- Australia

- /

- Commercial Services

- /

- ASX:MAD

Mader Group And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As the Australian market experiences a downturn, with the ASX 200 dropping 1.25% amid concerns over U.S. tariffs on Chinese goods impacting local commodities, investors are increasingly cautious about small-cap stocks. In this challenging environment, identifying undiscovered gems like Mader Group and others requires focusing on companies with robust fundamentals and resilience to broader economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -21.42% | -41.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★★★★

Overview: Mader Group Limited is a contracting company that offers specialist technical services across the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of approximately A$1.25 billion.

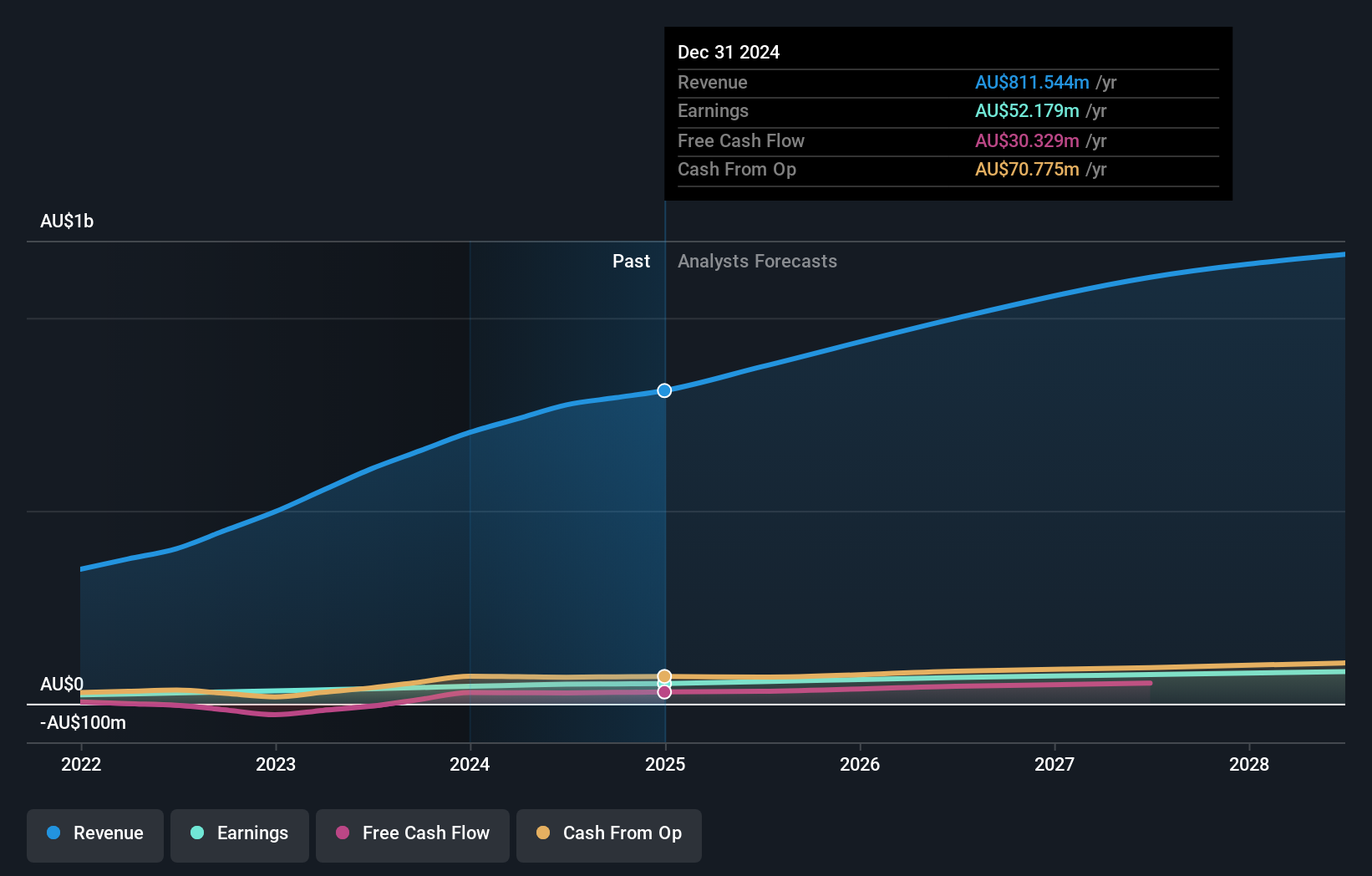

Operations: Mader Group derives its revenue primarily from staffing and outsourcing services, generating A$811.54 million. The company has a market cap of approximately A$1.25 billion.

