- Australia

- /

- Capital Markets

- /

- ASX:RPL

ASX Stocks That May Be Trading Below Their Estimated Value In January 2025

Reviewed by Simply Wall St

The Australian stock market has recently experienced a positive upswing, with the ASX200 closing at a seven-week high of 8,429 points. This rise comes amid optimism fueled by Donald Trump's "Stargate" plan for AI investment and favorable trade outcomes, particularly benefiting sectors like IT and Industrials. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.73 | A$12.32 | 45.4% |

| Mader Group (ASX:MAD) | A$6.25 | A$11.89 | 47.4% |

| Atlas Arteria (ASX:ALX) | A$4.97 | A$9.53 | 47.8% |

| MLG Oz (ASX:MLG) | A$0.60 | A$1.15 | 47.9% |

| Charter Hall Group (ASX:CHC) | A$15.27 | A$28.64 | 46.7% |

| Aussie Broadband (ASX:ABB) | A$3.64 | A$6.42 | 43.3% |

| ReadyTech Holdings (ASX:RDY) | A$3.19 | A$6.20 | 48.5% |

| Syrah Resources (ASX:SYR) | A$0.25 | A$0.48 | 47.4% |

| Gold Road Resources (ASX:GOR) | A$2.52 | A$4.63 | 45.5% |

| Vault Minerals (ASX:VAU) | A$0.385 | A$0.68 | 43% |

Here we highlight a subset of our preferred stocks from the screener.

Ansell (ASX:ANN)

Overview: Ansell Limited is a global company that designs, sources, develops, manufactures, distributes, and sells hand and body protection solutions across various regions including the Asia Pacific, Europe, the Middle East, Africa, Latin America, the Caribbean, and North America with a market cap of A$4.87 billion.

Operations: The company's revenue segments include $834.20 million from Healthcare and $785.10 million from Industrial, including Specialty Markets.

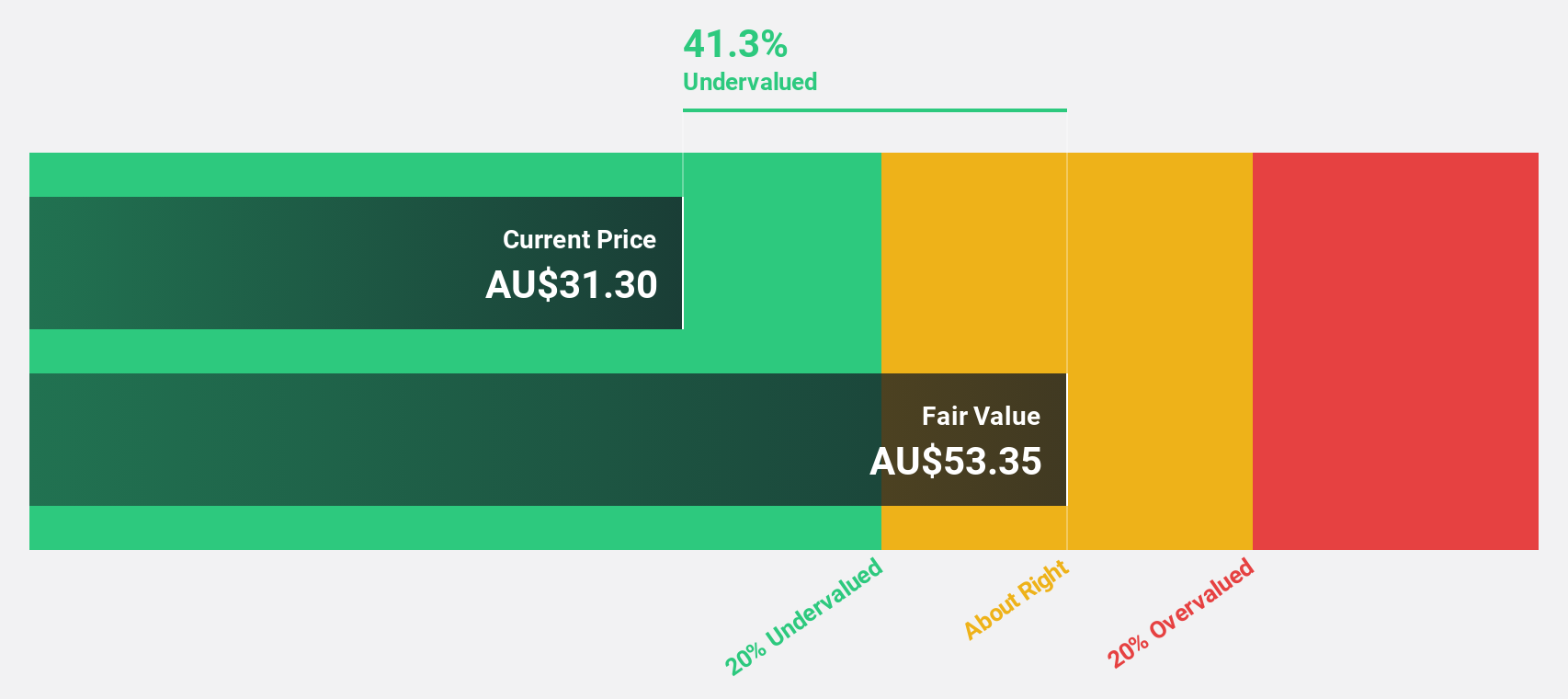

Estimated Discount To Fair Value: 40.4%

Ansell is trading at A$34.4, significantly below its estimated fair value of A$57.71, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 9% to 4.7%, earnings are forecast to grow significantly at 22.1% annually, outpacing the Australian market's growth rate of 12.6%. However, shareholders experienced dilution last year and recent buyback plans have expired as of January 3, 2025.

- The analysis detailed in our Ansell growth report hints at robust future financial performance.

- Take a closer look at Ansell's balance sheet health here in our report.

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market capitalization of A$1.25 billion.

Operations: The company's revenue segment is primarily from the provision of investment management services, amounting to A$198.50 million.

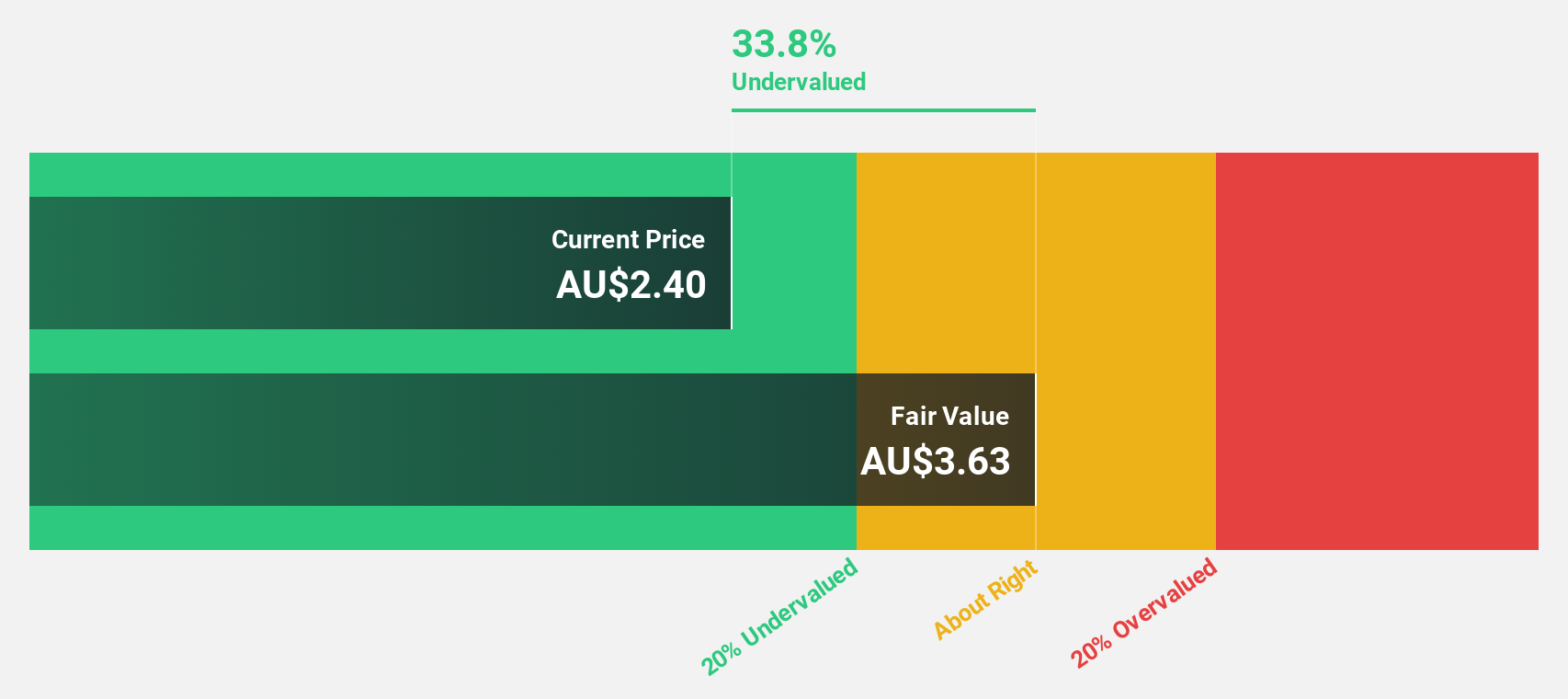

Estimated Discount To Fair Value: 42.6%

Regal Partners is trading at A$3.76, well below its estimated fair value of A$6.55, indicating undervaluation based on cash flows. Despite significant earnings growth of 1492.3% last year and a forecasted annual profit increase of 23.34%, the dividend yield of 4.26% isn't well supported by free cash flows. The company is involved in takeover discussions for Platinum Investment Management, potentially impacting future valuations and strategic direction amidst recent delisting from OTC Equity due to inactivity.

- Our earnings growth report unveils the potential for significant increases in Regal Partners' future results.

- Click here to discover the nuances of Regal Partners with our detailed financial health report.

Technology One (ASX:TNE)

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$9.56 billion.

Operations: The company generates revenue through its segments: Software (A$347.35 million), Corporate (A$87.02 million), and Consulting (A$72.17 million).

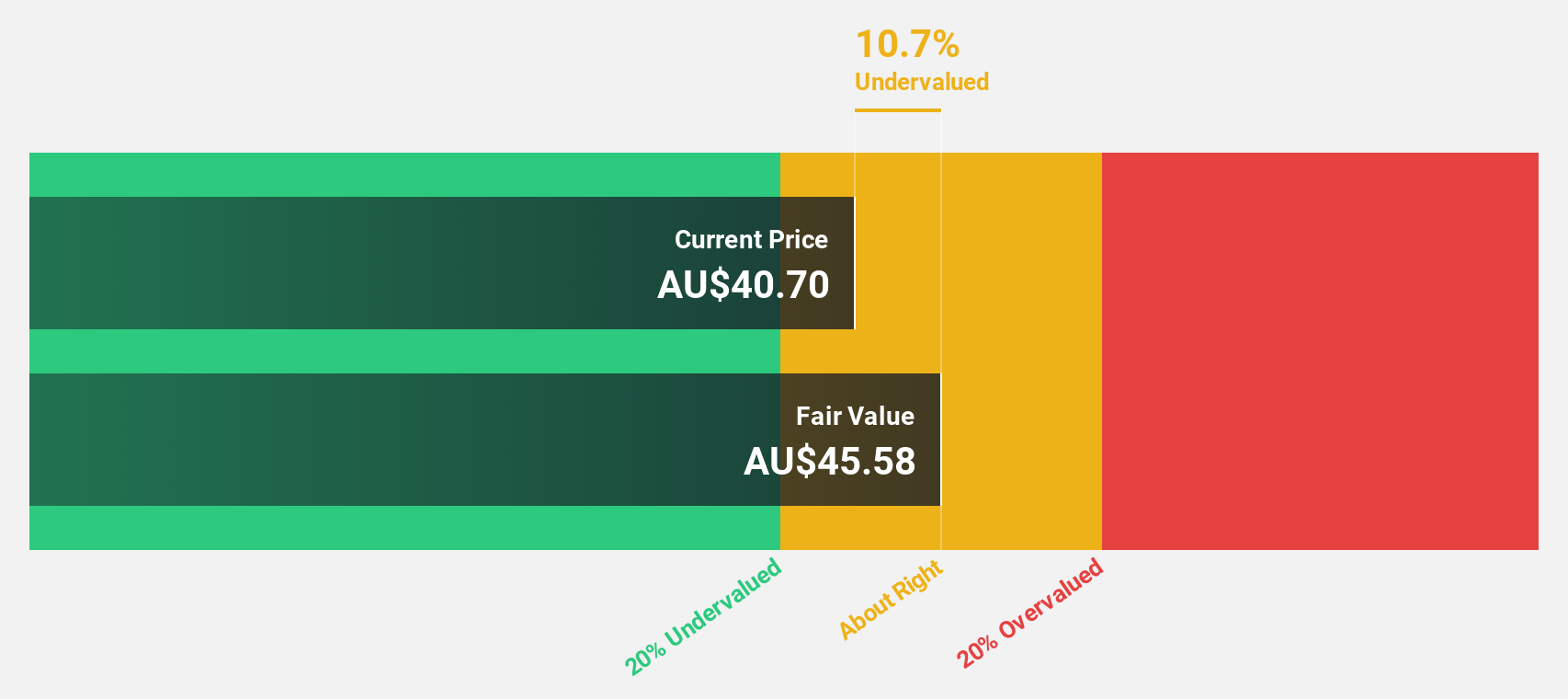

Estimated Discount To Fair Value: 32.5%

Technology One is trading at A$29.8, significantly below its estimated fair value of A$44.17, reflecting potential undervaluation based on cash flows. Despite recent insider selling, the company reported strong financials with revenue rising to A$506.54 million and net income reaching A$118.01 million for the year ending September 2024. Earnings are forecasted to grow at 16.1% annually, outpacing the Australian market's growth rate, though revenue growth remains moderate at 12.4% per year.

- Upon reviewing our latest growth report, Technology One's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Technology One stock in this financial health report.

Key Takeaways

- Click here to access our complete index of 43 Undervalued ASX Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RPL

Good value with reasonable growth potential.