Key Takeaways

- Record capital raising and deployment with strong net inflow indicates potential future revenue growth from fee-earning investments.

- Focus on balance sheet efficiency and larger private credit deployments hint at improved margins and significant future earnings growth.

- Dependence on the Australian residential sector and undrawn construction credit may hinder revenue growth amid fluctuating interest rates and unstable equity fund valuations.

Catalysts

About Qualitas- Qualitas is a real estate investment firm which focuses on direct investment in all real estate classes and geographies, acquisitions and restructuring of distressed debt, third party capital raisings and consulting services.

- Qualitas has achieved a record year of capital raising and deployment, with $2.8 billion in net inflow and $4.2 billion in deployment, which indicates future revenue growth due to increased fee-earning funds under management (FUM).

- The company has $1.4 billion of undrawn construction credit and $1.5 billion in dry powder, expected to boost revenue growth in FY '25 as these funds are deployed.

- Qualitas' increased focus on optimizing balance sheet efficiency and reducing co-investment relative to FUM suggests improved capital efficiency, which may enhance net margins.

- With 47% of unrecognized performance fees from credit funds and a stable realization profile, Qualitas projects significant future earnings growth from these performance fees as they are recognized.

- The strong growth in private credit deployment and larger average investment sizes are poised to increase earnings, as the company benefits from transaction fees and increased stability in the fee realization profile.

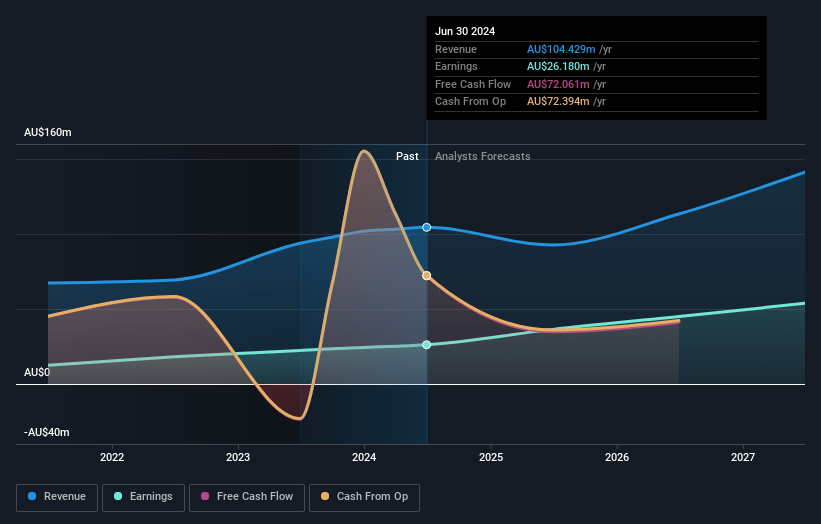

Qualitas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Qualitas's revenue will grow by 10.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 25.1% today to 38.1% in 3 years time.

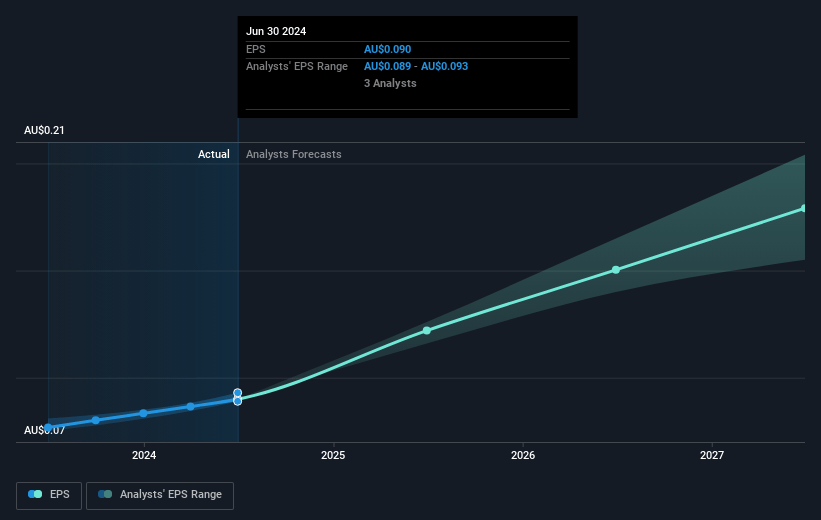

- Analysts expect earnings to reach A$53.8 million (and earnings per share of A$0.18) by about February 2028, up from A$26.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$61 million in earnings, and the most bearish expecting A$46.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.5x on those 2028 earnings, down from 28.7x today. This future PE is greater than the current PE for the AU Capital Markets industry at 21.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.52%, as per the Simply Wall St company report.

Qualitas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Interest rate volatility: The stabilizing interest rate environment mentioned might not hold, potentially leading to increased costs and impacting net margins if interest rates were to rise unexpectedly.

- Market Dependency and Competition: The reliance on the Australian residential sector for development poses a risk if this sector underperforms or if increased competition reduces anticipated revenues.

- Macroeconomic Risks: An alternative scenario where rapid rate cuts lead to recession could increase market volatility and affect asset valuations, impacting both earnings reliability and revenue generation.

- Undrawn Construction Credit: With $1.4 billion of undrawn construction credit not earning full management fees, slower-than-expected drawdowns could delay revenue growth, affecting earnings.

- Equity Fund Valuations: The noted decline in equity fund valuations leading to performance fee reversals highlights vulnerabilities to market conditions, posing a risk to future earnings stability and revenue potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$3.458 for Qualitas based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.9, and the most bearish reporting a price target of just A$2.93.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$141.2 million, earnings will come to A$53.8 million, and it would be trading on a PE ratio of 23.5x, assuming you use a discount rate of 7.5%.

- Given the current share price of A$2.55, the analyst price target of A$3.46 is 26.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives