- Australia

- /

- Commercial Services

- /

- ASX:STG

Dusk Group Leads The Pack Of 3 ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market has been buoyant, with the ASX200 reaching a seven-week high, driven by positive investor sentiment following Donald Trump's AI investment plan and favorable trade outcomes. In such an optimistic climate, investors often look beyond the major indices to explore opportunities in smaller companies that might offer both affordability and growth potential. Penny stocks, though a somewhat outdated term, still signify these smaller or emerging companies that can present significant value when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$69.16M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.94 | A$241.27M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$322.48M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$321.56M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.94 | A$107.87M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.15 | A$329.91M | ★★★★☆☆ |

| Servcorp (ASX:SRV) | A$4.95 | A$493.36M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$1.97 | A$111.85M | ★★★★★★ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dusk Group (ASX:DSK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dusk Group Limited is an Australian retailer specializing in scented and unscented candles, home decor, home fragrances, and gift solutions, with a market cap of A$70.99 million.

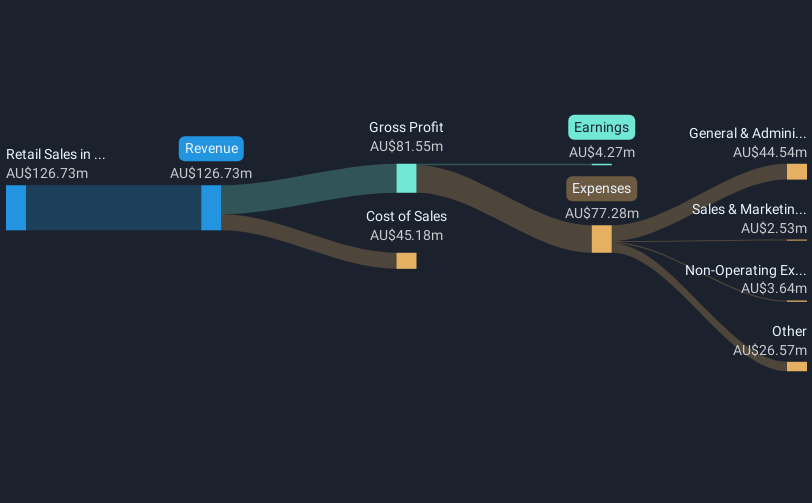

Operations: The company generates revenue through its retail sales in the home fragrances and accessories segment, amounting to A$126.73 million.

Market Cap: A$70.99M

Dusk Group, with a market cap of A$70.99 million, operates in the home fragrances sector, generating revenue of A$126.73 million. Despite having high-quality earnings and no debt concerns, Dusk's net profit margins have declined to 3.4% from 8.5% last year, and its earnings have decreased by an average of 9.5% annually over five years. The company is trading at a significant discount to its estimated fair value and shows potential for future growth with forecasted earnings increases of nearly 30% per year; however, its dividend coverage remains weak due to insufficient profits.

- Unlock comprehensive insights into our analysis of Dusk Group stock in this financial health report.

- Assess Dusk Group's future earnings estimates with our detailed growth reports.

Prescient Therapeutics (ASX:PTX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prescient Therapeutics Limited is a clinical-stage oncology company in Australia that develops drugs for treating various cancers, with a market cap of A$40.27 million.

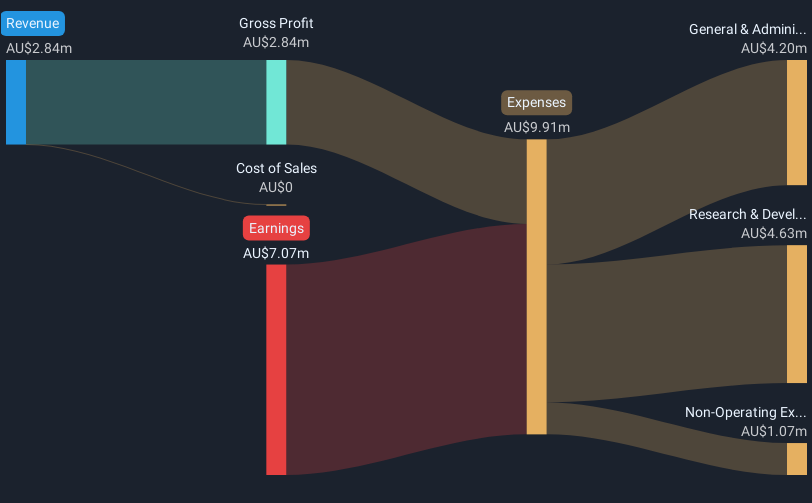

Operations: The company generates revenue of A$3.71 million from its clinical-stage oncology segment.

Market Cap: A$40.27M

Prescient Therapeutics, with a market cap of A$40.27 million, is currently pre-revenue and unprofitable. Despite this, the company maintains a strong financial position with short-term assets of A$18.7 million exceeding its liabilities and more cash than total debt. The management team is experienced, averaging 9.3 years in tenure, which may provide stability amid its high weekly volatility of 10%. Although earnings have declined by 19.1% annually over five years, Prescient has not significantly diluted shareholders recently and possesses a cash runway sufficient for over a year at current free cash flow rates.

- Jump into the full analysis health report here for a deeper understanding of Prescient Therapeutics.

- Explore historical data to track Prescient Therapeutics' performance over time in our past results report.

Straker (ASX:STG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Straker Limited, along with its subsidiaries, provides language services and technology solutions across the Asia Pacific, Europe, the Middle East, Africa, and North America with a market cap of A$39.89 million.

Operations: The company generates revenue of NZ$47.23 million from its business services segment.

Market Cap: A$39.89M

Straker Limited, with a market cap of A$39.89 million, is unprofitable but maintains a solid financial footing as short-term assets of NZ$21.1 million outweigh liabilities and the company remains debt-free. Despite reducing losses by 3.4% annually over five years, Straker's recent earnings revealed a net loss increase to NZ$5.33 million for the half-year ending September 2024, driven by revenue decline due to contract non-renewals in Europe. The management team is seasoned with an average tenure of 12 years, providing stability amid high share price volatility and negative return on equity at -22.34%.

- Get an in-depth perspective on Straker's performance by reading our balance sheet health report here.

- Understand Straker's earnings outlook by examining our growth report.

Taking Advantage

- Take a closer look at our ASX Penny Stocks list of 1,027 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:STG

Straker

Engages in the provision of language services and technology solutions in the Asia Pacific, Europe, the Middle East, Africa, and North America.

Flawless balance sheet and slightly overvalued.