- Australia

- /

- Diversified Financial

- /

- ASX:HLI

ASX Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As the ASX 200 experiences a downturn, dropping by approximately 1.25% amid concerns over U.S. tariffs on Chinese goods affecting Australian commodities, investors are closely monitoring market movements across all sectors. In such volatile conditions, dividend stocks can offer a measure of stability and income potential, making them an appealing option for those seeking to navigate the current economic landscape.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| IPH (ASX:IPH) | 7.32% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.44% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.90% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.42% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.77% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.58% | ★★★★★☆ |

| Grange Resources (ASX:GRR) | 9.09% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.33% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.15% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 6.17% | ★★★★★☆ |

Click here to see the full list of 35 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

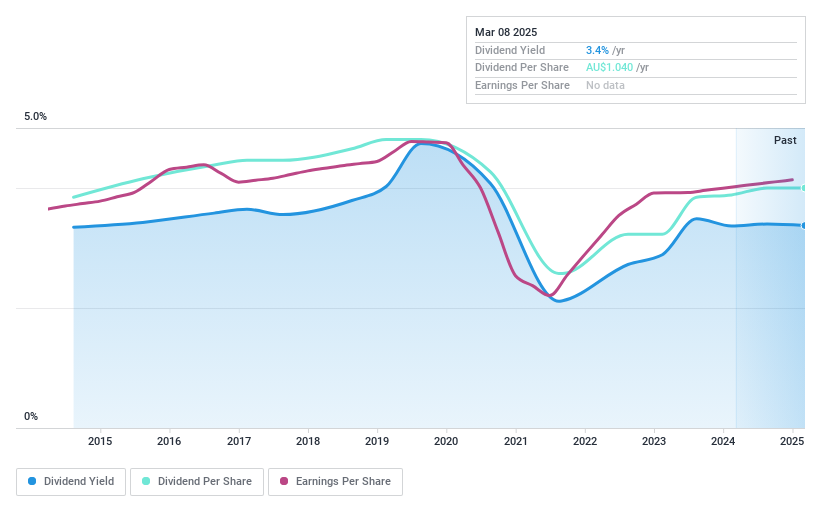

Carlton Investments (ASX:CIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carlton Investments Limited is a publicly owned asset management holding company with a market cap of A$845.64 million.

Operations: Carlton Investments Limited generates revenue primarily through the acquisition and long-term holding of shares and units, amounting to A$42.01 million.

Dividend Yield: 3.3%

Carlton Investments offers a mixed dividend profile, with a payout ratio of 72.5% indicating dividends are covered by earnings, and a cash payout ratio of 68.9% showing coverage by cash flows. However, its dividend yield of 3.25% falls short compared to top Australian payers. Although dividends have grown over the past decade, they have been volatile and unreliable at times. Recently, it declared an interim fully franked dividend of A$0.45 per ordinary share payable on March 24, 2025.

- Click here to discover the nuances of Carlton Investments with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Carlton Investments' share price might be too optimistic.

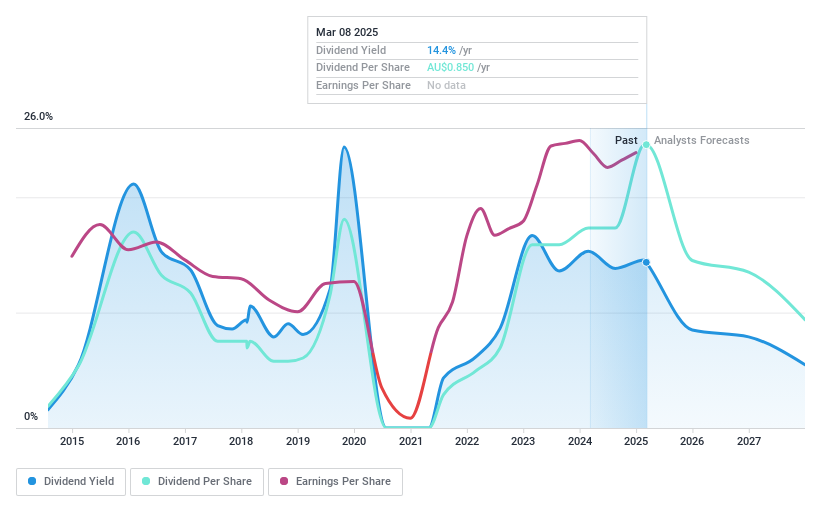

Helia Group (ASX:HLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Helia Group Limited, along with its subsidiaries, operates in the loan mortgage insurance sector mainly in Australia and has a market cap of A$1.66 billion.

Operations: Helia Group Limited generates its revenue through its involvement in the loan mortgage insurance business primarily in Australia.

Dividend Yield: 9.8%

Helia Group presents a high dividend yield of 9.82%, ranking in the top 25% of Australian payers, yet its dividends have been volatile and not well-covered by cash flows. Despite a low payout ratio of 1.3%, the sustainability is questionable due to earnings decline forecasts. Recent announcements include a special fully franked dividend of A$0.53 per share and an increased equity buyback plan from A$100 million to A$200 million, extending through June 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Helia Group.

- In light of our recent valuation report, it seems possible that Helia Group is trading behind its estimated value.

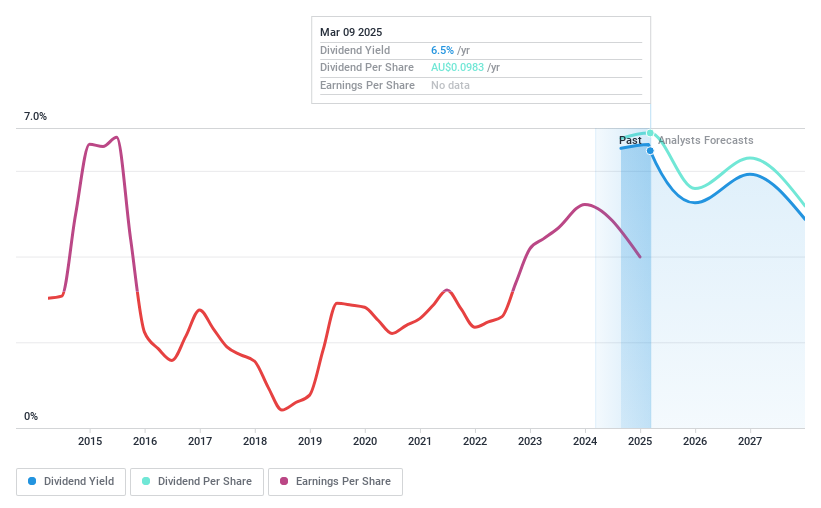

Karoon Energy (ASX:KAR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Karoon Energy Ltd is an oil and gas exploration and production company operating in Brazil, the United States, and Australia, with a market cap of A$1.17 billion.

Operations: Karoon Energy Ltd generates revenue primarily from the exploration and evaluation of hydrocarbons, amounting to $776.50 million.

Dividend Yield: 6.5%

Karoon Energy's dividend yield of 6.51% places it among the top 25% of Australian dividend payers, supported by a low payout ratio of 36.6%, indicating strong coverage by earnings and cash flows. The recent ordinary dividend declaration of A$0.05 per share for the six months ending December 2024 highlights its commitment to returning value to shareholders, although it's too early to assess long-term reliability or growth trends in dividends as they have only recently initiated payouts.

- Navigate through the intricacies of Karoon Energy with our comprehensive dividend report here.

- Our expertly prepared valuation report Karoon Energy implies its share price may be lower than expected.

Summing It All Up

- Explore the 35 names from our Top ASX Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLI

Helia Group

Helia Group Limited, together with its subsidiaries, is involved in the loan mortgage insurance business primarily in Australia.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives