$2.05 | A$3.76 | 45.5% |

We're going to check out a few of the best picks from our screener tool.

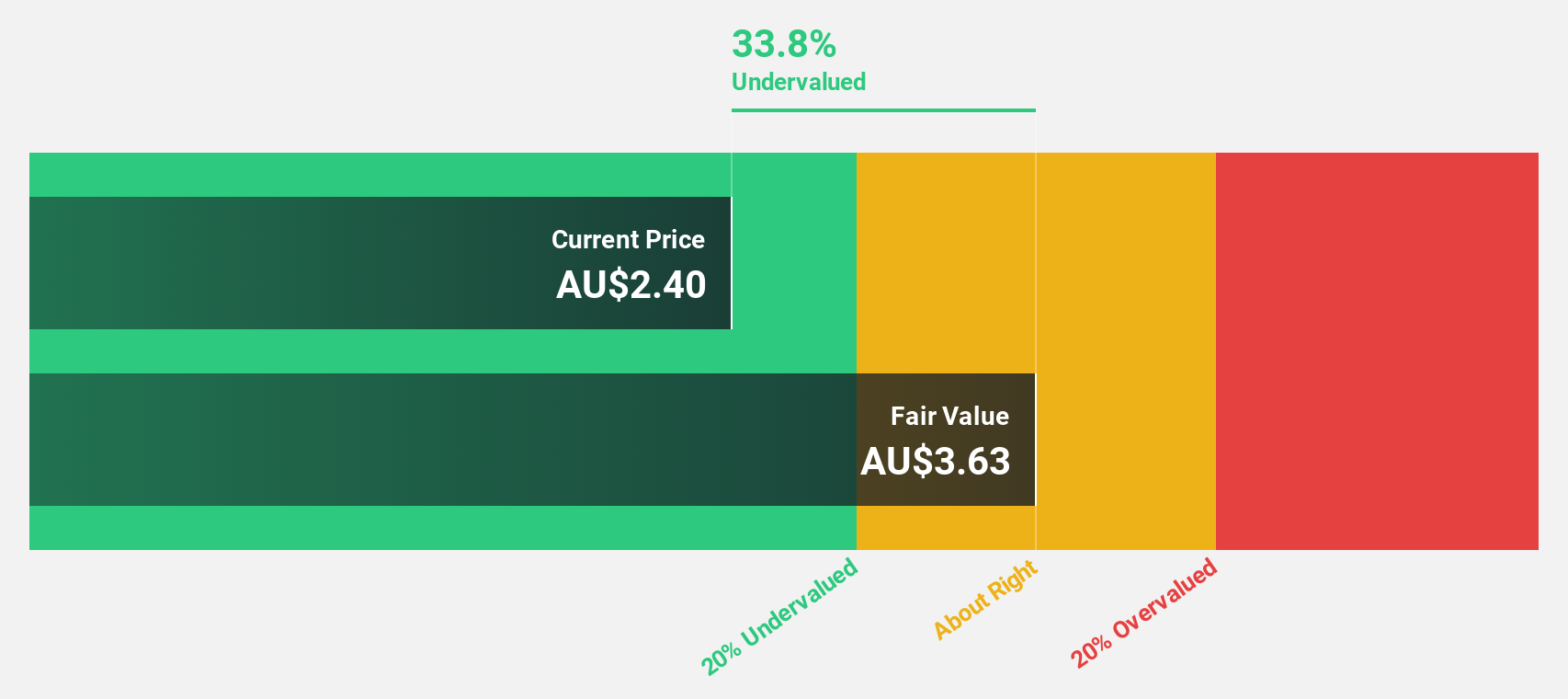

Codan (ASX:CDA)

Overview: Codan Limited provides technology solutions for United Nations organizations, security and military groups, government departments, individuals, and small-scale miners with a market cap of A$2.88 billion.

Operations: The company's revenue segments include Communications, generating A$326.91 million, and Metal Detection, contributing A$219.85 million.

Estimated Discount To Fair Value: 40.8%

Codan is trading at A$15.91, significantly below its estimated fair value of A$26.86, indicating it may be undervalued based on cash flows. The company has demonstrated strong earnings growth of 20.1% over the past year and is forecast to continue growing earnings at 17.4% annually, outpacing the Australian market's average growth rate. Recently added to the S&P/ASX 200 Index, Codan's revenue growth also exceeds market expectations at 10.2% per year.

- According our earnings growth report, there's an indication that Codan might be ready to expand.

- Click here to discover the nuances of Codan with our detailed financial health report.

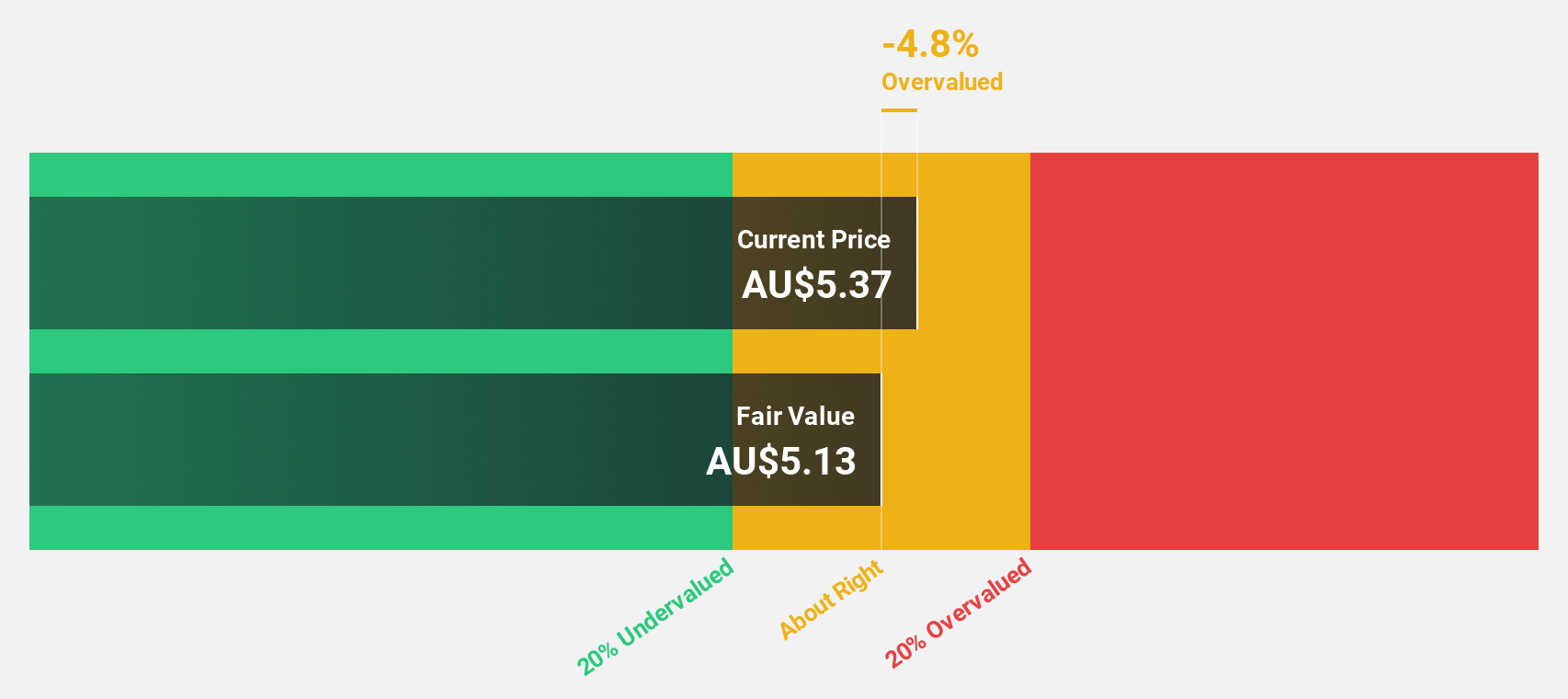

Ingenia Communities Group (ASX:INA)

Overview: Ingenia Communities Group (ASX:INA) is a prominent operator, owner, and developer of residential communities and holiday accommodations with a market cap of A$2.04 billion.

Operations: The revenue segments for ASX:INA include A$134.84 million from Tourism - Ingenia Holidays, A$23.67 million from Residential - Ingenia Gardens, A$86.50 million from Residential - Lifestyle Rental, and A$205.81 million from Residential - Lifestyle Development, along with A$19.26 million generated by Fuel, Food & Beverage services.

Estimated Discount To Fair Value: 46.4%

Ingenia Communities Group is trading at A$5, substantially below its estimated fair value of A$9.33, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 16.5% to 3%, earnings are projected to grow significantly at 25.6% annually, surpassing the Australian market average of 12.4%. However, debt coverage by operating cash flow remains inadequate. Recently, Dr. Jenny Fagg was appointed as an independent Non-Executive Director, bringing extensive financial expertise to the board.

- Upon reviewing our latest growth report, Ingenia Communities Group's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Ingenia Communities Group stock in this financial health report.

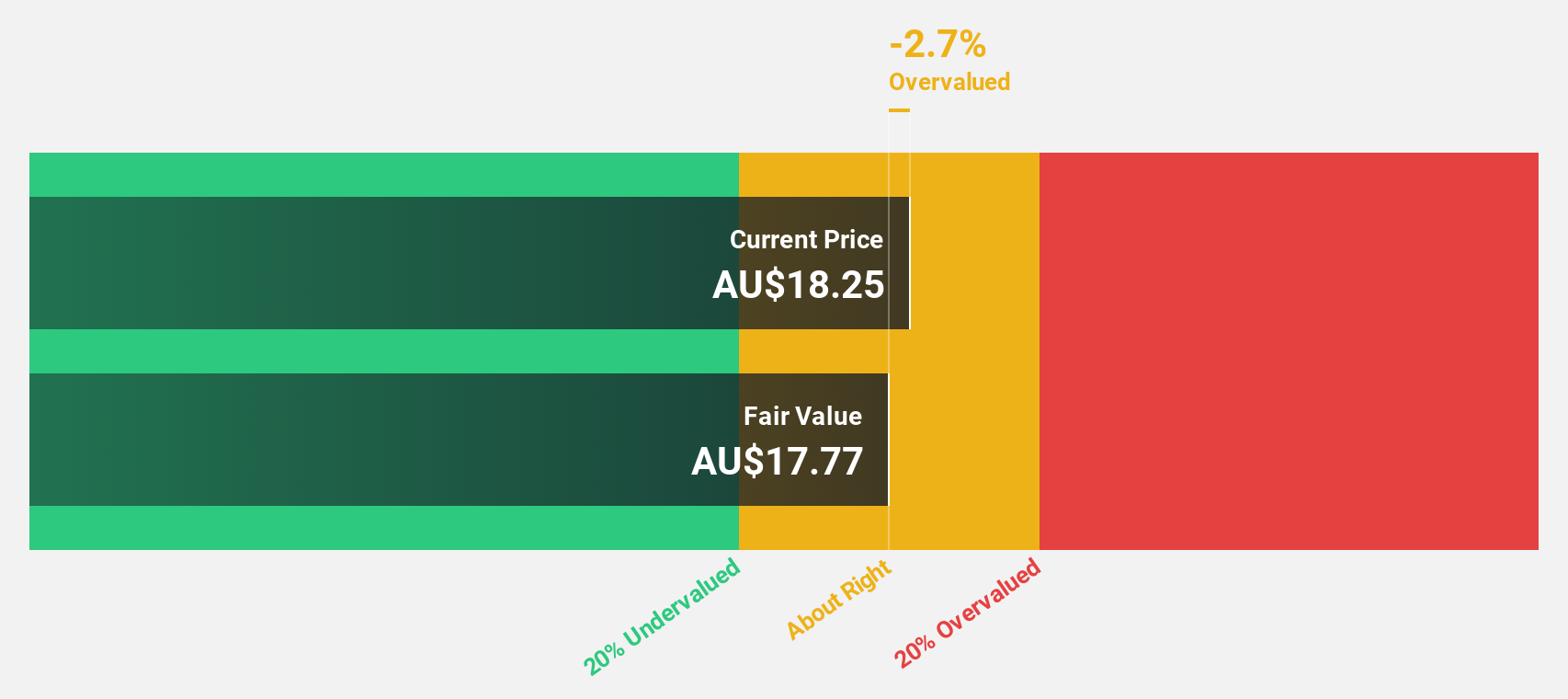

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market capitalization of A$1.38 billion.

Operations: The company generates revenue primarily through the provision of investment management services, amounting to A$198.50 million.

Estimated Discount To Fair Value: 33.7%

Regal Partners is trading at A$4.18, significantly below its estimated fair value of A$6.31, suggesting undervaluation based on cash flows. Despite shareholder dilution and significant insider selling recently, earnings have surged by a very large percentage over the past year and are expected to grow annually by 20.9%, outpacing the Australian market average of 12.4%. However, its dividend yield of 3.83% is not well covered by free cash flows, indicating potential sustainability concerns.

- Our growth report here indicates Regal Partners may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Regal Partners.

Make It Happen

- Unlock our comprehensive list of 39 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military groups, government departments, individuals, and small-scale miners.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives