- Australia

- /

- Professional Services

- /

- ASX:ALQ

ASX Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

In the current Australian market, the ASX200 is hovering near the 8,000-point mark despite recent fluctuations driven by global trade tensions and sector-specific movements. Amidst this environment of cautious optimism, identifying stocks that are potentially trading below their intrinsic value can offer investors opportunities to capitalize on long-term growth prospects while navigating uncertainties such as upcoming US tariffs.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.37 | A$0.66 | 43.7% |

| Acrow (ASX:ACF) | A$1.07 | A$2.04 | 47.5% |

| GenusPlus Group (ASX:GNP) | A$2.70 | A$5.12 | 47.3% |

| Medical Developments International (ASX:MVP) | A$0.455 | A$0.89 | 48.9% |

| Genetic Signatures (ASX:GSS) | A$0.44 | A$0.84 | 47.6% |

| Pantoro Gold (ASX:PNR) | A$3.05 | A$5.33 | 42.7% |

| Integral Diagnostics (ASX:IDX) | A$2.27 | A$4.07 | 44.2% |

| Nuix (ASX:NXL) | A$2.43 | A$4.23 | 42.6% |

| Electro Optic Systems Holdings (ASX:EOS) | A$1.25 | A$2.35 | 46.9% |

| Superloop (ASX:SLC) | A$2.39 | A$4.58 | 47.8% |

Let's take a closer look at a couple of our picks from the screened companies.

ALS (ASX:ALQ)

Overview: ALS Limited offers professional technical services focused on testing, measurement, and inspection across multiple regions including Africa, Asia/Pacific, Europe, the Middle East, and the Americas; it has a market cap of A$7.64 billion.

Operations: The company generates revenue primarily from its Commodities segment, which accounts for A$1.08 billion, and its Life Sciences Excluding Nuvisan segment, contributing A$1.63 billion.

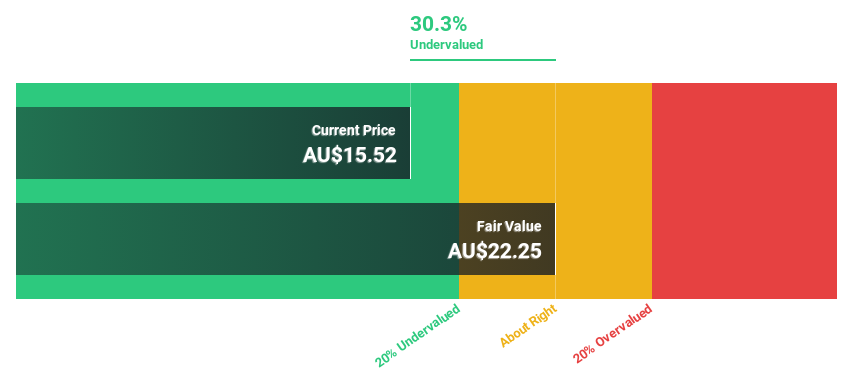

Estimated Discount To Fair Value: 32.5%

ALS is trading at A$15.75, significantly below its estimated fair value of A$23.35, suggesting it may be undervalued based on cash flows. Despite a high debt level and recent profit margin decline, its earnings are forecast to grow at 24.9% annually, outpacing the Australian market's growth rate of 11.6%. The appointment of Catharine Farrow as a Non-Executive Director could enhance governance and strategic direction given her extensive industry experience.

- Our expertly prepared growth report on ALS implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of ALS.

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited offers travel retailing services for both leisure and corporate sectors across various regions worldwide, with a market capitalization of A$2.75 billion.

Operations: The company's revenue is primarily derived from its leisure segment, which generated A$1.38 billion, and its corporate segment, contributing A$1.13 billion.

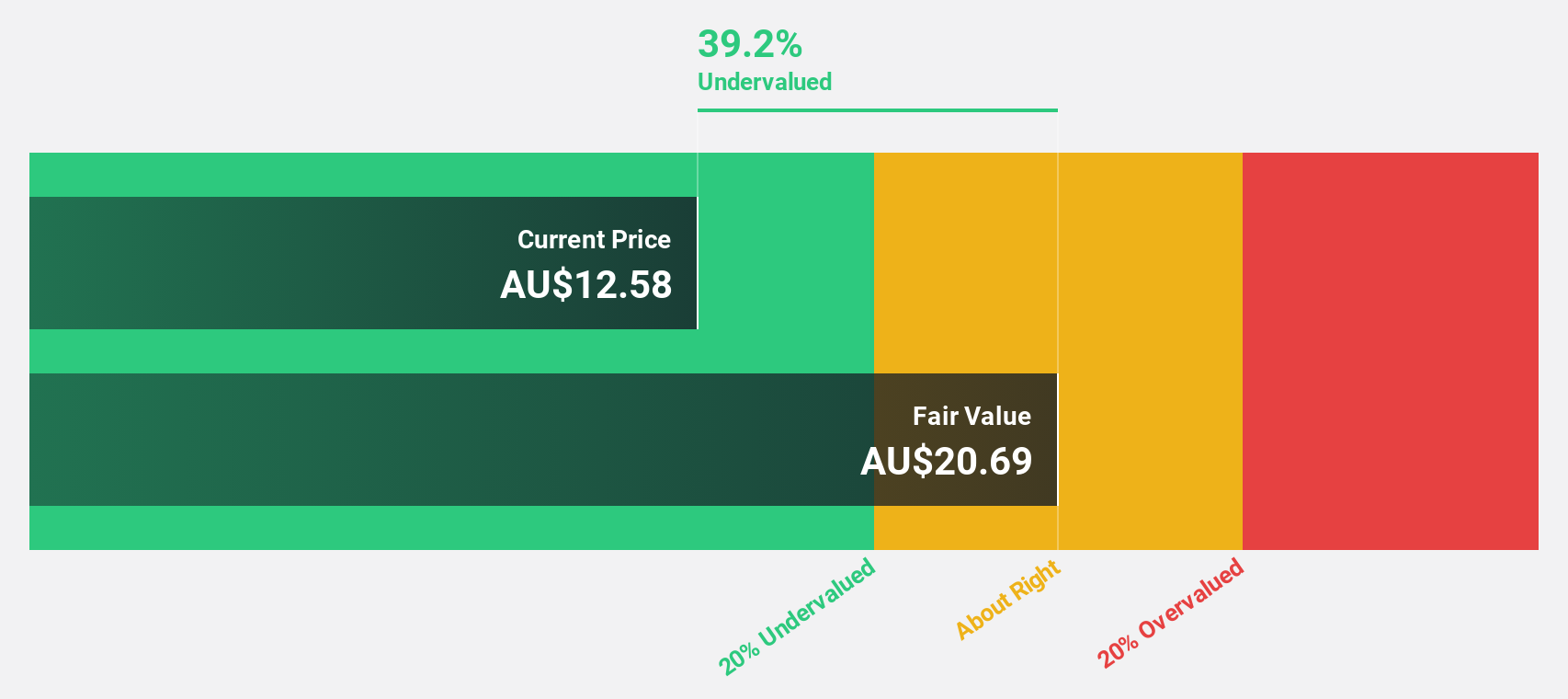

Estimated Discount To Fair Value: 39%

Flight Centre Travel Group is trading at A$12.46, considerably below its estimated fair value of A$20.41, highlighting potential undervaluation based on cash flows. While profit margins have declined from 6% to 4.1%, earnings are expected to grow significantly at 23.41% annually, surpassing the Australian market's growth rate of 11.6%. Despite a dividend not well covered by free cash flows, analysts anticipate a stock price increase of over 50%.

- According our earnings growth report, there's an indication that Flight Centre Travel Group might be ready to expand.

- Click to explore a detailed breakdown of our findings in Flight Centre Travel Group's balance sheet health report.

Nuix (ASX:NXL)

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of A$803.68 million.

Operations: Nuix's revenue is primarily derived from its Software & Programming segment, which generated A$227.37 million.

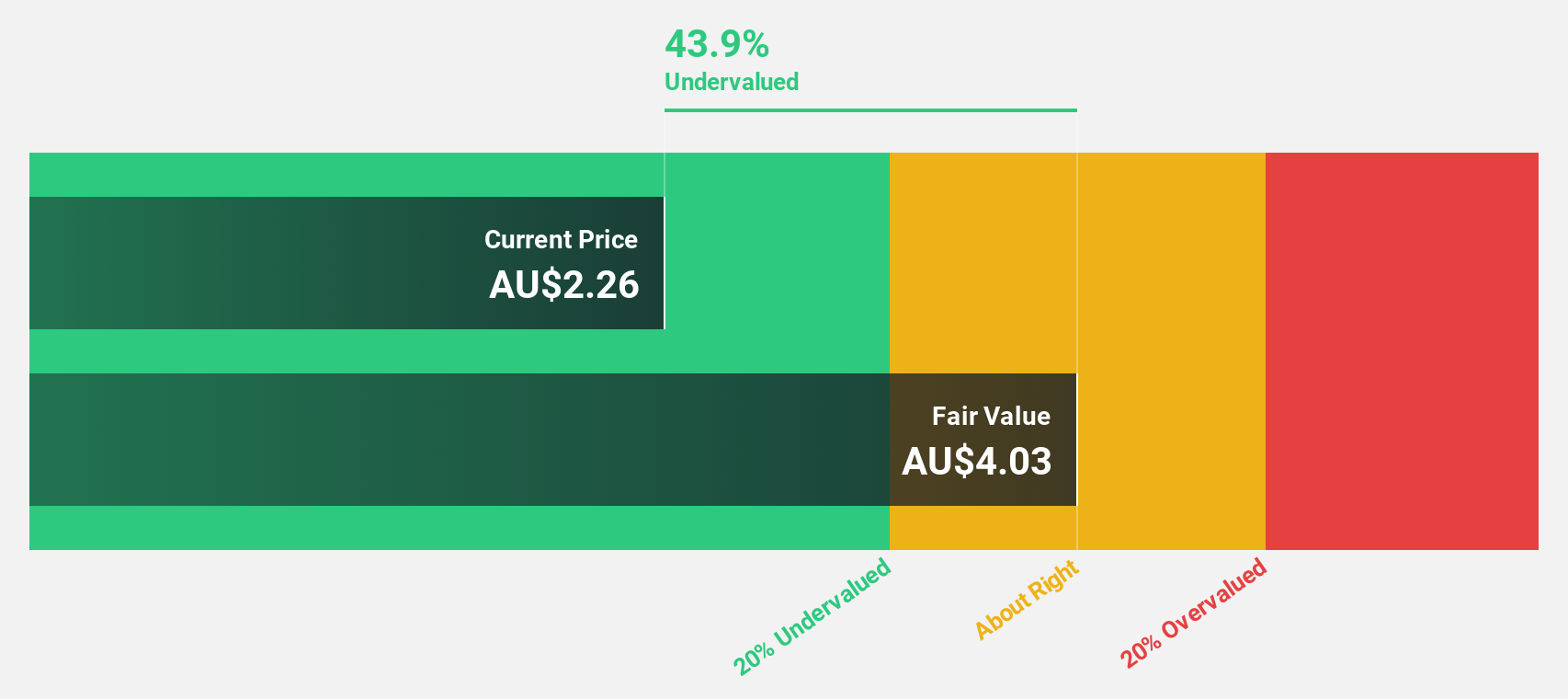

Estimated Discount To Fair Value: 42.6%

Nuix Limited is trading at A$2.43, significantly below its estimated fair value of A$4.23, indicating a potential undervaluation based on cash flows. The company is expected to achieve profitability within three years with earnings projected to grow 53.49% annually, surpassing the market's average growth rate. Despite a recent net loss increase to A$10.4 million for the half-year ending December 2024, Nuix's revenue growth forecast of 15.5% remains robust compared to the broader market.

- In light of our recent growth report, it seems possible that Nuix's financial performance will exceed current levels.

- Dive into the specifics of Nuix here with our thorough financial health report.

Seize The Opportunity

- Unlock more gems! Our Undervalued ASX Stocks Based On Cash Flows screener has unearthed 31 more companies for you to explore.Click here to unveil our expertly curated list of 34 Undervalued ASX Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALQ

ALS

Provides professional technical services primarily in the areas of testing, measurement, and inspection in Africa, Asia/Pacific, Europe, the Middle East, and the Americas.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives