- Australia

- /

- Hospitality

- /

- ASX:FLT

ASX Growth Stocks With High Insider Ownership Boasting Up To 46% Earnings Growth

Reviewed by Simply Wall St

As the Australian market braces for a slight dip, influenced by global economic uncertainties and cautious corporate outlooks, investors are keenly observing growth opportunities amid these challenging conditions. In this environment, companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, especially when coupled with substantial earnings growth potential.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12.3% | 117.7% |

| Catalyst Metals (ASX:CYL) | 14.8% | 42.9% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 66.6% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's explore several standout options from the results in the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.88 billion.

Operations: The company's revenue primarily comes from mine operations, totaling A$366.04 million.

Insider Ownership: 18%

Earnings Growth Forecast: 32.2% p.a.

Emerald Resources exhibits strong growth potential with earnings expected to grow significantly at 32.2% annually, outpacing the Australian market. Revenue is forecast to increase by 31.1% per year, indicating robust expansion prospects. The company trades at a substantial discount to its estimated fair value, enhancing its appeal as an investment opportunity. Recent developments include the retirement of influential board member Simon Lee AO and ongoing M&A discussions involving key assets like the Ravenswood Gold Mine.

- Navigate through the intricacies of Emerald Resources with our comprehensive analyst estimates report here.

- The analysis detailed in our Emerald Resources valuation report hints at an inflated share price compared to its estimated value.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited is a company that offers travel retailing services to both leisure and corporate clients across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia and other international markets with a market cap of approximately A$3.61 billion.

Operations: The company's revenue is primarily derived from its leisure segment, contributing A$1.35 billion, and its corporate segment, which accounts for A$1.11 billion.

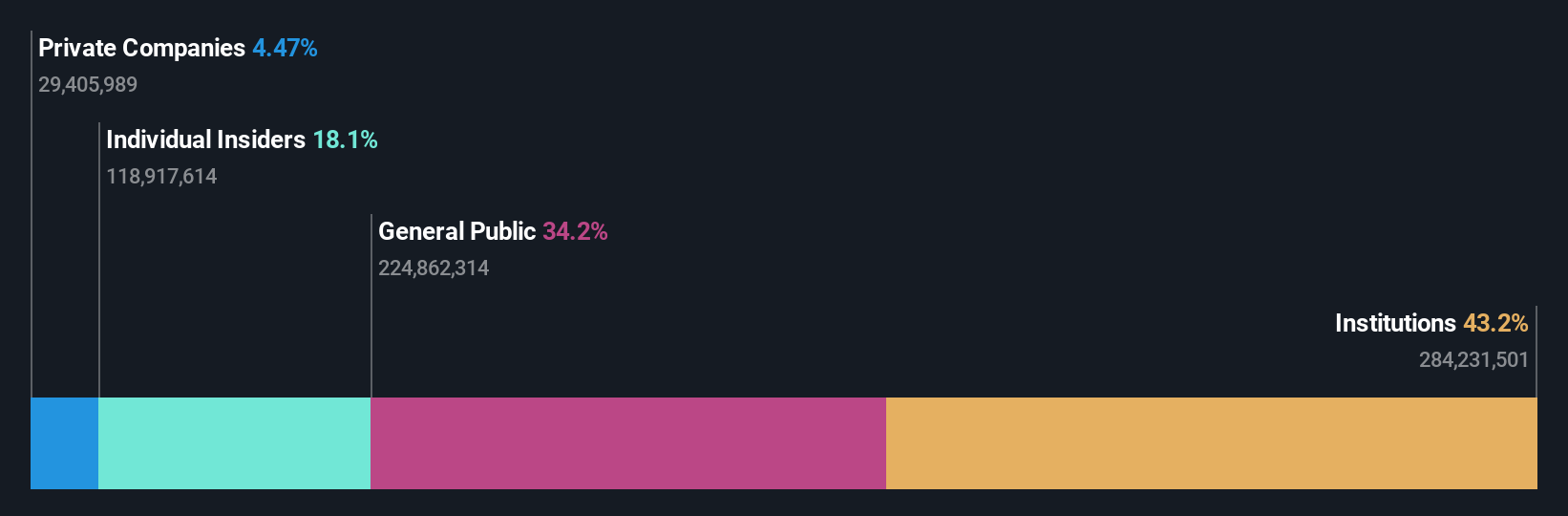

Insider Ownership: 13.5%

Earnings Growth Forecast: 19.1% p.a.

Flight Centre Travel Group demonstrates solid growth potential, with earnings forecasted to grow at 19.1% annually, surpassing the Australian market's average. Recent full-year results show a significant increase in net income to A$139 million from A$47 million the previous year. The company is actively seeking acquisitions and investments to double its Cruise & Touring sales, leveraging strong brands and a robust cash position for reinvestment opportunities despite an unstable dividend track record.

- Dive into the specifics of Flight Centre Travel Group here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Flight Centre Travel Group is trading behind its estimated value.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited owns, operates, and franchises quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$3.96 billion.

Operations: The company generates revenue primarily through its quick service restaurant operations, totaling A$364.99 million.

Insider Ownership: 13%

Earnings Growth Forecast: 46.7% p.a.

Guzman y Gomez is experiencing robust revenue growth, with a 31.9% increase last year and forecasts of 17.8% annually, outpacing the Australian market. Despite a net loss of A$13.75 million for the full year ending June 2024, the company is projected to become profitable within three years. Recent inclusion in multiple S&P/ASX indices highlights its growing market presence, although return on equity remains low at an estimated 11.6% over three years.

- Unlock comprehensive insights into our analysis of Guzman y Gomez stock in this growth report.

- In light of our recent valuation report, it seems possible that Guzman y Gomez is trading beyond its estimated value.

Next Steps

- Click here to access our complete index of 96 Fast Growing ASX Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives