- Australia

- /

- Hospitality

- /

- ASX:FLT

3 ASX Stocks Estimated To Be Trading Below Fair Value In December 2024

Reviewed by Simply Wall St

As the Australian stock market wraps up a turbulent year, the ASX closed slightly down on its penultimate trading day of 2024, with only Energy and Healthcare sectors showing notable gains amidst widespread declines. In such a fluctuating environment, identifying stocks that are trading below their fair value can offer potential opportunities for investors seeking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.40 | A$12.29 | 47.9% |

| SKS Technologies Group (ASX:SKS) | A$1.935 | A$3.85 | 49.7% |

| Telix Pharmaceuticals (ASX:TLX) | A$24.67 | A$44.00 | 43.9% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| Charter Hall Group (ASX:CHC) | A$14.63 | A$28.84 | 49.3% |

| Ansell (ASX:ANN) | A$33.78 | A$60.30 | 44% |

| Ingenia Communities Group (ASX:INA) | A$4.69 | A$9.24 | 49.2% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Genesis Minerals (ASX:GMD) | A$2.52 | A$4.90 | 48.6% |

| Sandfire Resources (ASX:SFR) | A$9.39 | A$16.58 | 43.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Cettire (ASX:CTT)

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market cap of A$550.89 million.

Operations: The company generates revenue through online retail sales, amounting to A$742.26 million.

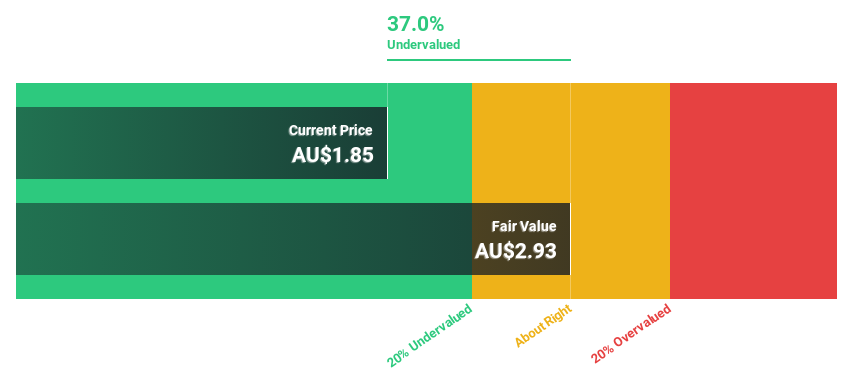

Estimated Discount To Fair Value: 49.9%

Cettire is trading at A$1.51, significantly below its estimated fair value of A$3.02, presenting a potential undervaluation based on discounted cash flow analysis. The company's earnings are projected to grow by 32% annually over the next three years, outpacing the broader Australian market's growth forecast of 12.6%. However, profit margins have decreased from 3.8% to 1.4% over the past year, which could be a concern for investors focusing on profitability improvements.

- Our earnings growth report unveils the potential for significant increases in Cettire's future results.

- Take a closer look at Cettire's balance sheet health here in our report.

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited offers travel retailing services for both leisure and corporate clients across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and other international markets with a market cap of A$3.69 billion.

Operations: The company's revenue is primarily derived from its leisure segment, generating A$1.35 billion, and its corporate segment, contributing A$1.11 billion.

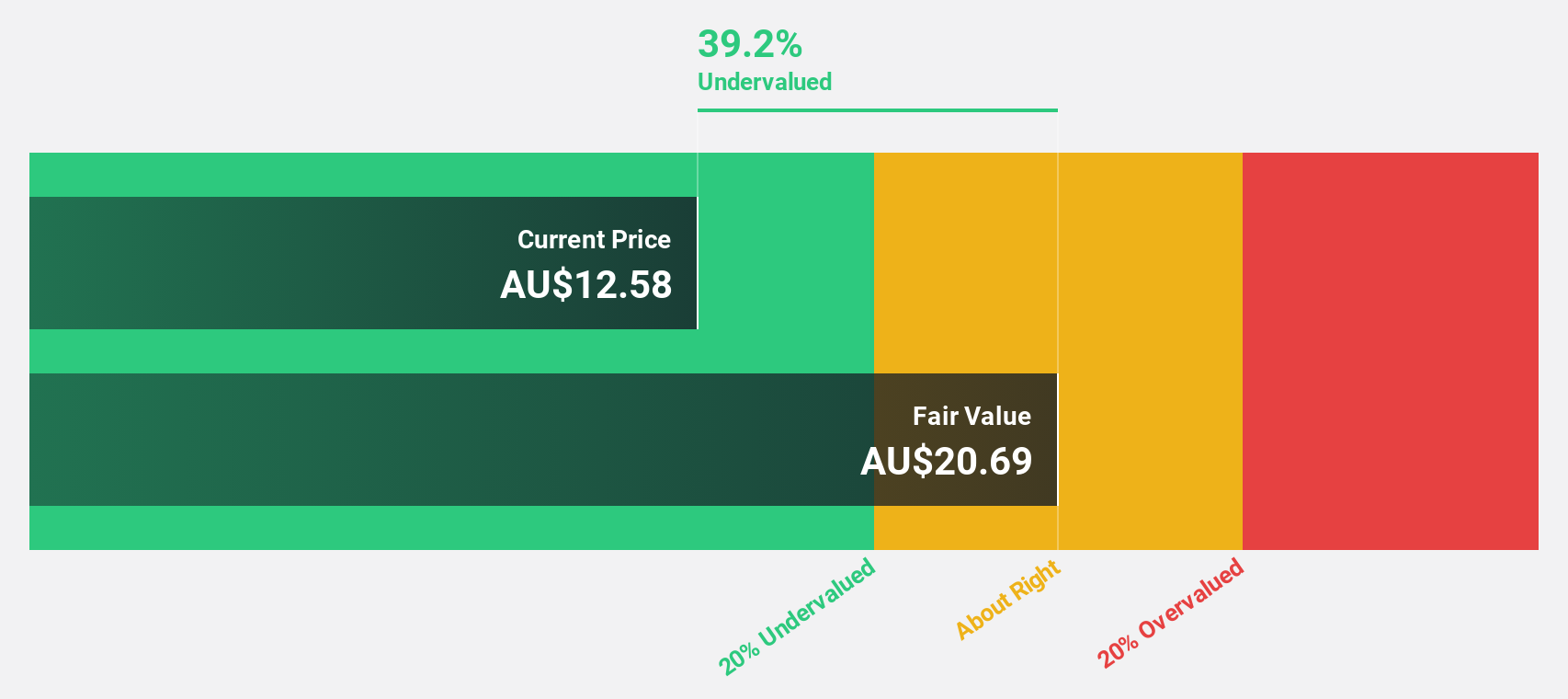

Estimated Discount To Fair Value: 35.9%

Flight Centre Travel Group is trading at A$16.71, notably below its estimated fair value of A$26.08, indicating potential undervaluation based on discounted cash flow analysis. Earnings are forecast to grow by 19% annually, surpassing the Australian market's growth rate of 12.6%. Recent issuance of A$140 million in convertible notes could impact financial flexibility but aligns with strategic financing efforts. Despite an unstable dividend history, revenue and profit growth prospects appear robust against market benchmarks.

- Our expertly prepared growth report on Flight Centre Travel Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Flight Centre Travel Group.

SEEK (ASX:SEK)

Overview: SEEK Limited operates an online employment marketplace serving Australia, South East Asia, New Zealand, the United Kingdom, Europe, and other international markets with a market cap of A$8.23 billion.

Operations: The company's revenue segments include Employment Marketplaces in ANZ generating A$840.10 million and Employment Marketplaces in Asia contributing A$244 million.

Estimated Discount To Fair Value: 10.7%

SEEK is trading at A$22.95, slightly below its estimated fair value of A$25.71, reflecting a modest undervaluation based on discounted cash flow analysis. Revenue growth is projected at 7.9% annually, outpacing the broader Australian market's 5.9%. Earnings are expected to rise by a substantial 37.72% per year over the next three years, although return on equity remains low at a forecasted 10.4%, which could be a concern for some investors.

- In light of our recent growth report, it seems possible that SEEK's financial performance will exceed current levels.

- Dive into the specifics of SEEK here with our thorough financial health report.

Key Takeaways

- Click this link to deep-dive into the 37 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Flight Centre Travel Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives