Will NAB's (ASX:NAB) New CFO Appointment Shape Its Financial Strategy and Competitive Edge?

Reviewed by Simply Wall St

- National Australia Bank has announced the appointment of Inder Singh as Group Chief Financial Officer and Group Executive, Strategy, with Mr. Singh joining the company in March 2026 subject to regulatory approvals.

- Singh’s depth of experience across investment banking and insurance is set to influence both NAB’s financial management and its overarching corporate strategy.

- To assess the potential impact on NAB’s investment narrative, we’ll focus on how Singh’s dual financial and strategic expertise could shape the company’s future direction.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is National Australia Bank's Investment Narrative?

Being invested in National Australia Bank means trusting in its ability to maintain steady, if unspectacular, earnings growth and robust capital management while managing change in its executive team. The announcement of Inder Singh as incoming CFO and Group Executive, Strategy is unlikely to move the needle on near-term catalysts like earnings, dividends, or ongoing M&A speculation such as the HSBC Australia deal. However, his reputation for bank strategy and capital structuring could become a differentiator over time, especially in aligning future financial management with growth ambitions. The biggest risks remain NAB’s relatively slow expected earnings and revenue growth compared to peers, its low allowance for bad loans, and the impact of board turnover on governance. Singh’s appointment may help address some of the leadership continuity concerns, but the market seems to be reserving judgment based on recent price action.

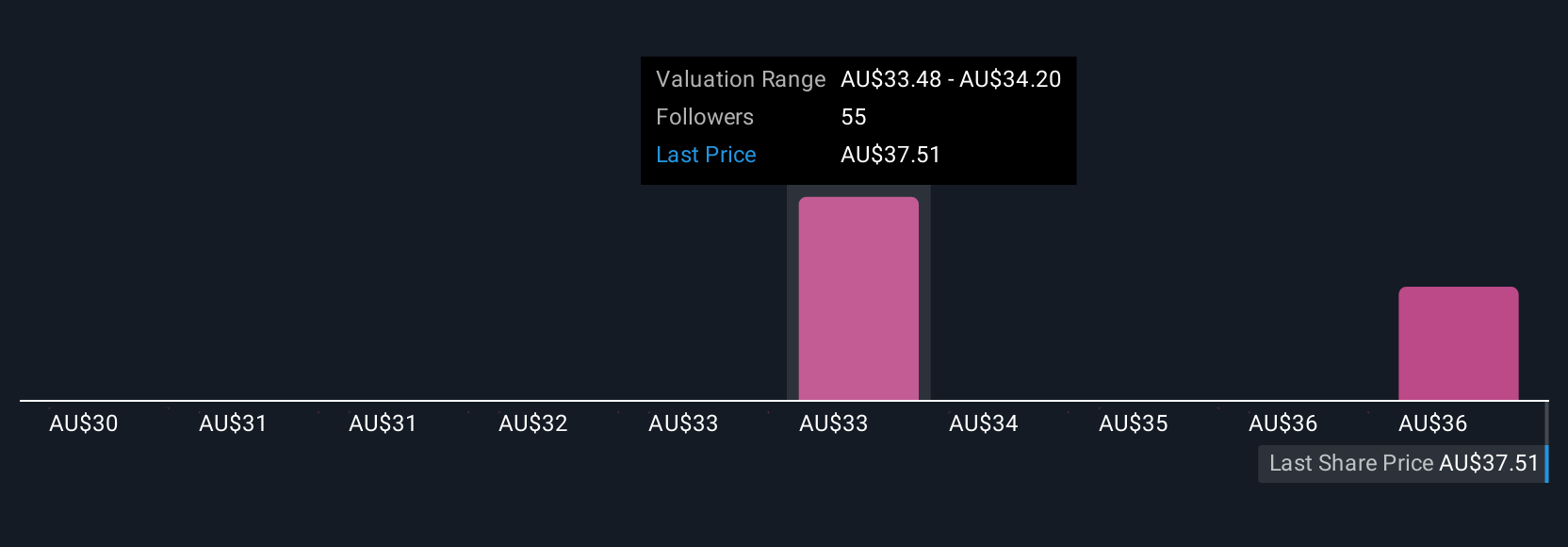

But will NAB’s new finance chief really shift the risk profile you face as a shareholder? National Australia Bank's shares are on the way up, but they could be overextended by 12%. Uncover the fair value now.Exploring Other Perspectives

Explore 4 other fair value estimates on National Australia Bank - why the stock might be worth as much as A$38.39!

Build Your Own National Australia Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Australia Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National Australia Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Australia Bank's overall financial health at a glance.

No Opportunity In National Australia Bank?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Australia Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NAB

National Australia Bank

Provides financial services to individuals and businesses in Australia, New Zealand, Europe, Asia, the United States, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives