- Australia

- /

- Professional Services

- /

- ASX:C79

Chrysos (ASX:C79) Is Up 9.7% After Board Appointment and Strong FY25 Growth—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Chrysos Corporation recently announced the appointment of experienced finance executive Ms. Elisha Civil as an independent Non-Executive Director and reported strong financial growth in FY25, reflecting increased adoption of its PhotonAssay technology and entry into new markets like South America.

- Ms. Civil’s deep financial governance expertise and the company’s expanded global partnerships further reinforce Chrysos’ momentum in delivering innovative assay solutions and strengthening board leadership.

- With the addition of Ms. Civil and growing demand for PhotonAssay, we’ll explore how these factors shape Chrysos’ investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Chrysos' Investment Narrative?

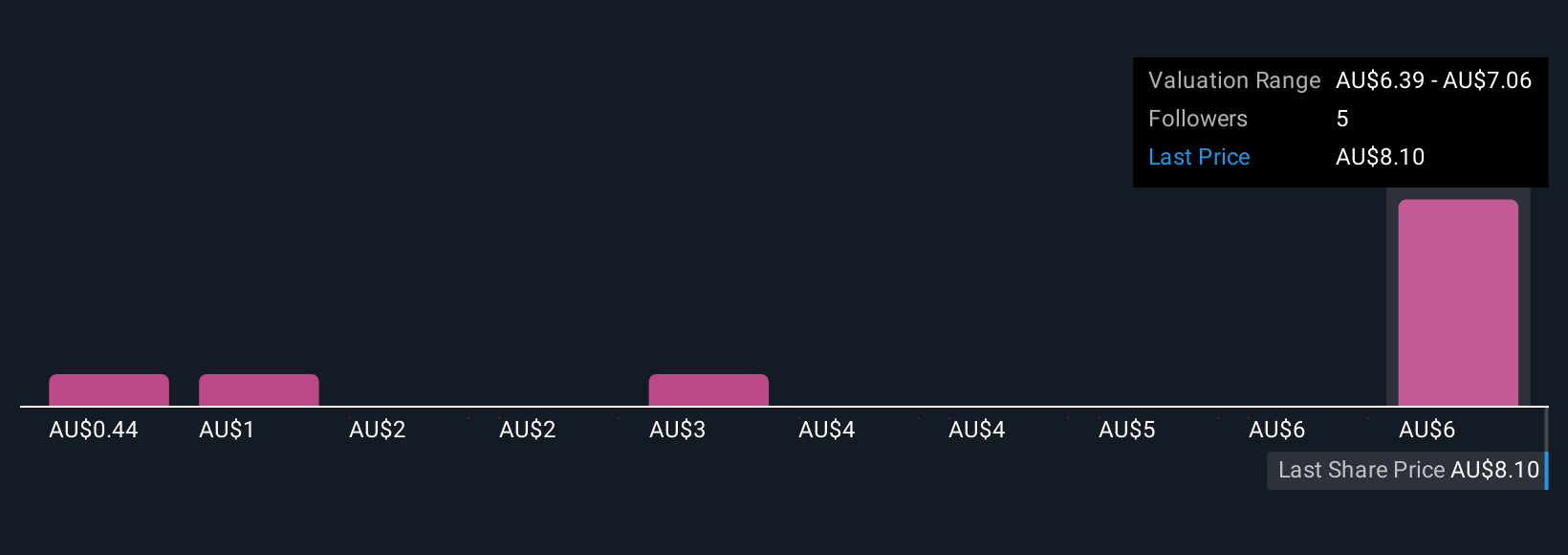

For Chrysos, the path ahead comes down to belief in the PhotonAssay technology's potential to further disrupt mineral analysis on a global scale. The recent appointment of Ms. Elisha Civil as an independent Non-Executive Director could meaningfully enhance board oversight given her financial governance track record, arriving just as the company is scaling into new markets and reporting rapid growth. This bolsters the credibility around guidance and execution, and may ease concerns about balance sheet risk given Chrysos' less than 1 year of cash runway and consistent net losses. However, the stock’s high valuation relative to peers, continued unprofitability, and heavy reliance on accelerating adoption remain central risks, which this board change alone likely does not resolve. Recent strong price gains could increase sensitivity to any slowing of revenue growth or delays on the path to profitability.

In contrast, the challenge of an expensive valuation is something investors should keep firmly in mind.

Exploring Other Perspectives

Explore 4 other fair value estimates on Chrysos - why the stock might be worth less than half the current price!

Build Your Own Chrysos Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chrysos research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Chrysos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chrysos' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:C79

Chrysos

Engages in the development and supply of mining technologies in Europe, the Middle east, Africa, the Asia pacific, and the Americas.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)