Mader Group, a nimble player in the technical services industry, is making waves with its strategic expansion into energy and transport logistics. This move is expected to drive future growth, supported by a 15.5% earnings increase over the past year, outpacing the industry's 11.4%. The company's debt to equity ratio has impressively decreased from 84% to 23.5% over five years, underscoring financial prudence with interest payments well covered at 20.5x EBIT. Trading at A$6.26 per share and below fair value estimates by about 21%, Mader's focus on high-margin segments could enhance profitability despite potential geopolitical risks in North America impacting revenue streams.

Pacific Current Group (ASX:PAC)

Simply Wall St Value Rating: ★★★★★★

Overview: Pacific Current Group Limited operates a multi-boutique asset management business on a global scale, with a market capitalization of A$624.28 million.

Operations: Pacific Current Group generates revenue primarily through its multi-boutique asset management operations. The company's financial performance is reflected in its market capitalization of A$624.28 million.

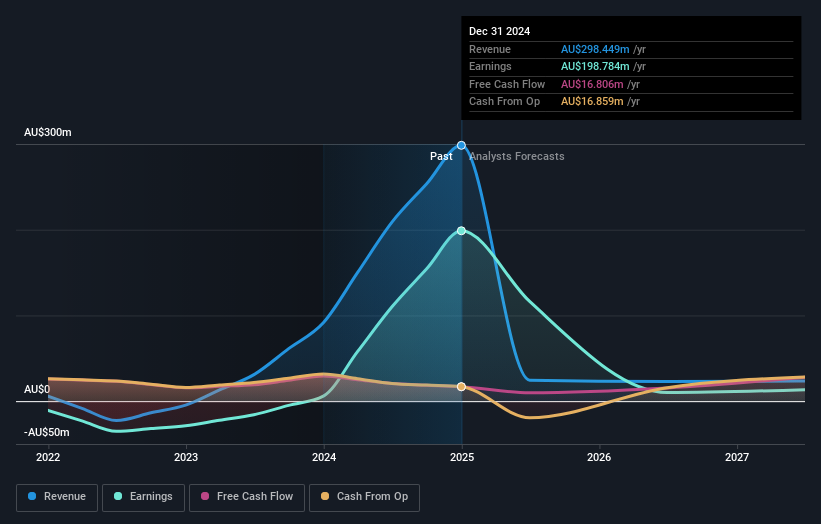

Pacific Current Group, a player in the asset management sector, stands out with its impressive earnings growth of 3270% over the past year. Despite being debt-free and trading at a favorable price-to-earnings ratio of 3.1x compared to the broader Australian market's 17.8x, its reliance on asset sales for cash flow introduces potential volatility in revenue streams. Recent results highlight this concern as net income surged to A$100 million from A$11.66 million last year, yet future earnings are forecasted to decline by an average of 78% annually over three years, indicating caution for prospective investors.

Qualitas (ASX:QAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qualitas is a real estate investment firm specializing in direct investments, distressed debt restructuring, third-party capital raisings, and consulting services, with a market cap of A$851.03 million.

Operations: Qualitas generates revenue primarily through its Direct Lending and Funds Management segments, with A$23.03 million and A$21.46 million respectively. The company's net profit margin is a key financial metric to consider when evaluating its profitability within the real estate investment sector.

Qualitas, a real estate investment firm, has demonstrated strong financial performance with its earnings growing by 23.5% over the past year, surpassing industry benchmarks. The company boasts a robust balance sheet with more cash than total debt and has significantly reduced its debt to equity ratio from 1014.3% to 10.7% in five years. However, free cash flow remains negative despite record capital raising of A$2.8 billion and deployment of A$4.2 billion, which could drive future revenue growth through increased fee-earning funds under management. Recent half-year results showed revenue at A$50 million and net income at A$16 million compared to the previous year's figures of A$42 million and A$13 million respectively, reflecting improved profitability amidst market challenges related to interest rate fluctuations and residential sector dependency.

Key Takeaways

- Click here to access our complete index of 49 ASX Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mader Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives