- Australia

- /

- Aerospace & Defense

- /

- ASX:EOS

Did Business Growth Power Electro Optic Systems Holdings' (ASX:EOS) Share Price Gain of 112%?

While Electro Optic Systems Holdings Limited (ASX:EOS) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 15% in the last quarter. But that doesn't change the fact that shareholders have received really good returns over the last five years. It's fair to say most would be happy with 112% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. The more important question is whether the stock is too cheap or too expensive today. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 30% decline over the last twelve months.

See our latest analysis for Electro Optic Systems Holdings

Given that Electro Optic Systems Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Electro Optic Systems Holdings saw its revenue grow at 46% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 16% per year, in that time. This suggests the market has well and truly recognized the progress the business has made. To our minds that makes Electro Optic Systems Holdings worth investigating - it may have its best days ahead.

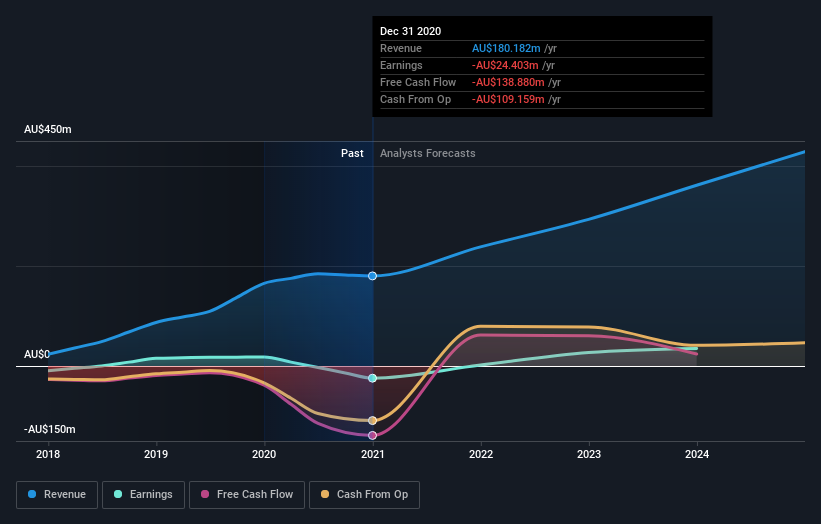

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Electro Optic Systems Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 29% in the last year, Electro Optic Systems Holdings shareholders lost 30%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 16%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Electro Optic Systems Holdings that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Electro Optic Systems Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Electro Optic Systems Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EOS

Electro Optic Systems Holdings

Engages in the development, manufacture, and sale of telescopes and dome enclosures, laser satellite tracking systems, electro-optic fire control systems, and microwave satellite dishes and receivers.

Excellent balance sheet and fair value.