- Australia

- /

- Construction

- /

- ASX:RDG

Upgrade: Analysts Just Made A Stunning Increase To Their Resource Development Group Limited (ASX:RDG) Forecasts

Celebrations may be in order for Resource Development Group Limited (ASX:RDG) shareholders, with the covering analyst delivering a significant upgrade to their statutory estimates for the company. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

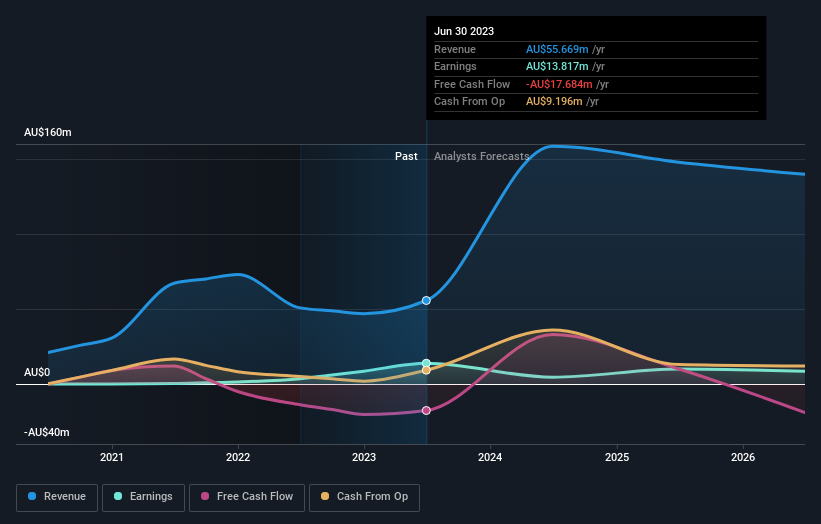

Following the upgrade, the latest consensus from Resource Development Group's lone analyst is for revenues of AU$159m in 2024, which would reflect a sizeable 185% improvement in sales compared to the last 12 months. Statutory earnings per share are anticipated to crater 69% to AU$0.0015 in the same period. Prior to this update, the analyst had been forecasting revenues of AU$92m and earnings per share (EPS) of AU$0.001 in 2024. There has definitely been an improvement in perception recently, with the analyst substantially increasing both their earnings and revenue estimates.

View our latest analysis for Resource Development Group

With these upgrades, we're not surprised to see that the analyst has lifted their price target 6.3% to AU$0.068 per share.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Resource Development Group's past performance and to peers in the same industry. It's clear from the latest estimates that Resource Development Group's rate of growth is expected to accelerate meaningfully, with the forecast 185% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 19% p.a. over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 6.3% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect Resource Development Group to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that the analyst upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Resource Development Group could be worth investigating further.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RDG

Resource Development Group

Provides contracting and construction services to the resources, infrastructure, and energy sectors in Australia.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026